Investment Pyramid

May 2024 - DO IT NOW! - Keep at least 80% of your savings out of political reach - and become a Permanent Resident of a politically correct country...

Now that we are 99% sure that Physical Gold and Silver will preserve our wealth, the next step is to ensure we keep it out of political reach.

This task may be more complicated than many think.

PRICE will come down when the system collapses, but VALUE will not. At that time, it will be important NOT to liquidate your positions. Even if we have a CRASH...Keep your securities registered in your name DIRECTLY with the company or a transfer agent. Do it preferably in a country where the government guarantees the Transfer Agent.

"How NOT to preserve your purchasing power? Invest in Cryptocurrencies, Bank deposits (saving accounts), ETFs', Options, Arts & Vintage Cars, Real Estate, Hedge Funds, Mutual Funds, Pension funds, Bonds, Shares, Commodities,..."

Digital Securities (Shares, Bonds) will be frozen when your BANK, BROKER, or Country runs into financial problems. It can take YEARS (up to 10 years) to reaccess your savings when such happens. Digital Securities can become subject to a BAIL-IN and/or Gutt-Lieftinck operation by your Government at any time. With CONCIERGE service, the best is to keep your savings in PHYSICAL GOLD & SILVER in a non-bank vault out of political reach.

|

Swiss Bank accounts aren't so safe anymore...click here. If you haven't moved your savings out of political reach and you don't plan to do it soon, you better stop investing/saving...for the Government will take it away...! New EU legislation as of March 1, 2023: It has become extremely difficult (if possible at all) to export Gold out of Belgium. SWITZERLAND has set a MAX—yearly EXPORT LIMIT for GOLD...of 250 Tonnes. Note there is a min—7% tax on physical Gold and silver in Switzerland. |

- Safety cannot be achieved by keeping equities with your bank. Remember that by keeping shares with a commercial bank and/or Broker, you only have A CLAIM on your own shares, and the bank can and will use your shares as collateral for its obligations..more [Also click on the VALUE picture for more information regarding TRANSFER AGENTS - link is different]

- The financial markets have become one big shit show, and you really have to be crazy to continue to participate in this fraudulent casino. My positions in the stock market represent barely 10% of all my assets, and seeing all this, I will continue to lower that percentage. I feel increasingly comfortable in this market with physical silver and gold in a (Panamanian) safe.

Keep at least 80% of your savings in physical gold and/or silver. Sell all Bonds, Money market instruments (TAK21 - TAK23), Pension Funds, Common funds, and real estate in most parts of the world. Don't keep cash or near cash (bank deposits, savings accounts, 401k). Holding any material portion of your Wealth in Dollars or Euros is suicidal, mainly if held in insolvent BANKS in the USA, Europe, or the UK. (This implies you must request physical delivery, and paper Gold/Silver is not a valid option!) When the time comes, a vital part of the strategy is to move out of gold/silver into other instruments, and you must start preparing for this today! [click to enlarge the picture below]

This we expect to happen over the next 12 to 24 months (Sept 2020 - Still valid on December 2023):

- Stock markets will close the gaps they made on the charts during the COVID-19 crash and climb back to their old tops (and may probably overshoot these).

- From now on, Gold & silver will outperform stocks, bonds, real estate, cryptos,

- Hyperinflation is starting, and consequently, interest rates will continue to rise.

- Inflation will continue to rise because of a falling supply of consumer goods and an increase in the Money Supply (COVID, UKRAINE WAR)

- GDP will fall because of the Corona crisis, the Ukraine War & the Depression.

- Unemployment will rise because of the Corona crisis, the Ukraine War & the Hyperinflationary Depression.

- Taxation will increase substantially.

- We may see 'CAPITAL CONTROLS' at any time soon.

- Continue to SELL stocks in the coming weeks and months, convert the funds into Physical Gold and silver, and GET OUT of the FIAT FINANCIAL WORLD! You must do so because every penny you make in the fiat financial world will be lost due to Currencies crashing to ZERO.

| DATE: | August 12, 2023 |

Long Term Trend |

| $-Gold | Breaking out of a halfway-medium-term saucer bottom | trend is bullish | buy |

| Silver | Breaking out of a halfway-medium-term CUP and HANDLE formation | trend is bullish | buy |

| US-Dollar | The long-term trend is still bearish |

the trend ?? | ?? |

| Euro-Dollar | Sideward triangle |

the trend ?? |

?? |

| Euro-Gold |

All-time record & bull trend. |

trend is bullish | buy |

| Aussie-Gold |

All-time record & bull trend. |

trend is bullish | buy |

| Swiss-Gold |

Bullish trend & strong BUY |

trend is bullish | buy |

| Swiss fr |

Oversold and strong BUY versus Euro and US-Dollar | trend is bullish | buy |

| Can$-Gold | All-time record & bull trend. |

trend is bullish |

buy |

| Can-Dollar | Potential Trend change in favor of the Can-Dollar. |

||

| Stock markets expressed in Gold will lose 95%! |

|||

| Dow Jones | Halfway Top* - Long Term, we expect a Fiat Dow of 30,000 & higher! - Risk too high |

resuming bull |

sell |

| SP500 | Halfway Top - * - Long Term, we expect a Fiat SP500 of 3,000 & higher! - Risk too high |

resuming bull | sell |

| BEDOW | Potential and plausible bullish trend reversal on long-term support level. |

Trend reversal. |

sell |

| Royalties | Bottoming (will UNDERPERFORM Gold & Silver) | Breakout | buy |

| Majors | Breaking out = BUY |

Breakout | buy |

| Juniors | Breaking out = BUY |

Breakout | buy |

| Bonds USA | Bear Trend * | Bear Trend | Sell |

| Bonds EU | Bear Trend * | Bear Trend | Sell |

| Interest r. | Expect HIGHER interest rates. | ||

| Bank shares | Don't touch - not even with a 20-yard-long stick - * | Stop loss | Sell |

| Belgian Real Estate | Buy Climax - * Confirmation of Buy climax as of November 2, 2019 |

Strong Sell | Sell |

| * = trend is bearish versus GOLD...Indexes will go up only in FIAT MONEY. | |||

| Keep your physical Gold & Silver in a VAULT only (NOT in a safety deposit box with a bank) |

Bucket list for the Intelligent Investor. |

| 1. Don't trust traditional financial institutions, banks, or hedge fund managers, but do your own homework and make your own financial decisions. Banks work on their own agenda! |

| 2. Don't invest in bonds or Money Market funds, as you can be 100% sure you will lose ANY cent you have invested: short-term because of negative real interest rates and long-term because of a debt moratorium. |

| 3. Don't invest in ETFs, Options, Warrants, or Futures,...especially not in PAPER GOLD & PAPER SILVER. |

| 4. Real Estate won't save you as the price/income of real estate always gets ridiculously low during inflation depressions. |

| 5. Don't keep large deposits/savings accounts with Banks. Sooner or later, you will lose these—short term because of REAL Negative Real Interest Rates, long term because of financial drama. |

| 6. Don't buy or invest in Bitcoin & Crypto-Currencies. Although the mechanism will survive, much will happen before it is safe. Be advised that in their present form, they are a HASARD. |

| 7. Don't fall in love with financial movie stars. They mainly try to sell their books and like to appeal to the emotions of the public |

| 8. NEVER ever trust the Government. Authorities don't give a damn about you. They LIE, CHEAT, and are only interested in how much money they can LEGALLY STEAL from you. If they can't take it from you today, they will find a way to take it tomorrow. |

| 9. You must keep at least 70% of your assets out of political reach. Out of Political reach means "on another continent." For Europeans, Asia, or better, the Americas for North America, South & Central America, and Europe. Another Continent means that one is subject to a different system... |

| 10. Today, one should keep at least 80% of his/her assets in physical gold and silver and keep them in your own box in a non-bank-safe. To be safe, it is best to ensure the goods. |

| 11. Make sure you have at least one bank account with credit/debit cards with a bank on another continent. If a local problem occurs, you can still use the other cards. Also, a second bank account can someday be your ticket to freedom. |

| 12. Extreme situations rarely occur overnight. Venezuelans had 15 years to leave the country....only IDIOTS stayed and kept their savings & real estate in the country. |

| 13. The END is NOT NEAR. If you are appropriately invested, you will see that over time, the financial markets will favor your investments by raising your personal purchasing power. |

| 14. Make sure you have a 2nd permanent residency/passport. Life will get GRIM because Bankrupt Authorities will keep stealing from you and will, at some point in the future, limit your freedom (e.g., DDR), and/or we get a Civil War, more terrorism..or simply a War. With your 2nd passport, you can hop on a plane and leave...and fly to the savings you stored "out of political reach." |

| 15. Keep limited savings in SHARES (out of political reach). Shares can be sold, and you can use the funds to start another business...Shares will fluctuate, but as they are REAL ASSETS, they ALWAYS survive financial catastrophes. |

|

Conclusion:

|

| Note: We (Goldonomic) will assist any relations to bring the above to a good end. |

- Soon, Authorities and Bankers will ensure Paper Money becomes obsolete, and they will BAN and at least severely RESTRICT its use. TAX optimization will become extremely hard once all economic /financial action has been channeled into the DIGITAL MONEY system. I am almost sure that Bankers will levy TAXES directly for governments. Once all money has been digitalized, we shall have a DIGITAL GUTT ACTION OPERATION, and Hyperinflation will eat away at your savings. Those holding physical Gold/Silver must start TODAY to prepare for their exit procedure. We can help!

- Brace for Capital Controls and Legal Theft.....Location, location, or Extremely important is the political location of your savings: you MUST keep these out of political reach in SAFE COUNTRIES (NOT the EU-zone, NOT the USA, NOT in Canada)! During the crisis in Argentina, the authorities confiscated all foreign currencies of the account holders, which were used to pay off the external debt. During the Cyprus Bail-in, the biggest chunk of bank deposits of over €100,000 was confiscated. Pursue SAFETY rather than Profit...unless you don't care if the Government profits from your investment decisions. The government can AND will legally plunder its own people! Sad but true. History shows they ALWAYS have! This time won't be different...click here for more on Operation Gutt -

Looking back to the figures for the last five years, the Model portfolio, even if one invests in Commodity stocks (Oil and Gas) and Gold and Silver mines, it was hard to do better than Gold and Silver.

Looking back to the figures for the last five years, the Model portfolio, even if one invests in Commodity stocks (Oil and Gas) and Gold and Silver mines, it was hard to do better than Gold and Silver.

- Be aware that World Stock markets, Bonds, and ALL Fiat paper Currencies still sit in a solid downtrend when expressed in Real Money or Gold and Silver.[See charts of indexes expressed in Gold]

- FIAT PAPER MONEY should, under NO CONDITION, BE USED TO STORE YOUR SAVINGS...use the Swiss franc, Australian Dollar, and Canadian Dollar as temporary cash instruments only. Be advised that Bail-in operations are now legal.

- Today, some potentially attractive Homes are for sale on the American market...[An opportunity always is an opportunity]. Prices, however, will continue to fall until 2033...

- Don't forget Energy, Oil, natural gas, recession-proof shares, and URANIUM...but only a maximum of 5% of your savings.

- Shares are REAL ASSETS, and although stock markets can wildly fluctuate, stocks (except bank shares) mostly survive economic and financial catastrophes.

- Don't forget the SAFER than Bonds and Utilities (recession-proof shares), which will also survive this Economic Depression. I am wildly BULLISH for designated stock markets and stocks (in Fiat currency terms only).

- Our goal is not to MAKE FIAT MONEY but to preserve your wealth, SECURITY, and WEALTH PRESERVATION.

Communicating Financial Vessels: Freshly created money flows in the economy, either into bonds (debt, bank deposits, savings accounts), real estate or commodities or shares, etc. Monetary History proves that during a time of (hyper)inflation, money ALWAYS flows into SHARES, and we have a CRASH once the system fails...Money also ALWAYS flows into Gold and Silver (physical and shares), and the latter yields the best and is the safest way to preserve buying power.

Coincidence? Dow Hits 20,000 As National Debt Reaches $20 Trillion. We have communicating Financial Vessels (more in the Investment Pyramid). No Coincidence to see that it has been and is fueled by debt. The Dow crossed the 20,000 mark for the first time, which comes at a time when the U.S. national debt is on the verge of hitting 20 trillion dollars. With the U.S. national debt of 31 trillion dollars, we expect a Dow Jones to hit 30,000! Likewise, a 40 trillion dollar debt will push the Dow Jones to 40,000...and a 50,000 trillion would make it 50,000.

Note: Because of Gresham's law, Gold and Silver disappear from the open market during times of financial crisis. People prefer to pay with Fiat Money and hold on to Gold and Silver instruments just because these are perceived as highly safe (i.e., the accumulation of gold by China, India, and Central Banks in general...) - Click on the figure below to see how good the correlation is between Money Printing and Stocks.

|

|

| Click to enlarge | This is what the picture looked like in March 2015 |

|

|

If Central Banks adopt a 100% DIGITAL MONEY SYSTEM, rigging the system will be even easier.

A rising tide raises all boats, as does massive global money printing by central banks. When the money supply grows faster than nominal GDP, excess liquidity flows to financial assets. However, if the money supply grows more slowly than the nominal GDP, the real economy absorbs more available liquidity. That’s one reason stocks go up so much when the economy is weak but the money supply is rising.

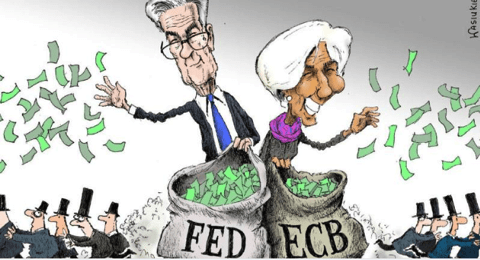

| Quantitative Easing (money printing) and Negative Interest Rates have a DIRECT IMPACT on the General level of Stock Markets... |

The picture gives an indication of CHEAP versus EXPENSIVE stock markets....one must SELL expensive ones and BUY the cheap ones (click to enlarge)

"Models and technical analysis cannot always spot each change in market conditions. Independent thinking, emotional stability, and a keen understanding of both human and institutional behavior is vital for T-term investment success."

©, All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic