Investing for dummies

Rule # 1: Don’t listen to the Demon of Diversification. Today is the time to put savings in a LIMITED amount of instruments and to watch the instruments closely. Diversification will only make it harder to follow up and adjust your savings.

Rule # 1: Don’t listen to the Demon of Diversification. Today is the time to put savings in a LIMITED amount of instruments and to watch the instruments closely. Diversification will only make it harder to follow up and adjust your savings.

Rule # 2: Beware of modern colonialism. Today's share certificates and even money have become ‘electronic-computer’ bits. Physical certificates have become obsolete and have in many countries even become illegal. Using excuses as Terrorism and Money laundering, EU authorities are also ruling out financial transactions in cash larger than € 10,000 and try to add Swiss and Luxemburg banks to the blacklist listing Andorra, Monaco, and Liechtenstein. Hong Kong and Singapore are also standing in the shooting range.

As Switzerland holds 40% of the world’s private wealth, we hope this will take more time and lobbying. We may even come to a point where Switzerland may not allow foreigners to open up new bank accounts. Having said this, the world is a huge financial planet and there are still many spots out of reach and even unknown by the majority of investors.

Rule # 3: NEVER invest in an instrument you don’t fully understand. Not even if it is guaranteed by a Government.

Because of low interest rates, people have been investing more and more in Hedge funds, Common Investment funds, structured products, ETF’s and derivatives. In 25 years’ time, these investment instruments have proliferated as a weed. The financial sector has through lobbying strengthened its position. Ever since a legal and controlled status is requested, many Financial Advisors have disappeared. Other financial institutions (stock market brokers) have been forced into a Bank status and are controlled by the authorities.

Authorities have legislated all marketing by non-state and non-EU/USA bank institutions. Only month’s age Swiss bankers have been arrested by their arrival in the US. Many EU countries have legislation forbidding any financial entity to advise on foreign banks.

Since competition and many ‘second opinions’ have disappeared, Banks had a free hand in marketing their investment instruments. The investors had blind confidence in the products.

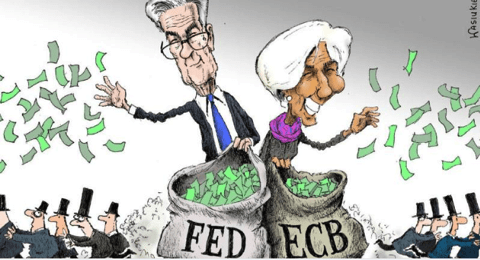

The Credit Crunch, however, changed it all. As the Real Estate and Bank shares crashed and banks even disappeared, Fortunes were lost by those you followed blindly the advice of the Banks. Because the authorities were able to stop a ‘Run of the Banks’, many (especially those not affected) believe the danger is gone and live in the conviction that because we have electronic certificates, their savings can be transferred by a simple click on the Enter of their computer. The least one can say, is that this is an extremely dangerous game.

Rule # 4: Precautionary investment has to be organized TODAY. Residents of Iceland and Zimbabwe have experienced this life. Better be early and not be caught by the stampede.

Once things get really bad, it will be too late to act. Authorities will become extremely protective as the geopolitical situation worsens. Remember bank accounts cannot be opened overnight and transfers also can be halted by pulling out a plug. Gold and Silver could be difficult to find. We could see Bank Holidays and a reorganization of Treasuries (moratorium).

| History shows over and over again Authorities simply are NOT to be trusted. The 2008 months are a life example that Bankers are not to be trusted. Today, more than ever, one has to make his own home work and trustworthy advice is only to be found with experienced and independent financial advisors. |

Typical Small Investor's cycle:

Conclusion:

- Put your eggs in a couple of baskets and watch them closely.

- Make sure you own physical Gold and Silver coins and have them out of reach of the authorities/banks and hold at least 5% to 10% of it as an insurance policy. In case of doubt, ask your Grand Mother.

- Invest in LOCG (low order consumer goods) and disinvest in HOCG (high order capital goods). Examples of LOCG are crude oil and oil products, agricultural/food products, agricultural land and farms, basic life necessities (soap, coffee). A school example of HOCG is real estate incl. commercial real estate.

- Only invest in Real Assets which have been fully paid for.

- Don’t invest into Bonds and especially into Government Bonds.

- Don’t store your wealth into FIAT PAPER money or on electronic bank accounts. If you do, don’t exceed the maximum insured limit and use only safe banks (ISI 1 and AAA).

- Most shares are REAL ASSETS. Use your cash to buy certain sectors and shares as markets offer opportunities.

- Only invest in Real Estate if you find real opportunities (a price equal or below 100 times the real or hypothetical rental income). If you do, be prepared for more taxation and be aware you can be stuck with the property for some time if things get bad.

- Stay away from certain currencies and from ALL FIAT PAPER MONEY. Examples are Iceland Krona, South African Rand, Zimdollar, Eastern European currencies, Venezuelan Peso, most central and South-American currencies.