Bank & Fin. Shares (charts)

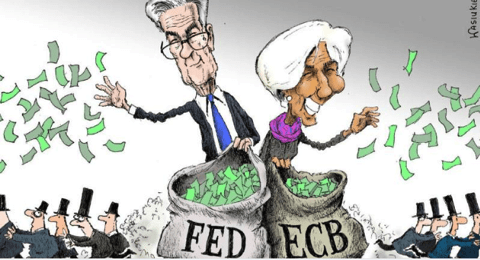

July 4, 2024: From now on (because of inflation), we shall see higher interest rates only!

|

|

| Bank Index | ||||

| Bullish objective | na |  |

Banks have landed in a similar but MORE DANGEROUS situation as in the 1970s .  |

|

| Resistance | 5200 |

|||

| Support | 3800 | |||

| Bearish Objective | 2200 | |||

| Technical pattern | BOTTOM! |

|||

Banks expressed in Real Money or Gold:

|

Our Opinion:

|

© - All Rights Reserved - The report's contents may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic.