Treasuries in the EU

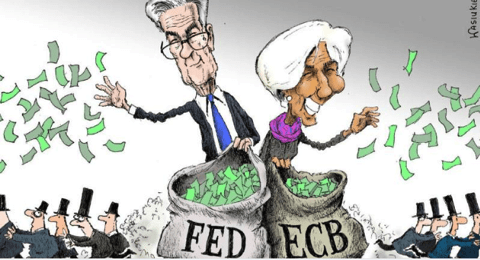

April 1, 2024 - Central Banks are in a Panic Mode - The trend of interest rates is UP!

|

Interest Rates LAG on the Inflation Rate: The more inflation (money) there is, the higher the interest rates! The Central Banks of Europe and the FED are coordinating their monetary policies. (April 2024) Hiking Interest Rates during recessions will make the Hyperinflationary Depression even worse. The Bond markets are showing a BEAR TREND...whatever Authorities do, in the long run, they can not stop rising interest rates! Bond markets can implode in a matter of seconds... In Europe, the bond market is destroyed. What institution will buy a bond from Europe with a REAL negative interest rate? Pension funds need 8% to break even. They have bankrupted all the pension funds over there. It is a complete disaster. This is the most significant financial crisis in human history, and people don’t understand what is happening. All excuses are welcome: Covid, Global Warming,...The EU & ECB plan to spend €300 billion over the coming months. The EUSSR and the ECB are going for precisely the same policy the U.S. and A. are going for, creating hyperinflationary amounts of fiat money out of thin air. As expected and as usual, most investors won't realize it until it is too late to act. A random walk through various Social Media shows that the Millennials have NO CLUE about what is happening and what will happen soon. (Dec 21) |

- WHEN, not IF, inflation returns and investors finally end their lousy love affair with bonds, then bond prices will fall, which means bond yields will rise—which means interest rates will rise too, and it will be GAME OVER.

- A collapse of Treasuries will, by definition, result in the collapse of Fiat Money (because today, Money is debt).

- The European bond markets have become illiquid, trapping the ECB and European Central Banks. This severely repercussions the PENSION FUNDS, and worse will come over the next few years. Insurance and Reinsurance companies are not much better off. Low & negative interest rates slaughter these entities. As a retaliation, Governments will have to RAISE TAXES dramatically.

- The only way for Pension funds and Insurance companies to survive is to get out of Treasuries and Bonds. This, HOWEVER, is TOTALLY IMPOSSIBLE and, in many cases, even ILLEGAL.

- Contrary to crashing Stock Markets, crashing Bond markets never bounce up. Even worse, they become worthless. A bond market crash is dramatic because it concerns the whole Western world: Pension funds, insurance companies, and money.

- Higher Interest rates, in turn, make it increasingly impossible to honor the HUGE DEBT. To avoid this, Central Banks must create more and more debt to create more and more money. The higher debt, in turn, affects the general interest rate. At a certain point, Interest Rates and (Hyper)inflation will rise simultaneously.

British GILTS (Treasuries) show now a BEAR TREND (Sep. 2022) - Bank of England raised the interest rate to 4% (Feb. 2023)

|

|

| A wonderful, ever-rising bond market...a severe bear trend it is. |

ʘ ʘ ʘ Euro Deutsche Mark bonds: TOP CONFIRMED (Feb 2018) - Germany or the Deutsche Mark is the driving factor behind the EURO.

|

|

|

|

| Breakout and bull trend! |

Expect HIGHER interest rates. |

Click to enlarge - 10-year BundesYield - note the critical days: FEB 9-11 and Feb 29, 2016

- Money is created by governments and banks. Money comes out of thin air, as the Central Bank creates money when it ‘buys’ TREASURIES/DEBT. New Fed money is always exchanged for debt. When the Federal Reserve writes a check, it is creating money."

- The government uses the money to pay for its expenditures and taxes its citizens to pay for the interest. Treasuries can be redeemed, and by doing so, the amount of money in circulation will decrease, or more Treasuries/bonds can be issued. By doing so, the amount of money in circulation will increase.

- The government uses the so-called money to pay for its expenditures and becomes commercial bank deposits. As a result of fractional reserve banking, Commercial Banks can leverage the amount of money created by the Central bank and create even more money: Bank deposits and Bank Credit. Bank credit is a type of money that comes with an equal and offsetting amount of associated debt. Debt upon which interest must also be paid.

| Negative interest rates: Either Banks and governments die, or you die. If Banks and governments die, you may also die... |

This is an exponential system by its very design. All dollars/euros are backed by debt. Debt that pays interest. Therefore, each year, enough new money must be loaned into existence to cover the interest payments on all of the past outstanding debt. Each year, all the outstanding debt must be compounded by at least the interest rate on that debt each year.

| What happens when a money system that must continually expand runs into physical limits by its very design? |

Defaults are the Achilles' heel of any debt-based money system. Past debts cannot be serviced without continuously expanding the money supply, and defaults may destroy the entire system.

It is essential to understand that all DEBT has to be redeemed together with interest on debt and interest on interest and that INTEREST is an important factor. Interest is a multiplier factor; the lower the interest, the lower the multiplier. Negative Interest rates have a NEGATIVE multiplier factor. The question is whether negative interest rates can STOP the compounded effect. Sure, they won't be able to reverse the process.

| 2015 Governments can not only create money but are now rewarded for it. |

If you, even for a split second, think that Authorities and Bankers have manipulated interest rates towards ZERO and made NEGATIVE for anything other than the battle for their survival, you're incredibly naive. Governments are heavily indebted; we all know the situation is far worse and will worsen over the coming years. Negative interest rates come in extremely handy as the situation makes it cheaper to go into more debt and makes repayment of the existing debt lighter. As a matter of fact, Negative interest rates are a hidden debt moratorium.

| Negative Interest Rates extend the lives of the Parasites and bloodsuckers but shorten the lives of SAVERS, Entrepreneurs, and Wealth Generators. It's a loss-loss situation |

In 2012, the ECB began lending capital at a 1% interest rate to European banks, which is used to buy local (Greek, Spanish, Italian, etc.) government bonds yielding 4.50% more. Or how to keep interest rates below the detonation level of 4%. 2013. The ECB started to lower the key interest rate to 0.25% (almost ZERO) because they were desperately trying to revive the economy, but last but not least, to keep governments, the EU, and the ECB alive.

In 2012, the ECB began lending capital at a 1% interest rate to European banks, which is used to buy local (Greek, Spanish, Italian, etc.) government bonds yielding 4.50% more. Or how to keep interest rates below the detonation level of 4%. 2013. The ECB started to lower the key interest rate to 0.25% (almost ZERO) because they were desperately trying to revive the economy, but last but not least, to keep governments, the EU, and the ECB alive.

- The ECB forces Italy to borrow funds at 7% and to lend these to Spain at 3%!

- The magic/dangerous threshold is 4% (adj. April 2015). Once interest rates break through this level, the DEBT becomes uncontrollable. Over time (and because of increasing debt), this threshold is coming down to 1% (the actual level for Japan).

- The European Central Bank put a floor under the eurozone by agreeing to buy unlimited quantities of bonds of any troubled member state that accepts the conditions of a bailout program. ECB President Mario Draghi made clear the bank will use all its tools to defeat anyone betting on a break-up of the monetary union.

- The ECB values the Treasuries of its member states at 29%.

What happened in Greece (and Iceland) will happen in other countries the very day the domino for that country falls. Assuming the EU builds a firewall (this is precisely what they are trying to achieve), I expect the EUROZONE domino countries to fall together. The point of no return has been passed, and it is now IMPOSSIBLE to introduce some corrective action. The ECB is intervening daily to contain the explosive rise of Greek, Portuguese, Spanish, Italian, and French interest rates. Doing this destroys European savings, re-insurance companies, insurance cos, and pension funds. The logic is that the economy, at some point, needs high interest rates first, so more people decide to save more and consume less. But because of fractional reserve banking and the creation of fiat money, there is little logic left...

Negative yields became fashionable in 2015. They destroy SAVINGS and only serve Indebted Governments.

|

|

| negative interest rates in Germany, Switzerland | negative yields in Europe |

| Click to enlarge | |

|

|

Euro Yields, Gilts, and Government bonds

Warning: Holding on to Government bonds is hazardous to your financial health. Long-term Greek government bonds crashed, and yield rose to +10% in only a week. The yield on Portuguese bonds rose to +5%...only in days...Those holding on to Government bonds will lose 50% to 90% of their savings!!!!

|

|

| German yields are now negative (2015) | 2017 |

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic