Shares are Real Assets

Unlike Saving accounts, Bank deposits, and Paper Money, Stocks are REAL ASSETS.

Unlike Saving accounts, Bank deposits, and Paper Money, Stocks are REAL ASSETS.

Shares are REAL ASSETS, participation in Real Estate (buildings, office complexes, commercial real estate), participation in machinery, automobiles, trucks, labor, patents, minerals, etc

"The problem Shares have today, is that they have become DANGEROUS DIGITAL ENTITIES kept by Brokers, Bankers, and Transfer Agents. Any of these counterparties AND the Government can SEIZE and TAX these at any time."

Shares of stocks are quoted in nominal fiat money but by acquiring a stock you exchange Fiat Money for Real assets and VALUE which often are spread all over the World. IBM (international business machines is a good example). Nestle, ATT, Unilever, BP, EXXON, CONOCO, Johnson & Johnson,...

| Buy when blood runs through the streets, sell when everyone is partying. |

A good share is better than good Real Estate.....the main difference is that a crash/correction as a rule only lasts for 2 years (worst case scenario) where a crash/correction for Real Estate normally lasts for 26 years. This of course on the condition you buy participation in some decent, GOOD company [and not in worthless financials/banks].

Having said this, with little homework it is not too hard to have a yearly +20% performance. This of course on the condition you buy CHEAP and sell HIGH and don't let them scare you out of a position in between...

| Better and a lot safer to hold 10 shares at a loss in your portfolio than to hold $500,000 in a bank account.!.. |

Contrary to Real Estate, stocks are PRICED DAILY. Short-term predictions are extremely hard: the shorter, the harder. Important is to have the trend right and to sit it out until it changes. Most of the time there are clear indications a trend change is about to happen (good examples were Bank/Financials and Real Estate). Those who refuse to accept market conditions have changed and keep on holding to stocks because they fell in love with these (or because stupid and most of the time inexperienced bankers told them to) can lose fortunes in similar way fortunes are lost by those holding on to Real Estate when the bubble bursts...or holding on/buying Treasuries and Bonds at the top of the market. Stocks and Real Estate follow different cycles.

| The Rothschilds made their fortune by exchanging GOLD (a real asset) for TREASURIES at the right time! |

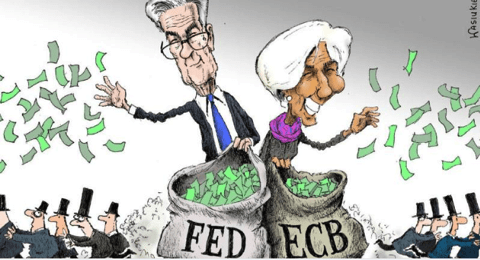

Remember at all times a Bond/Treasury is an option to buy Fiat Money and Bank Deposits/Saving accounts can be extremely hazardous...as well as the money kept under your mattress. As a matter of fact, years ago when paper money was introduced in the western world, Money used to be Interest Bearing Treasuries. Governments had again found "the trick" to fool the people.

Remember at all times a Bond/Treasury is an option to buy Fiat Money and Bank Deposits/Saving accounts can be extremely hazardous...as well as the money kept under your mattress. As a matter of fact, years ago when paper money was introduced in the western world, Money used to be Interest Bearing Treasuries. Governments had again found "the trick" to fool the people.

Stocks can offer an ESCAPE ROUTE when Authorities enforce Capital Controls. When such happens, citizens have lost all faith in Fiat Money and Treasuries issued by the Rulers and as there is no escape route and they are, most of the time, not allowed to buy/trade with foreign fiat money, they flee into STOCKS. Modern examples are South Africa and Iran. During the sanctions against South Africa, the locals bought even automobiles as a hedge against the weakening South-African Rand.

Example of a certificate of shares registered in the name of Robert M Tanney (click to enlarge)

Copyright, All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic