Real Estate

June 2023 - The Real Estate Bubble is deflating!

This (chart below - click to enlarge) is what the Real Estate Cycle looks like. Note that the present Bull Trend started after WW2 (1950). The FIAT price of Real Estate is NOT a function of the Quantity of Money in Circulation only. Nor is it a function of the level of Interest Rates only. The former arguments are often used by Snake-oil-merchants who have no clue about economics, finance, and how the Real Estate Market functions. But it is extremely easy to sell these to greedy, ignorant civilians. Time to read the book: Extraordinary Popular Delusions and the Madness of Crowds...Charles Mackay

September 2022 - Real Home prices start to crash.

Real home prices are going to fall, and it’s going to cause a massive negative wealth effect. Real home prices impact the wealth effect more than nominal home prices. Many people invest in real estate as an asset to beat inflation. If inflation is 10% and your home goes up 15%, you beat inflation by 5%, thus making you 5% wealthier in real terms. If inflation is 10% and your home goes up 5%, you lost 5% of your purchasing power in an asset that is supposed to protect you, and you are worse off.

Real home prices are going to fall, and it’s going to cause a massive negative wealth effect. Real home prices impact the wealth effect more than nominal home prices. Many people invest in real estate as an asset to beat inflation. If inflation is 10% and your home goes up 15%, you beat inflation by 5%, thus making you 5% wealthier in real terms. If inflation is 10% and your home goes up 5%, you lost 5% of your purchasing power in an asset that is supposed to protect you, and you are worse off.

Also, real home prices are the best measure of the true performance of real estate as an asset class across long periods of time. You can’t compare home prices today to those in the 1970s without looking at them in real or inflation-adjusted terms. Since the 1970s, real home prices have declined several times, mainly during recessionary periods.

"The financial crisis in 2008 caused home prices to decline by almost 30% in real terms. It took until 2021 to regain the peak in real home prices in 2006, 15 years!"

Over the last ten years, real home price growth averaged 4.5%, which is way higher than the 20-year average of 2%. Consumers and investors became accustomed to home prices rising sharply above the rate of inflation and a source of wealth building, particularly when using high amounts of leverage and mortgage debt. With the feeling that home prices would always rise above inflation and nearly 5% above inflation, a prevailing sentiment was born that you could leverage your way to wealth. But now, real home prices are starting to decline.

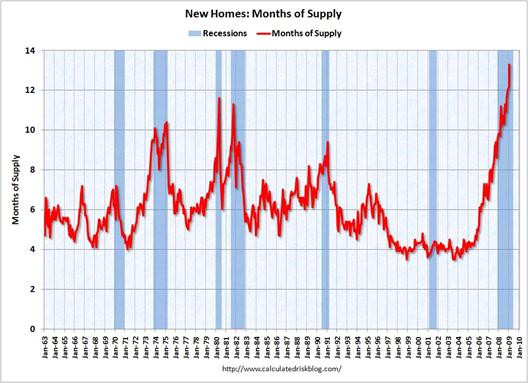

Serious Problems In The Housing Market. There are several key leading indicators of real home prices: the months’ supply of new homes, the spread between 30YR mortgage rates and 30YR Treasury rates, and the growth rate of real M2. All three indicators imply that the real home price appreciation rate will likely continue to decline in the months ahead.

There was a fascinating Twitter thread by Rick Palacios, the Director of Research at John Burns Real Estate Consulting, expanding on housing. I’m going to include the important quotes that he gathered from participants in a variety of markets:

- Atlanta builder: “Someone turned out the lights on our sales in June!”

- Austin builder: “Sales have fallen off a cliff. We’re selling 1/3 of what we sold in March and April. Traders are more willing to negotiate the price since the market has adjusted significantly past 60 days.”

- Birmingham builder: “Sales have fallen 75% the last two months in a further out community.”

- Boise builder: “Sales have slowed tremendously. Builders are dropping prices and halting new starts. Seeing prices drop on labor due to slowing of home starts. Expecting 15% to 20% reduction in most costs.”

- Charlotte Builder: “This recession looks like and feels like a big long five-year depression.”

- Colorado Springs builder: “Amazing how fast a market can change with such a rapid rate increase. So many people were taken out of the market. Most builders will go to suppliers/trades and ask for rollbacks [on costs].”

- Dallas builder: “Framing labor has become readily available, suggesting housing starts slowdown is finally showing its typical signs. Haven’t raised prices in 3 months.”

- Des Moines builder: “Starting to see [construction] trades hold labor prices for us as they are fearful of a downturn.”

- Fort Myers builder: “Investor sales have stalled.”

- Grand Rapids builder: “Believe we’re on the edge of cost reductions. Making every effort to refuse further [cost] increases and pushing for decreases in all areas that have seen significant two-year run-up.”

- Greenville builder: “Traffic has slowed from red hot. It feels different, but it’s more like a normal market.”

- Harrisburg builder: “Sales decreased to 50% of what they were 3 months ago. Traffic is down, and we’re only moving spec homes after dropping prices. No one is buying to-be-built homes at this time.”

- Phoenix builder: “Some builders are already cutting staff. Cancellations are extremely high. Dismal traffic and sales climate.”

|

|

| A Real Estate crash is harrowing, as it always is happening in an EMPTY market. | Prices come down after the market has trapped most investors, and no buyers are left. |

|

|

And NO, you're going to suffer if you, for a split second, think you will be able to profit from the coming hyperinflation and debt (a mortgage). The rule is that they ALWAYS reset the amount and/or the interest rate during these times. NO WAY to win from the Banksters and the Authorities.

| The price level of Belgian Real Estate is as dangerous as the price level of Real Estate in Amsterdam. | No, Real Estate is NOT a good place to hide. Certainly not with a mortgage. |

© - All Rights Reserved - The report's contents may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic.

Updated March 2022 - And what always happens to bubbles? They pop.

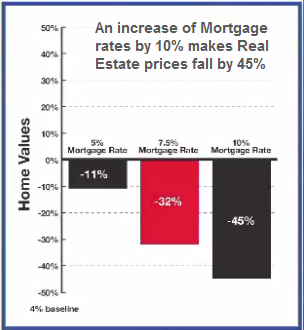

We have a massive housing bubble — even bigger than the one that popped in 2007 and led to the 2008 financial crisis. And the Fed has the pin in its hand. It’s about raising interest rates. Mortgage rates will go up right along with them. And it’s already tapering its purchase of mortgage-backed securities. Even if they don't raise interest rates, this market will crash as the consumers' Real Spending Power is being destroyed by the (hyper)inflation. At the same time, the landlords will see their tiny profit margin taken away by higher maintenance costs, higher taxation, and last but not least, RENT CONTROLS.

We have a massive housing bubble — even bigger than the one that popped in 2007 and led to the 2008 financial crisis. And the Fed has the pin in its hand. It’s about raising interest rates. Mortgage rates will go up right along with them. And it’s already tapering its purchase of mortgage-backed securities. Even if they don't raise interest rates, this market will crash as the consumers' Real Spending Power is being destroyed by the (hyper)inflation. At the same time, the landlords will see their tiny profit margin taken away by higher maintenance costs, higher taxation, and last but not least, RENT CONTROLS.

A comparison between the runup to 2008 and today.

The bubble that developed from 2002 to 2007 peaked at around a 47 % price increase before plummeting by 20 percent from 2007 to the first quarter of 2009. If we see a similar pattern emerge for the bubble that has been developing since roughly 2012, then we could see housing prices drop by 30 to 40 percent over a two-year period. Whatever the final numbers end up being, the evidence is clear: based on data reported over the past six decades, America appears to be on the verge of an epic real estate crash.”

A collapsing housing market will ripple through the economy, and it’s hard to say exactly how it will play out. Regardless, this is a big problem for the Fed (ECB). We have been saying that the Fed (ECB) can’t do what it’s saying it will do to fight inflation, and this is yet another reason. If it follows through with rate hikes and stops buying mortgage-backed securities and starts selling them into the market, mortgage rates will skyrocket. Unaffordable homes will become more unaffordable.

The housing bubble will pop Again....this time also in Europe. It may not take much of a pinprick to pop the bubble. Even the 1 or 2% rate hike the Fed (ECB) talks about could do the trick.

July 2021 - The Western World is experiencing a BUY CLIMAX of Real Estate, or the "end is near"!

On Real Estate: what we see now all over the world is the BUY CLIMAX or the last spike before the Real Estate market dries up and comes sharply down. And yes, a drop of 60% in Real Estate prices will probably be seen.

On Real Estate: what we see now all over the world is the BUY CLIMAX or the last spike before the Real Estate market dries up and comes sharply down. And yes, a drop of 60% in Real Estate prices will probably be seen.

In the USA last year, Real Estate also increased by 23%. This increasingly looks like a market top. It's not the value of the Real Estate going up, but rather the value of the currencies going down as more and more money is created out of thin air.

"This is comparable with the NEGATIVE interest rate you have to pay to banks on your bank deposits."

Most people fail to understand that a Real Estate Asset becomes a Real Estate LIABILITY in times of high & hyperinflation. This happens as soon as the RENTAL INCOME (real or calculated income) no longer covers the REAL COST of a property. Or the income no longer covers the taxes, maintenance, mortgage, amortization,... The fact that because of the high inflation rates and the recession, RENTERS are no longer able to pay their rent and/or LANDLORDS are no longer able to honor their mortgage adds to the drama.

As soon as Real Estate becomes a liability, the market dries up, and prices start to come down. The forced sales often push the general level of prices down by 40% to 60% and more when expressed in Real Money or Gold.

Updated March 2021 - Prepare NOW for a once-in-a-lifetime opportunity!

Most people still don't understand the mechanisms of Real Estate pricing. Either they are stubborn and protect their own incorrect vision, or they refuse to understand reality. We compare it to the Bitcoin and cryptocurrency traders. Only when buying Real Estate, the odds are that at the end of the run, you will be left with something but Thin Air in your hands. That is, on the condition your property is not SEIZED (1917-USSR), bombed (WW2-1940-45), or heavily taxed (Germany 1950s).

Most people still don't understand the mechanisms of Real Estate pricing. Either they are stubborn and protect their own incorrect vision, or they refuse to understand reality. We compare it to the Bitcoin and cryptocurrency traders. Only when buying Real Estate, the odds are that at the end of the run, you will be left with something but Thin Air in your hands. That is, on the condition your property is not SEIZED (1917-USSR), bombed (WW2-1940-45), or heavily taxed (Germany 1950s).

Few people realize that the Real Estate sector dries out at the TOP of the Market. Impossible to sell at the expected price levels. Selling becomes only possible at much lower levels: -50% to -60%. When this happens, those who bought Real Estate with a mortgage really are in deep trouble.

Most Real Estate lovers don't realize that during recessions and depressions, the Real Estate Bubbles ALWAYS burst and deflate because the Real Purchasing power of the consumer disappears. When this happens, kids stay with their parents. Often kids, parents, and grandparents live under one roof. When the former is impossible, people live in their cars or on the streets, as we see in the BIG DEMOCRATIC state of California.

We don't doubt that sometime soon, Real Estate will offer a tremendous investment opportunity for those who managed to preserve their purchasing power (which cannot be done by investing in Bonds and/or Shares). During the Weimar depression, one could buy only a whole street with 2 gold coins. Things got so bad that the legislator had to enact a law whereby non-Germans could not buy German Real Estate. In the USA, during the great depression of the 1930s, one could buy a Skyscraper for 2 only gold coins.

More recently, from 1980-1981, one could buy a Single Family house for less than 1,500 x 1 oz. Silver coins. This time, Real Estate and Silver and Gold are terribly undervalued because of the Terrible BIG Bubble. We expect to see that even smaller amounts of Silver and Gold coins will buy a single-family home. The TRICK will ensure the Government; the Authorities don't STEAL (SEIZE) your Gold & Silver holdings. We know HOW!

|

|

| In 1980 - 85 x 1 oz. Gold coins bought 1 house. | In 2011 - 5,521 x 1 oz. Silver coins bought 1 house |

Update June 20, 2020 - Real Estate - General

With lower Real Estate prices and higher Gold, it will become even easier to acquire Real Estate and buy CASH!

US Housing market slump continues. Few realize that the BUBBLE is now BIGGER than it was in 2006. Belgium's real estate bubble has also deflated, including Commercial Real Estate.

Nearly Half Of Americans Considers Selling Home As COVID Crushes Finances. As the virus pandemic has metastasized into an economic downturn, tens of millions of Americans have lost their jobs and are struggling to service mortgage payments. Households are struggling, and over half (52%) of respondents say they're routinely worried about making future mortgage payments, and nearly half (47%) consider selling their home because of the inability to service mortgage payments.

"Delinquencies are set to surpass the great depression, which peakned at 10%."

81% of the respondents had experienced unexpected financial stress due to the virus-induced recession. Over half (56%) reduced spending so they could service mortgage payments. From clothing (71%) and take-out (66%) to streaming TV services (46%) and groceries (45%), respondents said their spending habits had been significantly reduced so they could service mortgage payments. In a separate report, more than 4 million homeowners are in mortgage forbearance plans - representing 7.54% of all mortgages. Delinquencies are set to surpass the great recession, which peaked at 10%.

A House Is a Terrible Investment. Unless you buy a new house, you will probably spend up to 1% of the house's value on maintenance every year. Gold, held in a vault in Panama, will not burn down. It costs a little bit to store gold in a vault in Panama (especially if you insure 100% of the value), but it costs a lot more to maintain your house.

Your house essentially yields -1% unless you rent it out. You have to pay to insure it, you have to pay the property taxes, and you have to pay for all the other crap. This doesn’t include the mortgage. Ordinarily, you wouldn’t characterize something that costs you money as a good investment.

Your house essentially yields -1% unless you rent it out. You have to pay to insure it, you have to pay the property taxes, and you have to pay for all the other crap. This doesn’t include the mortgage. Ordinarily, you wouldn’t characterize something that costs you money as a good investment.

But house prices go up over time, right? We learned ten years ago that they can also go down. The housing market dynamics have changed dramatically in the last 20 years. We’ve had one big national bubble, and now we have some very pronounced secondary bubbles. People should stop thinking about their house as a trade and start thinking about it as a place to live. That is what it was and nothing more throughout most of US history.

Renting gets a bad rap—the “I’m just flushing all that money down the toilet” argument. Yes, but if you buy a house, you will probably flush even more money down the toilet. There are times when it mathematically makes sense to rent… and there are times when it makes sense to rent even when it doesn’t make sense mathematically.

How 500 Silver Maple Leafs will buy your single-family home.

During the Weimar Depression in Germany, one could buy a street for a couple of Gold coins. It was so bad that Germany had to change the law so non-Germans could not acquire German Real Estate.

|

|

| click to enlarge | |

|

|

We know two things about housing bubbles: apologists and pundits always deny housing is in a bubble, but they always pop with devastating consequences.

This chart reveals the tight correlation between real (i.e., adjusted for inflation) new house sales prices and real wages/salaries. Every time house prices get ahead of earnings, and house prices decline sharply. Since these are real prices/wages, they go down when prices/wages don't keep up with inflation. So while nominal house prices didn't say much in the late 1960s as inflation took off, they fell sharply when adjusted for inflation.

- Housing is relatively cheap when it is well below earnings. Housing was an attractive buy in 1945, 1970, 1982, and the mid-1990s.

- Housing Bubble #1 is clearly visible as house prices skyrocketed far above earnings in the 2004-2008 period. The gap between house prices and earnings widened to an unprecedented degree, which resulted in an equally unprecedented crash in housing valuations.

- The gap between real house prices and real earnings is even wider than in Housing Bubble #1. History (and common sense) suggest that housing prices will once again fall sharply. The situation today is so bad that even in countries like Canada, Real Estate prices start to come down. To expect anything different is unrealistic and highly dangerous to one's financial well-being.

30 Reasons to sell Real Estate:

| A Real Estate investment with a mortgage is a one-sided leveraged and hazardous investment! |

This is what the 2018 picture looks like:

(click on the chart below to enlarge and to check the tops for other Real Estate markets)

Updated 2017 picture:

In real estate investment, real property is often valued according to projected capitalization rates used as investment criteria. This is done by algebraic manipulation of the formula below:

| Capital Cost (asset price) = Net Operating Income/ Capitalization Rate. |

For example, in valuing the projected sale price of an apartment building that produces a net operating income of $10,000, if we set a projected capitalization rate at 7%, then the asset value (or price we would pay to own it) is $142,857 (142,857 = 10,000 / .07). This is often referred to as direct capitalization and is commonly used for valuing income-generating property in a real estate appraisal.

One advantage of capitalization rate valuation is that it is separate from a "market-comparables" approach to an appraisal (which compares 3 valuations: what other similar properties have sold for based on a comparison of physical, location, and economic characteristics, actual replacement cost to rebuild the structure in addition to the cost of the land and capitalization rates).

Given the inefficiency of real estate markets, multiple approaches are generally preferred when valuing a real estate asset.

Capitalization rates for similar properties, particularly for "pure" income properties, are usually compared to ensure that estimated revenue is being properly valued. Click here for more.

A shelter always costs money; either you pay rent or buy and hereby invest capital in it and cannot use it for other purposes.

"Stock markets can come down swiftly and lose 50% in only weeks' time. Traditionally, they recover quickly (often in less than 6 months' time). Historically, Real Estate markets need about 26 years to recover. In some cases, like Florida, they never recover."

Real Estate Cycles Real Estate cycles are, by definition, LONG-TERM (+76 years) cycles. Most people will, during a lifetime, only experience one cycle. For this reason, it is essential to locate each sub-cycle in the Long Term secular up or downtrend. Secular trends last up to 75 years. When I see the real estate market's misery, and I link it to the historic low-interest rates, I hold my heart when I realize what will happen once the interest rates, under the pressure of (hyper)inflation, start to increase.

There is no doubt we have seen the end of the Secular bull trend, and the euphoria of the Bubble we have seen worldwide will end up in all history books. The actual Secular Bear market trend for real estate is real, and things are getting worse each month.

The main difference between Real Estate and Stocks is that it usually takes a generation before real estate losses are recovered (Florida 1926). Stock market losses occur more frequently, and can be severe (-50% in 2008), but recovery of all losses often happens in less than a year's time.

Previous Tops & Bottoms in Real Estate:

How low will real estate prices fall?When you own a house, and your monthly mortgage payment is double the rent your neighbor pays, you definitely know something is wrong. I completely disagree with the Talking Heads shouting that what we see today is nothing more than an insignificant reaction and that within 3 years from now, Miss Goldilocks will be back holding the hand of Real Estate. One should understand the potentially dramatic consequences of a Long Term Secular Bear market that has been initiated at a point where the general level of worldwide INTEREST rates is LOW. Once interest rates go up (they already do in countries with weaker economies - and THEY WILL ) under the pressure of inflation, the only way for Real Estate is down. Looking at historical prices (including Japan), real estate prices, on average, tend to come down by 75 % to 80 % from peak to bottom. Basically, it is said that after a parabolic run-up, prices always fall back until on or below the base where the run initially started from. Conditions in Japan after 1990 and into 1993 are certainly confirming this. Another rule is that Real Estate prices will come down until the nominal value equals 100 times the monthly rent. In other words, if the nominal rent is 1,000 $/ € per month, the property's value will fall back to $/€ 100,000. |

|

|

REAL ESTATE CAN BE CHEAP! € 150,000, £ 130,00 or $ 200,000 buys you a brand new 300 m² / 3000 sq.ft home

This home comes with 4 beds/4baths, a two-car garage, an installed kitchen, AC and central heating, a central vacuum system, a nice garden, an upmarket area...more.

|

Real Estate is a High Order Capital Good and will be adversely affected by the economic depression, the over-supply, higher interest rates, lower real income, and aging Baby boomers...but any crisis also offers opportunities and opportunities we have if we can buy NEW Homes at half the price it would cost to build them today......AND Real Estate is better than Fiat Paper Money and Treasuries. |

|

Buy a condo in sunny Florida for € 50,000 or a Single Family home for € 149,000! |

||

| PGA Village | The Lakes | Tradition |

|

|

|

Increased taxation and expensive, hard-to-get mortgages add pressure on a market that is already suffering from lower demand as a result of lower Real Income and higher supply as a result of the Real Estate bubble and the retiring Baby boom generation.

The following graphs are for Japan but also apply to other countries: USA, West-Europe, Belgium, The Netherlands, France, Spain, UK, and Germany ....click here to select your country and see for yourself what to expect for the local Real Estate market. A narrowing base = Lower Prices, and a widening base = Higher prices.

|

|

|

|

Other negative factors for Real Estate: taxation, regulation, expensive energy, declining real spendable income of the general population (middle-class), growing unemployment, falling immigration,...

During the Weimar hyperinflation, one month's rent barely paid for one loaf of bread. Many tend to forget that Real Estate (especially a home) wears out, gets old, and is badly isolated,...During recessions and depressions, Authorities do all they can to keep rents as low as possible (housing is part of the inflation indexes) and, as a rule, block rents during hyperinflation. As a result, Landlords see their income and right amputated, and the income on their property disappear, and they try to sell.

My parents bought a small three-bedroom house in Texas in 1960 for the seven of us in the family. My brother and I shared one bedroom, my parents had the center bedroom, and my three sisters shared the back bedroom. The house cost about $12,000. Today it’s probably worth $120,000. My parents put down about 15%, which they could afford on a 15-year mortgage.

They didn’t look at it as an investment. At best, they may have considered it a sort of savings plan. Owning a house was considered an expense, just like operating a car. You might need shelter, but painting and small repairs were constant. If someone had gone to them and suggested it was a great investment because housing could only go up, they would have looked at him like a goat with three heads. Housing an investment? Are you kidding? At best, you might break even, and it would take 18 months to sell.

The home price drop in the USA exceeds the Great Depression. Home prices have fallen 26 percent since their peak in 2006, exceeding the 25.9 percent drop registered in the five years between 1928 and 1933, the housing data company said in a report on Monday. Prices fell 0.8 percent over the month...more.

Updated December 2010 [ posted November 27, 2009] - This is the REAL PRICE evolution of Real Estate...

|

US Gold price - Gold ratio |

|

How to dig a financial hole of $/€ 600,000!?

How to dig a financial hole of $/€ 600,000!? Amazing is that many Europeans refuse to LEARN about what happened in the USA and Spain and still BELIEVE what the Authorities say...In 2005 RIGHT BEFORE the American Real Estate busted, Bernanke himself testified that there was no Real Estate Bubble and that it was safe to buy a property. In 2006 the bubble busted, and today, somebody who bought a house in 2006 at $ 500,000 and made a $ 100,000 down payment has a debt of $ 800,000 (capital plus interest). His house, however, is worth ONLY $ 200,000. The end result is that instead of being better off by buying a property, those people dug a financial hole of $ 600,000! Those who have the guts to watch the clip to the end will understand what we are talking about...

A landmark ruling in a recent Kansas Supreme Court case may have given millions of distressed homeowners the legal wedge they need to avoid foreclosure. In Landmark National Bank v. Kesler, 2009 Kan. LEXIS 834, the Kansas Supreme Court held that a nominee company called MERS has no right or standing to bring an action for foreclosure. MERS is an acronym for Mortgage Electronic Registration Systems, a private company that registers mortgages electronically and tracks changes in ownership. The significance of the holding is that if MERS has no standing to foreclose, then nobody has the standing to foreclose – on 60 million mortgages. That is the number of American mortgages currently reported to be held by MERS. Over half of all new U.S. residential mortgage loans are registered with MERS and recorded in its name. Holdings of the Kansas Supreme Court are not binding on the rest of the country, but they are dicta of which other courts take note, and the reasoning behind the decision is sound...click here for more...

May 22, 2009 - With this huge supply of new homes, there is no room for improvement

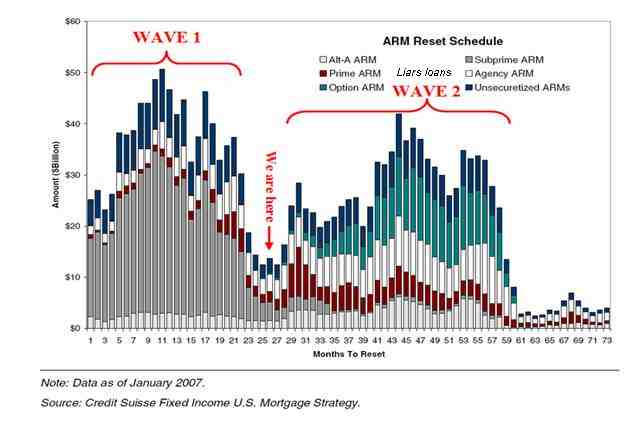

Danger as we move out of the Eye of the storm into the 2nd Wave!

More bad news for Real Estate. The number of foreclosures in the US keeps going up. People are looking at the schedule of mortgage resets for option ARM loans [also called liar loans]. These will begin to reset in a couple of months, and the process will not peak before 2011.

April 22, 2009: in the USA, 600,000 foreclosed houses are kept off the market by lenders.

’ We believe there are in the neighborhood of 600,000 properties nationwide that banks have repossessed but not put on the market,’ said Rick Sharga, vice president of RealtyTrac, which compiles nationwide statistics on foreclosures. ‘California probably represents 80,000 of those homes. It could be disastrous if the banks suddenly flooded the market with those distressed properties. You’d have further depreciation and carnage.’

According to the Wall Street Journal: “Ronald Temple, co-director of research at Lazard Asset Management, expects home prices to fall 22% to 27% from their January levels. More than 2.1 million homes will be lost this year because borrowers can’t meet their loan payments, up from about 1.7 million in 2008.” (Ruth Simon, “The housing crisis is about to take center stage once again,” Wall Street Journal)

Spanish banks use a similar pattern. (Spanish banks over-invested in Real Estate as they were sure trees would grow all the way into heaven)

The next shoe to drop is Commercial Real Estate -

In December 2008, the Commercial Real Estate bubble is bursting as expected. In November, analysts at Credit Suisse said two big commercial mortgages that had been packaged into securities in the past year were likely to default. The rapid deterioration of these loans fed worries that the weakening economy and higher unemployment rate would drag down the $800 billion market for commercial-mortgage-backed securities, or CMBS, which so far has withstood the credit crisis with low delinquency rates.

2017 is de crash van de commercial-vastgoed-sector nog steeds levend. Macy's , Target, Sears, ....grote ketens sluiten steeds meer filialen in de USA. Terzelfdertijd wordt in Europa de detailhandel door de zieke politiek van gekke GROENEN uitgemoord. Auto's worden met drogredenen uit de steden geweerd (alhoewel de stad Antwerpen oudere auto's uit de stad houdt, is de meting van het FIJN STOF er dit jaar verdubbeld! - volgens Europese leiders is lucht stationnair).

Om het kwaad erger te maken, begint de INTERNET VERKOOP langzaam maar zeker de winkel verkoop over te nemen. Het publiek hoeft niet langer met de auto de stad in. Men hoeft niet langer file te rijden naar een winkelcentrum. Er wordt gewoon via de computer gekocht en de goederen worden netjes thuis geleverd.

De grote vraag die we ons vandaag moeten stellen, is wat de TOEKOMST wordt van de stad. In Europa worden stadspanden steeds meer gekocht door immigranten (Turken, Marokkanen, Tunesiers, Noord en Centraal Afrikanen en vluchtelingen uit het Midden-Oosten. Europese steden worden steeds meer GHETTO'S (Johannesburg stijl) die door de inheemse bevolking vermeden wordt. Over enkele jaren vind men hier wellicht de Europese soeks van de 21st eeuw.

Updated March 31, 2009

This is an exciting long-term chart of Real Estate. To see just how unusual recent price activity has been, take a look at Yale economist Robert Shiller's inflation-adjusted housing chart, going back more than a century.

The chart makes it crystal clear that the current overvaluation of real estate in real terms grossly exceeds the one during the 1920s. The coming correction in real estate will be protracted and gut-wrenching, with an expected cumulative effect that is much worse than the Great Depression.

Posted March 31, 2009

The Real Estate Boom was nothing more than a desert mirage. The direct result is fractional reserve banking and money creation out of thin air.

- The Real Estate crisis and the freefall of home prices are expanding to commercial properties. Other countries like the UK, Spain, France, Belgium, Morocco, Canada, Costa Rica, Belize, Austria, and East European countries have joined the USA as their real estate bubbles also are deflating.

- Trees nor Real Estate grow all the way into Heaven! I understand that for many, it is tough to understand what is happening right now. A real estate cycle is, in most cases, a 'once in a lifetime experience, and they saw nothing else than rising prices (apart from some short-term corrections). Even the Paradise of the Real estate: the city of London, Manhattan, and the paradise resorts in the Gulf petro-monarchies are becoming a real estate hell.

- The real estate crisis has become a self-feeding monster. The Real Estate crisis is amplified because banks keep reducing the number of mortgages and real estate loans to potential buyers.

- As a rule of thumb, in a secular real estate bear market, Real Estate prices fall until the price equals 100 times the rent.

- Another rule is that a Home should cost no more than three times the annual household income.

- Purchasing a house creates dead capital. It does not create jobs once the construction is terminated but consumes capital through financing.

- The wealth created by Real Estate is mainly an illusion created by currency movements. (South Africans bought automobiles, drove them for a couple of years, and sold them at a profit because the Rand used to be so weak).

- The harder it gets to borrow money to buy a home, the harder Real Estate prices will fall.

- In the best-case scenario, the Debt Crisis and the US Real Estate won't bottom until 2011 and probably 2017. As the crisis started with a delay for the EU and other countries, expect to see the bottom with the same delay. For the EU, this could well be 2014-2020.

- When the Argentinean Real Estate sector bottomed, it had become impossible to get a mortgage to buy property (it still is).

- Real Estate is a LEVERAGED good. Hence its general price level is directly affected by the level of interest rates.

Monetary inflation is even more deceptive - or dangerous - when it is working with asset deflation.

Most of the population does not understand what happens when monetary inflation meets asset deflation. Hidden within the convergence of those two fundamental forces will be the likely "solution" to the current housing crisis, as well as opportunities for astute individuals to protect and even increase their net worth during a time of falling real home prices."

Posted January 9, 2009

When I discussed the imminent crash of the Japanese Real Estate and Stock market in 1989, experts said I was crazy. Japan was an overpopulated island, and for this reason alone, a Real Estate crash would and could never occur. And yet, 15 years later, a house selling for 220,000 yen in 1989 can be bought for 80,000 yen. Japanese real estate crashed, and the Yen also has a terrible shock for all 1989 non-believers. Today similar conditions occur for British real estate owners: on top of sliding British real estate prices, the Pound is also crashing.

People are so naive to believe that what happened in Japan would never occur in the United States, Australia, the City of London, the Costa del Sol in Spain, or Belgium, Yet it is happening in all these countries!

Stock markets can come down swiftly and lose 50% in only weeks' time. Traditionally, they recover quickly (often in less than 6 months' time). Historically, Real Estate markets need about 75 years to recover. In some cases, like Florida, they never recover.

"You don't get rich by buying a house! You get rich by investing your money wisely. You could even get poor by buying a house in today's market!"

"What asset or Real Estate deflation (in inflation-adjusted terms) and monetary inflation have in common is that they are complementary (not opposing) forces of financial destruction. Asset deflation destroys the purchasing power of your assets even as monetary inflation destroys the purchasing power of your money".

Today one can buy Real Estate below $ 10,000. Some of these opportunities are wise investments! The housing market for the next several years will undoubtedly take a severe hit. In the end, the torrential flood of homes that come to the market for sale will be bought at much lower prices by my children as well as yours at affordable prices. Those who count on 'a dip' in the market will be amazed by how deep the Real Estate market can slip!

Only $ 50,000 for a three-bedroom house! This is a foretaste of what Spanish builders may expect shortly. 2017 this has become REALITY...and prices will continue to fall!

July 23 (Bloomberg) -- Fannie Mae, the largest U.S. mortgage finance company, couldn't find a buyer paying $6,900 for the three-bedroom house at 1916 Prospect St. in Flint, Michigan. So broker Raymond Megie, who is handling the foreclosure sale, advised cutting the price to $5,000.

Megie still couldn't sell it. ``There's an oversupply,'' he said. The home sold in 2005 for $1