Will the EU survive?

A bunch of selfish politicians (intelligent psychopaths) won't be able to achieve what Caesar, Napoleon and Hitler could not.

| currency status | public debt | budget balance |

|

|

|

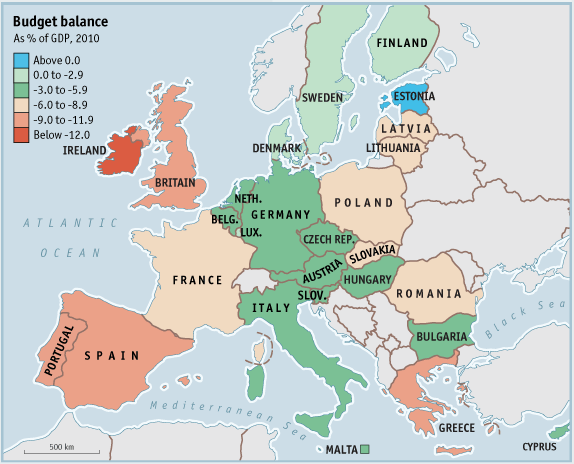

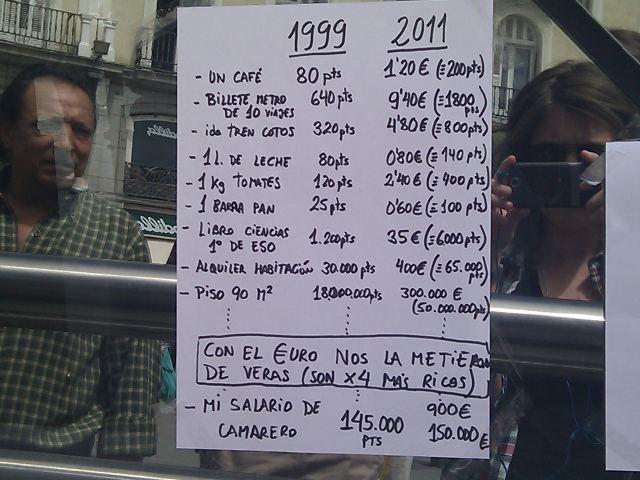

From an economic point of view, the only thing the Euro succeeded in was to window dress Inflation. If you still believe Inflation is good, see how little a Waiter's salary (mi salario de camarero) has gone up. Clearly not enough to cover for the higher cost of living. Inflation is theft in daylight by the Authorities...The irony is that as a consequence, we are ALL getting poorer. Those countries with the highest taxes, the largest debt, and biggest budget deficits have the highest unemployment rates and the weakest economies!

The video clip clearly proofs the EU is a Marxist invention and structure where politicians just bypass the will of the people, deny referendums (26 States were denied a referendum) and push through their will using back doors -

The Euro's bitter-sweet triumph at 10

If the purpose of the euro is to confront US dollar hegemony and turn the European Union into a monetary superpower, it is a signal triumph. But politicians should be careful what they wish for. Posted December 31, 2008

By Ambrose Evans-Pritchard

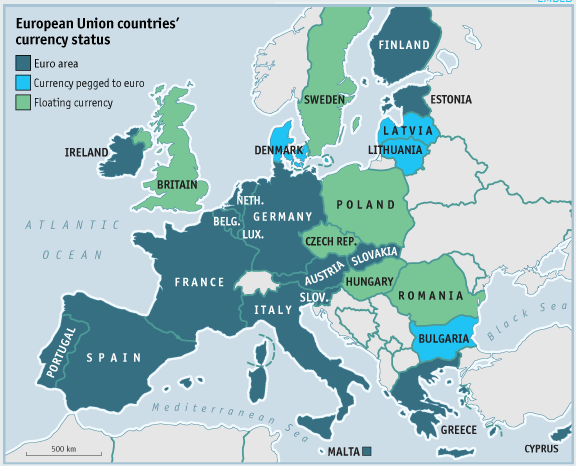

On its tenth birthday, the single currency is an unquestioned part of daily life for 330m people in sixteen states (Slovakia joins on January 1st), spreading almost as widely as Rome's denarius -- the first truly Pan-European coin.

On its tenth birthday, the single currency is an unquestioned part of daily life for 330m people in sixteen states (Slovakia joins on January 1st), spreading almost as widely as Rome's denarius -- the first truly Pan-European coin.

There has been no "tissue rejection" by the public, even if Euro-barometer data shows that the euro is more accepted than loved. Shoppers blame it - unfairly -- for inflation. Half the French still think in francs. Oddly, a slew of regional currencies has begun to circulate in German regions since the launch of EMU. Sociologists are baffled.

Market eagerness to push the euro to sterling parity, and too defiant highs against the dollar, Yuan, ruble, and rupee, is an undeniable stamp of confidence. But success is bitter-sweet. The euro-zone itself is in deep recession. A currency surge at this juncture is a cruel blow for the export industry. The full damage will hit in late 2009 as the time-lag effects work their curse.

The point of monetary union -- at least for Paris -- was to stop this happening. EMU was supposed to shield Europe against the fall-out from Anglo-Saxon "casino capitalism" and to ensure a stable currency.

Stable it is not. The Élysée never imagined that it would be a currency on steroids, spiking so high that it hollows out the French industrial core and drives Airbus to the brink. As President Nicolas Sarkozy put it in a moment of fury, "we didn't create the euro so that we could no longer build a single aircraft in Europe".

Otmar Issing, an ex-High priest of the European Central Bank, says half the states of West Europe would now be facing currency storms akin to the early 1990s were it not for the fortress strength of EMU.

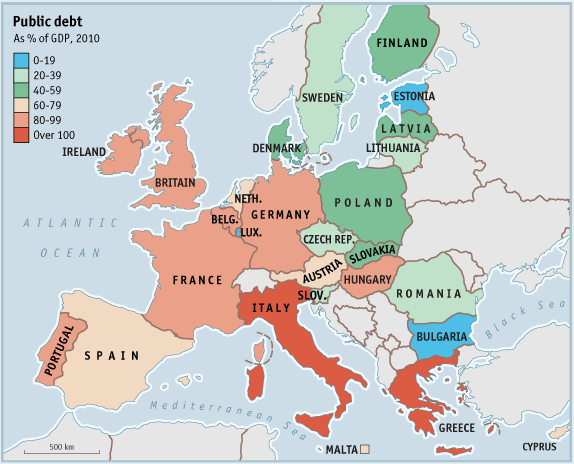

The yield spreads on Italian, Greek, Portuguese, Spanish, Austrian, and Irish debt would be even higher than they are already, amplifying the effects of the credit crunch and probably making it too dangerous for governments even to think of fiscal rescue plans. "People do not seem aware of this. They are now taking the advantages of the euro for granted," he said.

This is true in one sense, although the 1990s ructions stemmed from a fixed link to the D-Mark, a recipe for disaster. But such claims and counter-claims hardly touch on the deeper question of whether EMU is a viable undertaking over the long run -- or an "optimal currency area" (OCA) in economic jargon. Ten years on, the controversy rages. Both sides have enough evidence to say with equal vehemence, "I told you so". It all depends on which part of the picture you look at.

Let us not forget that the euro is a revolutionary construct. Never before have sovereign states of equal weight agreed to abolish their currencies -- some dating back to the Middle Ages -- and tied their destiny to a supranational bank.

The franc -- minted in 1360 to celebrate the end of Jean Le Bon's captivity in England -- evoked France itself, and French voters were not easily persuaded to give it up. The Maastricht Treaty passed by a wafer-thin margin in September 1992. We will never know how the German people would have voted if allowed to decide on the fate of their beloved D-Mark, the symbol of national renewal.

Currency unions come and go, typically revolving around one dominant power. The euro is a different animal. It has no political anchor. It is a leap into the unknown without a state, treasury, debt union, or EU social security net to back it up.

For arch-critics at Germany's universities, the decision to press ahead with the euro before the creation of a full-fledged EU state was to put the cart before the horse. America had forged its union before issuing a currency, as had 19th century Germany.

This is the bigger question to be tested over the euro's second decade. Currency unions can mask risk for a while. They shield sinners long enough to let imbalances get out of hand, storing up trouble for a more traumatic crisis later.

Eurosceptics say this is exactly what is happening. The gap between North and South has grown ever wider as Europe's nations hold true to type, and as the ECB's one-size-fits-all policy has vastly different effects on different cultures. Italy has lost 40pc in labor cost competitiveness against Germany since the currencies were fixed in 1995, and Spain has lost about 35pc.

The reasons are complex, rooted in the wage-bargaining structures, the protected guilds, and the banking systems of countries refusing to give up their traditions. In Spain, 70pc of wages are indexed to inflation, and over 98pc of mortgages are linked to floating Euribor. Is it any wonder that Spain's property boom mushroomed out of control when the ECB held rates at 2pc (to help Germany, then in trouble)?

Latin Bloc states could have taken drastic steps to make their economies more compatible with Germany. They failed to do -- despite heroic efforts by officials, especially at the Bank of Spain -- because the political class never understood the implications of EMU. Nor did Germany's leaders, for that matter. The shining exception is Finland.

Current accounts tell the sorry tale. Germany has a surplus near 7pc of GDP, while deficits have reached 10pc in Spain and Portugal, and 14pc in Greece. Club Med extravagance can continue only as long as foreign investors are willing to plug the gaps with fresh capital. Italy's debt headache is different but no less serious. As Europe's most indebted state, it must roll over €200bn of bonds this year in hostile markets.

It will not be easy for victims to claw back competitiveness within the constraints of monetary union. They will have to "deflate" wages relative to Northern Europe, but there lies the risk of a self-feeding debt trap.

We are shifting into the political realm in any case. Spain's unemployment has jumped from 8pc to 13pc in little over a year, and some analysts are predicting 18pc by 2010. When does civic patience snap? Nobody knows, but the ferocity of last month's riots in Greece is a warning. [2011 official unemployment is Spain is 23%]

As Europe's slump deepens this year we may find out if it matters whether or not the euro is a stateless currency. In dollar land, Washington disburses a fifth of GDP. A system of "fiscal transfers" automatically shifts stimulus from healthy regions to bust zones. This is how an 'OCA' self-adjusts. We may find out too whether Euro land enjoys the solidarity of a nation, "all for one and one for all" when the chips are down. German body-language so far does not suggest that it does.

For now, the eurozone is basking in glory as of the world's ultimate safe-haven. Icelanders are eyeing the currency longingly, and Denmark has paid a high price (two rate rises into the crisis) for its semi-detached role in the Exchange Rate Mechanism. The Poles are trying to rid themselves of the zloty as fast they can.

Berkeley Professor Barry Eichengreen says the euro is the "great winner" of this financial crisis, confounding those in the Milton Friedman camp who thought EMU would blow apart in the first bad storm. The nature of this banking drama has played -- unexpectedly -- to EMU's strengths, he argues.

Banks in European states outside EMU mostly lack a domestic currency used for international dealings, so they have borrowed in euros (and dollars). This has proved to be an Achilles Heel. "The implication is clear. National banking systems need a lender of last resort. In small countries, where a significant share of bank liabilities is in someone else's currency, the national central bank lacks this capacity. The only options are then to slap draconian controls on the banking system or join the euro area," he says.

His verdict is that every country except perhaps Britain will have to join Euroland. "The writing is on the wall", he said.

So the debate goes on. For defenders of sterling - and the Swedish and Norwegian crowns -- the precipitous slide against the euro over recent months is broadly a boon, unless you work in the travel industry, or ski a lot. It acts as a shock absorber at a crucial moment, helping to cushion the economy against debt deflation.

Export profits may hold up long enough to give a lifeline to UK manufacturing and service firms as banks shut off credit lines. It is the difference between survival and failure for thousands of healthy companies. This is what an independent currency is for. It preserved social stability in 1931 when Britain left the Gold Standard, and again in 1992 on leaving the ERM (from which the pound later roared back to a higher level, at the appropriate time).

We are too close to events to draw any definitive conclusions about the workings of EMU or the crash in sterling. There will be many twists and turns before this great debacle has played itself out across the world.

When the Chinese leader Chou-en-Lai was asked what he thought about the French Revolution, he replied: "too soon to tell". To judge the euro revolution on just a decade is frivolous.

Posted August 16, 2008 , Ambrose Evans-Pritchard

, Ambrose Evans-Pritchard

Well, my own view is that gold bugs should start looking very closely at something else: the implosion of Europe. (Japan is in recession too)

Germany's economy shrank by 1pc in Q2. Italy shrank by 0.3pc. Spain is sliding into a crisis that looks all too like the early stages of Argentina's debacle in 2001. The head of the Spanish banking federation today pleaded with the European Central Bank for rescue measures to end the credit crisis.

The slow-burn damage of the over-valued euro is becoming apparent in every corner of the eurozone. The ECB misjudged the severity of the downturn, as executive board member Lorenzo Bini-Smaghi admitted today in the Italian press. By raising interest rates into the teeth of the storm last month, Frankfurt has made it that much more likely that parts of Europe's credit system will seize up as defaults snowball next year.

As readers know, I do not believe the eurozone is a fully workable currency union over the long run. There was a momentary "convergence" when the currencies were fixed in perpetuity, mostly in 1995. They have diverged ever since. The rift between North and South was not enough to fracture the system in the first post-EMU downturn, the dot-com bust. We have moved a long way since then. The Club Med bloc is now massively dependent on capital inflows from North Europe to plug their current account gaps: Spain (10pc), Portugal (10pc), Greece (14pc). UBS warned that these flows are no longer forthcoming.

The central banks of Asia, the Mid-East, and Russia have been parking a chunk of their $6 trillion reserves in European bonds on the assumption that the euro can serve as a twin pillar of the global monetary system alongside the dollar. But the euro is nothing like the dollar. It has no European government, tax, or social security system to back it up. Each member country is sovereign, each fiercely proud, answering to its own ancient rhythms.

It lacks the mechanism of "fiscal transfers" to switch money to depressed regions. The Babel of languages keeps workers pinned down in their own country. The escape valve of labor mobility is half-blocked. We are about to find out whether EMU really has the levels of political solidarity of a nation, the kind that holds America's currency union together through storms.

My guess is that political protest will mark the next phase of this drama. Almost half a million people have lost their jobs in Spain alone over the last year. At some point, the feeling of national impotence in the face of monetary rule from Frankfurt will erupt into popular fury. The ECB will swallow its pride and opt for a weak euro policy, or face its own destruction.

What we are about to see is a race to the bottom by the world's major currencies as each tries to devalue against others in a beggar-thy-neighbor policy to shore up exports, or indeed simply because they have to cut rates frantically to stave off the consequences of debt-deleveraging and the risk of an outright Slump.

When that happens - if it is not already happening - it will become clear that both pillars of the global monetary system are unstable, infested with the dry rot of excess debt.

The Fed has already invoked Article 13 (3) - the "unusual and exigent circumstances" clause last used in the Great Depression - to rescue Bear Stearns. The US Treasury has since had to shore up Fannie and Freddie, the world's two biggest financial institutions.

Europe's turn will come next. We will discover that Europe cannot conduct such rescues. There is no lender of last resort in the system. The ECB is prohibited by the Maastricht Treaty from carrying out direct bail-outs. There is no EU treasury. So the answer will be drift and paralysis.

When EU Single Market Commissioner Charlie McCreevy was asked at a dinner what Brussels would have done if the eurozone faced a crisis like Bear Stearns, he rolled his eyes and thanked the Heavens that so such crisis had yet happened.

Posted June 14, 2008

Let those pretending there is democracy in Europe stand up! - Francis d. Schutte

Let those pretending there is democracy in Europe stand up! - Francis d. Schutte

Once political power is transferred from father to son and/or from man to wife, we should all know something is deathly wrong with Democracy.

Now that Ireland has rejected the Lisbon Treaty, I don’t see any earthquakes but rather a resumption of the scenario we saw after the French and Dutch voted ‘No’.

The EU ain’t freezing up. The talking heads designate either a country as too small to count (Ireland, The Netherlands) or the people’s decision is classified vertically and the Lisbon treaty will be pushed through overnight when all are asleep.

The European Parliament will do the impossible to ensure it’s very existence and I have no doubt Europe's clever lawyers will find a way to slip any text through in some way.

Nicolas Sarkozy plans to use France’s EU presidency to steamroll the treaty through “legal’ measures in the same way Louis XVI did before he ended up on the Guillotine.

However, with the Real Estate crises, the Credit Crunch and the destruction of money and the (hyper) inflation that comes as a consequence, I see the EU bumping into heavy problems. The odds are this complex society won’t survive the actual energy crisis after all.

History shows over and over again that if politicians don’t change politics, We the People get rid of the politicians ( even if it means they have to use a guillotine). One can only fool people as long there are games and bread but the upcoming hyperinflation and depression with a potential shortage of Food and Energy commodities will be a wake-up call for most of us.

-