01

March

2023

Velocity, inflation and Wars

What do Gold, Fiat Money, Velocity, Hyperinflation and Wars have in common?

The 1920's and today is different...at least if you compare the 1920's and today for the USA. It is not different however if you compare today's situation with the period preceding the Weimar Hyperinflation. In the US, during the 1920's the creation of fresh money was limited as the US-Dollar was backed by GOLD & Silver. However in Germany the German Mark was NOT backed by Gold & Silver! Therefore , during the 1920's -30's it was technically impossible to see a hyperinflation in the USA. In the aftermath of the American Great Depression and until after World War II, VELOCITY of the US-Dollar remained low. Only after the second World War, things got a lot better in the USA....logic as at that time the bulk of the World's Gold had been transferred to the USA.

Only the Velocity figures and statistics measured during and before the Weimar Revolution are a correct example of what we have and can expect today. Many Financial analysts and economists are incorrectly comparing the VELOCITY we have today with the evolution during the 1920's - 1930's and hereby make a huge mistake. One must compare today's evolution in velocity with the velocity of the period preceding and during the Weimar revolution!

Today (2014) the ingredients for Hyperinflation are ready for action. But what will ignite and kick start Hyperinflation? Is Hyperinflation merely a psychological process or is the fuse leading to it an macro-economic happening? The fuse could be a weak dollar (like it probably was lighted by a weak Deutschmark in the 1920’s). If this is true, the Real Income of the consumer is of lesser importance ! Therefore the coming US-hyperinflation switch may well lie in the hands of China - their action can kick start the velocity...If so, they will take all the requested precautions and only flip the switch once they have liquidated the maximum possible amount of US-Dollars (Treasuries) and US-Debt. This is exactly what Putin is doing (would he know better?).

| This time it's the same old story with a new cover. |

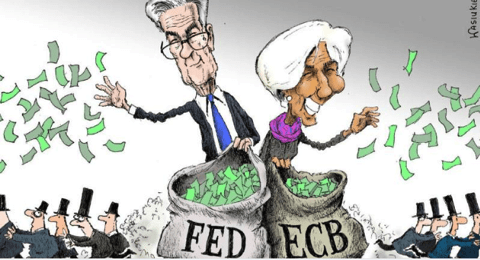

One hundred years ago (1914-18) and 1939-1945 Germany started two World Wars ... and it was all about the German Mark. Today we have a similar situation where the USA has been starting wars in North-Africa and the Middle-East and Central-Europe...and it is all about the survival of the US-Dollar (and the Euro, and the British Pound, and fiat Money). If markets stop accepting US-Dollars (Fiat Currency), what else can a country do than to ENFORCE the use of it with a gun? One hunderd years ago, Germany had a modern army...just like the USA has a modern army today...the same old story with a new cover !

Technically, there is more to be said about this. But in order not to make it too complex, one should know that it is extremely important that the GLOBAL AMOUNT of Goods traded in US-Dollar should be maintained. If not, it becomes extremely difficult, if possible at all to manipulate/rig a currency.

The good news is that in a closed system (USA-FATCA-IRS) the Stock Markets as a rule rise exponentially. That is until they crash. The bad news is that in the long run, the higher stock prices don't always compensate for the falling Dollar (currency). Examples are: Venezuela, Zimbabwe, Iran, Israel, South-Africa,...

Note: click here for the forecast made in 2009

October 2014

Francis D. Schutte