April 2024

![[Most Recent Quotes from www.kitco.com]](https://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif) |

![[Most Recent Quotes from www.kitco.com]](https://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif) |

|

| Physical: Add up to $200 per oz. | For physical, add up to $16 per oz. | Are you still Paper Gold? |

- The internet system makes it increasingly difficult to receive these in your Inbox. Create the following email addresses in your email system: This email address is being protected from spambots. You need JavaScript enabled to view it. and This email address is being protected from spambots. You need JavaScript enabled to view it., and check your spam box. On average, we mail one newsletter each week.

- We advise you to consult the site daily because interesting YouTube videos are often CENSURED!

- Read the older updates and education hall - and you will find A LOT of valuable information.

- Many Candles (and PF charts) may be updated, even if not mentioned in the "Updated Sections."

- Click on the logo below to pay with PayPal.

- From now on, Subscribers can send emails with personal questions and/or remarks to This email address is being protected from spambots. You need JavaScript enabled to view it..

In 30 days, Gold has gone from $2179 to $2391 (a 9.7% increase), and silver has gone from $24.33 to $28.77 (an 18.2% increase)...and Gold is NOT rising because of the Israel-Iran War!

Monday to Tuesday, April 29 - 30, 2024: The mania in the silver market is directly in front of us.??!

Updated Sections: Rupee Gold, Yuan Gold, Candollar & Gold,

The end of the Roman (American-Euro) empire.

This historical parallel from the Roman Empire is the perfect analogy to today's situation—the US appears far weaker than it was just a few years ago, which has some pretty substantial implications for the future.

This historical parallel from the Roman Empire is the perfect analogy to today's situation—the US appears far weaker than it was just a few years ago, which has some pretty substantial implications for the future.

When the barbarian king Rugila died in 434 AD, Roman Emperor Theodosius II likely rejoiced that his mortal enemy was no more. Rugila (and his father Uldin) had been invading and terrorizing Roman territory for decades, but the Empire was so weak that Theodosius was powerless to stop them.

By the early 400s, Rome was an almost unrecognizable shell of its former greatness. Nearly two centuries of civil war, plague, inflation, invasion, and economic malaise had sapped the empire's strength and reputation…, and foreign kingdoms didn’t hesitate to take advantage. In the early 420s, Theodosius finally resorted to paying off King Rugila, bribing him with an annual offer of 350 pounds of gold. Rugila took the money… probably bewildered at how easily he could bend the supposedly powerful Roman Empire to his will.

Theodosius subserviently made the payments year after year and managed to pretend that the deal was a win for Rome. The Emperor acted as if he was still powerful and in charge of the situation. He even tried to convince his subjects that the annual tribute was payment for some bogus service that the barbarians were supposedly providing rather than the ransom money it was.

And that’s why King Rugila’s death was probably such welcome news to the Emperor. Finally, the menace was gone. Unfortunately for Theodosius, Rugila’s successor would be a far greater threat.

His name was Attila, and he is known to history as Attila the Hun. He wasted no time picking up where his father and grandfather had left off, capitalizing on the Roman leadership’s weakness and cowardice. Attila’s first order of business was to renegotiate the peace deal and make even more demands of the Roman Empire. Theodosius caved almost immediately.

His name was Attila, and he is known to history as Attila the Hun. He wasted no time picking up where his father and grandfather had left off, capitalizing on the Roman leadership’s weakness and cowardice. Attila’s first order of business was to renegotiate the peace deal and make even more demands of the Roman Empire. Theodosius caved almost immediately.

It became known as the Treaty of Margus; Attila walked away with DOUBLE the annual tribute (an increase from 350 to 700 pounds of gold). Plus, he forced the Emperor to eliminate trade sanctions against the Huns and open Rome’s vast markets to Hun merchants. Lastly, Attila negotiated a prisoner swap, receiving some high-value Hun nobles who had taken refuge in the Roman Empire.

In exchange, Theodosius received a few low-level soldiers… and the Emperor had to pay an additional ransom for each one. Like his father Rugila, Attila was probably astonished that the ruler of the supposedly most powerful empire in the world had no backbone, confidence, or will to stand and fight. So naturally, Attila’s demands did not end with the Treaty of Margus. He knew an obvious advantage when he saw one, and he continued exploiting Roman weakness until his life's end.

Despite promises of peace, for example, Attila constantly found new excuses to set aside the treaty and make incursions into Roman territory. He crossed the Danube and laid waste to Rome’s provinces in the Balkans, forcing Theodosius to renegotiate the peace treaty once again. This time, the annual tribute was tripled to 2,100 pounds of gold. A few years later, Attila demanded to marry the sister of Valentinian, the ruler of the western portion of the Roman Empire. Valentinian refused the proposal (as well as Attila’s demand for half of the western lands), so Attila invaded Italy, plundering and pillaging along the way. Attila finally died in 453 AD before he could completely destroy the empire.

However, other barbarian kings also saw the ineptitude and weakness of Roman leadership, and they followed in Attila’s footsteps. That’s the thing about cowardice and weakness: adversaries tend to notice and take advantage.

However, other barbarian kings also saw the ineptitude and weakness of Roman leadership, and they followed in Attila’s footsteps. That’s the thing about cowardice and weakness: adversaries tend to notice and take advantage.

It’s no different today. Iran, Russia, and China have all paid close attention to the weakness and cowardice of the Biden administration. They see the social and financial decay of the United States. The political instability. The woke priorities of the Defense Department. And they can barely believe their eyes. They know that the guy (clown) with five decades of experience has no backbone… that he’s a corrupt, brainless stooge who bends to the most radical wing of his party. He stands for nothing, abandons his allies, and gives away the farm for absolutely nothing in return. He traded away the most valuable Russian prisoner in US custody for a WNBA player. He freed up potentially tens of billions of dollars for Iran in exchange for little more than a phony promise that they won’t develop nuclear weapons. (But it seems the Ayatollah pinky swore, so it’s all good.)

He allows invasions and incursions of US territory… and not only does nothing but sues state governments to prevent them from securing the border. He tries to prevent allies from defending themselves. He pathetically attempts to use the Strategic Petroleum Reserve to boost his sagging approval rating. And he caves anytime a belligerent nation threatens violence. These are all signs of obvious weakness adversaries are too happy to exploit. Iran is just the most recent example. After this weekend’s attack against Israel, Iran specifically warned the US against responding. Biden immediately wilted. It’s pretty clear who wears the pants in the relationship.

And just like the case of Attila, it never ends. Any treaty that is signed, any agreement that is reached, is simply a lie. They’ll never keep their word and continue milking the obvious cowardice on display for the world to see. Now, this story of weakness isn’t just about Joe Biden. Congress is also weak and ineffective. Many courts and judges now ignore the rule of law and are simply activists in robes. The military suffers a public recruiting crisis, outdated weapons systems, and critically low mission readiness.

It goes beyond government, too. Big Media is a left-wing propaganda machine. Premier universities cultivate radicalism. Even Boeing can’t seem to build quality aircraft anymore. Optics matter and the end result is undeniable: America appears far, far weaker than it was just a few years ago. And adversaries have no intention of letting up.

To your freedom,

James Hickman

Co-Founder, Schiff Sovereign LLC

While more than 20 million Americans live on food stamps and probably over one million people are homeless, Washington decided to grant $61 BILLION to Ukraine. Try to explain this to your fellow citizens.

Ukrainers without a second permanent residency and/or second passport are cooked. Ukraine cancels consular services for military-age men abroad. About 4.3 million Ukrainians were living in EU countries in January 2024, including 860,000 adult males (gun meat). Those without a second passport/permanent residency will have no alternative but to enlist in the Ukrainian army. Those who don't will be arrested and deported back to Ukraine.

Lesson: Everyone who doesn't apply for a second passport and/or second permanent residency will sooner or later be called for military service.

Our Real Estate Corner: no comment!

- If you bought an average house for $5,000 in 1920 and sold it today for $500,000, you would have lost money!

- ARGENTINIA: 6,600 homes were up for rent in 2023. President MILEI abolished ALL SICK Socialist legislation, AND today, there are already 19,900 HOUSES FOR RENT.

© - The report's contents may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic.

Monday through Friday, April 22 - 26, 2024: only about 0.5% of global financial allocations include physical gold!

Updated Sections: Bank & Fin. Shares , Solar & Rare Elements, Agriculturals,

Copper, Platinum, Non-Ferrous & shares, Long Term Commodity Charts,

Commodities expressed in Gold, Inflation Index, Silver, Gold-$,

Euro and €-Gold,

World War III is in the making. As Putin did not take the bite, they decided to play the same game (the trick used to trap Hitler and Germany into World War II) with Iran. The Israeli leaders are so stubbornly stupid and greedy that they decided to try to push Iran into a war (WWIII). And it seems to be working—both Israel and Iran are taking the bite.

Israel attacks Iran and widens the war "WW III sits right around the corner and will soon be in your backyard. Building a bunker will not save you!"

A deadly out-of-control war in the Middle East became a reality this week. Israel attacked Iran. Iran released a massive counter-attack on Israel. And now, Israel has attacked multiple Iranian targets, including Iran’s nuclear facilities in the center of the country. Where will it stop?

Now, Iran is vowing to attack Israel’s nuke sites. Many have been warning for months about a conflict that could bring on World War III. Is this it? It sure looks like it.

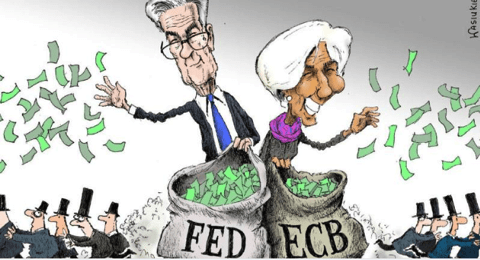

Most people don't realize the danger of DEBT per CAPITA and the atrocities this results in...Most don't realize that debt must always be paid! ALWAYS.

It is the politicians who put their citizens in debt. In the EU, the situation is even worse because unelected politicians do this; most investors refuse to understand that apart from emigrating, the only way to get out of this Seven-Headed Political Monsters is to put your savings in Physical gold and silver...and keep these out of political reach! Those who, for some silly reason, don't do it because they trust their local government more than a TAX-FREE zone Vault with concierge service out of political reach will soon experience the greediness of the politicians. You have been warned!

Gold will start a rally that you will never sell!

Only suckers sell physical gold and silver now! Politicians (super suckers) sold a long time ago...at the lowest of the market.

Physical gold and silver make you independent and extremely flexible and help you survive war, Revolution, and Communism.

Our Real Estate Corner: no comment!

- This is why Belgium and the Netherlands are about to see a Real Estate crash with Biblical dimensions: just because THE HERD doesn't believe there will be a crash...until it starts to happen and it becomes too late to sell! At that time, the suicide rate will spike.

- Real Estate chains you as a slave to your government!.... The sheeple are going to be getting a huge lesson on managing risk. A crashing economy and real estate market are definitely on the table if war does not kick the table completely over.

© - The report's contents may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic.

Monday through Friday, April 15 - 19, 2024: Should Silver Hit an All-Time High Above $50 by November?

Updated Sections: Gold-$, US Dollar, Silver, Index In Real Money/Gold, Long Term Charts,

Euro and €-Gold, Recession Proof Shs (LOCG), Recession Proof - hold, Bio Tech-Pharma,

Oil Shares, Natural Gas & shares, Uranium Shares,

Don't think and hope this debt will disappear and nothing will happen! When nothing else works, they take you to war—and this is exactly what they are preparing and doing! The Western world sits on a time bomb, and the HERD does nothing. Only a few people made preparations. It makes me think of the pre-World War 2 years. Only Reasoning people like Albert Einstein had a plan "B." As usual, the HERD did nothing, and today, it also does nothing.

This is WAR: Iran launches dozens of drones towards Israel!

Inflation Everywhere, War Everywhere, CV19 Vax Death Everywhere. The Government, together with the Banks, is invading people's lives. In Europe, the banks know exactly what you eat on Sunday and which medications you take. Banks order those who withdraw too much cash from the ATM machines to close their accounts. Few realize this is the EUSSR...today's DDR. Most don't even know what the DDR was.

Where is the inflation coming from? War spending in the hundreds of billions of dollars in Ukraine and more is being spent every day so we can have war everywhere. Then, there are the billions of bucks spent on taking care of illegal immigrants.

Top virologist Geert Vander Bossche is warning of an “imminent tsunami of death among the highly vaccinated.” Vander Bossche says this will replace the huge surge of cancers caused by the CV19 vax and will be replaced by an even bigger surge of death.

Are you ready for a BIG DUMP in Bitcoin?

Many already know that Peter and I think along the same lines. Bitcoin and many cryptos are accidents waiting to happen.

Bitcoin and most cryptos are worth even less than fiat money as it costs money to keep it alive. A modern Ponzi scheme it is.

Our Real Estate Corner: no comment!

Significant Fundamentals:

© - The report's contents may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic.

Monday through Friday, April 8 - 12, 2024: We know what happens when there is a disconnect between the real economy and the financial markets!

Updated Sections: Crude Oil price evolution, all gold sections,

Russia Booms, and the West sucks!

- MOSCOW, April 3 (Reuters)—Russia's finance ministry said on Wednesday it would more than double its foreign currency and gold purchases in the month ahead. This move, combined with central bank selling, will bring the state's net forex interventions overall close to zero. The finance ministry said it would buy the equivalent of 235.3 billion roubles ($2.6 billion), or 11.2 billion roubles per day, of foreign currency and gold from April 5 to May 7.

- The Russian economy exceeded expectations with growth of 3.6% in 2023, higher than all other G7 countries. The IMF predicts growth of 2.6 percent this year, twice as much as previous forecasts; this looks particularly favorable compared to the 0.9 percent growth level forecast for Europe. And while inflation remains quite high, its effects are somewhat mitigated by a historically low unemployment rate of 2.9 percent.

- The Russian ruble has also proven more resilient than expected. The percentage of Russian export transactions settled in the US dollar or euro has fallen from around 90 percent at the beginning of 2022 to less than 30 percent today; meanwhile, the percentage of transactions in the ruble has increased from around 10 to more than 30 percent, while the share of transactions in other currencies, mainly the Chinese renminbi, exceeds 40 percent. Despite Western boasts about the campaign to destroy the ruble, the currency has remained relatively stable despite temporary fluctuations, refuting promises of an impending demise, largely thanks to capital controls (and perhaps an element of loyalty on the part of Russia's export companies).

Suppose you overlook the Bull Shit and the thousand of Blogs and Articles published by Politicians, MSM, Television channels, and people WHO THINK their name is  Albert Einstein. In that case, it is not hard to understand that the herd and all those who don't reason and don't think are completely lost and don't know where to go with their savings.

Albert Einstein. In that case, it is not hard to understand that the herd and all those who don't reason and don't think are completely lost and don't know where to go with their savings.

Financial crashes occur because the Investing Herd consists of a group of IDIOTS.

I’m fortunate to have personal relationships with many of today's biggest shakers, but I do much more than talk to them. I’m walking the expat walk with my “boots on the ground.” The best day in my life was when I left that CORRUPT Belgium. In fact, for more than 35 years, I’ve been living abroad, figuring out the best ways to legally eliminate taxes and obtain second residences and passports. I've been searching for the best ways to enjoy life in the most liberty-loving places on earth and make money simultaneously.

Originally from Belgium, I’ve traveled to over 100 countries, including Zimbabwe, Africa, Europe, Canada, and the Caribbean islands. I visited the DDR and the USSR when the Bolsheviks were still in power. Since the 1990s, I’ve lived in South Africa, the United States, and Central America (Panama). My wife lived in Australia.

Off the top of my head, I could tell you how to open an offshore bank account in the name of a Trust or foundation, save a fortune with medical tourism in Colombia, buy real estate in South Africa (don't), store gold offshore, set up a corporation or foundation in Panama and Wyoming, and so much more…

I’m not sharing any of this to impress you. I'm only sharing it to impress upon you that if you have any interest in exploring opportunities to live with greater freedom, legally pay less taxes, and find simple ways to diversify and protect your assets outside the borders of your home country (and stay out of a war zone), then I’ve got 35 years of valuable experience to share with you.

Today's greatest risk is the Sovereign Risk (Your Government)!

The most life-saving lesson I’ve learned over the past 35 years is this…The Greatest Risk Today is Sovereign Risk…Having all your eggs in one basket—your entire life at risk in a single country—is the surest way to wind up broke and desperate when all hell breaks loose, especially if you have frozen your savings in local Real Estate, Pension Funds, Bank deposits, and/or Portfolios. If you have no savings out of political reach, you won't even be able to leave when the day comes when you must go!

That could be the tragic story of any human being: with all assets trapped inside National borders (Belgium, The Netherlands, USA, Canada, the EU, Switzerland), when all hell breaks loose, you will be killed financially. Then, many may kill themselves literally.

That could be the tragic story of any human being: with all assets trapped inside National borders (Belgium, The Netherlands, USA, Canada, the EU, Switzerland), when all hell breaks loose, you will be killed financially. Then, many may kill themselves literally.

Canadian banks are freezing the financial accounts of peaceful protesters. And anyone who contributed to the cause. The government is actively harassing these patriots. The dangers of having all your assets under the control of a single government were playing out in real time. Consider the “Freedom Convoy” in Canada. It’s a peaceful group of law-abiding citizens voicing their opposition to illegal government vaccine mandates. That’s completely normal in a free country. Freedom of speech has been a foundational pillar of democracy for thousands of years. But not anymore…Within days, Trudeau became Canada’s first Prime Minister to invoke the “Emergencies Act.” Giving the government unprecedented authoritarian powers.

Assets of Russian citizens have been frozen worldwide mainly because they are Russian.

Yet when free citizens peacefully oppose overreaching governments that impose unconstitutional mask mandates, vaccine mandates, and economic lockdowns…These people are treated as criminals, unfairly called terrorists, and have their financial assets frozen. This is not democracy. This is textbook tyranny—and devastating capital controls.

The time to take the critical first step to protect yourself against government tyranny is now. The way events are playing out in real-time, waiting even one day may be too long. This is not the time to procrastinate. And jeopardize your family’s future if you’ve got a family you love. You have been financially successful enough to build up a few million dollars/euros in assets, and you and I have a lot in common. And we’ve also become increasingly concerned at how governments never hesitate to invade our private lives and trample our civil rights. More aggressively every day.

Privacy is officially DEAD. The government spies on our emails, texts, and phone conversations and tracks every financial transaction. Medical privacy is history, too.

Banking is a hassle these days. You’re assumed to be a drug-dealing money launderer until you show you’re not. “Innocent until proven guilty” has been turned upside down. Even worse, even if you are innocent, the government won’t hesitate to label anyone who fails to obey orders as a domestic terrorist.

It’s gotten so bad that many international banks refuse to do business with US citizens. They refuse to open a new account when they see a US address or ID. In Belgium, some banks refuse flat-out to send funds to Panama (where the Central American quarters of the EU are located).

As the US government prints mountains of money, they’re destroying your children's and grandchildren’s future with a massive debt they can’t possibly repay. The same is true for the EU, Switzerland, a.o. This is not how freedom and democracy are supposed to work. Both the US, Canada, and Western Europe are moving dangerously towards communism.

As the US government prints mountains of money, they’re destroying your children's and grandchildren’s future with a massive debt they can’t possibly repay. The same is true for the EU, Switzerland, a.o. This is not how freedom and democracy are supposed to work. Both the US, Canada, and Western Europe are moving dangerously towards communism.

America’s reign as the world’s dominant superpower could soon end with the dollar losing its privileged reserve currency status. This could lead to a financial catastrophe for anyone holding all their assets in US dollars, Canadian dollars, or any other fiat currency. Paper money may soon be worthless (like in Venezuela).

+++

The NEW Principle of Global Diversification…

The old “principle of diversification” applies mostly to financial assets. Conventional wisdom says to spread your money across different asset classes: stocks, bonds, real estate, and maybe even gold and silver. As one asset declines in value, another rises. This model worked well in the past by saving, producing, creating a strong middle class, and exporting valuable goods for the world to consume. Unfortunately, today, we’ve turned that upside down. We’ve become spenders, shifted from manufacturing goods to importing them, and run up record amounts of debt.

The US (Canada, the ECB,..) has printed trillions of dollars, resulting in 40-year inflation rates. Every dollar/euro buys less food, less gas, and less of all the basic necessities we need to enjoy a happy life.

The US (Canada, the ECB,..) has printed trillions of dollars, resulting in 40-year inflation rates. Every dollar/euro buys less food, less gas, and less of all the basic necessities we need to enjoy a happy life.

Here’s the BOTTOM LINE: Holding all your financial assets in US dollars, Canadian dollars, euros, British Pounds, Yen,.. (or any fiat currency) is committing financial suicide. There is a much better, smarter, and safer way.

A Simple Secret for Eliminating Sovereign Risk

Simply put, when you remove all your assets from the control of a single government, you reduce your sovereign risk. It's a simple concept because no single government can wipe you out. And it’s perfectly legal despite the BS spread in the mainstream media.

Think about how the system works today. People choose from pre-packaged options for the major decisions in their lives. There are pre-defined career paths for becoming doctors, lawyers, pilots, nurses, and almost any other profession.

When it comes to retirement planning, you answer a series of questions to define your risk profile and instantly have a model portfolio. There’s little choice, considering the limited options available in most retirement accounts.

When you walk into a bank, for example, no one is going to sit down with you and say:

“Hey, you should protect yourself from a depreciating fiat currency. Let’s discuss precious metals, gold, silver, or a less unstable currency like the Swiss Franc.” Not a chance! Banksters jam the same two limiting choices down our throats every day: the checking or savings account. Paying 0.1% interest if you’re lucky.

Instead of accepting the limiting choices offered in your home country, you can open a foreign bank account in alternative currencies, store gold and silver in a private vault overseas, or open a foreign brokerage account, giving you more investment choices.

It is still 100% legal for citizens from most countries to open an offshore bank account…at least for now. Sweden is an exception, as you have to get permission from the tax authorities before you do.

Out of political reach!

Desperate governments will not hesitate to impose capital controls designed to prevent the free flow of capital from crossing borders. Authorities are trying to prevent citizens from protecting their assets in offshore accounts. CRS and FATCA are only two of the control instruments they use.

2nd Passports & Citizenship (even if you never plan to leave your home country, a 2nd passport is the ULTIMATE insurance policy… if the proverbial “shit hits the fan” – or you just get sick and tired of the emerging socialist police state – you’ll have an escape route already in place… A second passport can also increase your travel options. For example, most Western countries closed their borders to tourists due to COVID. Having a second passport from one of those countries allows you to enter the country when a US or Canadian passport would not)...

2nd Passports & Citizenship (even if you never plan to leave your home country, a 2nd passport is the ULTIMATE insurance policy… if the proverbial “shit hits the fan” – or you just get sick and tired of the emerging socialist police state – you’ll have an escape route already in place… A second passport can also increase your travel options. For example, most Western countries closed their borders to tourists due to COVID. Having a second passport from one of those countries allows you to enter the country when a US or Canadian passport would not)...

Offshore Trust or Private Interest Foundation (for protection & privacy)...(A business entity protects an individual from lawsuits against the company, while a trust or foundation protects the business entity’s assets from lawsuits against your person. Setting up a structure like this offshore provides even greater protection from predators. They’re also fantastic vehicles for privacy and for legally avoiding wealth transfer or estate taxes)...

It could be even more daunting if you decide to pursue a 2nd passport (it’s perfectly legal to hold multiple passports). What country? Who can you trust to help you through the bureaucracy and paperwork? Do you speak the local language?

The Critical First Step You Must Take NOW…As I said, it can be challenging, but it’s not nearly as difficult as you might imagine.

In fact, right now, I can help you open an offshore bank account and establish an offshore entity without leaving the comfort of your own home. Even better, I can help you obtain a second residency and a second passport without traveling to that country—or even leaving home if you don’t want to.

Nobody knows for sure what the next insanity will be, what evil plans are coming next, or the exact date the system will officially implode. We only know that the traditional system is crumbling, and the window opportunity to capitalize on the situation will slam shut forever. If you’re still with me, I know you understand the urgent need to diversify your sovereign risk before it’s too late. Go ahead and fill out this application right now. CONTACT

© - The report's contents may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic.

Thursday to Friday, April 4 - 5, 2024: Sorry, you can't have your gold, and The implications of Fatal Debt will be more Lies sold by politicians and bankers!

Updated Sections: note, if judged necessary, we are updating the candle and PF charts in the

Gold/Silver sections. Gold-$, Silver, Portfolio , Royalty Co's, Gold & Silver Juniors,

The implications of Fatal Debt will be more Lies sold by politicians and bankers. And you know what? It is working and will continue to impact the herd. The average investor keeps buying Real Estate, Cryptos, Bonds, Stocks, ETFs, Pension Funds, and so on because they are sure nothing bad will happen. The Governments and politicians will never allow it, and when things get bad, they will save them.

The implications of Fatal Debt will be more Lies sold by politicians and bankers. And you know what? It is working and will continue to impact the herd. The average investor keeps buying Real Estate, Cryptos, Bonds, Stocks, ETFs, Pension Funds, and so on because they are sure nothing bad will happen. The Governments and politicians will never allow it, and when things get bad, they will save them.

The herd's investment IQ level is the same as that of a redfish. They only mind the profit they think they make from their investments. They are happy if the figures (nominal confusion) go up. That is also why they always buy in a rising market, and we have a Buy Climax. When prices start to fall, they don't sell. Rather, wait until the price goes up again...and finally sell during the panic sell-off climax. I know it has been so for years and will never change. The Sheeple, the Herd, are born losers...

Out of experience, we know that The Sheeple is not subscribing to our site or even reading our public updates. What the MSM and politicians sell is more important. It's their conviction that what we sell is mainly pessimism and incorrect information. Even so, for those who paid attention, we called Gold for the first time in 2003/04 and for the second time in 2016. See the subscriber's sections for what happened next.

When the psychology of the public changes, it will be like trying to funnel the contents of Hoover Dam through a garden hose...and all gold and silver will disappear from the international markets.

Remember that only 0.5% of investors have Gold & Silver.

Remember that only 0.5% of investors have Gold & Silver.

More is more? Although $-Gold has clearly broken out of a (Bullish) Reversed Head and Shoulders pattern and the short term of this very SAFE financial instrument is well known, the average investor still finds excuses to stay and buy other investment vehicles because they are totally convinced these are safer and will earn them more money.

Sorry, You Can't Have Your Gold!

Now that most of The Reasoning people are invested in physical, the next step is to ensure that the Government doesn't steal (seize) it. Remember that they tortured and killed the Crusaders to find out where they had hidden their gold. Don't expect that this time over, it won't happen again. Politicians are sick, deranged narcists, thieves, and murderers. To stay in power, they are prepared to do everything, even if it means torture and war.

Now that most of The Reasoning people are invested in physical, the next step is to ensure that the Government doesn't steal (seize) it. Remember that they tortured and killed the Crusaders to find out where they had hidden their gold. Don't expect that this time over, it won't happen again. Politicians are sick, deranged narcists, thieves, and murderers. To stay in power, they are prepared to do everything, even if it means torture and war.

We warn regularly of the risk involved in storing wealth in banks. They’ve made removing deposits increasingly difficult and colluding with governments to allow them to freeze or confiscate your money legally. To add insult to injury, they’re creating reporting requirements regarding the contents of safe deposit boxes and restricting what can be stored in them—again, at risk of confiscation. Note that this has all taken international dimensions: CRS and FATCA.

Banks are among the most risky places to store wealth. Unsurprisingly, many people are returning to facilities that treat wealth storage like the first banks did millennia ago—vault facilities that store wealth for a fee but engage in no other banking activities.

But, in suggesting to our readers that such facilities are a better bet, I’ve also repeatedly warned readers that many such facilities don’t store actual, physical gold/silver. Instead, they provide you with a contract that states that they will deliver an agreed-upon amount of gold/silver upon demand. The trouble with this idea is that it becomes tempting for such facilities to sign a contract with you and collect the purchase price but never actually purchase and store any gold. It’s been estimated that the total worldwide value of such contracts equals 150 times the amount of gold globally.

This is why it’s imperative that you purchase only physical, allocated gold/silver.

And another caution: I’ve repeatedly stated that although many of the most secure facilities in the world are located in North America and Europe (Switzerland), these jurisdictions are on the cusp of economic crisis, a fact that suggests that, if and when the crisis arrives, the rule book will be thrown out the window. Governments and facilities alike may prove untrustworthy, and at some point, you may drop by the facility to withdraw your gold and be told, "Sorry, we’re unable to provide delivery." [WE KNOW AND HAVE EXPERIENCED THIS REGULARLY]. There could be a multitude of reasons given, hoops to jump through, and endless red tape to deal with. And still, in the end, you may never be able to take delivery.

For these reasons, we advise that, although nothing in life is guaranteed, you should always protect your wealth by choosing the least risky option. This means that you should follow two simple rules –

- Rule #1: Select the jurisdiction with the best laws and reputation.

- Rule #2: Ensure a reputable storage facility in that jurisdiction has a Class III vault and a contract that meets your needs.

Am I being overly cautious when I so frequently offer this advice? Unfortunately, no. I’ve predicted that, in the future, as we get closer to a monetary crisis, banks and storage facilities located in countries likely to be heavily affected will work ever harder to avoid releasing either money on deposit (in the case of banks) or precious metals (in the case of storage facilities).

Recently, the reports I’ve been receiving from wealth storage facilities in advantageous jurisdictions indicate that that prediction is beginning to fruition. In case after case, clients have a harder time getting their money and metals out. In most cases, those institutions that don’t wish to deliver create red tape, stalling techniques (which are costly in both time and money), and, in some cases, outright refusals. Again, this kind of adventure happens often in Switzerland.

Austria/Switzerland: A client tries to transfer his allocated 138 gold Philharmonics from his bank to a facility in another jurisdiction. The bank repeatedly produced roadblocks, as follows:

- Refused to ship the products themselves and refused to arrange shipment.

- When they arrived, they refused to release the goods to FedEx, even though proof of insurance was provided. The bank then insisted on hiring a Brinks truck.

- They then refused to release the coins at all except to another bank.

- They then claimed they were "not ready" to release the coins. The client was invited to "try again" if he wished. (Eight attempts were required.)

- Finally, they agreed to release the coins, but only if a 1% withdrawal fee was applied (this was not part of the original agreement—it was essentially a ransom).

There are many, many more examples. Still, these should illustrate the growing trend: If you wish to get your money or metals out of an endangered jurisdiction like an EU country or North America, the window of opportunity is closing. Expect them to make getting out difficult, costly, and even impossible. But why should this be? What are these institutions up to? Don’t they realize they’re sending clients a message that they’re not helpful partners?

Yes, they do, but they also know another more important factor. As the economic crisis gets ever closer, they understand that the day will soon come when a banking emergency is declared. The banks will shut their doors for an as-yet-unknown period of time (presumably until a solution is found). What will the new rules be? No one knows. Will the banks and storage facilities be obligated to deliver in full if the doors open again? No one knows.

Therefore, in the final stretch of this race to the bottom, banks want to hold as much of your money and metals as possible.

The above examples are just the thin end of the wedge, and we can expect the future to reveal greater restrictions. Whilst, in an economic crisis, there are no guarantees, what we can do is opt for the situation that’s least likely to cost us our wealth. Again,

- Choose the best possible jurisdiction: one with a low-tax or no-tax regime, a stable government, and legislation that protects rather than victimizes the foreign investor.

- Choose the jurisdiction that’s easiest for you to access.

- Choose the best facility within that jurisdiction with the best reputation and contract (tax-free zone, competitive rates, Class III vault facility, 24-hour viewing access, properly insured, etc.).

Our Real Estate Corner:

Our Real Estate Corner:

Brits to be forced out of their own homes for Asylum seekers. Private properties are to be compulsorily purchased for Asylum Seekers and seized. People are told that their houses may be too big for them and forcibly downgraded while their properties are given to Asylum seekers.

This is what happened in 1917 when the Bolsheviks took over Russia.

Private property rights are being torn up, and Brits are being told to give up their properties for illegal migrants and asylum seekers. Such is the scale of massive illegal immigration perpetrated by the globalists who have infiltrated our government and parliament in the UK that Tent cities are now expected to be seen. British people are being told that they may be forced to sell their properties or move out of them to make way for illegal migrants.

Significant Fundamentals:

- SLV and GLD are still net sellers of physical gold and silver.

Important Technicals:

- Be advised that the HERD is ...

© - The report's contents may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic.

Monday to Wednesday, April 1 - 3, 2024: Gold breaks out, but no one cares. Do you realize you missed "Our Pattern X" because you are not a subscriber?!

Updated Sections: check for updates this coming week...Bonds general & USA, Treasuries-EU,

Corporate Bonds,

Europe's suicide:

This happens when you let Monkeys (politicians) govern a country and a continent. In the beginning, I thought it was a joke. Next, I thought it was a mistake. Finally, I realize it is for real. Letting Monkeys fly an airplane doesn't matter whether the Monkey is small, tall, old, or a baby. In all cases, the plane will crash with everybody on board.

The mainstream media and politicians are admitting that WW3 will occur and that it has already begun. And yet, the Herd keeps doing nothing but staring in the headlights, waiting to be shot.

HEAD in the sand. I really don't understand the HERD and many analysts. There are in history 1001 examples of what happens once the financial and political system becomes once it runs along today's lines.

There are on this planet plenty of examples of what happens when politicians rape the system...and yet, THE HERD keeps doing what it is doing, keeps its head in the sand, has 1001 excuses not to do what a man has to do, and sits put...waiting for the execution.

I don't think the overall situation in the USA is any better. There is record credit card debt, an implosion in commercial real estate, millions of delinquent mortgage and car payments, and hundreds of trillions in unpayable derivative debt that Warren Buffett called “weapons of mass destruction” is coming due.

It’s all coming to a head in a so-called debt reset we have written about for years. The mass destruction is coming in the not-so-distant future. They may be able to do some shenanigans, but this is the ‘Great Reset. This is the takeover and take-down of the global economy, and the dominos are beginning to fall. The mainstream media, which I call the mainstream accessory to genocide, are not reporting this. . . .The question is, what is the final touch? In martial arts, it’s called the Dim Mak or death touch. What is the death touch that is going to push the leaning financial Tower of Pisa over? I am telling you, it’s going to be the derivative debt. A trillion dollars of credit card debt can never be repaid.

Are you intelligent, and do you have the guts to sell your old cow for magic beans?

Are you intelligent, and do you have the guts to sell your old cow for magic beans?

When the cow stops giving milk, you have to sell it. That's what began the old tale of Jack and the Beanstalk.

So, the old warning signals once again: Get out of the dollar, the Euro, the Swiss, the Sterling, fiat money, and all money that can be created artificially!

At his mother's request, Jack brought the family cow, their one source of income, to the market to sell it. Then, a mysterious man offers him magic beans for the cow. As it turns out, Jack takes the deal.

When he returns home, his mother is furious, but Jack decides to plant the beans anyway. The next morning, a massive beanstalk shoots up out of the ground, and Jack climbs it all the way to the top. And finds gold coins, a hen that lays golden eggs, and a harp.

This is the quickest and easiest way to store your wealth... Not by buying magic beans but by exchanging the thing that will soon lose value (an old milkless cow) for gold.

The gold price has just broken out to new all-time record highs. Not a single person who has ever purchased gold in the history of human civilization has ever lost money on their purchase (if they held through today). One would think that investors would feel positive about the gold price today. Yet when we check sentiment indicators – no one seems to care.

This backdrop of record-high prices amidst indifferent sentiment is the most bullish setup current investors could request. Higher prices lie ahead – and YES, the Pattern X we have developed over the years tells much more than most people can imagine.

As of March 29, 2024, $-gold has just recorded new daily, weekly, monthly, and quarterly all-time high record closes: the spot price of bullion settled at $2,233 per ounce today, the highest price ever recorded in human civilization's history. Attentive investors and our subscribers know that Gold has already broken all-time record prices when expressed in other fiat currencies: the Euro, the Japanese yen, the British pound, the Australian Dollar, The Canadian Dollar, the South African Rand, the Indian Rupee, the Chinese Yuan, and even the Swiss Franc. See our Subscriber sections for more.

Record-high prices normally attract mainstream attention, as news articles should loudly proclaim the new records to draw interest from the readership. In the current case of gold, however, we see no such mainstream interest even though gold has just recorded its highest price ever. More in the Subscribers' sections.

Our Real Estate Corner:

Our Real Estate Corner:

The fertility rate of the EU nation has hit a record low. So yes, in a couple of years, as more people die than are born, there will be nobody to buy that house. No buyers will mean house prices crash to $1 or € 1.

Also, the general level of SAVINGS is crashing because of the surging INFLATION. Therefore, there is no money to make a downpayment on that house. Youngsters are increasingly forced to continue living with their parents or relatives.

Last but not least, because of hyperinflation, interest rates will go up instead of going down (like the try to make you believe), making it even harder to get that mortgage and make the monthly payments.

Significant Fundamentals:

- US debt has gone parabolic, and Hyperinflation has arrived. Accordingly, since then, the public debt (purple line below) has increased by 90X to the aforementioned $34.5 trillion — a gain far higher than the 25X rise of nominal GDP during the last 53 years. Therefore, the burden on GDP (black line below) has returned to peak WWII levels, at 120%.

|

|

| Public Debt Outstanding and % of GDP, 1970 to 2023 | Net Household Savings Rate, 1970 to 2023 |

Important Technicals:

- This "Pattern X" we developed over the years only happens a couple of times in a lifetime, and as our Subscribers' already know, it has important implications.

| For premium members only. |

|

| No comment |

No comment |

|

For premium members only. |

| No comment | No comment |

© - The report's contents may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic.