(hyper) Inflation & LOCG

HOCG = High order Capital Goods (real estate, machinery).

LOCG = Low Order Consumer Goods (energy, food)

Hyperinflation is caused not by facts but by an intangible: the sudden realization of what had been there all along but hadn't been recognized. Today inflation is rising slower because the velocity of the growing money supply is momentarily coming down. This is a normal phenomenon in an inflation and hyperinflation cycle. On April 15, some talking heads pretend the US has fallen into Deflation, and the UK is to follow. This happens because they do not understand what Inflation, Deflation, and Hyperinflation is.

Important is to UNDERSTAND a hyperinflationary depression sees simultaneously FALLING prices (HOCG) and rising prices (LOCG). [HOCG = High order capital goods (ex. Real Estate) - LOCG = Low Order Consumer Goods (ex. energy and food).

The most challenging concept for the professional public to understand is that hyperinflation can exist along with a totally disastrous economic environment. Hyperinflation falls flat because it fails to consider the infinite velocity of money that a Weimar creates during a depression economy as a product of throwing monetary discipline at the wall.

Prices = Money Supply x Velocity of the money

Basically, there are 3 inflation fazes:

- In the first phase, as goods and services cost increase, people spend less. They save because they 'think' prices will come down again. The velocity (the speed money is spent) decreases. Such a situation is possible because of the ignorance of people trusting the authorities. (Today, people hardly can save more there is too much debt!)

- In the second phase, people recognize Inflation. After some denial, they start to become aware that the cost of goods and services won't come down again. Velocity goes up again.

- As soon as people understand that the cost of goods and services will continue to go up, they lose faith in Fiat Money and prefer to hold goods instead of op paper money (Gresham's law). Velocity increases dramatically. We have runaway hyperinflation.

| Examples of inflation phase - Argentina - click to enlarge. | |

|

|

| CPI - inflation index | Money supply |

- The expansion of the Money Supply in the Western world has been explosive [this is the least one can say]. Yesterday the G20 agreed to expand it by another 5 TRILLION dollars. Contrary to the 1930s (Great Depression) in the USA, the opposite happened. Only Germany did the same what they are doing today, and the policy resulted in the Weimar Hyperinflation.

- The lesson? whatever the authorities do, once the economy and the financial system have been violated (and it has), it snaps. It does so because the system becomes more unstable. It starts to rock more and more until something snaps, and it crashes.

- NO FINANCIAL SYSTEM has survived FRACTIONAL RESERVE BANKING (usury) and the creation of FIAT PAPER MONEY out of thin air EVER. Such a thing is simply impossible.

- Hyperinflation ALSO results in parabolic rising stock markets (Zimbabwe) as people apply Gresham's law: the bad money chases the good and exchanges Fiat paper for Equities which are participations in REAL ASSETS.

The velocity of Money is still negative. Hyperinflation will start once this trend reverses.... as it did in Argentina.

To stop inflation, they should stop Fractional Reserve Banking and the creation of Fiat Money.

| Price increase of LOCG y/y | 1 year | 3 years * |

| Steel | 40% to 70% | 150% |

| Chemicals | 25% | 75% |

| Shipping costs | 375% | |

| Crude oil | 43% | 129% |

| Ethanol | 21% | 63% |

| Heating oil | 44% | 132% |

| Natural gas | 77% | 231% |

| Unleaded gas | 40% | 120% |

| Corn | 60% | 180% |

| Soybeans | 26% | 78% |

| Aluminum | 35% | 105% |

| Copper | 26% | 78% |

| * extrapolated over 3 years | ||

| Price decrease of HOCG | ||

| Real Estate | -20% to -60% | |

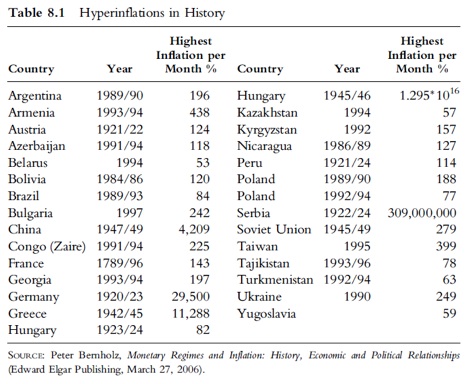

The Calendar of Modern Hyperinflations:

For the moron financial TV hosts claiming that significant inflation is well down the road because inflation requires a business recovery to occur:

Angola 1991-1999

Bosnia – Herzegovina 1992 – 1993

Chile 1971 – 1981

Greece 1943 – 1953 At the high point, prices doubled every 28 hours. Greek inflation reached a rate of %8.5 billion per month.

Israel 1971 – 1985 (price controls instituted)

Japan 1934 – 1951

Romania 1998 – 2006

Turkey 1990 – 2001

USA 1773 – not worth a Continental

Yugoslavia 1989 – 1994

Zaire 1989 – present (now the Congo)

Zimbabwe – 2000 to present. November of 2008 – inflation rate of 516 quintillion percent

Venezuela, Ukraine (44% in Dec 2015), Iran,...

From https://en.wikipedia.org/wiki/Weimar Republic

©, All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic.