|

Wednesday

March 31, 2010

-

Ireland:

triple (+1,50%) mortgage rise as taxpayers bail out AIB.

This lies completely in the line of what we are

expecting. Interest and mortgage rates will rise first in those

countries with weaker economies and further impact real estate prices.

-

The Dollar had a free

ride on the back of the European problems...but

the pendulum is about to swing in the opposite direction. Forex markets

often behave like brainless sheep...and can swiftly change direction

when a so said believable source published a different kind of news: JP

Morgan says California is of greater danger than Greece. And true it

is...click

here for more...

-

Gene Arensberg's new "Got Gold Report," excerpted

from Brien Lundin's Gold Newsletter, reports that the big

commercial traders are starting to cover short positions in gold.

Arensberg also expresses great satisfaction with last week's hearing on

metals trading by the U.S. Commodity Futures Trading Commission. He

writes that GATA's disclosure of whistleblower Andrew Maguire's

correspondence with the CFTC stole the show.

Tuesday March 30, 2010 - watch out for the

reverse clockwork once the Dollar weakens!

-

Don't

forget Crude Oil and Oil shares.

The sideward and positive consolidation/accumulation

tells us the bull market is still alive. The Oil sector will (as usual)

only come in the spotlight once it starts its upward action...click

here for more...

-

Natural Gas is running into huge support

and is strongly oversold...click

here...

-

Sorry

to disappoint many Britons but the Pound Sterling is not ready to

recover against the Euro...best case scenario we will see a weaker

Dollar.

Monday March 29, 2010 - Markets are slowing

down in expectation of Eastern (next Sunday).

-

France will over the next couple of years probably become a huge bad

surprise and Spain is not doing well either.

While the Spanish real estate park has (at least in some areas) been

modernized as the Real Estate bubble was inflated such was not the case

in France. Southern France is picturesque but apart from wineries and

agriculture it has no industry left whatsoever...click

here for more... The more regulation a country has the harder and

the longer it will take to adjust to the depression and hence the more

damage will be made.

-

North African countries tried it and saw it

did not work. Congested traffic, inadequate

roads, expensive/poor or no parking space, slow traffic, high cost of

liquid energy, toll roads, excessive automobile regulation, poor and/or

expensive means of communication (Internet, mobile phone systems) all

slow down the economic activity and increase its operating cost. [1990

Casablanca (Morocco) already had "Roundabouts" in today's style. Such

are cheaper than traffic lights but are also choking traffic].

-

The Dollar

is finally correcting and last Friday we had a Bearish Key reversal...click

here...

-

The candle chart of the

Bank index

shows a technical reversal pattern...click

here

Saturday March 27, 2010

-

World Stock markets

are overbought. We have clear

indications a correction is imminent. If the correlation mechanism is

correct, expect the financial clockwork to reverse its action. Stock

markets will come down together with the US Dollar, the Euro will

strengthen and so will Gold,

Silver, Crude Oil,

Copper (copper has built an

schoolbook technical pattern)

-

The 30 year Treasury Bonds and the British

Gilts are dangerously close to break through

their support line...click here

Friday March 26, 2010

-

The HUI (Gold

bugs index) hasn't broken its bull trend....click

here...

-

SA Banks cut prime lending rates. Commercial

banks FNB, Nedbank, Standard Bank as well as Absa have all announced

they will cut their prime lending rates by 0.5% from 10.5% to 10%.

-

Real Estate is a

dead duck and it will take until 2033 until we see the bottom!

Real Estate is a High

order capital good and during a recession/depression it behaves in a

completely different way than Low Order Consumer goods.

A compete Real Estate

cycle takes 76 years before completion: prices go up during 50 years and

come down for 26 years. The next bottom is expected in 2033. Important is

to understand the depression reduces the demand for real estate and that

it always takes a certain time before sufficient capital is saved which will

create fresh demand for RE.

The 1st part of

the down leg is characterized by denial. People are incorrectly convinced

the deflating bubble is just one of the small cyclical dips they

experienced during the bull cycle. Expressed in nominal terms it is not

sure the top of a future boom will be higher than the top of the previous

cycle. Rents typically come down in sequence. The move over supply crated

during the time the bubble was inflated, the more rents come down during

the bust (because of the abundant supply)

-

A lot of noise, volatility but no trend

change for Gold and Silver, nor for the Euro/Dollar.

Your

emotions and what the brainless talking heads are trying to make you

believe are dangerous for the health of your savings.

-

Today is Friday and 4 more banks were closed down in the USA:

Desert

Hills Bank, Phoenix, AZ Unity

National Bank, Cartersville, GA Key

West Bank, Key West, FL

McIntosh Commercial Bank, Carrolton, GA

-

The push back of Gold above the $1,100 level

and back into the former

trading range between $1,130 on the top and $1,100 on the bottom is

friendly as it indicates that bears were either unable to press the

market down much lower after it bounced into the lower limit of the

triangle.

Thursday March 25, 2010

The

real canaries in the coalmines:

They

were an early warning of carbon monoxide gas which was a silent

killer being odorless. Miners who died from this exhibited the

characteristic cherry red colored skin caused by the CO forming a

strong bond to the hemoglobin in the blood & thus leaving it unable

to carry the oxygen necessary for life. At school in a mining valley

in Wales in the sixties, our chemistry teacher, who had worked

underground, told us haunting details like these which have stayed

with me much longer than the chemistry has. The methane in the

mines, known as 'fire

damp'

was an explosion risk and it was these explosions that caused most

large scale mine disasters up until the National Coal Board was

formed and started spending money on mine safety." They

were an early warning of carbon monoxide gas which was a silent

killer being odorless. Miners who died from this exhibited the

characteristic cherry red colored skin caused by the CO forming a

strong bond to the hemoglobin in the blood & thus leaving it unable

to carry the oxygen necessary for life. At school in a mining valley

in Wales in the sixties, our chemistry teacher, who had worked

underground, told us haunting details like these which have stayed

with me much longer than the chemistry has. The methane in the

mines, known as 'fire

damp'

was an explosion risk and it was these explosions that caused most

large scale mine disasters up until the National Coal Board was

formed and started spending money on mine safety."

-

It

is not a question of will long-dated bond yields rise? Instead, it is

a question of when will they rise?

The slide of US-BONDS

over the last couple of days really starts to be scary....and these

are the canaries in the mine shaft for HYPERINFLATION.

-

The

Euro breaks below the psychological

$1.35

and

a countermanding upward dynamic would now be required to question

scope some additional downside. Having said this, the weakness

of the Euro is not really a problem for our subscribers who were

informed (Investment roster) that the Aussie, Canadian Dollar, Swiss

Franc and South-African Rand were better off.

-

Politicians must understand it is

absolutely impossible to reflate the Real Estate bubble.

Whatever is said

and written, the bubble is and will be deflating until 2033...click

here for more...

-

Only in South Africa -

The

Return of the 100% home loan.

Banks are again giving

mortgages without requiring a deposit, with Absa even prepared to fund

110% of a property's price.

-

Gold

still sits in a Bull run and we expect that it will glitter again

soon...click

here... GLD (the Gold

ETF) gave a nice signal today. And

$-Silver has also fallen back on

the bottom of its triangle.

-

China and the United

States may be on a collision course

over Beijing’s insistence

that it will not allow the value of the Renminbi (RMB) to rise. Off

course not. They would be idiots to do so. Chinese know this is a game

of WORTHLESS FIAT money and the know that the WEST (Europe and the US)

are reading Karl Marx. Now that the world manufacturing unit has been

moved to China because of stupid western politics, they will anything

in their power to keep it under their control.

-

Health care or more

Karl Marx:

With the passage of the

legislation allowing the federal government to take control of the

medical care system of the United States, a major turning point has

been reached in the dismantling of the values and institutions of

America. Health care will become a

massive transfer of crucial decisions from millions of doctors and

patients to Washington bureaucrats.

-

Scary and unbelievable

so many people still 'BELIEVE' the economy is going to repair itself!?

Such is impossible as long as unemployment keeps rising and we have a

consumer driven economy.

Try telling that to the

“Dollar is a safe haven” crowd. The financial difficulties that the

states, counties and municipalities are experiencing is sooner rather

than later going to become an issue for the Dollar to contend with. If

that were not enough,

the amount of indebtedness that the US has now incurred is

mathematically impossible to repay without a currency devaluation. The

British Pound has always been the Canary in the mineshaft for the US

dollar and this time won't be different! Also the CDS

(Credit Default Swap) market is telling a different story...click

here...

Wednesday March 24, 2010 - Trading ranges

all over - Price will go up when time has come = patience!

-

The

FPigs are barely alive. (add France) After

Greece Fitch Ratings agency says it has downgraded Portugal's

sovereign debt by one notch and this has off course an impact on the

Dollar/Euro.

Expect to see this happening over and over again all over the Western

World both in Europe and in the USA...Jim's

formula is alive and well and last year we already warned about

this problem. The logic result of this indebtedness will be a

crash on the Bond markets.

The most dangerous part of the

non-American Reserve/Treasury bank holdings is the US dollar. \ The

FPigs are barely alive. (add France) After

Greece Fitch Ratings agency says it has downgraded Portugal's

sovereign debt by one notch and this has off course an impact on the

Dollar/Euro.

Expect to see this happening over and over again all over the Western

World both in Europe and in the USA...Jim's

formula is alive and well and last year we already warned about

this problem. The logic result of this indebtedness will be a

crash on the Bond markets.

The most dangerous part of the

non-American Reserve/Treasury bank holdings is the US dollar. \

-

Gold,

Silver,

Gold and Silver mines, the Dollar and the Euro are confined to their

trading zones. The Euro continues to hover

precipitously above major chart support below the 1.35 level. It has

been holding with the result that the Dollar cannot muster enough upside

strength to take out 81.50 on the Dollar index. This range bound

activity in the Forex markets has been affecting gold which while higher

today, is still effectively contained in a range as well. Euro gold

remains very firm holding above the €800 level. Gold priced in British

Pound terms is also strong holding above the €700 level. Crude oil is

stuck between $83 on the upside and $79 on the downside and similar

conditions occur for Copper. Platinum and Palladium continue to make new

highs.

-

The Swiss franc

surges to a record against the Euro but is really not worth a

cent more...check Gold expressed in Swiss Franc and

you will see for yourself...click here...

-

Sooner of later the EU will fall apart and it will be good for

Europe. Likewise the USA will fall apart like the USSR did in 1989 and

it will be good for the Americans.

-

In the fiat money era all governments are currency manipulators at

some point, usually via excessive printing and periodic jawboning.

By excessive printing they create the very demand for

Real Assets (Low order consumer goods only) and barbaric Gold and

Silver. Volatility is increasing but as long as we do not have a clear

indication of a trend reversal on the Euro/Dollar we won't change our

opinion. Having said this, it is now more than ever extremely

important to watch the relationship between all Fiat currencies and

Barbaric Gold. For the same

reason it is also extremely important you DON'T act without making your

home work first.

-

Our candle chart for 30 year US Bonds shows a completed formation and

a break-down gap...click here...

-

Bank and Financial

shares are heavily weighted in most stock market indexes

and the Bank Index is not only overbought but also

running into resistance. Better be careful!

-

Who cares the Euro is somewhat weaker as long

as €-Gold stays in its bull run!

Tuesday March 23, 2010 - The world has become a

big circus and the politicians are the best paid clowns!...but the

people start to revolt and in the end the politicians will pay a high

price for their mismanagement.

-

Obama

signs massive health care bill and it seems that the politicians will

finally succeed in controlling the second biggest sector in the USA

(the largest being Defense). At the same time 12 states are filing

lawsuits against the mandatory insurance. Important for non American

readers is to know that overseas the US Health Care bill is pictured in

a completely different (and often incorrect) way it is pictured in

the USA...click

here for more... It's going to be great for the

uninsured...like XMas...You know, no worry about the Health care

bills... Next comes the US money machine of Global Warming or

will they notice what is happening in France where President Nicolas

Sarkozy Tuesday scrapped the country's proposed carbon tax...click

here for more... Obama

signs massive health care bill and it seems that the politicians will

finally succeed in controlling the second biggest sector in the USA

(the largest being Defense). At the same time 12 states are filing

lawsuits against the mandatory insurance. Important for non American

readers is to know that overseas the US Health Care bill is pictured in

a completely different (and often incorrect) way it is pictured in

the USA...click

here for more... It's going to be great for the

uninsured...like XMas...You know, no worry about the Health care

bills... Next comes the US money machine of Global Warming or

will they notice what is happening in France where President Nicolas

Sarkozy Tuesday scrapped the country's proposed carbon tax...click

here for more...

-

World Stock markets are an example by excellence that there is a

disconnect between the fundamentals and the markets

in a similar way we had a disconnect between the economy in Zimbabwe and

the local economy. Equities are REAL ASSETS and a lot safer than

Fiat Paper money and Bonds which are nothing else but an option to buy

fiat paper money.

-

Any investor buying Bonds must be aware

he's buying an investment vehicle at record levels

in a same way real estate investors were buying houses at

record levels in 2006. Bonds are just like Fiat Paper money not even

worth the ink and the paper they have been printed on and their quantity

is being multiplied daily by hitting ENTER.! The day Bonds break through

there neckline part of the Herd will be killed as it will scramble to

get out at the same time through a gate which is way too small.

Monday March 22, 2010 -

The World is round but only those which have

traveled around it know this for sure. All others can do nothing else

but 'believe' what is being told...

It is mind boggling that so many people just 'believe'

whatever is said by the talking heads which very often have never

traveled around the world themselves. Static never stops....and this

is one of the reasons for today's volatile markets. Intra day and

short term fluctuations most of the time resemble to a Casino where luck

decides about your loss or profit instead of Brains. The fundamental

forces behind the price of Gold, Silver, Equities, Bonds and Fiat Forex

however don't change overnight. Timing is the most difficult part

of investing for most of the time all actors have been in place before a

'fait divers' make it all happen.

Friday March 19, 2010 -

Inflationism

is a slippery road – the road to hyperinflation. The inflationist

Bernanke Fed behaves as if they would not be “dialling back” from

Quantitative Easing any time soon. They talk the talk, but can’t walk

the walk. The inflationary genie is out of the bottle. Taming it back

will result in a crushing deflationary collapse. The Fed will never let

this happen again. They did it once during the Great Depression, they

won’t do it again. Inflationism

is a slippery road – the road to hyperinflation. The inflationist

Bernanke Fed behaves as if they would not be “dialling back” from

Quantitative Easing any time soon. They talk the talk, but can’t walk

the walk. The inflationary genie is out of the bottle. Taming it back

will result in a crushing deflationary collapse. The Fed will never let

this happen again. They did it once during the Great Depression, they

won’t do it again.

The economic crisis is well under

way. However, there are major differences in predicting how the crisis

will end. Yes, “under way”, because most people still think that we will

be soon coming out of the crisis, may be even within a couple of months.

Economic philosophizers still prognosticate that the economic boom is

about re-emerge. Many in the Establishment even declare that the crisis

is over. They forecast business as usual – the resurrection of the

consumption-based economy, only if the banks were to start loaning

again. Unfortunately, this will be impossible.

(Krassimir Petrov)

The longer the accumulation lasts, the stronger the bull and bear run

once it breaks out of the trading zone! Price will go up or come down when

the time has come (Gann)

-

Gold (but also silver and the Dollar/Euro) is stuck in a range trade

with a bit of a higher bias to it as downside support thus far remains

firm with the upside continuing to be capped by bullion bank selling at

or near $1,130.

-

The Dollar which is stuck in a range

but cannot seem to muster any enthusiasm for a downside

breakout. Every single time it moves into the zone near and just below

the 80 level, the volume dries up indicating that the trade simply does

not want to take it lower.

-

Gold and Silver mines are following exactly the same pattern...click

here for more...

-

Today is Friday and only 7 American banks had to close down...but

"all is well Mme le Marquise"! State

Bank of Aurora, Aurora, MN, First

Lowndes Bank, Fort Deposit, AL ,

Bank of Hiawassee, Hiawassee, GA

Appalachian

Community Bank, Ellijay, GA ,

Advanta Bank Corp., Draper, UT ,

Century Security Bank, Duluth, GA

American

National Bank, Parma, OH

-

The Pendulum is hovering over the EU. After

Greece, expect Spain and Portugal to hit the front

pages. In the mean time California, Massachusetts,

Illinois, Ohio, North Carolina, New York and 34 other

American states receive some kind of relief...

-

In California foreclosures are up 29% and Florida courts are choking

with foreclosure cases and Florida courts request $

9.6 million just to help to cleanse the system...click

here...

-

And the Reserve Bank of India also rises interest rates.

The direction for interest rates has been set and UP it is!...click

here...

Thursday March 18, 2010.

-

We

know why we don't like bank shares:

March 17 (Bloomberg) --

Deutsche Bank AG, JPMorgan Chase & Co.,

UBS AG and Hypo Real Estate Holding AG’s Depfa Bank Plc unit were

charged with fraud linked to the sale of derivatives to the City of

Milan...click

here for the details... We

know why we don't like bank shares:

March 17 (Bloomberg) --

Deutsche Bank AG, JPMorgan Chase & Co.,

UBS AG and Hypo Real Estate Holding AG’s Depfa Bank Plc unit were

charged with fraud linked to the sale of derivatives to the City of

Milan...click

here for the details...

-

What we wrote about the Dollar months

ago still applies and over the past weeks the fundamentals moved even

more against the 'Dead Dollar Walking'.

The

Central banks will continue to do all within their power to keep the

mirrors and the smoke curtains up to avoid the Herd sees the Emperor has

no clothes. They always have and always will (prior to the forced

introduction of the Euro I lived this scenario multiple times). The big

advantage is that it gives the Intelligent Investor more time to protect

his savings...and he'd better wisely use this time for once the trap

closes, there will be no mercy.

-

What we wrote about the

Dollar we also wrote for months about the British Pound before the 30%

de facto devaluation came into effect. Only

the Intelligent Investors were able to escape a 30% cut of their net

worth. Those who stayed invested in Real Estate are stuck and will loose

even more...Real Estate is just the wrong kind of Real Assets (High

Order Capital Goods).

-

It's all

for your safety! You don't realize how much Government loves you:

Body scanners at airports, speed limits on the roads, control of your

bank operations to ensure you don't get polluted by money laundry,

taxation for social security so you will be able to survive when your

old (social security and pension funds are empty), digitalization of

securities (so your physical bonds, equities and other valuable don't

get stolen or lost in case your home burns down). A poll

shows 89% of the Belgian population has lost trust in the Belgian

politicians. The remaining 17% are probably the politicians self.

Wednesday

March 17, 2010

-

The

wild card remains the Middle-East, Pakistan and Afghanistan and there is

no doubt something dangerous is brewing.

The US is making preparations for a pre-emptive strike on Iran or some

other Eastern destination. Although one would doubt that the US would 'go it alone,'

one has to question whether or not they would act in support of a

pre-emptive strike by Israel on Iranian nuclear facilities. Although

this news piece assumes Iran is the target, other easterly destinations

come to mind in the vicinity of Afghanistan. The implications of such a

strike on the world financial and commodity markets is obvious, and

bears careful watching. I would doubt the US would circumvent a

discussion at the United Nations. Even George W had to at least pay lip

service to international support prior to his attack on Iraq. [Jesse's

Cafe Amèricain] The

wild card remains the Middle-East, Pakistan and Afghanistan and there is

no doubt something dangerous is brewing.

The US is making preparations for a pre-emptive strike on Iran or some

other Eastern destination. Although one would doubt that the US would 'go it alone,'

one has to question whether or not they would act in support of a

pre-emptive strike by Israel on Iranian nuclear facilities. Although

this news piece assumes Iran is the target, other easterly destinations

come to mind in the vicinity of Afghanistan. The implications of such a

strike on the world financial and commodity markets is obvious, and

bears careful watching. I would doubt the US would circumvent a

discussion at the United Nations. Even George W had to at least pay lip

service to international support prior to his attack on Iraq. [Jesse's

Cafe Amèricain]

-

Crude Oil expressed in

Euro is confirming the move of Crude Oil expressed in Dollar...click

here..

-

Excellent behavior of

Gold and

Silver as they bounce of their 50 day

Moving Average.

-

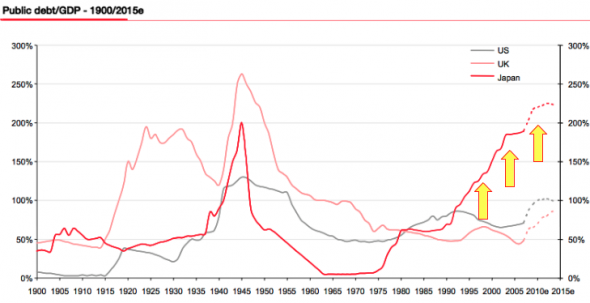

Bonds are

dangerously hovering around their neck and/or support line.

The Treasury Department said Monday that China's holdings

dipped by $5.8 billion to $889 billion in January compared with

December. Japan, the second-largest foreign holder of U.S. government

debt, also trimmed its holdings but by a much smaller $300 million, to

$765.4 billion...see Bond

fundamentals... We have no doubt and the US and the

European Authorities are selling their mothers and children in order to

keep interest rates as low as possible. This -at least- provides some

sense of false security to many consumers and CEO's which don't

understand this FALSE SIGNAL is extremely dangerous to their financial

health. In the end the MARKETS will decide which way the interest rates

will go...and there is NO DOUBT it will be up!

-

Investors who decide to stay in Bonds

will loose even more than those who understand

Equities are safer.

World Stock markets don't let a lot of room for doubt

about this statement.

-

The U.S. dollar index is toying will

critical up trend support. Our charts leave little

doubt as they clearly show the correction has stalled in the top part of

the trend channel...click here

-

Gresham's law live in Argentina makes me

think about the days where residents of European countries

(Greece, Spain) used Post stamps instead of coins (because the coins had

disappeared)...The Argentina coin shortage is

growing as inflation makes a coin's metal worth more than its face

value. Despite Argentine President Cristina Fernández de Kirchner’s

promise more than a year ago to introduce electronic bus tickets in

Buenos Aires, the vast majority of the capital’s bus lines still only

accepts coins. This would not be such a big deal if not for the fact

that Argentina has had a coin shortage for more than three years. The

crisis has turned normally mundane tasks – like buying a newspaper or a

snack – into a big hassle.

-

The Canadian Dollar is about to reach

parity with the US-Dollar...click

here... and the British Pound is trying to reach parity with

the Euro...click here...

-

Communicating

financial vessels: Yes, we know the economy sucks and we are sliding

into a Depression...and yet World Stock markets

continue to respond to the Quantitative Easing

and it becomes clear the Zimbabwe effect is pushing up markets or it

ain't the price of the Equities (real assets) going up but rather the

value of Fiat Paper money coming down. But what sense does it make

to invest into Equities which are sitting in a Secular Bear market trend

when expressed in Real Money or Gold.

-

At this point

we have more clarity about the behavior of

World Stock Markets

expressed in Fiat Money and we have deleted one of the potential

scenario's.

-

Charts in the section

Financials

have been updated...click

here...

Tuesday March 16, 2010

-

This

is one American state which has decided to accept barbaric Silver as

payment...click

here for more... This

is one American state which has decided to accept barbaric Silver as

payment...click

here for more...

-

Honestly, I am getting sick of this

double dip recession talk.

I also wonder who

invented the term 'Double dip recession'? Probably the same people who

invented the terms: Negative inflation, disinflation, etc...We're

already in a depression and I really don't see how one can define what

we are going to experience as a 'Double Dip"!? Propaganda, ignorance,

stupidity?...double

dip recession believers must click here....

-

Real Estate will be out

of fashion until 2033.

I

understand many entrepreneurs are being misled by Fractional Reserve

Banking, the creation of Fiat Money out of thin air and the artificial

low interest rates. Ultimately they will pay a high price for their

belief...[ This is what

many people think: I am not an economist, nor an

estate agent or financial advisor; However, housing prices in this

country are completely over inflated and this makes them unaffordable]

-

There is not the

slightest doubt the Dollar remains bearish (is no safe heaven) and Gold

and Silver bullish. This statement

applies to all world Residents and all Fiat paper money holders. Our

Point and Figure charts are clear and straightforward...The

dollar finally reached our key resistance level of 81..click

here...

-

The longer Gold sits in

the present trading range, the stronger the move will be once it breaks

out of it.

-

Crude Oil is playing the

game of Three taps and a Breakout/breakdown...click

here...

Having said this, don't

forget natural Gas...click

here

-

Interesting chart and

comment in the section Bond fundamentals...click

here...

Monday March 15, 2010 - not

only the Dollar, but also the Euro and other Fiat Paper currencies are

about to come home to roost! It makes absolutely no sense to jump out of

the Dollar into the Euro or out of the Euro into the British pound...

-

Thanks

to the Talking Heads the Herd is almost always running into the wrong

direction. Ironically it is the HERD who

makes the extreme prices. Real Estate was and is a good example and

Bonds are another example by excellence. The month of

February saw the biggest US government budget deficit ever of $ 2

trillion and Bonds are just off their historic peaks!? At the

mean time China and Japan are selling part of their US-Treasury holdings

and Dollars. Before

you decide to buy any Dollars don't forget to check our

Dollar-Fundamentals section! Thanks

to the Talking Heads the Herd is almost always running into the wrong

direction. Ironically it is the HERD who

makes the extreme prices. Real Estate was and is a good example and

Bonds are another example by excellence. The month of

February saw the biggest US government budget deficit ever of $ 2

trillion and Bonds are just off their historic peaks!? At the

mean time China and Japan are selling part of their US-Treasury holdings

and Dollars. Before

you decide to buy any Dollars don't forget to check our

Dollar-Fundamentals section!

-

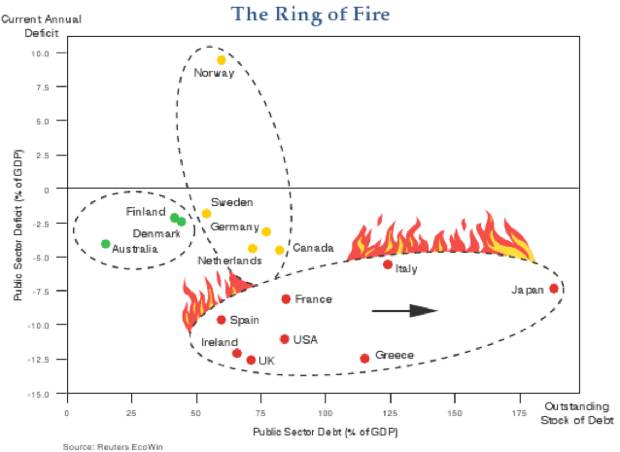

Everybody has noticed the hectic about

Greece, country with a similar (ratio to GNP) budget deficit as the USA.

The Greek are locked in by the EU (because of the

Euro they cannot devaluate their currency)

but the USA is not. The Dollar can and will be devaluated. Few

people see the dramatic financial problems of the Federal USA, American

states and cities...

-

Talks about double dip recessions are

great but don’t tell the investor what’s gonna happen to the Stock

Markets. It is clear this is a liquidity

driven Bull Run and that markets are extremely overbought and that the

fundamentals aren’t there. This however doesn’t mean the Stock Markets

must necessarily slide into a second down wave. Quantitative Easing and

the Zimbabwe effect can ensure we have at least a sideward action and

once the Hyperinflation kicks in, we could actually see a Dow Jones

industrials of 30,000, 300,000 and higher.

-

Anno 2012 the digitalization of

Securities (bonds, equities) in the EU will be complete.

And the trap will be completely closed. Hiding will

become extremely difficult (if possible at all) and any kind of control,

taxation, moratorium, re-arrangement extremely easy. A click

on

ENTER will be enough to take away all

of your official savings! The only investment

instrument which one will be able to hold without anybody else’s

knowledge will be physical Gold and Silver.

-

And yes, last Friday 3 banks had to

close down in the USA...and all is well

Madame la Marquise.

Worldwide Retail

sales are up, unemployment is down and Real Estate activity is UP...at

least this is what 'the King' wants you to believe.

The

Bank index has

broken out and technically this signals a BUY...however

click here for more...

Saturday March 13, 2010

-

American

states may hold onto tax refunds for months:

40 American states are in such a bad

financial shape that they now even start to postpone tax refunds.

New York, hit with a $9 billion deficit, may

delay $500 million in refunds to keep the state from running out of

cash, says Gov.

David Paterson...click

here for more...

-

Social Democracy, Pillar of US Hegemony in Europe,

Is Dying .

This is an article published by the English

version of the Pravda. Nobody will doubt Russians (the former USSR)

knows what they are talking about as their leaders have read and adopted

Karl Marx for years until 1989 when the USSR went bankrupt overnight...click

here for more...

-

We have little

doubt that the EU won't survive as complex societies never survive

expensive energy.

It is

clear that somehow the huge problems of Greece, Italy, France, Spain and

Portugal will break the back of the Euro. It is however impossible to

tell when this is gonna happen before, after or during the secession of

the USA. The transition will be preceded by an increase in volatility of

the Fiat currency rates. Yesterday the EU and Europe was a dead duck,

today the sentiment has reversed. Or how short term fluctuations

often don't make any sense and act in an absolute illogic way. Better

know what you are doing unless you prefer to head straight for disaster!

-

$-Gold has somewhat been behaving in an

illogic way....but

charts are charts and what they tell hasn't changed a dime...click

here .

As usual we refer to our charts of Gold in

British Pound, Euro,

CanDollar

[has our special

attention -

see investment table],

Yen,

Aussie, SA-Rand

and Swiss if

$-Gold is behaving in a weird way...and you will

change your mind quickly!

-

$-Silver is steady and the candle chart is interesting...click

here... €-Silver looks even better...click

here

-

Once international currency controls are put in place, it

will become impossible to buy Gold and Silver.

Better act now before it's too late. Don't say they won't do it.

They have done it in the past and they will do it again to save their

skin. (or at least they think it will )

Friday March 12, 2010

-

What

is wrong with these Kamikaze politicians creating Social unrest in

Athens, Greece? This is exactly what we expected for

Greece and what can be expected for other countries which will in the

future run into similar problems because Politicians are doing EXACTLY

the opposite of what must be done. These guys are completely

irresponsible! Even J. M. Keynes knew it: you simply DO NOT increase

taxes during an economic downturn unless you want to slaughter what is

left of the economic activity! What

is wrong with these Kamikaze politicians creating Social unrest in

Athens, Greece? This is exactly what we expected for

Greece and what can be expected for other countries which will in the

future run into similar problems because Politicians are doing EXACTLY

the opposite of what must be done. These guys are completely

irresponsible! Even J. M. Keynes knew it: you simply DO NOT increase

taxes during an economic downturn unless you want to slaughter what is

left of the economic activity!

-

The EU is absolutely right in limiting Hedge Fund activity in Europe

and Geithner (read Goldman Sachs and his 40 bandits) is absolutely

wrong. The time the USA could control the world

is consumed by stupid greed, debt and irresponsible financial

policies...click

here for more...

-

Will the Canadian loonie end up being a

better Fiat Currency than the US-Dollar!? Our PF

charts leave a clear and distinct answer...click

here...

-

JP Morgan and Citigroup 'had part in Lehman failure'! Off course

they had and it was 'the perfect murder'...It is no

secret that JPMorgan played a vicious role during the Great Depression

of the 30's...click

here for more...

-

Europe's banks brace for UK debt crisis.

UniCredit has alerted investors in a client note that Britain is at

serious risk of a bond market and sterling debacle and faces even more

intractable budget woes than Greece.

One has to be blind and deaf to

hold on to BRITISH GILTS (BONDS)

-

BONDS will

signal when Hyperinflation ignites. The mixture is

ready (Quantitative Easing) and we only need to wait until something or

somebody lights the fuse...click

here for more... The day the fuse burns, Gold and Silver will go

parabolic and those who don't buy any now will be left empty handed.

This is as fast as it will go! So remember that it doesn't make sense to

buy Gold and Silver if you don't take physical delivery. Those who

decide to keep Bonds will loose their savings in no time!

-

For those who keep trusting Banks (an average of 4 have to close down

each week in the USA), just check this list of +400

US Banks which are in deep trouble before you decide to buy

Bank/Financial shares...click

here

-

According to the talking Heads, markets are acting in expectation of

Retail figures which will be published tonight. In

reality these figures have since long been taken into account for by the

financial markets and such statement only adds to the volatility of the

financial markets. Having said this, Retail figures are function of

Inflation and we all know that -expressed in Real figures- they are bad

and will get worse. There is NO WAY we can see a recovery as long as

unemployment figures are rising. And this is exactly what they are

doing.

-

Today the Dollar, the Euro and Gold & Silver are doing exactly what

they are supposed to do. The US Dollar was a dead man

walking 12 and 6 months ago...and the only thing which has changed, is

that it's situation has worsened. Such is -off course- very hard

to understand for those who keep listening to the Static brewed by the

Media and Politicians. The world

is in such a mess that on both sides of the Atlantic they think their

problem is the worst one.

-

It is not hard to understand that down the road we shall have

CURRENCY CONTROLS. Such is an ultimate

instrument to control in- and export of Capital and is used by several

countries as a protection and to avoid a run on the Fiat currency.

It is a system of Financial money and Convertible money. Such

a system is currently used in South-Africa and was used by countries

with weaker economies and currencies in Europe years ago. Examples are

France, Spain and Belgium. Under such a system the exchange rate is

different depending the funds are used for payment of goods or for a

transfer of capital.

Thursday March 11, 2010

-

Abstract figures sometimes don't picture a situation properly.

We all know that

Greece, Italy, France, Spain and Portugal

are in a bad shape. There is however no better lesson than experiencing

this LIFE and when actually traveling through these countries it becomes

obvious that these have an HUGE problem. Locals have unconsciously

adapted and learned to live with the worsening shape their society is

in.

-

Gold is down for two sessions and the whole world is on fire?

Markets are overbought and

oversold, markets do fluctuate and have become increasingly volatile.

Fundamentals haven't changed...neither have the technicals. Be aware the

total market capitalization of the Gold sector is smaller than the

capitalization of Coca-Cola...Be aware there are trillions of

uncontrolled monopoly DERIVATIVES and that they are a handy tool to try

to manipulate the markets in the short run [no market can be manipulated

in the long run]. Having said this, if you were as China planning

to buy the balance of the IMF Gold, would you not at least try to push

down the spot price of Gold before you do?

-

Don't throw you Gold away for Fiat paper money!

Gold is the only money without any liability which can be

stored away out of reach of the Authorities. The Public finances are a

disaster and the Authorities have no alternate but to invent other ways

to tax people in order to survive.

-

The British pound and the Gold chart expressed in Pound is a

schoolbook example of PF charting!...click

here...

Wednesday March 10,2010

-

It is simply impossible for China to make Gold its primary

investment. There simply isn't enough physical gold.

Better watch what the Chinese are doing

(buying large quantities of Gold and promoting Gold as an investment

towards its citizens ans stop reading this kind of 'silly one day

articles which make no sense' . Gold is going to $ 1300, $ 1640

and higher...click

here...

-

The charts in the section Oil Shares have been updated...click

here...

-

The Natural Gas and Coal section has been updated...click

here...

-

The EU and especially Germany seem to understand

Derivatives and Credit Default

Swaps are an unregulated, uncontrolled financial

Atomic bomb which needs to be checked as soon as possible. The

question is whether it is not too late to act?...click

here...

Tuesday March 9, 2010

-

The

1st Tax Heavens were Villa's: A Villa used to be a

self sufficient estate that also became a safe haven from taxation in

the city and who gave birth to Suburbanization as people who could

afford it fled the taxation of the cities (Rome). The

1st Tax Heavens were Villa's: A Villa used to be a

self sufficient estate that also became a safe haven from taxation in

the city and who gave birth to Suburbanization as people who could

afford it fled the taxation of the cities (Rome).

-

Normally one could expect

Real Estate to rally with Inflation.

However this is normally not the case once the 78

year long term high has been reached (as it has now). This because

Real Estate will in the future suffer from higher taxation and

contraction in debt. For those who

understand the Public debt is together with the private debt and the

Real Estate crises the main engine behind the actual crisis it all

becomes very different and not rosy at all.

-

World Stock markets were overbought and we have/had a correction.

Our PF charts for the individual markets

and the candle charts picture the potential scenario's.

-

Are we approaching the point with government

bonds where the

assumptions that have carried this once-derided instrument triumphantly

through three decades of consistently good returns need to be discarded?

Remember to sell High and to buy Low...and do you really have

faith in Government and Banks after all what is happening right now? -

Iceland, Dubai, Greece, California, Illinois, Lehman Bros, Bear Stearns,

AIG and an average of 4 US banks closing each weekend. In the

1930’s the US was a creditor and Europe was collapsing in debt. One

Government after another declared a moratorium on its debt and capital

fled from Europe to the USA. In 1944 the US held 76% of the world’s Gold

reserves. Today the USA has become a net debtor and it's Gold holding

has vanished. It has actually moved to China and India. Actually, we can

compare today's shape of the USA with the shape Britain was after the

Great depression. As

a greater proportion of the public realizes the degree of

difficulty that

sovereign debt is in and when you can't depend on your

government paper as a safe haven, that fact puts gold in a much better

light in more people's eyes.

-

And yes the Middle and Far-East (China) is consuming all the west is

saving.

Monday March 8, 2010

-

We have updated the charts in the SA-Rand section....The

SA prime lending rate is 10,50%...click here .

And according to the IMF - Africa [a producer of commodities] is

back from crisis...click

here.

-

We have updated the charts in the

CanDollar section...click

here

-

Check also our charts for the Aussie...click

here

-

Those who are in denial and sticked to the British Pound live a

dramatic experience...click here

to see how one can loose at 30% of his

savings in only 12 month's time. Assuming they are invested in Real

Estate or Bonds the loss is larger.

-

Those who are so sure the Dollar will go

up and the Euro will tank,

could be in for a bad surprise...

-

Gold and Silver Juniors have been updated...click

here for the very interesting charts...

-

The never ending story goes and on...each day as the the US

markets open, Gold is down during the opening...but

only for so long. $ 1125+ 5 x $ 20 = $ 1225

-

OTC

derivatives marketed

out of London killed Iceland so the big wigs of

Iceland see no reason to pay back depositors. The vote was a plausible

denial for those up top in Iceland. Other

than making these instruments a capital crime, as the Chinese have,

there is no stopping them. (J. Sinclair) . ETF and Gold warrant

traders should be aware that in most cases the operation is settled in

CASH and NOT in Gold.

-

Credit default swap OTC derivatives are weapons of real warfare. Credit Default Swaps are like a

car insurance. Instead of buying an insurance for a car you have bought,

you buy an insurance for a Bond you bought. Financial institutions bought

crap Bonds and converted these into AAA Bonds by buying an Credit

default swap. If the insurance fails, what is left is a worthless Bond

..click

here...

-

There are still people which think we are doing nothing more than

promote Barbaric Gold and Silver. To be honest, we

would by far prefer to promote Bonds and ordinary investment vehicles.

The only problem is that our analysis says NO and we have -in the end-

little or no alternatives left.

Saturday March 6, 2010

-

Can

you imagine there are countries in the world with falling tax income,

who battle with budget deficits, have an economic depression and

unemployment but where at the same time

they BY LAW FORBID people to work and/or to open their shops on certain

days? Can

you imagine there are countries in the world with falling tax income,

who battle with budget deficits, have an economic depression and

unemployment but where at the same time

they BY LAW FORBID people to work and/or to open their shops on certain

days?

-

David Kern (Britain) pretends the recession is over!?

Either this guy is a complete idiot or he has Alzheimer

[read what Goebbels said about lies]. The situation in Britain is so bad

they are planning to increase taxes (VAT) on food. When Bread

becomes too expensive they will advise people to eat cake

(Marie-Antoinette, France) or when Pork gets too expensive they will

advise the people to eat Rabbit (Zapatero, Spain)

Raising taxes in a time of

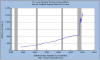

Depression is about the worst that can be done! [chart below is

for the USA...but Britain ain't any better!]...click

here...

-

Our Investment table is

straight foreward

and we try to clearly indicate which instruments are

valid when expressed in Real Barbaric Money and which ones are valid

when expressed in Nominal Fiat Monopoly money.

-

With fixed exchange rates (like in the EU) a devaluation is

impossible and only higher Interest Rates can attract fresh Capital at a

higher cost: after Iceland we see this happening in

Greece and it will happen in other countries as soon as they run into

trouble...Domino, domino...The higher

interest rates will choke any potential economic revival and break the

back of the Real Estate markets. Remember what we wrote months ago: this

is a paradigm shift!

-

The logic of the former paragraph is that the interest rates will

rise first in those countries with the weakest economies

(Iceland, Greece,....) and last in those

countries with the strongest economies (China,

Germany). This will in turn choke the

economies of the weaker countries....or ensure we shall see a complete

disaster of those economies and societies.

-

Oh...we almost forgot to tell that last Friday 'only' 4 Banks were

closed in the USA.

Centennial Bank, Ogden, UT Waterfield

Bank, Germantown, MD

Bank of Illinois, Normal, IL

Sun America Bank, Boca Raton, FL ...but nobody seems to

mind...the news doesn't even hit the Media Headlines!? You think this is

normal?

-

Iceland rejected Bank Payback plan. Iceland banks

go bankrupt, foreign investors loose money and foreign governments push

it so far that they want the Iceland citizen (which has nothing to do

with the whole story in the 1st place) to stand in for the losses of the

foreign investor...immoral and how arrogant Governments are! How twisted

the minds of some people are!?..click

here... If you decide to

invest with a Bank and this bank goes bust, you're the only one to

blame...if you buy bonds of a country (Greece, Britain) and the country

goes belly up and/or the currency of this country is devaluated by 30%

(Britain) , you're the one to blame...

Friday March 5, 2010

-

The

Greek debt is roughly the size of Lehman Bros. So please calm down!

As usual Politicians blame others for the stupidities

they made themselves. Greece is an excellent example. And they use the

problems happening in one country to mask more important ones in another

one (California). The King’s treasury chests are empty! History my

dear, don’t forget to study history…The Greek president Papandreou and

authorities has a lot of guts. First they rob the country, now they

raise taxes and tell those which have been robbed, they will have to pay

even more taxes. Similar scenario’s can be expected all over the Western

world.

The EU has been set on fire in Greece and we expect the fire to expand

to Italy, Spain, Portugal and Ireland tearing apart another political

bureaucratic idea. COMPLEX SOCIETIES NEVER SURVIVE EXPENSIVE ENERGY! The

Greek debt is roughly the size of Lehman Bros. So please calm down!

As usual Politicians blame others for the stupidities

they made themselves. Greece is an excellent example. And they use the

problems happening in one country to mask more important ones in another

one (California). The King’s treasury chests are empty! History my

dear, don’t forget to study history…The Greek president Papandreou and

authorities has a lot of guts. First they rob the country, now they

raise taxes and tell those which have been robbed, they will have to pay

even more taxes. Similar scenario’s can be expected all over the Western

world.

The EU has been set on fire in Greece and we expect the fire to expand

to Italy, Spain, Portugal and Ireland tearing apart another political

bureaucratic idea. COMPLEX SOCIETIES NEVER SURVIVE EXPENSIVE ENERGY!

-

A default on

the Greek debt would be excellent for it would punish those who were

stupid enough to lend money to the Government enabling

First of all, it would

punish people stupid enough, or immoral enough, to lend governments

money. They don't deserve to get their money back – they've been

supporting these governments and their bad habits…(Casey)

-

World stock markets are still in

the danger zone, but the coming days will either

bring security and an indication the Zimbabwe

factor is spreading [as we thing it will] or we will see the

start of the second down wave..

-

The bull run in Gold spills over into Treasuries.

Treasuries are right on the cusp of breaching a 30-year trendline.

-

The greatest returns are when a

widely-held belief of investors proves incorrect.

-

The British pound

is more unloved than the Zimbabwe Dollar. The

sterling also fell by more than 1.7 per cent against Zimbabwe’s

much-mocked paper, completing a decline of more than 7 % since the end

of January. Blair, Brown & Co. have cleansed out what was left of the

British Emporium after WWII. Because of taxation and regulation,

production and capital have left the UK for better yielding locations.

Jaguar is now in the hands of an Indian company....click

here for more... Amazing is the fact that British people kept

voting for these political Kamikazes...and that the Herd still doesn't

seem to understand what is going on and tend to blame OTHERS.

-

Jobs are the key….there cannot be any recovery without an increase of

employment. What see today is RISING unemployment and

hence falling consumption all over the Western world.

-

Who are there guys who borrow their way out of debt?

Only politicians and Central bankers are that stupid! Why

do they keep killing the Goose that lays the golden egg?

-

There are $ 204 trillion derivatives. The figure

equals 14 times the American GNP. They are spread over only 5 Banks.

The largest part (85%) is interest rate contracts. This is an

Financial Atomic Bomb!

-

Gold fundamentals have been updated...click

here...

-

South African Rand

rallies against the euro and the dollar.

Subscribers know the Rand has been on our watch list for

some time now...click here for the chart section...

Thursday March 4, 2010

-

March

31, 1960 Ferdinand Peeters, a deeply religious Belgian gynecologic

doctor revealed the results of his research for a birth control pill

before the scientists of

Schering in Berlin. Everything else is history.

Belgium had the 1st railroad system on the continent, great

entrepreneurs (Internet, Solvay, Cockerill), excellent products (beers,

waffles, chocolates, crystal glass, linen, breads and an quality

oriented work force (Volvo, Audi A1, FN). Unfortunately, the local

politicians have over the last decennia been specializing in destroying

the economy and chasing capital away out of a small country which

could have been richer than Switzerland... March

31, 1960 Ferdinand Peeters, a deeply religious Belgian gynecologic

doctor revealed the results of his research for a birth control pill

before the scientists of

Schering in Berlin. Everything else is history.

Belgium had the 1st railroad system on the continent, great

entrepreneurs (Internet, Solvay, Cockerill), excellent products (beers,

waffles, chocolates, crystal glass, linen, breads and an quality

oriented work force (Volvo, Audi A1, FN). Unfortunately, the local

politicians have over the last decennia been specializing in destroying

the economy and chasing capital away out of a small country which

could have been richer than Switzerland...

-

The Reserve Bank of Australia raised its overnight cash rate by 25

basis points to 4.0% in March 2010. RBA Governor

Glenn Stevens explained, "Interest rates to most borrowers nonetheless

remain lower than average. The Board judges that with growth likely to

be close to trend and inflation close to target over the coming year, it

is appropriate for interest rates to be closer to average." The RBA was

the first major central bank to hike interest rates, raising them in

October 2009.This decision will make all our

subscribers who hold Aussies happy...click here

for the chart section...

-

February 2, 2010 we published a bottom for

Gold had been reached...scroll

down...Ever since 2001 I have been bullish on Gold and Silver [and often

being treated as an idiot and a lunatic...even more when in 2006 I

became bearish on Real Estate]...but this is probably the fate of all

good financial analysts. There is something about a lot of people which

makes them act as being part of a Herd. For some dark reason they prefer

to 'believe' the lies of the Authorities, Banksters and Talking Heads

and/or to live in denial. Initially their advise doesn't cost a dime, in

the end it costs the fortune which is being lost.

-

The US Dollar has - as expected - lost upward momentum...click

here for the $ - chart section... and €-section.

Short term is has broken out of a trading range...not in the

direction the market expected. Interesting for the short term gamblers

is that for the last months each day Gold falls upon opening of the US

markets ...at the same time the Dollar rises against the Euro. But this

could change any day.

Wednesday March 3, 2010

-

Both

Gold and Silver are slowly but surely telling us the Fiat Paper money

system ain't even worth the ink and the paper it is printed on.

After Iceland, we had Dubai, California, Illinois,

Greece, Britain etc...and we are coming extremely close to Debt

Monetization [there is no way they will let Greece down for if they did

the consequences would start a dramatic domino game in the style of

Lehman Bros. Both

Gold and Silver are slowly but surely telling us the Fiat Paper money

system ain't even worth the ink and the paper it is printed on.

After Iceland, we had Dubai, California, Illinois,

Greece, Britain etc...and we are coming extremely close to Debt

Monetization [there is no way they will let Greece down for if they did

the consequences would start a dramatic domino game in the style of

Lehman Bros.

-

Gold mines

will be mining barbaric money even though that concept has never entered

the minds of the major producers. If it had they

would not sell every ounce they mine or hedge anything ever.

-

Yesterday €-Gold

and £-Gold both

hit a new record. Subscribers were warned in time.

One had to be blind not to see it...Just try to imagine what will

happen the day the Dollar weakens!

-

The Dollar/Euro sits in a trading range

with important resistance for the Dollar...see

charts

-

Interesting developments on the PF and candle charts for GLD

(Gold ETF)...see charts

-

Gold is not a

solitary runner. Silver

has also broken out of an ABC correction...click

here for the charts

-

I expect Swiss-Gold to make a fresh all time high today.

The PF is extremely interesting as it clearly shows the

channel borderlines and where Swiss-Gold sits at this time...click

here

-

Charts in the Commodity section have been updated,

rather interesting...click here...

-

We have defined a short to medium term objective for

$-Gold...click

here...Our objective is the result of 3 overlapping patterns:

trend channel, Head and Shoulder pattern and intermediate trend channel.

Tuesday March 2, 2010

-

Gold

is acting like it is in some sort of pressure cooker.

It keeps building up pressure but cannot blow the lid off of the pot.

Eventually it does. Technically we call this a coil. Once the lid blows

off...or the price breaks out of the coil (like today for

£-Gold) a bull or bear run is initiated. Gold

is acting like it is in some sort of pressure cooker.

It keeps building up pressure but cannot blow the lid off of the pot.

Eventually it does. Technically we call this a coil. Once the lid blows

off...or the price breaks out of the coil (like today for

£-Gold) a bull or bear run is initiated.

-

All of a Sudden, US Quickly Finds Reason to Delay Troops Withdrawal

from Iraq. Israel distributes new gas masks to

civilians...This could be the action blowing up the golden pressure

cooker...click

here for more...

-

The British pound

suffers sharpest daily fall in more than one year and

Gold

expressed in Sterling has made a new high. The pound fell the most in more

than a year as foreign-exchange markets reacted with shock to the

prospect that a hung parliament will fail to tackle Britain's deficit. ...click

here for more.. If Britain looses its AAA rating the Gilts (British

Treasury bonds could collapse, break through the support [see Bond

section] and force Britain to monetize its debt. Action which will have

Hyperinflationary consequences.

Today we had a breakaway gap on the candle chart of British Pound-Gold!

-

As we wrote earlier, the Bond market and the charts in the

Bond section

are extremely important as they will tell us WHEN the

Hyperinflation will start...as soon as the end of 2010 and not later than

2012. This applies to the USA, the UK and the EU.

-

We have adjusted our Gold position in the section "Investment"

-

We almost forgot. Only two American banks were closed last Friday.

-

Are Darling and the Brits on Speed? This is the time

to CUT TAXES and decrease regulation...not to increase them like the

British Authorities have in mind. Only deregulation and lower taxation

will bring back Capital and Employment back to England. Thatcher

understood this and gave London a special tax status. Whether or not

London is becoming a large laundry house is less important. If London

closes the door to the washing machine, the capital will go elsewhere and

the City suffer even more. Something Britain cannot afford today....click

here for more...

Monday March

1, 2010 - click on the graph to enlarge

-

This

is why it is preferable to buy physical

Gold instead of physical

Silver in West

Europe...click here and

scroll down for more... This

is why it is preferable to buy physical

Gold instead of physical

Silver in West

Europe...click here and

scroll down for more...

-

Do check our short term PF €-Gold chart with objectives....click

here...

-

More Quantitative Easing all over the Western World.

We would publish a similar chart for the Euro and the

British Pound....if only 'they' were not hiding the figures and the

charts even harder than the US does.

-

Gold expressed in Swiss Franc actually gives an excellent picture of the

trend channel...click here and

scroll down for more... The chart clearly

shows where Gold stands and what the bullish objective is.

-

World indexes

have been updated. One stock market index only has

successfully tested its reversal (breakout) level. Other stock

market indexes are still hovering between a bullish Zimbabwe break

through their Down trend line and a fresh down leg...

-

Hyperinflation in the USA, the UK and the EU is possible before the

end of 2010. Governments sit in a catch 22 (only in

December 2009 Trichet said Greece was no problem at all) and all

Governments will keep repeating all will be well...until Hell breaks

loose. Politics is the second oldest profession in the World. At

least the oldest profession has a happy ending. Read how well this

scenario fits today's reality...click

here...

-

For

the stubborn Bond and Treasury

holders/buyers this special chart. [click on it to

enlarge] Bonds dating from the last Depression

still have some collectors value...today's digital bonds will end up

being worth absolutely NOTHING or ZERO! For

the stubborn Bond and Treasury

holders/buyers this special chart. [click on it to

enlarge] Bonds dating from the last Depression

still have some collectors value...today's digital bonds will end up

being worth absolutely NOTHING or ZERO!

-

We will one of these publish a similar chart for the stubborn Real

Estate holder. It ain't any better and won't be until

2033!

Friday February 26, 2010

-

If only preserving your savings was so easy as making money.

Not only do you have to find a safe way through a

dangerous labyrinth but during this quest you are continuously bombarded

by false indications and lies. The worst is that the MOPE, STATIC and

LIES is actually produced by the Authorities, Talking Heads, Newspapers

and financial magazines. Madoff is an Altar boy compared to what

you are subject to each day...poor investors. As usual 'The

Herd' will at a certain point and all of a sudden realize 'the Emperor

has no clothes'...but at that time it will be too late to rearrange your

savings. I have experienced this over and over again. My last

experiences dates back from the days just before the Real Estate Crash

started in the US, the Iceland drama and the 30% pre-Pound Sterling

devaluation. I remember that in those days many called (or thought) I

was a pessimist and an idiot.

-

Junior investors/traders still live with the false hope Algorithms,

scalping, trading, buying and selling will make them money

and they use internet trading like a juke Box, an investment simulator

or some Internet game. It only takes so long before they find out there

must be a better and safer way....we offer this for only € 295 per

year! Last year we 'only' made 50% expressed in Nominal Money and we

don't remember the days where we made less than 25%...

-

Many Real Estate

investors still live in denial (the Nile is the

longest river on Earth) refuse to

cut their losses short and switch their assets into an investment

instrument which would actually allow them to get out of the red figures

fast...instead of waiting until 2033 before Real Estate actually stands

out of the death.

-

The Authorities more and more engage into LIES, Window Dressing and

Hiding of the truth. The Fed is loading its balance

sheets with garbage and the ECB is doing exactly the same. The ONLY

difference is that it is even harder to find out what the ECB is

doing...click

here fore more...

Particularly disturbing was the contradiction about China buying HALF of

IMF's Gold: the World Gold council affirmed China wasn't a

realistic candidate but the English version of the Pravda confirmed the

intention of China to buy the Gold.!!!??? This proofs how vicious and

unreliable the Authorities have become...GOT GOLD?

Thursday February 25, 2010

-

All

roads lead to Goldman Sachs. They helped Greece

to falsify the figures like they helped Portugal, Italy

and Ireland. Having said this, the problems of California,

Illinois, Florida, North Carolina and Ohio

(just to name some) are consistently higher than the problems of the

PIGS and PINGUIMS. But such is irrelevant as the odds grow the EU will

collapse as a result of the collapse of the Dollar anyhow. All

roads lead to Goldman Sachs. They helped Greece

to falsify the figures like they helped Portugal, Italy

and Ireland. Having said this, the problems of California,

Illinois, Florida, North Carolina and Ohio

(just to name some) are consistently higher than the problems of the

PIGS and PINGUIMS. But such is irrelevant as the odds grow the EU will

collapse as a result of the collapse of the Dollar anyhow.

-

The Euro is fishing for a bottom and

technically has yet to be confirmed. The Euro needs

to continue going sideways for 5-7 trading days and form a base

before there is any indication a bottom has been put in

place. But whether the Euro gets stronger against the Dollar or not is

less important, just as it is less important what the

World Stock markets

will do expressed in Nominal terms.

Only the relationship against

Barbaric Gold is important and as

our charts show, the trend is DOWN in both cases!

-

It’s going to be a great spring, starting any day now, if you are in

the right stuff:

gold and silver mines and

juniors

are at price levels below those when Gold was trading at $ 700 and we

expect great earning figures to be released soon.

-

The Germans felt their system wouldn't collapse, but it took a

wheelbarrow of money to buy a loaf of

bread in the 1930s. The Soviet Union didn't

think their system would collapse, but it did. Ours is capable of

collapsing also.

-

What Bernanke and Trichet are preaching about the

Interest Rates is nothing more but MOPE and LIES, DAMN LIES.

The social security, pension system, Medicare and Global debt (because

of the bailouts private debt is now also becoming public debt) has

reached an astronomical level. In the USA in 1929 the ratio Debt to GNP

was 190%. Today the official figure ranges close to 400% but the real

figure is as high as 800%.

In other words, it has become

impossible for the Authorities to cover it and today one can be 200%

sure that the Financial system will actually crash/collapse taking the

Dollar with it (or vice versa) What we have is a paradigm shift!

-

Best case scenario, in about 5 years from now interest payments will

account for 30% of the tax income.

In reality we think the

situation will reach a dramatic level by 2012 for the simple reason that

the Depression is killing tax income in an exponential way.

-

THE TRAP IS CLOSED: The yield on each additional

invested €/$ has become NEGATIVE. In a system of

fractional reserve banking and

fiat money, the amount of fresh credit/debt/money to pull the

economy out of a recession becomes larger each time a reversal has to be

engineered [Von Mises economics].

We have now reached the point where the GDP return of each

additional invested £/€/$ 1 has become NEGATIVE. In other words, we have

crossed the point of NO RETURN and

the only question left is not

whether but WHEN the system will collapse!...click

here for more This statement takes away ALL questions and

scenario's about mopping up the Quantitative Easing.

-

More social unrest or Greece is a foretaste of what it to happen in

Western Europe and the USA. The Greek population

certainly did not create the crisis they are in right now ....but

they let it happen...click

ere for more...

-

The charts in the Oil

section and

Commodities section have been

updated.

-

Bullish double bottoms with 2 key reversals...click

here to see more of today's impressive

action.

-

The charts of the

Junior mines have been updated.

-

Tip of the month: (click on the chart for the details)

Wednesday February 24, 2010

Are

you an account holder with Citibank!? If so, be advised following

statement is not a joke. [got Gold?] Are

you an account holder with Citibank!? If so, be advised following

statement is not a joke. [got Gold?]

"Effective April 1, 2010, we reserve the right to

require (7) days advance notice before permitting a withdrawal from all

checking accounts. While we do not currently exercise this right and

have not exercised it in the past, we are required by law to notify you

of this change," Citigroup said on statements received by customers all

over the country.

-

The Financial and economic crisis we are living is for real.

It is no accident Banksters and Authorities are doing all within their

power to keep the system alive because their very lives are involved. For

this reason the odds are the system will collapse overnight wiping out

billions of deposits and savings.

-

Ripley's believe it or not, but in Western Europe, legislation forbids

most businesses to be open on Sundays and not only

forces many to be closed on Mondays but also regulates the business

opening hours. Western Europe is sliding in a depression and yet the

politicians are doing all they can to bring down Employment !?

-

Thank you Mister President! Under the pretext of

reducing Carbon pollution and Global Warming (a political hoax) , maximum

speed on roads is limited and gas is heavily taxed. As a result,

liquid energy consumption has fallen by 3%, refinery plants are closed and

thousand of people loose their jobs!?

-

We haven't seen the bottom of the real estate markets yet!

New home sales in the USA drop 11 percent in January, new

low...click

here for more Worldwide it will get a lot worse before it gets any

better! (the figures were the lowest ever since they started to keep the

figures in 1963)

-

Fundamentally and Technically, the Pound risks a savage (down) reaction

and we could see a run on the Pound sometime

in the near future. Our readers know what we think of the British

politicians and economic decisions...click

here for more... Arrogant

Nigel Farage could not have chosen a worse time to declare Herman Van

Rompuy [the president of the EU] has the charisma of a damn rag and

the looks of low class bank clerk. The question I want to ask, is who are

these British politicians who have ruined Britain in the first place and

sold the British gold at the very bottom of the market in 1999!? I know

these guys are arrogant because they [only] speak English but I would