US DOLLAR

Fundamentals + $ 1 bn

more debt each day !!!

ʘ ʘ ʘ Updated August 3, 2011

|

In 2008 the Dollar was UP for the wrong reasons and turned on

a dime .

1. What happened in reality [there is clear evidence of

this today] was that by the means of a 'currency swap' between central

banks 2008 the Dollar was artificially pumped up. This is possible but we favor

the next explanation.

2. If not we had a similar scenario as we had in Japan

prior to the 1990 crash of the Yen...and in Germany prior to the beginning of

the

Weimar hyperinflation.

The Long Term Chart clearly

indicate that what we lived from August on to end October 2008, was nothing more than

a ABC Bear Market correction. Disbelievers will, in due time, be

in for a bad surprise. So far our Mother of all necklines keeps on doing her job well.

-

Really scary:

technically, once the neckline is broken, the objective for the Dollar index is

.20.

-

Many astute analysts

have declared that the Corrupt Powers that control the vast manipulated

machinery cannot conceivably keep both the US$ and US-Bond market levitated for long. One had to fall. Any sell off of the US

Treasuries, pushing bond yields higher, would trigger a credit derivative

sequence of events that would result in overnight bank failures and collapse of

entire financial markets, starting with a JP Morgan meltdown. It would occur

much like a financial nuclear bomb.

So the victim will be the US Dollar, clearly, by default.

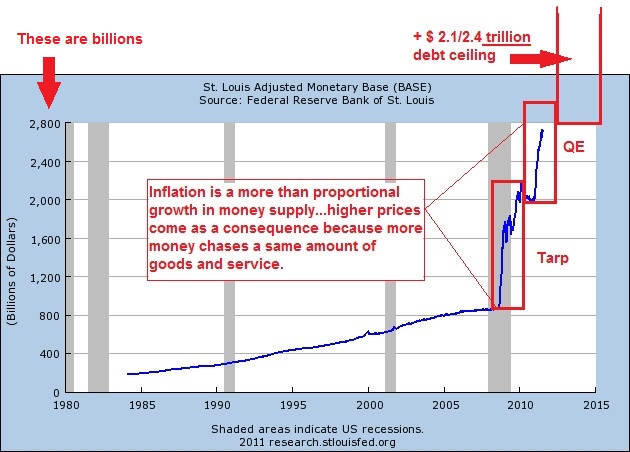

March 2009 the Fed has clearly confirmed it will follow a policy of

Quantitative easing.

-

The question is which problem is worse:

the one of the EU and Eastern Europe or the one of the USA and China/Japan? As

the Authorities have used most of their arrows, PROPAGANDA has become an

important instrument.

-

Time to make your own home work.

The cheaper your Fiat paper currency, the easier you can export and the harder

it becomes to import. It is for a country 'A LOT EASIER' to let the Dollar slide

than it is for Europe and the EU to even get a political agreement as to when

and by how much the Euro should be devaluated. Last but not least it is

important to understand the impact of a lower Euro would be even more

devastating to Europe because of the already extremely high taxes.

-

Derivatives and Fractional Reserve

Banking are the Tumors which will ultimately destroy the greedy

irresponsible Bankers and the USA.

|

May 2011 - Half of the actual American budget goes to

the defense.

April , 2010 - Considering the fundamentals it is a

miracle the Dollar is still being accepted!

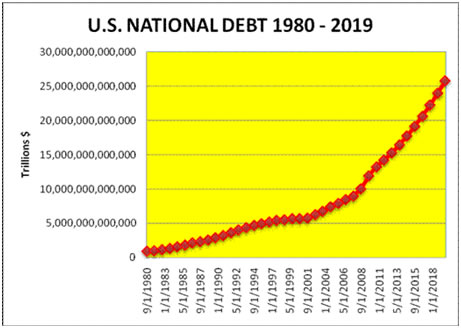

14.3 TRILLION DEBT

and growing...[click on the debt clock]

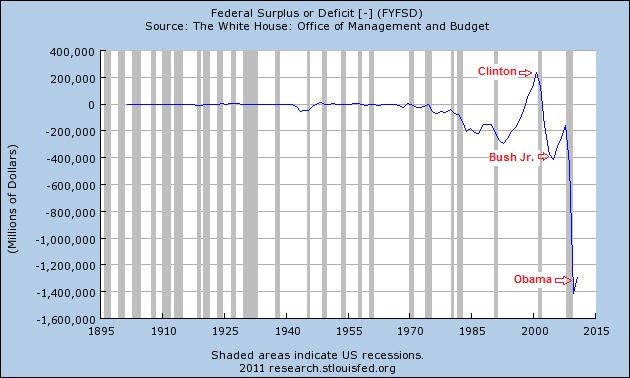

The deficit will get larger as a results of Jim's

Formula

Within the next 12 months, the U.S. Treasury

will have to refinance $2 trillion in short-term debt. And that's not counting

any additional deficit spending, which is estimated to be around $1.5 trillion.

Put the two numbers together. Then ask yourself, how in the world can the

Treasury borrow $3.5 trillion in only one year? That's an amount equal to nearly

30% of our entire GDP. And we're the world's biggest economy. Where will the

money come from?

Click here to watch CNN's video on pensions…

Posted October 23, 2009

The odds are the US dollar won't exist in 5 years time from today. It will

die because of Debt, Deficits, Derivatives, Real Estate and Deflation.

Updated November 2008

|

In truly perverse fashion, the

Dollar has been rallying as a prelude to a US financial system breakdown. If I

remember well, 1998 the same action was seen in Japan and Weimar Germany as they

had to sell foreign assets and repatriate these in a run for survival.

One of the reasons behind the Dollar correction

could be found in the forced repatriation of foreign American debt.

Earlier in 2008 the

BIS (Bank of

International Settlements) urged the USA to

bring international Bond obligations back to the USA so they could die on the

domestic market. By doing so, a relatively large quantity of Dollars had to be

bought. What we see now, is the result of this request.

Another

reason is the deleveraging of Banks and Hedge funds and also the repatriation of

the foreign funds. |

As the Euro fell back on its LONG

TERM support zone in a parabolic way, the Commercial Shorts are at a historic

high and the market has become extremely unbalanced (funds were long).

Add to this that there is NO CASE for a fundamental strong Dollar, extreme

caution is requested. We remain BEARISH on the Dollar!!

Posted August 4, 2008

This is to highlight how rapidly the

fundamentals of the Dollar are deteriorating.

The historical culprit of inflation

and hyperinflation has always been the use of fiat currencies.

This results in massive printing of paper money as the issuing authority sees no

alternative to raise money through taxation for its huge needs.

Additionally, the efforts by the FED to prevent a meltdown of the banking

system has spiked the broad Money growth (monetary inflation) to almost 20%.

Additionally, the Fed has created money by exchanging liquid versus illiquid

assets from the illiquid banks. As a result, these have been able to resume

their daily activity of lending money and creation of even more fiat money.

Bernanke vowed not to allow a

Deflationary crisis. The Fed will take and takes whatever action is

necessary to prevent a deflation and hence the Money supply is - even under

pressure of the Credit Crunch - not collapsing. On the contrary! As

of August and September 2008 the markets are INCORRECTLY anticipating a

DEFLATION.

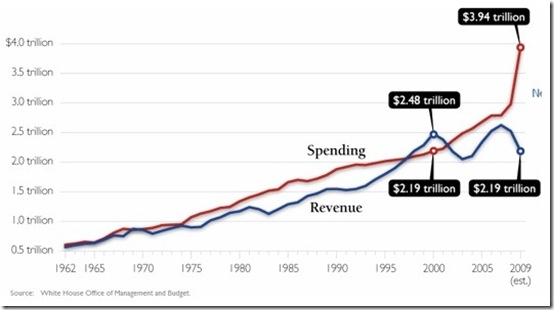

With an actual federal deficit

over $4 trillion and outstanding obligations of $62 trillion, the Fed can either

increase the interest rates, hope to attract more foreign funds and kill the

domestic economy or PRINT more Dollars.

Oil prices are off historic highs,

the dollar off a historic low and Money supply growth at an all-time

high. Hence, fundamentally, there is little or no room for the Dollar to reverse

its secular bear trend, let alone to strengthen momentarily.

Add to this situation the

Trade Deficit of $ 700 bn (the highest for any country in history), the

inability for the American consumer to increase his personal consumption and the

fact that fiscal stimulus by Tax cuts and increased federal spending have

reached their practical limits.

Globalism, Taxation and Profit

maximalization have ruined the American manufacturing sector and it will take

years before this stupidity can be repaired.

The perception that the dollar will be the preferred

safe haven during the remainder of this global financial crisis is being blown

away by the reality of exponential currency creation, budget deficit and

zeroed interest rates.

A similar situation occurred in the 1920's just before

the great Crash of the German Mark. From 1919 to 1920 there was a 1st dip for

the Mark.

Because of its low level, Marks were bought

massively . Investors were convinced the Mark would soon find back its AAA

status.

The currency recovered

slightly in 1921. Only months later,

as the economic situation got worse, they massively started to offload these

Marks, adding the to final crash and the initiation of the

Weimar hyperinflation.

The second down leg lasted

until 1929.

The dollar, due to the creation of

mountains of derivatives and now the bailing out the world, might just be in

worse shape. The Weimar mark didn't do so well .

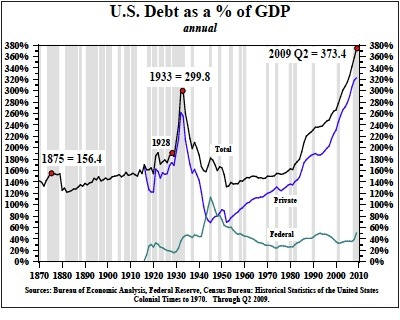

Nobody makes a strong currency and

certainly not a Reserve currency with a situation like following chart shows:

|

We are seeing a GLOBAL crisis. As the dollar will be reaching its long term

objective it will become clear that problems have also spread in Europe.

Britain, Japan, and the Antipodes are stalling. Denmark is in recession. Germany

contracted in the second quarter. May industrial output fell in Holland and

in Sweden. The coalitions in Belgium and Austria have just collapsed. Germany's

left-right team is fraying. Further south, the BNP Paribas has just issued

an alert for Spain. |

|