31

January

2019

UPDATE JANUARY 2019

Stockmarkets stumble into 2019.

![[Most Recent Quotes from www.kitco.com]](https://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif) |

![[Most Recent Quotes from www.kitco.com]](https://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif) |

Thursday January 31, 2019 - Are Gold & Silver breaking out?!

Updated Sections: $-Gold, US-Dollar (new candle chart), €-Gold, ,

If you don't think we are about to live QE4 and QE5 you have been smoking pot. If you don't prepare yourself NOW, you will end POOR. And believe me, Crypto-currencies, bonds and Real Estate WILL NOT SAVE you!

| There are lots of reasons to own gold but one I think is more relevant than others right now. The governments of the world are getting ready to spend their way out of trouble and historically that has meant debasing their currencies. Gold cannot simply be lent into existence and is therefore a supply inelasticity asset compared to the rapacious appetite for debasement the world’s governments represent. |

Important Fundamentals:

- For those who still bellieve the Global Warming HOAX the Authorities are selling today.

Important Technicals:

- €-Gold but also $-Gold is breaking out...see charts in respective sections for BULLISH TARGETS.

- Whatever your opinion is about the Euro - Dollar exchange rate, this Long Candle chart signals the end of the 7-8 year cycle and points towards a LOWER Dollar. I therefore strongly advise to convert DOLLARS into PHYSICAL GOLD and SILVER now. Because the price of Gold is also breaking out when expressed in Euro's I also strongly advise to convert their Euro holdings in PHYSICAL GOLD & SILVER now.

- The Pound Sterling is the canary in the coal mine for the US-Dollar. In othrt words, so as the Pound goes DOWN, will the US-Dollar go down.

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic

Wednesday January 30, 2019 - The UBO rules, digitization & other enforcement's by the Authorities is a preparation for the BIG RESET.

Updated Sections: Copper-Platinum & Non-Ferro's, Long Term Commodity Charts,

Commodities in Gold, Bonds general & USA,

No wonder the world is going to hell...with this kind of News Anchors, Mainstream Media, Authorities and 90% of "the people" only the (green) path to HELL seems to be possible.

To stop the inflation, post-war European countries each had their operation GUTT. In 1948 it was the turn of Germany. The new Deutsche Mark notes had been printed in the USA and shipped in all secrecy to Germany. In June 1948 all RentenMarks became worthless. In exchange each German received initially 40 new Deutsche Marks and one month later another 20 DM. This stopped the German hyperinflation overnight.

After WW2 the USA had an important production surplus and needed new EXPORT markets to sustain its growth. At the same time, Europe was a post-war devastated continent with no or little production, old factories and a lot of HUNGER. Because of this, West-Europe was sliding into communism. In times of hardship, people always become socialist, communist,…(Green).

After WW2 the USA had an important production surplus and needed new EXPORT markets to sustain its growth. At the same time, Europe was a post-war devastated continent with no or little production, old factories and a lot of HUNGER. Because of this, West-Europe was sliding into communism. In times of hardship, people always become socialist, communist,…(Green).

After "Czechoslovakian people" voted in favor of the USSR and the country became communist, the Americans realized that if they did not act soon, Europe would become a communist continent and they were to loose this export market forever. For this reason MARSHALL was finally able to get his MARSHALL PLAN through congress...

German Currency reform or BAIL-IN of June 1948: The Deutsche Mark was officially introduced on Sunday, June 20, 1948. The reform replaced the old money with the new Deutsche Mark at the rate of one new per ten old. This wiped out 90% of government and private debt, as well as private savings. Prices were decontrolled, and labor unions agreed to accept only a 15% wage increase, despite the 25% rise in prices.

| Through the introduction of the Deutsche Mark, Germany was able to get rid of most of it's DEBT...which was in fact paid by the German citizens who lost most if not all of their savings. Belgium, The Netherlands, France,...had already taken similar measures right after WW2. |

Officially, the introduction of the new currency was intended to protect western Germany from a second wave of hyperinflation and to stop the rampant barter and black market trade (where American cigarettes acted as currency). The currency reforms were simultaneous with the $1.4 billion in Marshall Plan money coming in from the United States, which primarily was used for investment. In addition, the Marshall plan forced German companies, as well as those in all of Western Europe, to modernize their business practices, and take account of the wider market. Europe was saved from Communism....

Important Fundamentals:

- The UBO register (see Goldonomic.be), the abolition of Bearer Shares, the digitization, the obligation to mention foreign bank accounts on your tax declaration, etc...is nothing more but the preparation of THE BIG EUROPEAN BAIL-IN which will be implemented during the coming financial crises for the BENEFIT of The People (that is how they will sell it).

Important Technicals:

- Today's bubble is a lot BIGGER than in the 1920's because of the huge amount Fiat PAPER money created out of thin air since 1971 and dramatic HIGHER Total Debt. Impossible to tell WHEN the BLACK SWAN will land and the system implodes. 100% sure though is that this will happen in the near future.

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic

Tuesday January 29, 2019 - Venezuela devalues currency to align it with black market - those with Gold are safe!

Updated Sections: Uranium shares, Bank & Financials, World Indexes in Gold, Long Term World

Indexes, Coal-Solar & Rare elements, Agriculturals, Inflation (new chart),

The West is doing the impossible to become as soon as possible another VENEZUELA . Note that even when there is no Toilet Paper, no medication, no food,...there are still IDIOTS which are supporting the Authorities & Regime . The Venezuelans who did not do what they had to do in time, now pay a terrible price for their complacency...

Venezuela has devalued the Bolivar, in an attempt to align the currency’s value with the country’s black market, AFP reported. Amid hyperinflation, many Venezuelans rely on the black market to gauge the currency’s value. The Central Bank of Venezuela (BCV) has authorized a private money exchange platform Interbanex to become part of the Exchange Market System in the country. Interbanex has said that its exchange is 3,200 sovereign bolivars for one dollar.

The country's economy has been in a steady decline since the sharp drop in oil prices in 2014 and the silly socialist, corruptive policy of Maduro. Since last week situation in Venezuela has become more tense after the opposition leader Juan Guaido declared himself the interim head of the state, with the support from US and its allies. A dollar exchange rate was 2.084 bolivars on the last auction at Exchange Market System (Dicom), EL Nacional reported citing the Central Bank of Venezuela. This means that the minimum monthly salary of 18,000 bolivars translates into only $ 8.64.

Important Fundamentals:

- Reported American Gold Reserves...

Important Technicals:

- Also see the sections for World Stock Market Indexes and Majors for these indexes.

|

|

| Our index tells us to SELL Shares.... | This indicator tells us to BUY the Gold & Silver sector (also see Majors) |

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic

Monday January 28, 2019 - Gold markets to explode to the upside!?

Updated Sections: $-Gold, World Stock Market Indexes (Short term Buy/Sell indicator added) ,

Silver, Gold Majors (Short/Medium term indicator added),

Counterparty risk is the risk associated with the other party to a financial transaction not meting its obligations. The average investor never worries about counterparty risk because “banks are always safe.” And “government bonds are the safest investment you can buy because governments can never default. That is unless they do. History teaches us this happens frequently.

| When Government and/or Banks default, global debt and liabilities will implode into a black hole and cause ALL asset prices to collapse and Fiat money to become WORTHLESS. |

Sovereign bonds are clearly a very bad risk since neither capital, nor interest, will be paid in the end. And the banking system is a terrible risk. With leverage of 10 to 50-times, banks will be unable to meet their obligations to depositors and clients. Thus, money will first be bailed in and eventually lost as the bank defaults. If governments try to save the financial system again, it is likely to fail this time. Global debt has doubled since the last financial crisis started in 2006 and printed money will be worth less than the paper it is printed on or the electricity required to create electronic money. So any fresh money fabricated by governments will just debase their currency to ZERO.

| The best wealth preservation asset is precious metals. Gold and silver are both a store of value and a medium of exchange. |

To store gold and silver at home is not a good idea. A criminal ( and a petty government officer) can always find it, using violence. If you store any valuables at home, which I would dissuade, it should not be more than you can afford to lose. If you hide your gold in a bank vault, the bank might denie access to your box and have it opened under control of a tax officer. It is much better to store it in high security vaults in countries like Panama. Especially in [TAX] FREE ZONES.

Even more important is that one day you will have to sell your Gold and Silver. I really wonder how many who have bought metals with black money and no invoice whatsoever will be able to sell their holdings at a time where these kind of transactions will be highly controled...and we probably will have windfall profit taxes and heavy fines for those who cannot proof the origin of their purchase.

The only SAFE way to keep your metals, is out of political reach in a poltical SAFE country (like Panama). Only there one will be able to sell the metal in a safe way. Whether or not you will decide to have it taxed after you sold it, will be your decision, not the government's. (if you store your metals in a high security vault, you must have direct ownership and access to your gold and silver bars without going through a middleman.)

Important Fundamentals:

- Gold & Silver Now In Massive Coiling Phase Similar To 2011. We are undergoing a coiling phase which is remarkably similar to 2011, where fundamentals will once again dictate to lagging technicals. The current bullish gold and silver setup evidences the physical market is far tighter than at any time since 1971 for gold, and in silver.

- Having spent many years in South Africa, I would advise investors not to hold their breath as regards the new president Cyril Ramaphosa bringing improved governance here. Corruption in the country is all pervasive and is now penetrating personnel in the judiciary. I know this from various contacts I have. The Zuma faction still wields huge influence within the ANC. The black economic empowerment policy has led to totally unsuitable and unqualified people being placed in key positions both in government and in the private sector. Given the current state of the world economy, I would indeed be surprised if the ZAR is not the currency to lose most in value among the emerging markets over the next year.

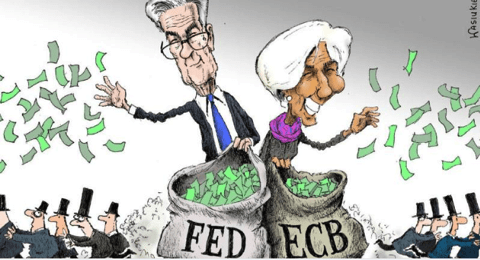

- Mario Draghi (the ECB) is unlikely to raise rates during his tenure at the ECB and his successors are going to have equally grim prospects of returning to normal monetary policy. People must realize that mopping up the extra liquidity of QE3 is totally IMPOSSIBLE. Even if the Belgian WET RAG (Van Rompuy) pretends it can. In other words, we are going to see more money created out of thin air and HYPERINFLATION.

Important Technicals:

- Remember we told you Gold & Silver would consolidate until the end of January and that February we would see higher.

- Gold markets reached towards the $1300 level during the trading session on Friday, which is a very bullish sign considering just how large the candlestick is. If the market can break above the $1320 level, we will go much higher. This is a very strong sign, and I do think that ultimately Gold takes off. For the Monday session, don’t be surprised at all if we get a bit of a pullback, perhaps in an attempt to build up the necessary momentum. However, if we close the week above the $1300 level, it’s likely that we see buyers jump in immediately on Monday morning. Below, I see the $1280 level as massive support, especially considering that we had just formed three hammers. To be honest, I can’t remember the last time that I had seen three hammers form in a row that did not kick off a bullish move. In fact, I may have never seen that pattern fail. If it did, that would have been an extraordinarily negative sign. Obviously, the buyers have taken control.

- Some of the best performing miners are:

|

|

|

|

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic

Friday January 25, 2019 - China may well be kickstarting the next recession.

Updated Sections: , ,

China’s headline government debt is comparatively small by international standards. However, China’s private sector debt is larger than the USA’s government debt. By first cutting off access to funding from the state banks, then cutting off shadow banking, then banning US Dollar loans, successive windows for funding have limited access of businesses to capital.

China's Real Estate Sector is a mess and SANCTIONS are seriously impacting the Chinese export and Chinese economy. If the property market falls apart, China will be in serious trouble. Add to this the falling purchasing power and a Western World sliding in a new recession.

Chinese Regulators realize they have a problem. They are now trotting out new central bank lending facilities to goad banks into extending credit to small enterprises.

| "IF YOU UNDERSTAND GOLD - YOU ARE NOT A GOLDBUG." Since less than 0.5% of world financial assets are in gold, most people neither hold gold, nor understand the purpose of gold. The people who understand the real value of gold could only agree with one of the definitions above - a goldbug is a gold beetle. There could be no argument about that clear definition. Egon von Greyerz |

Because of INTERNET, "they" lost control over the narrative. The people start to find out they have been lied to, screwed,....Therefore, there is no way out of this mess. The SYSTEM as we know it will first have to break before we shall see changes.

The DEBT FUNCTIONAL SYSTEM will have to break and will break on the way to recovery. When this is happening, don't forget that ALL DEBT GETS PAID, either by the BORROWER, either by the DEBTOR. As today's MONEY is in fact DEBT, many will end loosing all of their savings, pensions, life-insurances,...By many I mean 95% of the people.

Important Fundamentals:

- Adjusted for inflation, $-Gold can be bought at a 300 year low....and only 0.5% of the savers and investors have invested in physical gold. 95.5% of the world is invested in BUBBLES: fiat paper money, Treasuries, Stocks, Real Estate,...

Important Technicals:

- Since 2011 we had a MID-CYCLE PULL BACK for Gold and Silver. Since 1986 positions of commercials have NEVER gone LONG like these are LONG today. Understandable for those who realize that today physical Gold can be bought at a 300 year low. There is ZERO % doubt Gold and Silver will soar. As usual it is very hard, if possible at all to tell WHEN it will happen.

- Rather than trimming their long positions as the market ramps higher, investors have been increasing their bullish bets. Wethink this is a HUGE mistake.

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic

Thursday January 24, 2019 - Like we warned for: over the past months, U.S. stocks lived their biggest drop.

Updated Sections: , ,

Over the past months, U.S. stocks lived their biggest drop as rising pessimism that trade tensions with China will persist sent technology and multinational companies tumbling. Treasuries climbed, oil fell and the yen strengthened. The S&P 500 sank to session lows after the Financial Times reported that the U.S. turned down an offer of preparatory discussions. Chipmakers plunged more than 3 percent, with every member of the Philadelphia Semiconductor Index in the red. Caterpillar and DowDuPont led declines in the Dow Jones Industrial Average of more than 400 points.

Over the past months, U.S. stocks lived their biggest drop as rising pessimism that trade tensions with China will persist sent technology and multinational companies tumbling. Treasuries climbed, oil fell and the yen strengthened. The S&P 500 sank to session lows after the Financial Times reported that the U.S. turned down an offer of preparatory discussions. Chipmakers plunged more than 3 percent, with every member of the Philadelphia Semiconductor Index in the red. Caterpillar and DowDuPont led declines in the Dow Jones Industrial Average of more than 400 points.

| Our warning that Stock Markets were to slide down has been a constant refrain in the Subscriber’s sections over the last weeks and past months since February 2018! |

Important Fundamentals:

- In 2019 the investment world will start to realize that asset markets don’t grow to heaven as stocks, bonds, and property, start their long journey down which will eventually lead to declines of 75% to 95% in real terms (vs gold). But the major risk is not just investment markets. Just as important is counterparty risk, which too few investors are concerned about.

-

Once the next crisis starts, not a single bank will ever repay their depositors and no government will be able to repay their debt with real money.

Important Technicals:

- Technically speaking the STOCKS MARKETS are bearish but the Gold & Silver sector is BULLISH.

|

|

| The Belgian Stock index showed a distinct SELL last Summer (2018). |

Silver has completed a W-bottom formation and has broken out. |

|

|

| Majors are lagging but bullish. | Juniors have completed a W-bottom formation and Index has broken out. |

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic

Wednesday January 23, 2019 - After Manhattan real estate prices in the city of London also crash.

Updated Sections: Gold & Silver Juniors (new share), World Stock Market Ind. (short candles),

Asking Prices for London Homes Slump to Lowest Since 2015. Because of the uncertainly around Brexit but also because of the economic recession, many Headquarters of multi-nationals and other important companies are leaving "The City". Listing prices in the capital have declined from a peak of almost 650,000 pounds in May 2016, the month before Britons voted to leave the European Union. What we also see, is that many rich Britons are going for a PANAMA residence and are planning to emigrate. The glory days of the British Empire are since long gone and the money makers have been sold to foreign entities.

Asking Prices for London Homes Slump to Lowest Since 2015. Because of the uncertainly around Brexit but also because of the economic recession, many Headquarters of multi-nationals and other important companies are leaving "The City". Listing prices in the capital have declined from a peak of almost 650,000 pounds in May 2016, the month before Britons voted to leave the European Union. What we also see, is that many rich Britons are going for a PANAMA residence and are planning to emigrate. The glory days of the British Empire are since long gone and the money makers have been sold to foreign entities.

Whether we look at the United States, Europe or China, sure is that the next recession sits right around the corner. How far can families go if one or two income earners lose their jobs? With nearly 60% of Americans having less than $1,000 in savings and the next 15% having less than $5,000 I submit: Not very far. In Europe many families run into financial problems as soon as one family member looses its job. In countries like Greece, Italy, France, Spain and Portugal many families have already living from paycheck to paycheck for the last years.

The current unemployment rate is at decades long lows. At least that is what the official figures say. Real unemployment is a lot higher (www.shadowstatistics.com). Whatever figures one looks at, there is a problem: Every economic cycle ends despite the rosy attestations of those that wish to keep confidence high. By looking at the bad figures of Automobile sales (an excellent indicator) we now already know the world economy will slide into a fresh recession.

It is precisely at the end of an economic cycle that low unemployment rates tend to reverse rather suddenly. And when they do recessions soon follow and generally tend to increase unemployment rates by 6%-10%. The data shows most Americans and Europeans will be in dire straights during the next recession.

Like the European Community, America has added record debt over the past 10 years while financing its recovery with low rates, yet all this spending has done little for the wealth of the general population, rather most are left woefully unprepared for when the recovery ends.

|

|

| Global debt trebled since 1999 ... |

Expect DRAMATIC situations when Interest rates RISE...Because of the manipulation this may result in an accident. |

|

|

| Each low in unemployement is followed by a RECESSION | As we all know, REAL wages are DOWN... |

Important Fundamentals:

- we added one new share to the section for Juniors: NOVO Resources.

Important Technicals:

- US-stock market Indexes are running into resistance and loosing momentum. We may well have the END of what we call the BACKTEST or PULLBACK now.

- The Gold and Silver sector continues to digest the advance of the past weeks and is building up stamina in order to break $1,320 & $1,380 levels next month.

- Expect HIGHER Oil later this year.

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic

Tuesday January 22, 2019 - Do we have peak Gold and Peak Silver?

Updated Sections: Gold & Silver Majors (new stock added), World Stock Market Indexes,

Who do the Yellow Vests think will take over if they boot Macron? I can tell you right now it will be another brain dead idiot determined to line his own pockets until he gets the boot. some units of the riot police have been issued fully automatic G36 rifles. If and when some fool policeman starts shooting at the protestors, a bloody war will have started. Eventually more and more of the police will realize they are shooting their own citizens. At that point they will start shooting politicians.

| The trick is to have High Inflation (but claim there is none or only low inflation) and near Zero or negative interest rates....this whipes out most Global Debt....The cherry on the cake however will be a HUGE BAIL-IN (debt moratorium). |

Are you a 5k to 1m in five years "believer"? Or do you have more Brains and are you thinking of PRESERVING your savings and trying to make sure you still have any AFTER the CRASH, Bail-In, Hyperinflation, Deflation!? Value is never about how much you pay. It’s about how much you get for your money.

Those with FAITH in The Authorities and their Mainstream Media ALWAYS end up with what these promise and what they deserve: NOTHING...THIN AIR. The longer it takes before the situation is normalized, the harder and the more explosive "the catharsis"...

Important Fundamentals:

- We have added one new Gold major to the Majors section: Newcrest mining. PF charts comes with our bullish calculated price target.

- We have Peak Gold & Peak Silver. The global mine supply from the top silver producing countries may decline more than the industry forecasts. The leading consultancies reported that global silver production would increase moderately by 1-2% in 2018. However, the data from several countries and large mining companies suggest that overall world silver production may decline by 2-3+%.

- Today we have a DEBT functional Bank system and NOT and ASSETS functional Bank System. And DEBT ALWAYS gets repaid...ALWAYS!

|

|

Important Technicals:

- Stock rebound, the pullback, the backtest continues. All major U.S. stock indexes have exceeded their 50-day averages (blue lines). That still leaves their 200-day averages to contain the rally. But there are a couple of other VERY important resistance lines that still need to be tested. The falling trendline drawn over its October/December highs should also provided stiff overhead resistance. The Dow would have to clear both barriers to signal a major turn to the upside. The same is true of the other two major stock indexes. See our PF-charts in the respective sections for the RESISTANCE levels.

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic

Monday January 21, 2019 - What does 1848 and the Yellow Jackets have in common?

Updated Sections:

The Jared cycle 1848: Looking back to 1848, one Jared cycle away, we witnessed the European Revolutions – also known as the People's Spring of Nations. The revolutions were essentially democratic and liberal in nature, with the aim of removing the old monarchical structures and creating independent nation states. [tomorrow the old party-cratic professional cast of politicians will be removed and monarchies will completely disappear].

The Jared cycle 1848: Looking back to 1848, one Jared cycle away, we witnessed the European Revolutions – also known as the People's Spring of Nations. The revolutions were essentially democratic and liberal in nature, with the aim of removing the old monarchical structures and creating independent nation states. [tomorrow the old party-cratic professional cast of politicians will be removed and monarchies will completely disappear].

The revolutions spread across Europe after an initial revolution began in France in February 1848. Over 50 countries were affected, but with no significant coordination among their respective revolutionaries. The major contributing factors were widespread dissatisfaction with political leadership, demands for more participation in government, demands for freedom of the press, the upsurge of nationalism. The middle and working class shared this desire for reform.

Note: the Belgian Revolution already happened in 1830. In 1788 the Royal Treasury was empty and the French Revolution started a year later in 1789..

Revolutions we have each time the Authorities don't realize or realize too late that the people are getting hungry and they cannot longer feed their children. In many cases the Authorities were/are unable to bring relief (that is on condition they realized what was going on) because the FUNDS and/or CREDITS were/are unavailable. [like is the case now]

Important Fundamentals:

- Just like happened in the 1920's, 2018 was an extremely bad year for investors: private and professional. For most 2018 ended deep in the RED. Only those who preferred SECURITY to the CASINO and are invested in the Gold & Silver sector, ended with a plus.

Important Technicals:

- Silver is seriously under valued and Stocks seriously over valued. As always THE HERD will see that the disequilibrium is corrected, change the investment strategy too late and end as BAG HOLDER.

|

|

|

|

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic

Friday January 18, 2019 - Succesfull investors listen to the tunes of the financial markets!

Updated Sections:

Successful investors listen to the tunes of the financial markets. Loosers listen to Authorities, Politicians, Mainstream Media, Goldman Sachs, JP Morgan, propaganda,....The market is you best friend only if you are able to read and understand the market properly. This is something few investors are able to do. Especially because the EMOTION and IMMEDIATE SATISFACTION make it impossible to invest wisely. Example: although the Gold & Silver markets have been bottoming out since 2016, few are invested in the sector. Few took advantage of these exceptional low prices of Gold and Silver. As usual, THE HERD will come in and start to buy its way in once Gold soars above the $2000, $3,000 and $5,000. At that time THE WISE INVESTOR is already busy working on an EXIT and another investment.

Successful investors listen to the tunes of the financial markets. Loosers listen to Authorities, Politicians, Mainstream Media, Goldman Sachs, JP Morgan, propaganda,....The market is you best friend only if you are able to read and understand the market properly. This is something few investors are able to do. Especially because the EMOTION and IMMEDIATE SATISFACTION make it impossible to invest wisely. Example: although the Gold & Silver markets have been bottoming out since 2016, few are invested in the sector. Few took advantage of these exceptional low prices of Gold and Silver. As usual, THE HERD will come in and start to buy its way in once Gold soars above the $2000, $3,000 and $5,000. At that time THE WISE INVESTOR is already busy working on an EXIT and another investment.

- We all make errors, yet there are a few money mistakes the super-rich generally don't make.

- One of them is they don't follow the pack: whether it's a fad investment or panicking during a market sell-off.

- They also seek expert advice and look beyond the stock market for investments.

- Many investors have INVESTOTITIES...once they have money available, they want to invest it as soon as possible and don't wait for market opportunities.

The rich – they're just like us, right? Well, not exactly. First, they don't follow the pack. Second, they work at work at becoming successful every day. And it doesn't have to take hours of their time. "Every day, they do certain things that help them to change into the individuals they need to become in order for success to visit them." Daily habits could include increasing your knowledge, attending seminars and picking the brains of mentors.

Here are three more money mistakes that may be keeping you from getting rich.

- Do it yourself with the help of a good advisor: when the stock market drops — as we saw in December , when major indexes all dropped at least 8.7 percent — you have to know what you are doing. If you don't have time to spend a few hours a day tracking the market, the cost of a good financial advisor is well worth the investment...and you will be out of the market in time (Goldonomic issued a 1st warning in Feb 2018 and a 2nd in the Summer of 2018). Most wealthy people don't try to manage their money themselves — they hire financial planners to protect their assets and reduce their risks. When investors are a roller coaster and stressed, the odds of making a bad decision increase. Wealthy people mitigate that stress by having good advisors.

| While some may balk at paying a fee, the returns on that money will, most years, be well above that amount. During the bad years, your advisor can help you mitigate your losses to preserve your wealth for the long haul. |

- Do Not over-diversify: the average investor may have stocks and bonds in their 401(k) savings or investment portfolio. But they diversify way too much. Keep your eggs in one, two or three baskets only. Diversification has to be made using your brains when OPPORTUNITIES occur.

- Fad investing: the ultra-wealthy don't get caught up in the latest fads, pouncing on the next "new" thing. Take bitcoin, for example. The cryptocurrency took off in 2017, making instant millionaires out of some early investors. That spurred a lot of people to jump in and try their hand at making a fortune. The cryptocurrency has since fallen a stomach-churning 70 % in the past year.

Important Fundamentals:

- This is a DEPRESSION and not a recovery/boom like Authorities pretend.

Important Technicals:

- I started to advise to buy gold during the 1970's...so far there is a 3,437% profit and we haven't seen it all. This LEG C will be bigger in amplitude than LEG A + LEG B . At least another 3,437% profit that is.

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic

Thursday January 17, 2019 - Our charts and comments are worth 1001 "news" shows!

Updated Sections: ¥-Gold & ¥/€/$, R-Gold & R/€/$, Kr-Gold & Kr/€/$, Yuan-Gold & Yuan/€/$,

Rupee-Gold,

Many years ago I stopped watching virtually all "news" shows. It started out by me wanting to see what happened in the world over night as I was waking up, and what implications there may be to my investments in the day ahead. It was many years ago that I started to notice that all that was being reported was totally unimportant. At that time I had just turned 40 and emigrated to Johannesburg, South Africa. As a matter of fact, the REALITY of the FAKE NEWS hit me right in the face by watching the SABC (South African Television). Mainstream Media are the Propaganda media of the Authorities and those who follow these are prone to make the worst investment decisions.

| News Shows are extremely dangerous to your financial health. |

Many still don't seem to realize the size of the SHORTAGE...New Shortfall In Production Capacity For Fabricated Silver And Gold. The two largest private producers of bullion bars and rounds in the U.S. have gone defunct over the past two years. Premiums for silver bars and rounds are already on the rise as markets adjust to the lack of supply. At present, demand for these products is manageable. A surge in buying activity, however, could lead to serious difficulty finding low-premium products. [note it already is difficult]

Many still don't seem to realize the size of the SHORTAGE...New Shortfall In Production Capacity For Fabricated Silver And Gold. The two largest private producers of bullion bars and rounds in the U.S. have gone defunct over the past two years. Premiums for silver bars and rounds are already on the rise as markets adjust to the lack of supply. At present, demand for these products is manageable. A surge in buying activity, however, could lead to serious difficulty finding low-premium products. [note it already is difficult]

Elemetal shut down most of its operation in early 2017. The firm was implicated in a scheme to launder money for South American drug cartels and lost its designation as an LBMA and COMEX approved refiner. That loss was the kiss of death for the firm, which soon shuttered most of its production. Florida-based Republic Metals had a blow up of its own late last year.

These developments leave the bullion markets in vulnerable condition. Demand for fabricated silver rounds and bars ticked higher in December. The effect on premiums was immediate and dealers are now quoting lead times for some products. Buying appetite from investors remains well below what is was a few years ago. During the peak demand period, both Elemetal and Republic ran multiple shifts in an effort to keep up. Should even a portion of that demand return to markets, the current production capacity will be swamped quickly.

Capacity will eventually catch up. However, that process can take many months, perhaps even longer. People with plans to buy physical metal in the near future may want to move sooner rather than later.

Important Fundamentals:

- The 18 year performance of Gold: no comment

Important Technicals:

- Gold Hits An All Time High In 72 Currencies (the list is more or less correct)

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic

Wednesday January 16, 2019 - What did "MAY-DAY" bring for the investor?

Updated Sections: Banks & Financials, £-Gold & £/€/$,

Sterling stole the limelight as the U.K. parliament voted on Theresa May's Brexit deal. The odds currently looked stacked against her, setting the stage for further political turmoil just 10 weeks before Britain's scheduled departure from the bloc. While the scale of the expected defeat is unclear, it will be crucial to what happens next. Among the options: Brexit extension, a general election, renegotiating a new proposal, a second Brexit referendum or leaving the EU with no deal on March 29.

Sterling stole the limelight as the U.K. parliament voted on Theresa May's Brexit deal. The odds currently looked stacked against her, setting the stage for further political turmoil just 10 weeks before Britain's scheduled departure from the bloc. While the scale of the expected defeat is unclear, it will be crucial to what happens next. Among the options: Brexit extension, a general election, renegotiating a new proposal, a second Brexit referendum or leaving the EU with no deal on March 29.

| No doubt GOLD & SILVER are the best insurance against any BREXIT - issues. Financial Markets still think we shall see NO Brexit... |

Subscribers will remember that WE at Goldonomic NEVER believed we would see a BREXIT. The Brexit deal, painstakingly agreed upon with the EU by PM Theresa May last year, has ultimately flopped, as MPs said a firm no. The failure brings even more uncertainty to the fate of May’s cabinet and the whole Brexit process.

UK parliament voted down May’s Brexit plan on Tuesday by 432 votes to 202 – a margin of 230 – following lengthy debates on the matter. The vote was originally set to be held in mid-December, but was postponed amid fears that MPs would reject the unpopular deal between May and Brussels. The delay failed to prompt any meaningful changes to aid the PM's cause, as it was ultimately rejected by parliament. The development comes just 10 weeks before the UK is set to leave the EU, bringing even more uncertainty to the already turbulent Brexit process.

Important Fundamentals:

- AET is now CVS Health.

Important Technicals:

- Our PF-charts for BANKS simply look BAD (see section). Note that the BANK-INDEX has fallen in STOP LOSS and has broken down an important support level. If today's PULLBACK becomes a BACKTEST, we expect much lower. Especially the PF-charts of European and Swiss banks are a WARNING. Several American banks have broken their uptrend and Canadian banks show a TOP formation. Note: the situation in Canada is different because of the 5 CARTELS controlling the Canadian Banks and society. This is a plus as long as no severe accident occurs....

- The weakness of the Bank shares indicate that in the near future we SHALL NOT SEE HIGHER INTEREST RATES!

- The PF-charts for INSURANCE co's still are ok.

- The Footsie and the Pound Sterling...and it is always interesting to see what the financial markets think of important happenings...like a BREXIT.

|

|

| a failed breakout of the Footsie we have. |

Sterling is moving sideward...spelling no big changes re. BREXIT. |

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic

Tuesday January 15, 2019 - If interest rates stay level, the financial system will implode.

Updated Sections: Gold & Silver Majors (Newmont+Goldcorp), ,

CHESS MATE IT IS: If interest rates stay level, the financial system will implode next year. If interest rates rise, the financial system will implode tomorrow. The only way to postpone somewhat the DRAMA is with NEGATIVE Nominal Interest Rates. [Note Real Interest Rates are already "negative".]

CHESS MATE IT IS: If interest rates stay level, the financial system will implode next year. If interest rates rise, the financial system will implode tomorrow. The only way to postpone somewhat the DRAMA is with NEGATIVE Nominal Interest Rates. [Note Real Interest Rates are already "negative".]

As long as GNP GROWTH is higher than the general level of interest rates and assuming there are no accidents, the system can survive. If one assumes Government is able to borrow at an interest rate of for example 3% and the growth of the Domestic product is 3% or higher, the growth can finance the debt. However, the system will fail as soon as the growth of the domestic product falls below 3%.

A major problem is that we have reached a point where each additional amount of freshly created money, pushes the economy further into the recession and creates more upward pressure on the General Level of Interest Rates. Today one can assume that the Central Banks are simply manipulating the interest rates and keep these at abnormal low levels. Likewise the PPT (Plunge Protection Team) is manipulating the Stock Markets. To keep the secrecy the team operates indirectly through Goldman Sachs, JP Morgan,....Most investors don't have a clue about this and keep playing the financial markets as happy kids....VERY DANGEROUS. [Bear in mind that the longer this manipulation lasts, the more dramatic the situation will be the day that this manipulation stops working].

Important Fundamentals:

- Newmont Mining, Goldcorp combine in $10B stock deal combining two gold industry leaders, Newmont Mining (NYSE:NEM) is buying all the shares of its smaller rival Goldcorp (NYSE:GG) in an all-stock deal valued at $10B. The exchange ratio equals 0.3280 of a Newmont share and $0.02 for each Goldcorp share. In addition to providing shareholders the largest gold reserves per share, Newmont Goldcorp will "offer the highest annual dividend among senior gold producers."

- I have grown to beware the "ZeroHedge Trap" of making ANY investment and trading decisions after reading one of their perennial purveyors of doom-and-gloom propaganda engineered to attract site "hits", estimated to have grown from about 1.6m per month in 2009 to 40m per month, a record for the period ended January 1, 2019. Bill Murphy. Sites like ZeroHedge survive because of advertising and HITS...not because of quality.

| These are the types of mergers and acquisitions (NEM+GG) that happen at the end of bearish cycles in the gold market. The fact that two such large scale deals have been announced back-to-back is a very bullish medium- to long-term indicator for the price of gold. |

Important Technicals:

- Franco Nevada and Goldcorp can be bought at present levels.

|

|

| Target of technical pattern is $74 |

Target of technical pattern is $18 |

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic

Monday January 14, 2019 - Russia Buys Quarter of World Yuan Reserves in Shift From Dollar.

Updated Sections: , ,

Russia Buys Quarter of World Yuan Reserves in Shift From Dollar. Russia’s central bank dumped $101 billion in U.S. holdings from its huge reserves, shifting into euros and yuan last spring amid a new round of U.S. sanctions.

Russia Buys Quarter of World Yuan Reserves in Shift From Dollar. Russia’s central bank dumped $101 billion in U.S. holdings from its huge reserves, shifting into euros and yuan last spring amid a new round of U.S. sanctions.

The central bank moved the equivalent of $44 billion each into the European and Chinese currencies in the second quarter, according to a report published on late Wednesday by the Bank of Russia, which discloses the data with a six-month lag. Another $21 billion was invested in the Japanese yen.

The Chinese currency accounted for 15 percent of total holdings at the last reading, up from 5 percent at the end of the first quarter, according to the report. That puts Russia’s yuan share at about ten times the average for global central banks, with its total holdings of the currency accounting for about a quarter of world reserves in yuan, according to International Monetary Fund data. Morgan Stanley estimated Russia was the main buyer of Chinese bonds last year...more

The BIG RESET has began and follows into the footsteps of what happened to the British Emporium centuries ago.

Important Fundamentals:

- The dollar is used less and less in trade. The less US-Dollars in circulation, the less Good and Services are invoiced in Dollar, the less POWER the USA has over the world and the weaker the Dollar will become. An excellent historic example we have with the Pound Sterling. The American Empire is walking in the foodsteps of the British Empire.

- A substantial decline in the value of the US dollar is required to bring the US trade account into balance. That means a huge devaluation and a loss of its reserve status among oil producers and central banks. It means a huge increase in inflation of imported goods into the US during the lengthy transition. It means a huge increase in taxes on income and wealth for U.S. citizens. It means a wholesale liquidation of debt and equities followed by hyperinflation. It means social and political unrest. It means an end of an empire.

- Fundamentals DANGEROUSLY confirm the Technical analysis: We have a BUBBLE economy and the upcoming Earnings season will be so bad, it will push Stocks further down. See calender below.

- Yellow Jackets are unhappy because they realize their purchasing power has been eroded away by Inflation, Taxation and Regulation (regulation also costs money). Authorities sit between a rock and a hard plate because they have ZERO ROOM to give in to the demands of the Yellow Jackets....ZERO. The only thing they (the ECB) can do, is PRINT more money or initiate QE4.

- Global Debt can NEVER and will NEVER be repaid...such is simply IMPOSSIBLE. The implications of this are TERRIBLE....

Important Technicals:

- Gold & Silver to resume uptrend at any time now. Spot Gold prices rallied for three straight months to end 2018, with December seeing the biggest monthly gold gains in around two years (since Jan 2017)…

- Bear Market corrections are UP but Bull Market corrections are down. Bull market corrections are SWIFT and VIOLENT...Bear Market corrections are SLOW and create HOPE for those who are wrongly invested.

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic

Friday January 11, 2019 - Which countries will survive the economic & financial crisis?

Updated Sections: Swiss-Gold & Swiss/$/€, Can$-Gold & Can$/$/€,

| Some countries will suffer more but recover faster while other countries will recover later or not at all. |

Important Fundamentals:

- There comes a day where one will be able to buy a house for 500 Silver Eagles and less.

- The general price level of Real Estate will come down as soon as he creation of Fiat Money out of thin air stops.

- The price of Real Estate comes down when interest rates rise and DEMAND falls. Demand falls as soon as the REAL SPENDABLE income of the public falls. This is exactly what is happening i.e. in Europe. The Yellow Jackets are the proof on the cake.

Important Technicals:

- Gold & Silver continues to consolidate. We expect Higher NEXT month.

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic

Thursday January 10, 2019 - Whether Money Supply goes up or comes down won't make no difference...

Updated Sections: Commodities, Crude Oil Price,

The marginal productivity of each additional created unit of Money negatively impacts the economic growth. In other words, the more money Central Banks create, the worse the depression will become. Alternatively, if the Central Banks would stop printing money (or even reduce the money supply) the action would result in HIGHER INTEREST RATES and this in turn choke the economy and make the Global Debt unbearable. The point of no return has been passed long time ago....

|

|

| EU - Gross Domestic Product & ECB assets | ECB & FEC-assets versus GDP |

Therefore it is now only a matter of time before THE SYSTEM slides into the next financial crisis and Mainstream Media call the GREAT DEPRESSION of the 21st CENTURY. Bear in mind that the rule is that such an accident happens overnight WITHOUT WARNING. So don't expect to be able to flip positions and funds before the crisis unfolds.

Important Fundamentals:

- The European banks (incl. Swiss banks) are in a very bad shape....and the €-insurance is a JOKE (Cyprus clearly confirmed this statement) and we expect a MASSIVE BAIL-IN next time there is a financial crisis.

|

|

| 1989 - 2019 | 1999 - 2016 |

Important Technicals:

- US-Dollar Index falls to 3-months low and is hereby boosting commodity prices with gold in the lead.

- Crude Oil price to rise to $60 - $80 - $145 per barrel. Oil jumps - remember we advised to BUY oil shares yesterday!

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic

Wednesday January 9, 2019 - Whether interest rates continue to go up or down won't make no difference.

Updated Sections: Juniors, Oil Shares, Natural Gas shares

Whether interest rates continue to go up or down won't make no difference. Shit there will be. Two-Year Yield Dips Below Key Fed Rate For First Time Since 2008 - January 3, 2018. “The market is effectively saying that at some point in the next 24 months, the Fed is going to have to not only stop hiking, but actively start easing.” This time the central banks and sovereign treasuries also have impaired balance sheets…The U.S. two-year Treasury note yield US2YT=RR dropped below 2.4 percent on Thursday afternoon, reaching parity with the federal funds effective rate for the first time since 2008.

Whether interest rates continue to go up or down won't make no difference. Shit there will be. Two-Year Yield Dips Below Key Fed Rate For First Time Since 2008 - January 3, 2018. “The market is effectively saying that at some point in the next 24 months, the Fed is going to have to not only stop hiking, but actively start easing.” This time the central banks and sovereign treasuries also have impaired balance sheets…The U.S. two-year Treasury note yield US2YT=RR dropped below 2.4 percent on Thursday afternoon, reaching parity with the federal funds effective rate for the first time since 2008.

The fed funds effective rate, which was 2.4 percent on Thursday, moves within the Federal Reserve’s key policy range of 2.25 to 2.5 percent. The market move suggests investors believe the U.S. central bank will not be able to continue to tighten monetary policy as its forecast suggests, after having lifted benchmark interest rates four times in 2018. The market is effectively saying that at some point in the next 24 months, the Fed is going to have to not only stop hiking, but actively start easing.

In the EU Draghi is also looking at a colossal policy failure here and he has no good choices. If he ends QE and has nothing else in his pocket Europe may enter a recession right when he retires next September. Not having raised rates once, still running negative interest rates with everything looks gloomy. Is that to be his legacy? A failed central banker who did nothing but print and then left with a recession running?

His choices seem impossible here. If he doesn’t end QE he looks the fool with no credibility having signaled the end of QE all this year and even just a few weeks ago. Maybe this is the reason why the RATS are leaving the sinking EU-Titanic (Merkel, Draghi,...)

Next crisis to leave USD but also the Euro looking like Turkish Lira As foreign debt and rising inflation drive currency into the ground because budget and current account deficits spiral out of control. The U.S. Dollar/Euro could soon fall as much as 30% in a sell-off. The U.S. economy/European is a ticking time bomb with a detonator set for about 2 years time. The next big crisis will be caused by an unaffordable build-up of debt in the economy that is exacerbated by a devaluation of the Dollar/Euro, which pushes up the cost of servicing an increasingly large pile of foreign currency debt. Both the U.S. and Europe might even go through the kind of inflationary debt crisis suffered recently by countries like Argentina and Turkey.

A War and a currency reset?...interesting video. Correct you can't eat Gold. However you can AT ALL TIMES exchange it for Food or sell it and buy food with the money you get.

Important Fundamentals:

- Pharmaceutical giant Eli Lilly will acquire cancer treatment specialist Loxo Oncology in a cash deal valued at around $8 billion, the companies said on Monday. See "Green" labelled PF-chart in Bio-Pharma section

Important Technicals:

- Important today is HOW you are invested and WHERE your assets are kept and DOMICILIATED. Any mistake can turn any millionaire into a POOR man overnight.

- Cheniere (LNG) is a BUY at present level (see natural gas shares)

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic

Tuesday January 8, 2019 - The Authorities/Governments are going to attempt to restore market confidence

Updated Sections: World Stock Market Indexes (all), Recession Proof Shares (all), Recession

Proof Shares (hold), Royalties , Majors, Bio-tech & Pharma,

Manhattan Home Prices Fall Below $1 Million For First Time In Years. After declining for most of 2018, the median sales price for Manhattan apartments slipped again in the fourth quarter, with the median price moving below $1 million for the first time in three years. It is a frightening prospect for sellers as the condo market in the prime borough of New York City is rapidly cooling, and is likely to get much worse this year.

Manhattan Home Prices Fall Below $1 Million For First Time In Years. After declining for most of 2018, the median sales price for Manhattan apartments slipped again in the fourth quarter, with the median price moving below $1 million for the first time in three years. It is a frightening prospect for sellers as the condo market in the prime borough of New York City is rapidly cooling, and is likely to get much worse this year.

Manhattan real-estate is unlikely to improve this year. The market has been damaged by a convergence of economic forces: An oversupply of newly built luxury apartments; demand from foreign buyers cooled; the new tax law, which limits the deductibility of state and local taxes; increasing taxes in New York; rising mortgage interest rates; financial market volatility; political uncertainty; and of course, a global economic slowdown.

Since so many current homeowners have rock-bottom mortgage rates that are no longer available, they can't afford to buy new homes. Even if they wanted to sell they can't, as potential buyers can't afford current mortgage rates. So owners are locked in and buyers are locked out!

| Have you ever wondered “who” would be able to buy your house if credit was not available? It won’t be long before you see…the tide is going out on a naked financial world! |

It’s not just stocks: the global housing market is in for a rough patch, which has turned ugly for many homeowners and investors from Vancouver to London, with markets in Singapore, Hong Kong, and Australia already showing increased signs of softening. To put it blunt, if nobody has the means to buy your home, it's worth ZERO.

"I am now of the opinion that the elitists are going to attempt to restore market confidence due to their (rightly-founded) fear that recent global market turmoil will see the embodiment of the negative asymmetrical wealth effect of declining assets prices. Stocks, housing and commodities are now trending downward and while stocks alone are enough to sour consumer spending patterns, housing has an infinitely greater impact, as we saw in 2006 when the sub-prime bubble triggered the beginning of that catastrophic foreclosure/liquidation cycle ". (Bill Murphy)

Important Fundamentals:

- The new Barrick which was created from the merger between ABX (Barrick) and Randgold (GOLD) began trading last Wednesday. Symbol is GOLD for the USA and ABX.TO for Canada.

- People were afraid they (the miners) would follow the weak stocks. Instead they’ve followed the path of gold and they didn’t get liquidated because nobody owned them.

Important Technicals:

- Thanks to the negative markets of the past weeks, it now is relatively easy to select the BEST Gold shares....just hand pick those who actually went up in price. Normally these are *** marked.

- For the Gold & Silver sector, we expect consolidation over the next 2/3 weeks followed by a NEW UPLEG end of this month and next month of February.

- Oil shares are a BUY at present levels..see section for our selection.

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic

Monday January 7, 2019 - The EU prepared to destroy the banking system and cause the Italian economy to implode?

Updated Sections: World Stock Market Indexes, Recession Proof Shares (COMPQ-PF), ,

The European financial establishment is prepared to destroy the banking system and cause the Italian economy to implode. Like a Mafia boss, Dijsselbloem warned that Italy could run into trouble if it does not comply with Brussels’ directives.

The European financial establishment is prepared to destroy the banking system and cause the Italian economy to implode. Like a Mafia boss, Dijsselbloem warned that Italy could run into trouble if it does not comply with Brussels’ directives.

| Italy needs in funding this year alone we are talking about over 250 billion Euro, refinancing part of the stock of their debt and also, of course, these new spending plans. So markets will really have to look at that very critically.” |

Dijsselbloem’s statement is an ultimatum delivered to his Italian colleagues. In Cyprus, hundreds of retail investors lost their money under Dijselbloem’s authority. Much the same seems to be the case now. The ECB wants Rome to use the money of little retail investors such as pensioners to save the Italian banks. Jeroen Dijselbloem is known for such bail-in templates

Dijsselbloem's statement also shows that the EU-bandits start to panic....if the Italian landmine explodes, it will also make the EU-landmine explode....and all the EU-petty-government-officials will loose their job. Italy needs in funding this year alone we are talking about over 250 billion Euro, refinancing part of the stock of their debt and also, of course, these new spending plans. So markets will really have to look at that very critically.”

French President Macron is correct when he states that the Yellow Jackets are an attack on the "French Republic". Only this IDIOT and most politicians and petty government officials still not grasp the reality of what is happening in France, Europe and the Western World. The Yellow Jackets no longer trust Government, the Petty Government officials, their lies, their Media and their cooked statistics. The Yellow Jackets are the 1st to experience that the REAL PURCHASING POWER has been severely eroded.

| Macron has become the Louis XVI of the 21st Century. Investors must be aware that what happened during and after the French Revolution did affect money and savings in an NEGATIVE way. Internet & Social Media are about to fundamentally and drastically change society. Just like BOOK PRINTING did centuries ago. |

Macron and his 40 bandits sit between a Rock and a Hard Plate. France has - like is the case in Italy - too much debt and the recession makes it each day harder to honor its obligations. To add insult to injury, Government Income continues to fall while expenditures rise (Jim's Formula). Such is dramatic for a country where 60% of the National Product is generated by Government. People are hungry and Macron can therefore only try to buy some time...but a Civil War, a Revolution, a DEPRESSION and not prosperity sits right around the corner.

Important Fundamentals:

- A bad omen it is when LIBOR spikes....

|

|

| The higher the Libor the less Banks trust each other... | Gold always better than Equities? |

Important Technicals:

- We now expect gold action in coming weeks to move upside faster and in larger chunks. The same is likely at some point soon for the S&P500 the other way

- The outlook for Gold & Silver may be even better than is generally admitted.

|

|

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic

Friday January 4, 2019 - ECB takes reins of Italian bank to prevent wider crisis.

Updated Sections: Treasuries in the EU, €-Gold & €/$, Aussie-Gold & Aussie €/$,

This is the 1st one for 2019....we expect more! ECB takes the reins of Banca Carige in Italy to prevent wider crisis. Banca Carige, is a midsize lender, its fate has the potential to reverberate broadly. Among policymakers and economists looking for signs of the next crisis, Italy and its heavily indebted banks have been a source of concern for years. And the policies and statements of the populist government in Rome have recently added to the woes of Italy’s banks, and by extension, the whole economy. Note a NON-ITALIAN supra-national entity (the ECB) controlled by Germany is taking over a national Italian entity....

| People who still keep the bulk of their savings/investments with European banks (incl. Swiss banks) must be masochists...and are delusional. |

But the question of who will buy Banca Carige — and whether shareholders will be responsible for some of its debt — is likely to heighten tensions between the central bank and Italy’s coalition government. If the bank’s troubles deepen, the central bank, under European rules, would be obliged to make shareholders and creditors (account holders) bear some of the losses.

A RESET (debt moratorium) we ALWAYS get once DEBT is too HIGH...most of the time, we also have a REVOLUTION and/or a WAR. This is what happened in Germany, Europe in 1939 - 1945. After WWII we had massive DEBT moratoriums all over Europe. This LEGAL THEFT was sold in different ways in each European country. The wrapping was different...the end result however similar: governments took away the savings of their citizens in a legal way for the benefit of the country.

A collapse of Treasuries will by definition result in the collapse of Fiat Money (because today Money is debt).

- The European bond markets have become totally illiquid and the ECB and European Central Banks are trapped by these. This has already severe repercussions on the PENSION FUNDS and worse is to come over the next couple of years. Insurance and Re-Insurance co's are not much better off. These entities are slaughtered by the low & negative interest rates. As a retaliation, Governments will have to dramatically RAISE TAXES.

- The only way for Pension funds and Insurance co's to survive, is to get out of Treasuries and Bonds. This HOWEVER is TOTALLY IMPOSSIBLE and in many cases even ILLEGAL.

- Contrary to crashing Stock Markets, crashing Bond markets never bounce up. Even worse, they become worthless. A Bond market crash is therefore dramatic because it concerns the whole western world AND Pension Funds AND Insurance co's AND Money.

- As soon as the Central banks stop creating money, interest rates start to spike up. Higher Interest rates in turn make it increasingly impossible to honor the HUGE DEBT. To avoid this, Central Banks must create more and more debt in order to create more and more money. The higher debt in turn affects the general level of Interest rates.

Important Fundamentals:

- Investors continue - as we expected - to get rid of Shares and buy German Treasuries....but also Gold and Silver. Note the yield of German Treasuries is as low as the yield we had right before the Weimar Revolution and GREAT DEPRESSION.

|

|

| 10 Year German Treasury Yield | 10 Year German Treasury Yield since 1807 |

Important Technicals:

- We issued a 1st warning for APPLE last year in February. A second one last Summer... Stock price came down from $220 to $140 (- $80 or -35%). The scenario we expect for the coming weeks and months is pictures in the sections for World Stock Market Indexes, Long Term Indexes, Recession Proof shares....

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic

Thursday January 3, 2019 - Stock markets stumble into 2019.

Updated Sections: Gold, Silver, US-Dollar,

| We wish you and your loved ones a HEALTHY and SAFE 2019.... |

About Marijuana, Bitcoin, Trump, Socialists...and 2019

Following is EXTREMELY Bullish.

- CHICAGO (Reuters) - U.S. Mint sales of American Eagle gold and silver coins dropped to their lowest in 11 years during 2018, U.S. Mint data showed on Monday, as investors favored higher-yielding assets, despite global stock and bond market volatility late in the year.

- Total 2018 sales of American Eagle gold coins sold by the U.S. Mint reached 245,500 ounces, the lowest on a year-over-year basis since 2007. The Mint sold 3,000 ounces of gold coins in December, 85.4 percent lower than November sales, the data showed.

- Silver coin sales were 15.7 million ounces, also the lowest since 2007 on an annual basis, according to the U.S. Mint. December American Eagle silver coin sales reached 490,000 ounces, down 70.2 percent from the month prior.

Important Fundamentals:

- We expect the price of Commodities to fall when expressed in Gold but RISE when expressed in Fiat Money.

- According to what happened the past week, the US-Dollar should continue to weaken over the next months. This is confirmed by the fact that Italy is solving it's EU problems but also because the interest rate discrepancy works in favor of the Euro.

Important Technicals:

- Expect extremely sharp bear market rallies until the final capitulation. Having said this, it will be a painful year for those who have not liquidated stocks they are holding in our RED LABELLED Stock Markets. When something looks like a MATURE TOP, when SUPPORT is BROKEN and when the BACKTEST is over, there is NO WAY BACK...certainly not these days.

- The extremely oversold condition sets up the potential for a short-covering rally as the new year begins. Institutions have aggressively sold FANG stocks. Institutional selling of these growth stocks has accelerated into the end of 2018 and will likely subside in the new year.

- Oil prices set to rebound in 2019.

- $-Gold HAS BROKEN the 200 day Moving Average. This is very bullish!

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic