|

Saturday July 31, 2010

- Inflation and Hyperinflation policy is only

possible with Deflation propaganda...and this is exactly what is

happening!

Each

time more Quantitative Easing (money) is requested to lift the economy

out of the recession.

In the end the impact on the economy of the so created money out of thin

air becomes 'Negative' and the forthcoming depression is a lot worse

than had it be in the 1st place if no interference/manipulation of the

economy would have happened. The remaining question is to find out

whether at that point the Stock Markets will come down like they did

during the Great Depression or whether they will hold/go up in nominal

terms as a result of Quantitative Easing (Zimbabwe effect). In each case

it will probably happen over night (like we saw in 1989 in the USSR) and

investors will have no time to readjust their savings.

-

What the recession will not kill, the legal system will.

Structured products (Tak 21, Tak 23), CDO's, Credit

Default Swaps and a bunch of other unregulated and uncontrolled

financial products were created by the Banksters with only one goal: not

to serve the customer!

Having said this, not only the Bank is at fault for selling crappy

financial products but also the Investor which has been BELIEVING the

fairy tales "The Bank" sold him: any investment where there is no or

zero risk but nice rewards always is a dangerous investment.

-

Yesterday 3 banks were closed in the USA:

Coastal Community Bank, Panama City, FL

Bayside Savings Bank, Port Saint Joe, FL,

Northwest Bank & Trust, Acworth, GA

Friday July 30, 2010 -

-

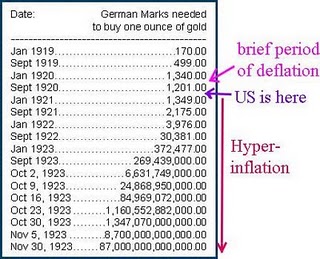

The

Death of Paper Money is imminent. Hyperinflation will come like a thief

in one night.! It is difficult to write a scenario of

how it all will unfold, but there is no doubt it will happen!.. And

off course...do you REALLY think the Authorities and the Bankers will

confess and tell you the money they are printing will be worth ZERO in a

couple of years from now!?... The

Death of Paper Money is imminent. Hyperinflation will come like a thief

in one night.! It is difficult to write a scenario of

how it all will unfold, but there is no doubt it will happen!.. And

off course...do you REALLY think the Authorities and the Bankers will

confess and tell you the money they are printing will be worth ZERO in a

couple of years from now!?...

Corruption became rampant.

People were stripped of their coat and shoes at knife-point on the

street. The winners were those who

by luck or design had borrowed heavily from banks to buy hard assets,

or industrial conglomerates that had issued debentures. There was a

great transfer of wealth from saver to debtor, though the Reichstag

later passed a law linking old contracts to the gold price. Creditors

clawed back something...more

-

Corruption there also is with Financial Newsletters.

There are indeed few good and honest ones (most

newsletters are drowning in propaganda and marketing). Other newsletters

and financial reports are printed by financial institutions and for this

very reason they simply cannot be trusted. Most investors forget that

Good wine takes years to age and free investment advise in the end

often costs 'A LOT OF MONEY'.

-

The

Dollar has fallen back into its

secular down trend channel. Not only did we have a

reversed Head and Shoulder pattern, but also has the Dollar eased back

below its secular down trend line on the Point & Figure chart. When we

look at the complete process it very much looks like a small edition of

the 2008 deleveraging.

-

-Gold has thanks to slightly weaker

$-Gold and a weaker Dollar come back to an affordable

price level...more

about the -Gold objectives and support level

-

The Bearish flag we indicated earlier on our PF charts of Gold

expressed in different currencies [

British Pound (with stop loss July 1st),

South African Rand,

Yen,

Swiss Franc,

Aussie,

CanDollar... ]did clearly indicate the spring bull run was over and

a price correction was in. At this point it also

indicates which potential size the present correction will have.

-

Only a week ago we clearly indicated the

Bonds showed a HUGE TECHNICAL NEGATIVE

DIVERGENCE and were a clear sell.

Remarkable is the similarity

between the 2008 deleveraging, the 2008 Dollar and Bond run and what we

had (in a lesser degree) in 2010.

-

Investors who shift their savings to China will be in for a bad

surprise once the Depression sets in. China is a High

Order Capital producer country and these traditionally suffer more from

a failing economy.

- Deflation can just be ruled

out...it is just impossible to see this now.

Out of thin air,

the U.S.

government created 2.75 dollars for every dollar that existed in the

entire country just one and a half years previous.

Thursday July 29, 2010 - Gold is the only

form of honest money which has no counterparty which will survive the

coming financial crash. Buy the dips!

-

We expect the volatility of Gold to increase but physical Gold must

not be sold under any circumstances...Faze I

of the actual Bull market started in 1999 and ended in 2008. We

are now running the 2nd Faze which will be followed by a 3rd

spectacular faze. During/at the end of this last faze nearly all

paper money, bonds, treasury certificates, etc. will default.

[during this 2nd faze it is possible to see $-Gold test the neckline of

the Reversed Head and Shoulders pattern or $1000-$1050. This would mean

a correction of 15% only].

-

If the Authorities keep doing exactly the opposite of what needs to

be done, the Western Societies will slide into a 100

year (two lost generations) depression: Europe and the USA will

fragment: the EU would fall apart and the American states would secess

from the Federal Government. During this black years unemployment could

easily rise to +35%. Social security, Medicare, private pensions and

pension funds won't be able to support the collapsing background

situation. It will be the dead of the Keynesian economics. Having said

this, even today it is hard to understand how most pension funds (which

are undercapitalized) will be able to grow enough provisions to cover

their future mathematical risks when interest rates are being

artificially kept at these low levels so that Government debt can be

refinanced at lower interest rates.

-

Remember to BUY the DIPS and NOT to SELL any PHYSICAL

Gold.

And yes, as we expected a weaker dollar and a Gold price hovering around

and slightly below the actual levels is pushing back -Gold, CHF-Gold,

Can$-Gold, £-Gold and ¥-Gold to the bottom

of their uptrend channels.

Wednesday July 28, 2010

P = M x V

The general level of prices is function of the Total Money Supply and

the Velocity of the Money Supply.

Tuesday July 27, 2010

-

The stress tests in Europe were nothing but one big masquerade.

The decision to exclude sovereign debt renders the

results as spin and not reality. What many readers and investors don't

know, is that Banks but also (life) Insurance co's and pension funds are

in the legal obligation to invest most of their Mathematical reserves

into Gilded paper. By now many do know that Governments are heavily

indebted and that they are or will not be in a position to repay their

debt...if Governments repudiate on their debt, the legal reserves of the

banks, insurance co's and pension funds (the latter are already in a

precarious position) are/become worthless. Hence the only possible way

for any modern government to try to survive as long as possible is to

walk the path of Inflation and Hyperinflation.

-

Gold and

Silver Juniors are A LOT BETTER and 1001 times safer than

Turbo's, Warrants and Options (which are uncontrolled and unregulated

instruments created by the Banks to rob the investors.

Some of the Juniors we list allowed for a profit of 50%

over a period of 3 months (such is 200% y/y...and this is only the

beginning of a HUGE MOVE! At this time we have only one junior in

our model portfolio...but it gave a DRAMATIC buy signal...Technical

patterns range from double bottoms to bullish triangles/coils...there

probably is a pattern for each investor...more

-

Our

Regular

Gold and Silver mines

(you must check our

investment table

to find out how to structure your savings as each

investment instrument will have a particular function during the coming

Hyperinflationary Depression. Remember a lot can happen OVERNIGHT and

that your savings can be mortally damaged if you have not positioned

these properly!) will keep their secret if you

only look at the Point and Figures charts. Therefore we have added

candle charts...very interesting they are.

Monday July 26, 2010 - We'll keep updating

the site over the next weeks but be informed part of our staff is

attending a

financial conference.

-

We

told you to take physical delivery of your Gold and Silver!

The LBMA (London Bullion Market Association) has

taken the unusual step of blocking access to statistics regarding their

member bullion banks' gold and silver trading activities. There

are strong indications bullion banks are holding only one real ounce of

Gold for every forty-five ounces of Gold that they have sold.

The irony is that out there there is still a huge bunch of

wise-nose-investors which don't even believe they need to have Gold to

secure their savings. We

told you to take physical delivery of your Gold and Silver!

The LBMA (London Bullion Market Association) has

taken the unusual step of blocking access to statistics regarding their

member bullion banks' gold and silver trading activities. There

are strong indications bullion banks are holding only one real ounce of

Gold for every forty-five ounces of Gold that they have sold.

The irony is that out there there is still a huge bunch of

wise-nose-investors which don't even believe they need to have Gold to

secure their savings.

-

We have a strong similarity between many of our charts:

crude Oil,

Oil and Gas shares, Gold & Silver

shares,

Gold and Silver juniors

(US Gold is a topper and many others are wakening up), many

commodities (i.e. coffee),

natural gas and coal. All charts show

the 2008 deleveraging crash, a subsequent correction and a large handle.

The bigger the consolidation zone, the more power is accumulated and the

stronger the coming UP LEG. I don't believe in Deflation. What we have

now is the transition between the 2nd and the 3rd faze of the

Hyperinflationary depression. Deflation we shall have AFTER

Hyperinflation.

-

Platinum

is building a consolidation zone which result will

surprise many investors.

Friday July 23, 2010

-

We like what we see when looking at the charts of

Gold expressed in Dollar,

-

I particularly like what happened to

Silver yesterday...more

-

The PF chart of the 30 year Treasury

bonds remains extremely interesting.

Especially if one compares the 2008 dollar run with the earlier 2010

dollar run.

-

The candle chart of the

Euro confirms there is

no trend change against the US Dollar. As a matter of

fact the 2008 Dollar correction and the one we had this year have

bizarre similarities.

-

SEVEN US Banks had to close down. So far this year

more than 100 US banks were closed....

-

SEVEN EU Banks fail stress tests. But the good news is that ALL IS

WELL MADAME LA MARQUISE...The Authorities will not

risk a Run on any Bank...and the requested amount of billions will be

printed...more

Thursday July 22, 2010

-

The

stress tests of the Banks both in the USA and Europe may well have been

sold with lot's of glamour and music but the status of many banks are

tricky. Many incorrectly still believe these still

are (like the Titanic) non-sinkable but our financial system is

leveraged to an unprecedented and unsustainable level. Therefore it is

massively undercapitalized and the regulations (like the Finance act

which was signed today)

are nothing but plasters on wooden leg. It is possible that we

shall see as many broken banks as we saw during the Great Depression.

The financial industry has been allowed to publish false balance sheets

and false income statements. So far the FDIC total losses for 2010 are

$18 billion. Each time banks had to be closed it becomes clear

they all have been misrepresenting their assets by an average of +50%! The

stress tests of the Banks both in the USA and Europe may well have been

sold with lot's of glamour and music but the status of many banks are

tricky. Many incorrectly still believe these still

are (like the Titanic) non-sinkable but our financial system is

leveraged to an unprecedented and unsustainable level. Therefore it is

massively undercapitalized and the regulations (like the Finance act

which was signed today)

are nothing but plasters on wooden leg. It is possible that we

shall see as many broken banks as we saw during the Great Depression.

The financial industry has been allowed to publish false balance sheets

and false income statements. So far the FDIC total losses for 2010 are

$18 billion. Each time banks had to be closed it becomes clear

they all have been misrepresenting their assets by an average of +50%!

-

When Capital leaves a country it always take employment with it.

It is impossible to stop capital leaving a country once

the level of Taxation gets too high as it is impossible to rule out

Gresham's law

once people start to mistrust paper money. Swiss endure safe-haven

agony from euro flight...more.

-

By now everybody should be aware the interest rates in the West are

artificially kept low and that from here they only can go up.

Today it was Brazil's turn to raise rates to

10.75% (more than expected)...more

-

South African Commercial Property takes a tumble.

Building activity in the commercial property sector registered a

substantial drop as constructors are constrained by lower demand for

space by tenants. The Real Estate problem is the result of fractional

reserve banking and the creation of money out of thin air and is not an

isolated problem. Real Estate ALL OVER THE WORLD sits in a secular

bear trend which will last until 2033.

Wednesday July 21, 2010 - Belgian National

day -

-

The

Herd makes the market. Are you part of it?

It is those who today (They will all of a sudden reverse course and

initiate Hyperinflation) resist change because they cannot see what is

happening and prefer to BELIEVE what their leaders tell them. This

is not the time to believe but rather a time to understand. The

Herd makes the market. Are you part of it?

It is those who today (They will all of a sudden reverse course and

initiate Hyperinflation) resist change because they cannot see what is

happening and prefer to BELIEVE what their leaders tell them. This

is not the time to believe but rather a time to understand.

-

We're in the 2nd Faze leading towards Hyperinflation.

The Money supply is increasing at a slower rate than the increase of the

prices of Low Order Capital Goods. Such happens

because people experience a shortage of real spending power (money).

This phenomenon is incorrectly called Deflation. We already see that the

Authorities prepare for even more Money Printing (quantitative easing)

which will lead us into the 3rd faze and Hyperinflation. Such can

and will probably happen over night and one of the indictors will be a

crashing Bond market. By then it will probably be too late to acquire

physical Gold and Silver. Even worse is that at that time Store

shelves will be empty in a couple of days only as the Herd decides to

exchange the worthless money for any good they can buy.

-

If Goldman Sachs' profits plunge 83% how bad will it be for other

Financials?

An unique aspect of Banking systems is that

they cannot be rebuilt once they turn insolvent. They rot in place and

nothing can be resuscitated except for the balance sheets....more

[I believe that banking institutions are

more dangerous to our liberties than standing armies - Thomas Jefferson,

1802]

-

The correction of the Euro/Dollar

has come to a halt. At this point some consolidation

is needed. The Dollar index had a 38.2% Fibonacci retracement almost on

the nose.

-

Before shouting that Capitalism isn't working one must analyze the

world we're living in and compare it with a correct definition of

Capitalism. Relevant is that today we are not living

under true free market capitalism. What we have is a controlled economy

where a group of arrogant men and women are trying to set interest rates

and manipulate the economy and financial markets. [Ron Paul correctly

calls what we have Corporatism]

-

The signal given by the Candle and PF charts of the HUI-index and the

Gold and Silver shares was correct. The Gold and

Silver market has probably made its Summer bottom.

-

People in Caracas, Venezuela have only 4 hours of electricity a day

and the city has run out of water. Karl Marx doesn't

work. It took until 1989 until the USSR and Chinese found out....At the

end of the Roman Empire there was (almost) free bread for all. The

result was that the farmers stopped working, left their farms behind and

moved to Rome...to be able to eat this Free Bread.

Tuesday July 20, 2010

-

Not only is there a enormous lack of knowledge about what Inflation,

Hyperinflation and Deflation is and how it is created

but there is also a lot of resistance of the general public who simply refuses

to accept reality. This is probably one of the main reasons why the

Authorities can through Propaganda keep Fiat Money and Treasuries alive.

After all most people are still convinced that what they read in

newspapers and what the Authorities tell them is true. There are

numerous examples of modern time Hyperinflations and yet most investors

act like it won't happen again and it won't happen to them in

particular. This is maybe one of the reasons why Hyperinflation sets is

so quickly once it starts. Not only is there a enormous lack of knowledge about what Inflation,

Hyperinflation and Deflation is and how it is created

but there is also a lot of resistance of the general public who simply refuses

to accept reality. This is probably one of the main reasons why the

Authorities can through Propaganda keep Fiat Money and Treasuries alive.

After all most people are still convinced that what they read in

newspapers and what the Authorities tell them is true. There are

numerous examples of modern time Hyperinflations and yet most investors

act like it won't happen again and it won't happen to them in

particular. This is maybe one of the reasons why Hyperinflation sets is

so quickly once it starts.

-

Each time Gold consolidates BS talks of Deflation is sent to the

Media. But Quantitative Easing (the printing press) is alive more than

ever. Today the IMF

(International Monetary Funds) seeks "only" $ 250bn to boost

resources...more

-

As usual Gold sails through the summer doldrums

but before we realize the wind of Quantitative Easing will hit the sails

again and Gold will sail to $ 1300 and $ 1450. Now is the time to buy

the dips!

-

The

Gold and

Silver index has eased back and is in the process of building

another bottom. There are more

bottoms than predicted and the accumulation is a lot larger than we

anticipated. The positive side of this is that once the Index breaks out

the rewards will be even bigger. It earns to be patient on condition

you're invested properly.

-

Readers who don't feel the need to go through the 150 pages of the

site sometimes incorrectly call us Gold merchants. We

have no particular interest in selling Gold and/or Silver. If we had we

would - for marketing reasons only- link our site to sites like Kitco

or the Bullion desk. The name Goldonomic comes from

Gold and Economics and was chosen because we aimed at explaining what

REAL BARBARIC MONEY was like. Today it happens to be Gold and Silver but

this can and will change and at some time in the future the Intelligent

Investor will exchange his accumulated Gold and Silver for another kind

of decent money or he will invest it again in other investment

instruments. By that time those who think they know better will be left

empty handed. Since 2001 and still today it earns more than ever to be a

Contrarian.

-

July 8 we had a bearish signal reversal on the Euro/dollar.

The Euro has recovered against the Dollar and the news

has been kept out of the Media. A bullish sign I would say.

Monday July 19, 2010

-

I'm

from the Government, I'm here to help. As we move

further into the depression the budget deficit of the Government will

widen and it's debt will rise...as always the people will have to pay

for it through inflation and taxation. I'm

from the Government, I'm here to help. As we move

further into the depression the budget deficit of the Government will

widen and it's debt will rise...as always the people will have to pay

for it through inflation and taxation.

-

Now that the

Dollar

weakens, we've decided to let you know which 10 American states are most

likely to default. These are 10 states out of the 40

which are in trouble...more

-

When Money dies: The Nightmare of the Weimar Collapse by Adam

Fergusson has been added to our

Literature

list. Why is it for so many so difficult to

understand the Fiat Paper Money never works? It never has and it never

will.

Saturday July 17, 2010 - We all know what

has to be done to cure the recession. Only we don't know how to get

reelected once we've done what must be done. (Jean-Claude

Juncker- president of Luxemburg)

-

The

Europeans are shouting the "End of the Euro is near" but right now the

voices of Americans "The End of the Dollar is near" are winning.

What both camps have yet to find out, is that in time

both will be right. As a matter of fact the club will be even larger

when the British, the Swiss, the Canadians, the Australians and most

Fiat Paper currencies join. Gold as over the last year UP expressed in

ALL FIAT PAPER CURRENCIES! The

Europeans are shouting the "End of the Euro is near" but right now the

voices of Americans "The End of the Dollar is near" are winning.

What both camps have yet to find out, is that in time

both will be right. As a matter of fact the club will be even larger

when the British, the Swiss, the Canadians, the Australians and most

Fiat Paper currencies join. Gold as over the last year UP expressed in

ALL FIAT PAPER CURRENCIES!

-

As usual and as expected each time Gold comes down a bit, the

Deflation criers are back in Town. Picking up a good

book may not suffice for many to UNDERSTAND a rather short definition

which has huge implications. I am not ashamed to confess that it took me

years to properly understand it. Deflation propaganda plays a huge role

and it seems extremely easy to mislead the Herd about a matter many

business people and lots of professionals fail to understand properly.

Inflation and Deflation are monetary phenomenon's and a

Hyperinflationary Depression we shall have. For those who fail to

understand, we advise to (re)read our story about

Zimbabwe...and to stop thinking that it is impossible that such can

be seen again in the Western world. There is absolutely no reason why we

will not. Unless of course we stop having Wars, Revolutions, Boom and

Busts and History becomes obsolete.... Especially as the Leaders are

doing exactly what needs to have such a depression.

-

Be advised the

Financials will be the leaders during weaker stock markets.

Whatever is said and written, they are rotten to the

core. A financial system based on Fractional Reserve banking and Fiat

money created out of thin air have NEVER survived and it never will.

Such simply isn't possible.

-

We have 6 Banks in this week's edition of Bank closures.

Three in Florida, two in South Carolina and one in

Mississippi.

-

The Commodity section has been updated and we have added the three

fazes towards hyperinflation on our long term

Commodity chart...more

Friday July 16, 2010

-

Agricultural commodities make a scary

move...but nobody seems to notice it!? [remember the

fazes we discussed earlier?]

-

Ever

played chess against a computer? If you did, you know

how hard it is. Playing the financial

market against artificially initiated moves is even harder.

This is exactly what is happening to the financial

markets and why they are - in the short run - being destroyed as an

indicator of value. The Financial markets used to be there TO SERVE the

economy and not to steal from it like it is the case today. The

influx of hedge fund money under the control of black box algorithms

instead of providing liquidity as they falsely claim is actually working

to undermine the integrity of our financial markets. Computers push

prices in attempts to generate price movement so that they can create

profits out of that movement based on their ability to fire off a series

of rapid fire Buy or Sell orders. This has absolutely nothing to do with

balancing the forces of supply and demand and everything to do with

separating the investing or trading public from their capital who are

the minnows swimming in this sea of unethical and unprincipled sharks

(Trader Dan). Ever

played chess against a computer? If you did, you know

how hard it is. Playing the financial

market against artificially initiated moves is even harder.

This is exactly what is happening to the financial

markets and why they are - in the short run - being destroyed as an

indicator of value. The Financial markets used to be there TO SERVE the

economy and not to steal from it like it is the case today. The

influx of hedge fund money under the control of black box algorithms

instead of providing liquidity as they falsely claim is actually working

to undermine the integrity of our financial markets. Computers push

prices in attempts to generate price movement so that they can create

profits out of that movement based on their ability to fire off a series

of rapid fire Buy or Sell orders. This has absolutely nothing to do with

balancing the forces of supply and demand and everything to do with

separating the investing or trading public from their capital who are

the minnows swimming in this sea of unethical and unprincipled sharks

(Trader Dan).

-

Those Guys who actually were responsible for the collapse of Fannie

and Freddie and the last Financial crisis in the 1st place wrote the 440

pages of the Financial bill which will in due time

sent what is left of the American economy to hell. Once the bill is

signed the President doesn't even has to go through Congress in order to

know who's too big to fail and who's not. He simply decides himself!?

-

Best case scenario we expect is a new test of the 2003 bottom.

We still don't like what we see when looking at the

charts of the

World indexes,

especially when looking at the charts expressed in

Real Barbaric

Money or Gold. Use better markets to

offload Common Stocks and use the dips to buy those investment

instruments which will actually protect your savings...Hyperinflation

only will stop the crash of the Stock Markets expressed in Nominal

terms.

-

We have updated all our

long term charts of the World indexes.

Those who still think the Chinese stock market is safe

will be surprised. Especially if you check the index expressed in Gold.

If you decide to stay into common Stocks, the German DAX (stock market)

may well be your best option. After all, they haven't forgotten the

Weimar Hyperinflation. On the charts we

have added the relationship of each index with Gold...more

This section is a school example for Head and Shoulder formations and

Bearish wedges.

-

We don't like what goes down too fast and too much....like

we don't like what goes up too fast and too much...and this is exactly

what is happening to the

Dollar and the Euro.

I feel sorry for all the business people trying to conduct

business under these conditions! Today a good Airline company CEO is a

good commodity analyst/broken and a good Import/Export CEO must be able

to forecast the short term fluctuations of the Dollar against those

countries he's doing business with.

Thursday July 15, 2010 - Important updates

in the subscriber's section.

-

As

usual the Forex sections give us more clues about what to expect for the

Dollar and

Gold.

Today more than ever it is important to look at the whole

picture before making any investment decisions. At this point we do have

some important changes! Also check the

South

African rand ,

Yen ,

Swiss Franc ,

Australian Dollar and

Canadian Dollar

sections. The Canadian Dollar point and figure chart is providing a

clear hint as to what to expect for the

American Dollar. Having said

this, holders of Australian, Canadian Dollars and South African Rand

better follow the Forex markets closely and remember the ultimate

barbaric money is PHYSICAL GOLD and SILVER. As

usual the Forex sections give us more clues about what to expect for the

Dollar and

Gold.

Today more than ever it is important to look at the whole

picture before making any investment decisions. At this point we do have

some important changes! Also check the

South

African rand ,

Yen ,

Swiss Franc ,

Australian Dollar and

Canadian Dollar

sections. The Canadian Dollar point and figure chart is providing a

clear hint as to what to expect for the

American Dollar. Having said

this, holders of Australian, Canadian Dollars and South African Rand

better follow the Forex markets closely and remember the ultimate

barbaric money is PHYSICAL GOLD and SILVER.

-

The section

-Gold objectives has been updated. -Gold

and

£-Gold offer a similar picture.

Worst case scenario, Gold can ease back another 5%.

-

The charts of

Stock Market indexes expressed in barbaric Gold are also part

of the global picture. When an index like the Dow

Jones Industrial expressed in Gold is bumping against its secular down

trend something is brewing.

Those investors who since the year 2001 stayed invested in the British

Stock market not only lost 83% of their savings because of the bearish

real trend of British Stocks but also 30% because of the weak British

pound...more

-

The Authorities, the FED, the ECB, the BIS, they all know This is a

lost cause. Only 'They'

cannot tell as this would probably result in social unrest. They will

continue to try to stimulate the economy until Hyperinflation explodes,

all trust in the financial sector and authorities disappear and we fall

into Deflation. Extra stimulus simply doesn't work!.

What it will do however, is sent

Gold and Silver to the Moon...got some?

-

The Real Estate sector in Spain and the USA are in a dramatic shape.

In the USA 20% tot +40% of the Mortgages are under

water. It is not hard to understand this will have a dramatic impact on

the Financial sector and the

economy. What many don't realize is that banks cannot follow up the bad

loans and also that they are not in a hurry to declare a foreclosure as

this would flood the market with Real Estate which could not be sold.

Click on the picture to find out which states has most Mortgages which

are under water.

Wednesday July 14, 2010 - Today is the

French national holiday . It remembers us of the abolition of

Dictatorship (decapitation of Louis XVI and Marie-Antoinette) and the

end of the

Assignats (the worthless fiat

paper money of the 1770's).[it was Marie-Antoinette

who said the people should eat cake if they had no bread - it was

Spanish Prime Minister Zapatero who said the people should eat Rabbit if

there is no Pork. Louis XV used to say that it would only last for his

generation and: après moi le dèluge.

So it happened]

-

It

is incorrect for the leaders of the Western World (Geithner,

Trichet,...) to blame the Chinese for their problems.

If Europe and the USA were competitive economies and

their leaders promoted and protected Business properly, there would be

no reason for Entrepreneurs to take a risk to manufacture in China. For

a risk it is! If taxation and regulation were decent, not a single

Entrepreneur would even dream of moving his manufacturing plant out of

the country. Is it not amazing

Unemployment is lowest in those countries which have the lowest

taxation? It

is incorrect for the leaders of the Western World (Geithner,

Trichet,...) to blame the Chinese for their problems.

If Europe and the USA were competitive economies and

their leaders promoted and protected Business properly, there would be

no reason for Entrepreneurs to take a risk to manufacture in China. For

a risk it is! If taxation and regulation were decent, not a single

Entrepreneur would even dream of moving his manufacturing plant out of

the country. Is it not amazing

Unemployment is lowest in those countries which have the lowest

taxation?

-

Gold and

Silver remain very

strong and it more and more seems we're not going to get much lower

prices during the summer doldrums.

Euro-Gold

and

British Pound-Gold

however can still come down a little.

Potential buyers MUST check our

-Gold objectives...more

-

The biggest advantage the

Euro has, is that it is also backed by Germany.

And that Germans experienced the Weimar Hyperinflation.

The biggest disadvantage however is that it is just like the Dollar,

Fiat Paper Money.

-

Eurozone crisis fund expects top rating.

This puts a bottom under

the Euro and opens again the trap under the Dollar. The

facility is ready to act....more

-

The manipulation of the free markets by the Authorities goes on.

The longer they keep it going, the more dramatic the

outcome will be. And disastrous it will be. Just for a minute, imagine

what will happen once the retiring Baby boomers find out there is no

funds available for their pension, that the Authorities spent all of the

money they actually paid them for their pension...At that point the

least we will see, is a revolt. Historically speaking we most of the

time have a WAR. Once all players are in place (and aren't they all in

the Middle East) such can happen over night. It is amazing to see

many people still believe there is a solution for the problem we're in

and that nothing serious will happen. If only a fraction of people would

realize what where we heading for, the Global Markets would not be what

they are today.

-

Take advantage of higher Stock markets to offload common stocks NOW!

Once the Hyperinflation starts, things will look

different when expressed in Nominal terms only.

-

In the USA each Friday about 3 to 4 banks have to close down.

In Florida the situation has become so bad that the Florida banks -

already weakened by the real estate bust are asking regulators for a

reprieve from government-ordered capital raising as they struggle to

stay alive.

-

The

British Pound

keeps on building a technical pattern which we call a COIL.

This is done well inside the downward trend channel. At the same time

fundamentals are worsening. The true scale of UK debt is twice as much

as "they" thought (£ 2 trillion or £ 78,000

for every household in the country. These figures however don't take

into account some 'off balance items' like the cost of civil service and

town hall pensions. Putting these liabilities into the official figure

would add £ 1.13 trillion to the red figure and debt would jump from 62%

to 138% of Britain's income.

Tuesday July 13, 2010

-

A currency which is not market generated has no means of being and

will never survive. The latest example of such a

currency is the Euro. Nothing more than a Frankenstein it is and

it will not survive. An example of market generated money is Gold

and Silver which have been barbaric money ever since there was

some kind of economy and trading on Planet Earth...more

-

Oh yes, things are so much better in the USA. At least this is what

'They' want you to think. The positive reverse side

of the medal however is that in the USA there is a lot less regulation.

This means that there are less instruments to damper a crisis, that a

crisis will be deeper than in Europe...but also that the recovery will

come much faster...more

-

Following chart comes for those who still believe they are doing

better by chasing common stocks than paying attention to Gold and Silver

mines.

Monday July 12, 2010 - A Good Financial

advisor/analyst is an (experienced) old financial analyst.

LISTEN

to the music of the Financial Markets and think out of the Box.

The more experience one has, the easier to understand

what is happening the better one sees through the smoke curtains and

static sold by the Officials (a lot of times it is clear even they don't

understand what is happening...unless it's too late!). Harry Schultz

was a veteran when I was a Junior. He was an excellent and also a

funny speaker. The Authorities are again (like happened to the Gold

pool) losing control of Gold. Just like in the days of the Burning Roman

Empire they cheat, lie, maneuver...but Gold will beat them and is

already doing so, in stages...more LISTEN

to the music of the Financial Markets and think out of the Box.

The more experience one has, the easier to understand

what is happening the better one sees through the smoke curtains and

static sold by the Officials (a lot of times it is clear even they don't

understand what is happening...unless it's too late!). Harry Schultz

was a veteran when I was a Junior. He was an excellent and also a

funny speaker. The Authorities are again (like happened to the Gold

pool) losing control of Gold. Just like in the days of the Burning Roman

Empire they cheat, lie, maneuver...but Gold will beat them and is

already doing so, in stages...more

Buy the dips ! Subscribers know what our

short and medium term objectives for Gold

are. We adjust these each time we have more clues. If we have a

Hyperinflation, $-Gold could hit billions, and even trillions...At

a time where the Talking Heads are calling Gold a bubble (Gold climbs a

wall of worry) we have following individual projections: Maloney, Katz,

Rickards and Watson see $-Gold higher than $ 11,000 . The bunch

of advisors sees Gold between $ 5,000 and $ 10,000 and about 8 aim for $

5,000 [remember that it is NOT the price of Gold which is rising but

rather the value of paper money and Bonds sliding to ZERO and that

Treasuries because they are nothing more than an option to buy fiat

paper money are extremely dangerous!] Having said this, it really

doesn't matter how high Gold is going....what matters is that it will

preserve your savings!

Saturday July 10, 2010 - What sense does it

make to Short if your counterparty becomes insolvent?

-

Why are Tons of paper, words and energy spended each day to try to

explain to you how to invest? Once the turning points

are defined it basically becomes so straight foreward and the only

negative forces you have to overcome are your "Ego", "The

Emotional Static sold by ignorants" and the "Lies of the

Authorities".

-

We told you not to be too greedy when bottom fishing for Gold,

Silver, Gold and Silver mines! How many times did we

write that we have a paradigm shift, that we're heading for an

Hyperinflationary Depression and that most Investment vehicles will

strand between now and the end of the crisis! Go on with day trading,

scalping, buying ETF's, Options, Warrants,

Bank-manufactured-investment-products, Structures Products, Life

Insurances, Treasuries, Bonds,...following Hot Advices. If you're not

properly invested, you can loose it all overnight. Things are so bad

your pension is probably already gone by now....So what sense does it

make to know that Gold is expected to pullback slightly to complete

patterns if you know it will be soaring above $ 1300 before the end of

2010!

-

A policy towards Hyperinflation is only possible with a Deflation

propaganda. Today's DEFLATIONARY talks are partly correct and a

reflection of Faze 2 leading to

Hyperinflation.

The danger is that if you start

to protect your savings for deflation now [this would mean the value of

Fiat paper money increases and the Authorities have become God] you will

probably be forced to sleep in the cold once Hyperinflation starts.

The problem is that most Financial advisors and Economists fail to

follow the red wire during a reasoning process. Such makes it

extremely difficult for the average investors to understand. This can be

compared to -for example- the fact that many believe we cannot have a

Hyperinflation because during a Depression Demand fails...Hyperinflation

however is a Monetary phenomenon! Off course, for most such is very

hard, if possible to understand. We have explained everything in the 150

pages of Goldonomic...and if you think your hard work and savings are

worth it, the least you can do is read these and ask questions if you

don't understand something. That's why we are here for! It is exactly

because of the complexity of the matter that we consciously don't want

to change the content of each subsection of the site over night. The

Economic cycle we are in also doesn't change over night.

The Real Consumer Price inflation has over the past

years been a lot different to what is sold by the Authorities! In

some countries (i.e. Belgium) they went so far to develop alternative

Inflation (Health) indexes so they could continue to window dress the

reality...

Friday July 9, 2010 - Gold is money and not

a commodity!

-

The

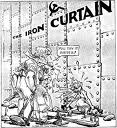

USSR and China went bankrupt because of Karl Marx.

1989 his books were burned. Today Putin wants

to abolish the Capital Gain tax. Russian and Chinese leaders understand

that if another Iron curtain has to be built, it will be to ensure the

citizens and the Capital of the West doesn't escape to Eastern Europe. As

expected German leaders are the only ones in Europe understanding that

we need to cut government expenses without increasing taxes. The

USSR and China went bankrupt because of Karl Marx.

1989 his books were burned. Today Putin wants

to abolish the Capital Gain tax. Russian and Chinese leaders understand

that if another Iron curtain has to be built, it will be to ensure the

citizens and the Capital of the West doesn't escape to Eastern Europe. As

expected German leaders are the only ones in Europe understanding that

we need to cut government expenses without increasing taxes.

-

The growing propaganda about this Double dip recession makes me feel

sick. Once the effect of Quantitative Easing is

wearing off, the bottom will fall out of this artificial recovery and a

Hyperinflationary Depression we shall have as soon as Governments start to

monetize their debt and Velocity picks up. The fact that Money supply is

down to 1930 levels confirms that this [see Goldonomic of last Saturday]

statement is correct.

-

Is VAT (value added tax) coming to America? If

'they' effectively DO this, the USA will in the end be no better than

the USSR. A pity it would be...more

-

We checked the charts in the

World Stock Indexes section &

Financials and still don't like what we see.

Markets are oversold and each correction MUST be

used to offload stocks. Once the hyperinflation unfolds, we think the

instruments listed in our

Investment table will offer a better

protection than common stocks.

-

Yesterday we had a symphony of key reversals on the candle charts of

Gold and Silver mines.

-

Only Gold and Silver seem to survive. Commodities

could take a hit as China and other HOCG producers start to feel the

consequences of the Depression. Hard to understand for many is that

there is a leverage effect between the LOCG countries and the HOCG

countries.

-

The Euro is back at $ 1,27. Compared to the static

sold during the slide only weeks ago this has almost been a silent

climb.

-

Only part of our Portfolio is invested in

Oil Shares...and

the performance over the last days has been excellent...more

. As we expected BP has risen from the dead.

-

You have to be completely blind to continue to believe you can beat

Real Barbaric Money or Gold by investing in Common Stocks or the

Standard and Poors 500!

Thursday July 8, 2010 - All Forex sections

and Gold in different currencies were updated!

-

It's

absolutely irresponsible to let the Bush tax cuts expire! You don't have

to be an Einstein to understand that tightening fiscal policy at this

point is the same Roosevelt did in the 1930's and that it will have

similar dramatic consequences. More taxation and more regulation

NEVER stimulates the economy, it kills it!

History is full of examples...so why don't the political leaders don't

get it? or maybe they don't want to? Having said this, there is no

reason why YOU would make the same mistakes the investors made in those

years: after a crash on the stock markets those who were invested in

Bonds (Treasuries) lost all of their savings as Governments started to

engage massively in Debt Moratoriums. It's

absolutely irresponsible to let the Bush tax cuts expire! You don't have

to be an Einstein to understand that tightening fiscal policy at this

point is the same Roosevelt did in the 1930's and that it will have

similar dramatic consequences. More taxation and more regulation

NEVER stimulates the economy, it kills it!

History is full of examples...so why don't the political leaders don't

get it? or maybe they don't want to? Having said this, there is no

reason why YOU would make the same mistakes the investors made in those

years: after a crash on the stock markets those who were invested in

Bonds (Treasuries) lost all of their savings as Governments started to

engage massively in Debt Moratoriums.

-

The

Euro came

down too fast and too much. It finally reversed

course and is now sitting on the 200 day Moving Average...more

-

Civil service pensions run like 'unstable Ponzi scheme'.

It's absolutely not sure the 'real' money will still be

available when you're about to retire...more

-

Western Politicians read and apply Karl Marx. What

right do 'they' have to limit somebody's income? By doing so they chase

away the best entrepreneurs. Controlling Capital and controlling the

income of labor was done for decades and up to 1989 by the USSR and

China. They finally realized Marx's advice destroyed their economies and

burned his books. Ever since, their economies have been booming...more

-

The Authorities failed to address the cause of the crisis.

The only thing they do, is (try to) mop up the

consequences. By doing this they are

staging the 2nd down leg of the Hyperinflationary depression...more

-

Beware of correlations. Many analysts like them because it enhances

them with an intelligent Aura.

Most of the time, they only work for so long and they certainly don't

apply to Gold and Silver...except off course for the negative

correlation.

-

Don't be greedy when bottom fishing for

Gold. Looking at the

charts of Gold and Silver is different Fiat currencies, these can't

really come down a lot more.

-

We've updated the charts of

Corporate bonds and don't like what we

see...more

Wednesday July 7, 2010

-

If you THINK about it, Gold will go up

if we have a (Hyper)Inflation but ALSO

if we have a Deflation scenario. In other words, by buying Physical Gold one

cannot make a mistake. Therefore, make sure you

follow our Investment advice and buy Gold each time it dips! SO far, if

you 'listen' to the market only an extremely small amount of Investors

have Gold. For this reason it is not difficult to imagine what Gold will

do the day the HERD realizes that Gold is the only barbaric money and

that even the ETF', warrants etc...are NOT GOLD.

Hyperinflation will start when the

Bond markets start to crash! If you THINK about it, Gold will go up

if we have a (Hyper)Inflation but ALSO

if we have a Deflation scenario. In other words, by buying Physical Gold one

cannot make a mistake. Therefore, make sure you

follow our Investment advice and buy Gold each time it dips! SO far, if

you 'listen' to the market only an extremely small amount of Investors

have Gold. For this reason it is not difficult to imagine what Gold will

do the day the HERD realizes that Gold is the only barbaric money and

that even the ETF', warrants etc...are NOT GOLD.

Hyperinflation will start when the

Bond markets start to crash!

-

Gold is easing

back towards the bottom part of its bullish trend channel.

Buy the dips! $-Gold is going to $ 1300, $ 1460 and

higher.

Silver

has almost reached its support level.

Once Silver has it will be an

indication Gold has seen its very own short term bottom.

Interesting will be whether either the Dollar will continue to weaken

over the coming days or either $-Silver will continue to ease so that

-Silver ends up back in the bottom of its uptrend channel...or maybe

they both will continue to correct!?

-

IMF-BIS engaged in Gold swaps to about 380 Tonnes; Organized looting

of Sovereign Wealth. Just as Gordon Brown sold

England's Gold at the lowest of the market to bail out the bullion banks

in New York and the City, so the IMF and its constituent members are

selling the public stores of Gold, to support what is essentially

appears to be a crony capitalist banking fraud...more

This action will - off course - be explained in a different way by

the Authorities and the Herd will - as usual - buy it. Those in charge

are so intelligent and they won't even dream of cheating on the people.

A Gold swap or Gold lease is never a threat to the gold price!

-

Any investor who holds no stocks and may also be short will certainly

be bearish, otherwise he would be schizophrenic.

-

The

Dollar

continues to correct and as the Mother of All necklines hasn't been

decisively broken, we could see a remake of the 2008 post-deleveraging

scenario...I don't like what I see when I look at

the Weekly and Monthly candle charts of the US dollar index. The Dollar

is today's biggest bubble. Remember

what happened in 2008?..more

-

Are you still holding on to Bank shares and Bonds issued by Banks &

Financials??? What we indicated May 20 for

Bank and Financial shares was accurate.

The technical signal which was given earlier was - as we expected - a

BULL TRAP...more .

We continue

to advice to stay away (except for those prepared to commit financial

suicide). Important is to check on these charts as they are also a

good indicator for what can happen for the Stock Markets in general.

-

Property prices

are even falling in China. Standard Chartered expects a drop

in property prices of 30% in Beijng, Shanghai, Shenzen and other large

cities in China as the delayed effects of monetary tightening begin to

bite. Interest rates in the US and Europe are

artificially maintained at extremely low levels. Such is only possible

for so long and the day is close these will also start to rise...more

-

Yesterday the FTSE index made a bullish key reversal.

This could be expected as technical indicators were/are

strongly oversold. We've seen similar reversals/corrections in the past.

This however does not indicate the Footsie is out of the woods...more

Similar (key)

reversals were seen for other

Stock Market

indexes...but have learned to pay attention to these but won't act

until out PF charts say so. Markets are way to volatile to rely on Key

Reversals!

Tuesday July 6, 2010 - Yesterday we went out fishing

Monday July 5, 2010 - Bank Holiday is the USA

- 4th of July was yesterday -

-

California's debt is a bigger risk than Kazakstan's and a bigger

worry than Greece...more

-

Illinois stops paying its bills, but can't stop digging hole.

After Greece and Spain the USA stands in the spotlight.

Illinois is not paying bills for absolutely essential services...more

-

Six months to go until the largest American tax hike in history:

there is the expiration of the 2001 and 2003 Tax Relief,

there is Obamacare and the alternative minimum tax and employer tax

hikes...more

-

Trichet (ECB) and Nouriel Roubini don't expect a new recession in the

Eurozone. It is this kind of stupid public statements

which make it so hard to see the trees. Everybody sees it coming but

some Financial Movie Star says it's not...!? Having said this, Trichet

must either be a perfect liar/propagandist or extremely stupid and there

is no doubt he will end up in history books in a way he will not like

it.

-

Our PF chart for the -Gold objectives, support and resistance levels

seems to be extremely accurate and interesting...check

out our 3 scenario's...more

-

We have updated our Investment table...more

-

Only 250 years age - 1770, 1789, 1830,..: Taxation without

representation leads to the Boston Tea party, the French revolution, the

Belgian independence, ...Economic factors included

widespread famine and malnutrition due to rising bread prices, the

French national debt amounting to 2 billion livres, huge war debt, the

exacerbated national debts,...

Saturday July 3, 2010 - M3 and

hyperinflation - hyperinflationary depression. [What

is published below has been published by us years and months ago. For some

reason either people don't want to take the time to read it (do they

prefer to risk their savings?). For the clever ones who do decide to read

the correct information it is extremely difficult to understand what is

really happening. Propaganda/static makes it sometimes harder to

understand this than it is to select a Cell-phone provider!

-

There is a great deal of debate about the root

causes of hyperinflation. But Hyperinflation is often associated

with economic depressions, wars (or aftermath) and political or social

upheavals. Those who advocate Deflation because of a decreasing M3

don't understand what inflation and deflation is all about. The money

supply (M3) is only one of three factors that determine whether we have

inflation or deflation. The other two are the velocity of money and the

real output of the economy. Due to its effects on the velocity of money,

the ebb and flow of confidence have a much greater impact on the

short-term trend of prices then changes in the money supply

(M1-M2-M3-MZM)

economic depressions, wars (or aftermath) and political or social

upheavals. Those who advocate Deflation because of a decreasing M3

don't understand what inflation and deflation is all about. The money

supply (M3) is only one of three factors that determine whether we have

inflation or deflation. The other two are the velocity of money and the

real output of the economy. Due to its effects on the velocity of money,

the ebb and flow of confidence have a much greater impact on the

short-term trend of prices then changes in the money supply

(M1-M2-M3-MZM)

-

We

have entered the 2nd Phase towards hyperinflation:

a lack of money becomes evident in the second phase of the crisis - the

financial crisis is replaced by an economic crisis, triggering massive

bankruptcies that would spread globally in a chain reaction. During the

second stage of the crisis, another large sum of capital will

"evaporate" from the market...click

here for more

-

Authorities cannot maintain an (hyper) inflationary

policy unless it is sugared with Deflation propaganda...like...why

would we have hyperinflation when M3 is contracting? M3 is contracting

because we have a economic depression! [By definition M3 must contract

during the 2nd phase!]

-

During a cycle of (Hyper)-inflationary (re)depression the

price of High Order Capital Goods keeps falling whilst

those of Low Order Consumer Goods rise strongly.

-

But Hyperinflation is a monetary phenomenon and not

an economic one...and M3 is contracting because of the depression.

This is something normal and is happening each time as the economy

moves towards hyperinflation.

-

Hyperinflation starts when the public is

unwilling to hold the money for more than the time it is needed to trade

it for something tangible to avoid further loss. A good indicator that

Hyperinflation has started will be a sudden increase in the Velocity of

Money. [ P = M x V ]. This alone can increase the general level of

prices. Even with a falling M3!

-

Hyperinflation is a psychological phenomenon.

It happens overnight and it is extremely difficult to forecast when it

will start.

-

The main cause of Hyperinflation is a massive and

rapid increase in the amount of money that is not supported by a

corresponding growth in the output of Goods and services.

Assuming there is a decrease in the output of Goods and services (like

we have now) it is still possible to see Hyperinflation when the Output

is falling faster than M3 is contracting.

-

We have a recession/depression (output of goods and

services is falling) and Public debt is soaring towards 100% of GDP

(gross domestic product) and has in some cases even become larger.

-

We are

about to enter the 3rd Phase towards Hyperinflation:

hyperinflation mostly starts when the Bond (Treasuries) market breaks

down. It does when Authorities start to monetize their debt like

they are doing now UNDERCOVER (The ECB and the FED are already buying

Treasuries/Bonds - Is it not weird that Spain sold all Bonds in about a

day's time after a downgrade warning?) and the public is unwilling to

absorb it (the confidence is eroding). Who would be so stupid to buy 30

year Treasuries yielding a nominal 4% when real inflation takes both the

Interest and Capital away?

-

We all know M3 is down over the past months but few

realize the Quantity of Money is still dramatically up in the long

run...click here for more

[charts for the Euro and the British Pound money supply are similar].

Looking at the chart below one can clearly understand there is

NO WAY to mop up this excess of Money supply. It is simply to large.

Having said this, the Authorities have absolutely no intention nor the

will to mop it up. Inflation and Hyperinflation will simply erase the

excess of Government debt and this is exactly what there are going for.

Friday July 2, 2010 - This is a storm and it

will get worse. Make sure you are positioning your savings according to

our investment plan and sit tight. Don't let anybody scare you out of

fundamentally good investment vehicles: Fool me once,

shame on you. Fool me twice, shame on me. Fool me eight times, am I a

F**king idiot? - Jon Steward

-

A

weak fiat currency is a blessing for Gold and Silver mines.

Operating expenses decrease and more is paid for the

finished product. As a result the profits go up. A

weak fiat currency is a blessing for Gold and Silver mines.

Operating expenses decrease and more is paid for the

finished product. As a result the profits go up.

-

Gold and Silver shares are more or less as volatile as the Barbaric

metals are. But the uptrend is intact!

-

And yes the

Dollar

is just like the Euro, the

British Pound a worthless Fiat paper currency and Treasuries

nothing more but an option to buy these worthless

"Assignats".

This is where our PF charts come in handy...

-

No - it is not the price of Gold and Silver which is going up but

rather the value of Fiat paper money crashing towards it real value =

ZERO.

-

The BIS

(Bank for International Settlements) Britain's

mountain of debt could leave the country powerless to launch another

rescue bid in the wake of a fresh financial crisis, the world's central

bankers warned yesterday. Remember Britain is the Canary in the mine

shaft for the rest of the World...more

-

$-Gold can actually

come down to $ .... and the short term Bull trend will still be

intact...The

key reversal on the Candle charts was disregarded but the bearish wedge

was not!...more .Expect the Elliot

Wave technicians and Deflationist to try to sell their theories - which

we cannot buy because they are neither practical nor logical.

-

Yesterday saw a violent reversal of the

Euro against the dollar [1.22 to 1.25].

Here the Bullish flag has

been activated and is also doing its job...click

here to see these important charts.

-

American

National Debt soars to highest level since WWII. The spotlight starts to

focus on the American problems...more

The Los Angeles Times claims a market shift and advises to dump

the Dollar and buy the Euro. This is how fast sentiment

changes!...more

-

Is

Pelosi being trained by the Europeans? Unemployment checks can never

create jobs. They will only

window dress unemployment...more

-

We don't

buy the Double Dip Propaganda.

There is absolutely NO WAY we can at this point see a recovery would

even be possible and in due time we shall have a Second down leg which

will take economic activity a lot lower...more

-

There is

an important pattern on the make for the

Dow Jones Industrials and it is all

happening right on a major trendline...more

Add to this a Cross of Death

(bearish cross-over as the 50 day Moving Average breaks down the 200 day

moving average on the S&P) which is not a very good signal for

markets...but readers knew for some time that we did not like what our

charts were telling us.

-

Fixed

income investment and cash are extremely vulnerable to to currency

debasement and high inflation.

As the value of fiat paper money deteriorates year after year,

Bonds are not going a star performer. One does not

need to be a brain surgeon to figure this one out.

Thursday July 1, 2010 - The time has come to put

your eggs in few baskets and watch the baskets closely. Today

"Diversification has become an excuse for Bankers and Fund Managers to

explain how they loose your savings"

-

The

U.N. wants to scrap the

Dollar as sole reserve currency. The

dollar has proved not to be able to be a stable store of value, which is

a requisite for a stable reserve currency...more The

U.N. wants to scrap the

Dollar as sole reserve currency. The

dollar has proved not to be able to be a stable store of value, which is

a requisite for a stable reserve currency...more

-

The

Dollar looses

strongly during today's trading session. We

updated the Dollar and Euro sections this week and our technical

indicators showed this kind of action was very plausible. The Dollar ran

into the Mother of all Necklines, and the weekly and monthly indicators

are turning down.

-

Gold ETF swells to

pass $ 05 billion milestone. The Gold ETF is a good

indicator for fractional Gold. If GLD would be a bank it would rank 5th

- just below France and above China...more

-

And yes,

we don't like

Bonds,

Treasuries, Municipal Bonds.

Best case scenario we will have a debt moratorium but

normal case scenario is that they will loose their full value during the

coming hyperinflation. As of May, Florida

had 125 districts in default on more than $3 billion in bonds, the

single biggest muni bond default wave in at least 30 years...more

-

The

level of public debt in many industrial countries is on a unsustainable

path. Expenditures related to ageing

populations are set to increase considerably over the next years...and

this is the catalyzer of

Jim's formula.

-

And YES,

there is absolutely NO DOUBT we're heading for another

HYPERINFLATIONARY

depression...Zimbabwe

fashion. As explained before it is extremely

difficult to forecast WHEN it will start because a Hyperinflation also

is a psychological/social phenomenon. For this reason one must be

prepared BEFORE it actually starts.

-

Taking

into account the 5 year accumulation pattern of

-Silver we are able to calculate the

long term objective. Mind blowing....more

Goldonomic, Florida, USA -

+1

(772)-905-2491

+1

(772)-905-2491 |