| January 2011 - There is no doubt some

alternate needs to be found for Liquid Energy.

Nuclear fusion is one possibility and as long as science hasn't been able

to manufacture a small fuel/energy cell this could be another

possibility...

Nuclear Fusion is the opposite of

Nuclear Fission or Solar Energy. In

Aix-en-Provence, France one of the world's first fusion plants is being

built. Iter

is the way to a source of new energy...more

A brave new world of fossil fuels

on demand:

In September, a privately

held and highly secretive U.S. biotech company named Joule Unlimited

received a patent for “a proprietary organism” – a genetically adapted

E. coli bacterium – that feeds solely on carbon dioxide and excretes

liquid hydrocarbons: diesel fuel, jet fuel and gasoline. This

breakthrough technology, the company says, will deliver renewable

supplies of liquid fossil fuel almost anywhere on Earth, in essentially

unlimited quantity and at an energy-cost equivalent of $30 (U.S.) a

barrel of crude oil. It will deliver, the company says, “fossil fuels on

demand.”..more

|

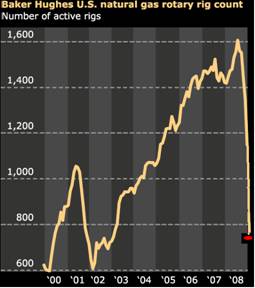

click on logo to see statistics |

|

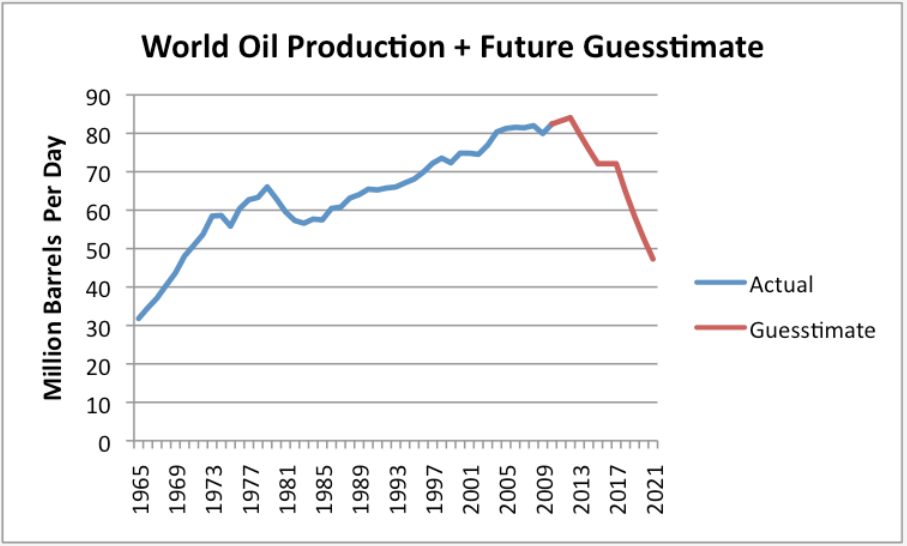

The world is now so

dependent on Oil that even during a major economic crisis

the demand for oil has

remained on a high level [contrary to the 1980's]. he transition form Oil to

other energy sources will be have consequences as important as the appearance of

the Steam train and the invention of the Automobile. Also Complex Societies (the

EU and the USA) will not survive the expensive energy

An economic boom becomes

impossible unless it has access to CHEAP ENERGY..

Click here to read

Tainter for details about ENERGY and ECONOMIC cycles.

On Aug. 14, 2009 the International Energy

Agency released a report based on a study on the oilfields that make up 75

percent of world supply showing that not only is production declining but it is

declining at double the rate of just two years ago, now 6.7 percent per year.

The IEA concludes that for the first time in history supply, not demand, is

going to drive prices. November 2009 an IEA official admits the figures have

been tricked in order to avoid panic.

In other words, though demand has dropped dramatically due to the economic

collapse, the oil industry is struggling to meet even the reduced demand, which

is why prices have risen so quickly. |

|

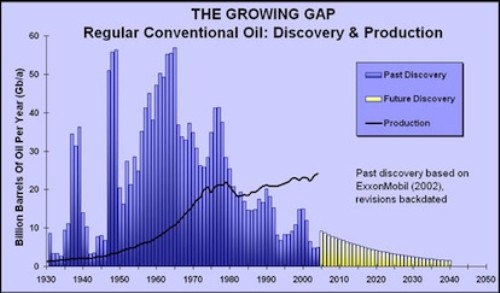

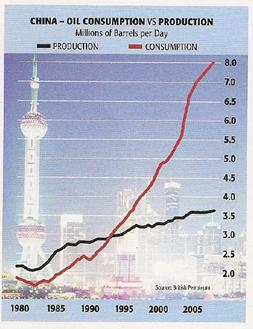

Oil is a REAL COMMODITY in short

supply. 70 % of the US oil consumption is imported…for the 1st time in history

the consumption curve has penetrated the production curve eating up the

inventories. A critical point has been crossed. Contrary to what a lot of people

think, Global Demand keeps rising by 1% per year and supply is coming down.

November 2008, the International Energy Agency (IEA)

released its World Energy Outlook report. According to the IEA, our existing oil

fields are depleting by a shocking 6.7% per annum and we would need

to find an additional 60 million barrels per day of new oil supply

in 20 years to meet global demand.

We are reasoning about LIQUID ENERGY. Solar,

Wind and nuclear CANNOT be used for automobiles, trucks, ships, airplanes, motor

bikes and grass mowers |

|

|

Houston we have a problem:

The U.S., with 5% of the world's population, uses 25% of its

global oil supply.

The

typical American, in other words, might be compared to an elephant, while

the average European or Japanese (to say nothing of the average Chinese or

Indian) might be likened to, say, a deer. The elephant needs an

enormous amount of food merely to stay alive; if it is restricted to

the amount consumed by the deer, the elephant will die. |

|

|

|

Updated January 13, 2011 - Peak Oil and misallocation of funds

We have for the 1st time entered an era

where Demand for oil is larger than Supply.

Crude oil prices are in a secular uptrend as the

shortage between supply and demand is compensated by stocks. But the day is

close these stocks will be depleted and demand will have to give in. The Western

world is already burning less liquid energy. The Far and the Middle-East are

over happy to use the balance.

Talking heads still don’t seem to

understand that the Oil prices ain’t rising in a context of falling demand and

rising supply and higher stocks. What we see for Oil is exactly the opposite.

Those waiting for a oil bubble like a credit bubble, a housing bubble and/or a

real estate bubble are going to be deceived.

We have a paradigm shift. The

misallocation of funds that are the result of Fractional Reserve Banking and

creation of money out of thin air are the motor behind the actual and future

shortage of liquid energy. Instead of allocating funds to new exploration,

drilling and the modernization of refineries, the funds were used to fuel the

worldwide Bubbles like those in Real Estate.

As usual, the political rulers have made

it worse than it already was: no licenses were given to built nuclear power

stations (today building a nuclear power station costs € 4.3 billion!)

and new oil refineries. They simply refused to accept the basic reality

that one needs to break eggs to make an omelet.

Chinese sales of automobiles increased by 73% in

only one year (November 2009) time. These cars

all need liquid energy or Oil and as we wrote on many occasions, the

East is burning each drop and more the West is saving and there is NO

DEMAND DESTRUCTION!.

China Car Sales Hit 18 Mln in 2010 China's auto industry association said

it expects China's 2011 growth rate for auto production and sales to be 10

to 15 percent. China saw both its car production and sales breaking 18

million units in 2010, setting a world record, according to the China

Association of Automobile Manufactures (CAAM).

(click on the picture for a slide show on the

Chinese energy situation)

The decrease in consumption by the Western World is burnt

by the Middle and Far East.

(* global demand increase is 1% per year)

"Peak Oil" scares the hell out of me;

there is no Plan B and we have left it too late. The chances of increasing

production are slim at best due to geology, rusty infrastructure, shortage of

equipment and scarcity of skilled workers. In my estimate, global supply of oil

will drop by 7-10 m barrels per day by 2012 and this is after taking into

account new supply over the same period. Not a happy thought and all we can do

now is to load up on commodities, pray and hope for the best. "

Energy is something very important for the

development of an economy and yet, extremely misunderstood. Total energy is the

sum of liquid and other renewable energies (like solar, wind, nuclear,

electricity). Misunderstood is the fact that there is a fundamental difference

between LIQUID ENERGY (oil) that makes engines run and global energy like

Electricity.

The Depression of the 1920's-30's saw the

end of the age of Coal and Steam and the replacement by Oil. What we are

living now, is the end of the Age of Petroleum. It is not 100% clear by what

Oil will be replaced. However, because of their inherent characteristics,

it is just impossible for Solar and Wind Energy to fulfill this

task. My conviction is that in the near future,

Nuclear Fusion and

not

Nuclear Fission will replace Oil and Gas and signal the start of the next

world economic boom. Hydrogen could also replace liquid energy and be used to

run cars, airplanes and vessels.

An increase in price basically happens in a

process to adjust Supply and Demand. Speculation only plays a secondary and

temporary role. There is NO DOUBT that this is peak oil: demand is 87 billion

barrels per day and supply is only 85 billion barrels per day. In other words

there is a shortage of 730 billion of barrels on a yearly basis. To make

things worse the inventory levels are below these of 2007. In other words,

we will only see limited price reaction within the secular bull trend. If there

is no price reaction between today and July, I expect to see $ 150 per barrel by

the end of 2008! In case (hopefully) there is a price reaction, there is NO

doubt we shall see this figure in 2009.

December 2008, the price of

Oil has as a result of deleveraging, the garage sale, deflation propaganda and

manipulation of the PAPER OIL DERIVATIVE MARKET (I hope you don't believe

Governments are the nice Altar boys the pretend to be) fallen back to $ 40

(technically a HUGE support line). Financial analysts who only months ago were

forecasting $ 300 for oil are now talking of $ 30 and less per barrel. Our

opinion is that Crude Oil price will not be able to fall below the $ 40 support

line and that somewhere next year it will take off again once the markets

realize the huge mistake they made.

Click on the chart below to

fly to the Technical Analysis for Crude Oil

> Back to the top of the page

> Back to Education Hall

© -

Goldonomic, Florida, USA -

+1

(772)-905-2491

+1

(772)-905-2491 |