|

Tuesday May 31, 2011 - Make sure to be out of paper money and out of

Bonds!

-

Are you

long on the Dollar? Be aware the

American debt goes up by 4 billion dollars each day.

This statement has dramatic and explosive consequences.

You really have to be retarded not to understand the implications of

this. The Dollar is cooked, done, a death man walking.

-

Are you

long Bonds?

Be aware a Treasury (Bond) is nothing more but an option to buy

worthless Dollars/Euro's. Did you see how fast the

Greek and Portuguese Bond markets collapsed?

-

Derivatives are unregulated and

uncontrolled investment instrument created by the Banksters.

The total value of derivatives in the world

exceeds total global gross domestic product by a factor of 10.They were at the origin of the 2008 financial accident

and subsequent deleveraging. Ever since NOTHING has been done to control

these and the financial bomb has become even more dangerous. Many hedge

funds, common investment funds, special funds, index funds, inflation

adjustable funds, interest rate adjustable funds all carry the cancer.

The safer you investment instruments appears, the more dangerous

it can be.

Monday May 30, 2011 - Gold is the answer, What was the Question?

-

Is

farmland A Smart Hedge Against Inflation? NO

says Gonzalo Lira, NO says Goldonomic. Farm Land is a HOCGood and will

be adversely affected by the (hyper) inflationary depression. BOTTOM

LINE ANSWER is NO !

more Is

farmland A Smart Hedge Against Inflation? NO

says Gonzalo Lira, NO says Goldonomic. Farm Land is a HOCGood and will

be adversely affected by the (hyper) inflationary depression. BOTTOM

LINE ANSWER is NO !

more

-

Never invest in funds of

funds, never invest in funds if you don't know how it is run.

Most funds and especially most Hedge funds are pure

scams. Over the past decennia they have grown like mushrooms

because investors had a blind trust in the Banksters. more by Monday

-

Is it not

ironic that even the Chinese stock market index has fallen in Stop Loss

when expressed in Gold. Such doesn't look good for

all those who were convinced China would solve all their investment

problems and provide huge capital gains. more by Monday

-

Political

leaders are clearly pure IDIOTS! They NEVER learn and

make me throw up...France has said it plans to use its chair of

the G-20 group of big developed and developing nations to push for

commodity price regulation in a bid to block what it saw a speculation

in the market of food crops such as grain and cereals...more

-

Gold and Silver shares now come with a profile

(link to home page) . A click on the name of the

stock brings you there.

-

Profits of

one of our

favorite Gold shares was up by 44% during the 1st Quarter.

We initially advised the stock at 75 cent. A

second medium sized stock holds 62.4 million ounces of gold,

90.9 million ounces of silver, and 1.4 billion pounds of copper

and is a CLEAR BUY at this level!

Friday May 27, 2011- "Permit me

to issue and control the money of a nation, and I care not who writes

the law" A

Rothschild

-

Greece

is the Achilles heel of the EU. The odds are that

it will be the 1st country which will return to the Drachma. We

brought this up months ago (will the EU survive). Complex societies

never survive expensive energy and it is not even sure that the US

will survive as we know it today!...more

.Politicians will off course do all they can to keep this Frankenstein

alive as their jobs (income) depends upon the survival of the EU. But

the dices have been thrown. The point of no return has been passed....What

is broken in Greece is also broken in many other European countries! Greece

is the Achilles heel of the EU. The odds are that

it will be the 1st country which will return to the Drachma. We

brought this up months ago (will the EU survive). Complex societies

never survive expensive energy and it is not even sure that the US

will survive as we know it today!...more

.Politicians will off course do all they can to keep this Frankenstein

alive as their jobs (income) depends upon the survival of the EU. But

the dices have been thrown. The point of no return has been passed....What

is broken in Greece is also broken in many other European countries!

-

French

Socialist minister Christine Lagarde steps into fraught race for IMF

top job. Control of the money is better than

standing armies. She would sell her father and mother in an effort to

get the presidency of the IMF so she can serve the people!?

sickening....more

Are these the leaders supposed to look after the Welfare of the

people? [You are a den of vipers and thieves. I intend to rout you

out, and by the eternal God I will rout you out." President A.

Jackson.]

-

President Kennedy signed a Presidential decree, Executive Order 11110.

This order virtually stripped the Fed of its power

to loan money to the US Government at interest. This order gave

the Treasury Department to issue silver certificates against any

silver in the treasury. In less than five months after signing

that executive order President Kennedy was assassinated on November

22, 1963. President Lincoln also took on the bankers and this

may also have cost him his life.

-

Do you

think I am crazy?

The EU to survive was published in

2008. At that time a Spanish unemployment figure of only 18%

was forecasted for 2010. The reality of today is an official figure of

23%. I invite and beg all those who think

I am just some stupid Doom teller to come up with ARGUMENTS! If

you are so sure I am wrong or blowing it up, do yourself and me a

pleasure...sent me an email with your arguments! If you're right, I'll

offer you ONE YEAR FREE ACCESS to Goldonomic and it's advices (worth

all the money if you consider the track record. In the 1980's I

already booked a performance of 20% per annum). The real problem is

that the Herd is STUPID and ALWAYS comes late. . Most of the time

being late ends up as a disaster: the Napoleonic Wars, Hitler,.

.History is full of examples and the world is full of people refusing

to believe that what is described in those books was at some

point REALITY and that this is happening over and over again just

because they REFUSE to use it as a catalogue of things not to do!

Thursday May 26, 2011 -

click here for the updated model portfolio

-

-

Japan is a

good example of the trouble we are in.

-

We know

Europe and the USA are in big trouble and Authorities keep covering it

up. We don't feel like taking your and our time to

publish over and over again slightly different stories. Our scenario is

clear: the EU won't survive and the USA will go through hard times...GDP

and Employment are not picking up and Governments have more and more

problems financing the the system they created. The economy will

not come to a standstill. It never does. But from now on it will go from

bad to worse. Don't be so naive to believe countries in South-America

and the Far East won't have their part of misery. Social unrest is on

the rise and not only in North-Africa and the Middle-East.

-

We also

have a clear strategy about how

you must protect yourself BEFORE an actually accident happens.

We are fine tuning the strategy as time goes on and we get more

indications as into which direction the beast will move. Do it NOW and

don't wait until it is too late and the Sheeple start to move.

-

Our

results are simply good. Know that we never

chased Fiat Paper Money profits. Hard to

understand if you live by month to month profits. Investment is NOT

making a profit each month. Certainly NOT today.

-

New

information added to the section of Gold fundamentals...click

here

-

Derivatives are a mighty dangerous sword.

"Manipulating cash prices for a larger derivative payout is a regular

feature in all markets. And $50 million is chump change compared to the

billions being made manipulating the markets on almost a daily basis."

That is, as the British economist Peter Warburton discerned in his

2001 essay, "The Debasement of World Currency -- It Is Inflation,

But Not as We Know It", market manipulation is the very purpose

of derivatives.

Wednesday Mar 25, 2011

-

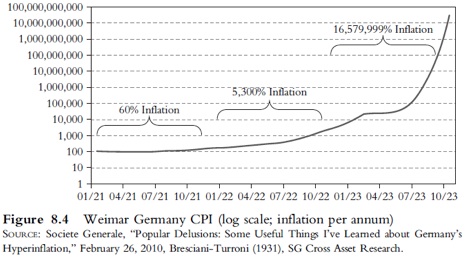

The

Weimar Hyperinflation started with an

inflation rate of 15%, next came 60%,...a year later the inflation rate

was 5,000%. Not the price of good and services went

up but the value of fiat paper money crashed down to ZERO. Those who had

invested in Real Estate saw that the Rents were blocked by Law and with

one month rent, they barely could buy a bread.

[this is why the price of German real estate is still relatively low]

. We have EXACTLY the same situation today

and the odds that Government will refrain from printing more Fiat Money

is as high as the ultimate value of what they serve: ZERO!

The danger is not one of banks going bankrupt but rather one of

Governments falling into default.

-

The fall

of the Dollar

will take all currencies along which are holding large amounts of

Dollars as Forex reserves. Equally dangerous are Fiat

currencies which have their economies/currencies pegged to the Dollar

(ex. South America). Make sure you don't hold any of these.

-

Real Estate is a High Order Capital Good

and one must by all means try to reduce its exposure

as much as possible BEFORE the

Hyperinflationary depression starts. Only extremely cheap bargains are

to be considered.

-

Remarkable

candle chart for Crude Oil. A schoolbook example it

in fact is...more

-

The

Gold and Silver

sector is gearing up to ride a monster wave.

When will it start and what will the wave look like...We

discussed this in detail yesterday.

Tuesday May 24, 2011

-

The Dollar

is stronger but so is Gold? Not many who expected to

see this. However for those who UNDERSTAND why the price of Gold/Silver

is going up such is absolutely no surprise. What we are experiencing is

a race of the Fiat Money currencies towards ZERO.

-

Do we

really have to fear a new 2008 style deleveraging?

Remember the danger NEVER comes out of a corner you don't expect, that

the Authorities are watching the 2008 corner and that even if it does

happen, it is better to be invested in physical Gold & Silver and Gold &

Silver shares than in Bonds and bank deposits/saving accounts as the

latter will take away all of you savings during a crisis while the

former will only correct. In only 2 years time the Gold and

Silver/energy sector fully recovered from the 2008 crash.

-

Utilities

are overbought...expect a correction. Typical is to

have a correction each time the Dollar index strengthens.

Monday May 23, 2011 - Really scary it is - ACCELERATE your purchases of

Gold - Buy NOW !!!

The Road

to Hell is Paved by Central Bankers. The House of

Rothschild ( see slide show of March 1, 2011

symposium) had been the dominant banking family in Europe for two

centuries. They were known for

making fortunes during Panics and War. The Rothschilds of London

understood that a fiat currency system would benefit the few (bankers &

politicians) who understood it and the masses would be too ignorant to

understand they were being screwed: The Road

to Hell is Paved by Central Bankers. The House of

Rothschild ( see slide show of March 1, 2011

symposium) had been the dominant banking family in Europe for two

centuries. They were known for

making fortunes during Panics and War. The Rothschilds of London

understood that a fiat currency system would benefit the few (bankers &

politicians) who understood it and the masses would be too ignorant to

understand they were being screwed:

“Those few who can understand the system

(check book money and credit) will either be so interested in its

profits, or so dependent on it favors, that there will be little

opposition from that class, while on the other hand, the great body

of people mentally incapable of comprehending the tremendous

advantage that capital derives from the system, will bear it burdens

without complaint, and perhaps without even suspecting that the

system is inimical to their interests.”

This

is what happened since 1971 when they made Nixon close the Gold Window:

|

Items |

1971 |

2010/11 |

%

Increase |

|

Average Cost of new house |

$28,000 |

$273,000 |

975% |

|

Median House Hold Income |

$10,300 |

$47,000 |

456% |

|

Average Monthly Rent |

$150 |

$750 |

500% |

|

Cost of a gallon of Gas |

$0.40 |

$3.80 |

950% |

|

Average New Car Price |

$3,430 |

$29,200 |

851% |

|

United States postage Stamp |

$0.08 |

$0.44 |

550% |

|

Movie Ticket |

$1.50 |

$7.89 |

526% |

|

Gold |

$35 |

$1500 |

4300% |

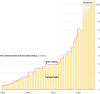

The average standard of living has declined dramatically over the last

forty years and people don’t even know it. People have become the slaves

of bankers and pay the cost of their own slavery through inflation

and debt. It is not a coincidence that consumer debt,

which was virtually non-existent prior to the 1960s, began to take off

in the 1970s and went nearly parabolic from the early 1990s until the

2008 financial collapse. As the Federal Reserve and political

class created inflation, which reduced your standard of living, the

bankers who own the Federal Reserve and control the politicians used

their slick marketing machine to convince you that acquiring goods using

vast quantities of debt was just as good as buying things with cash you

saved.

Quantitative Easing to infinity is requested to keep the Bankers (and

politicians) alive. If

the Central Banks fail, the system will collapse and the value of ALL

bank deposits, Derivatives, Bonds and money instruments will crash to

ZERO overnight. If they succeed the system will run into a

Hyperinflationary depression until people stop trusting the Banks. At

that point the Financial System (Banks) will also fail. In both cases

Gold and

Silver (and

certain stocks:

Gold and Silver shares,

Energy shares,...see our

investment

pyramid ) will still be there...As usual the Sheeple which

are mainly invested in

Treasuries,

bank shares,

bank manufactured investment instruments, saving accounts, money market

funds, etc... and Bank Deposits will loose it ALL! Forget

Real Estate...it

never did well during

hyperinflationary depressions

for it is a HOCG!

|

Real Income since 1960 |

Total Consumer debt |

Debt held by the public |

| |

|

|

|

|

|

1971 was

also the beginning of the exodus of the Manufacturing apparatus to the

Far East. After Made in Japan and made in Hong Kong it was

made in Korea, made in China and India. Capital must have felt that it

was tricked by cooked figures, increasing taxation (the more the profit

figures are inflated, the higher the % taxation), more and more

regulation (regulation by definition increases the cost of a product and

reduces the profit),

more and more Government intervention in the economy (Socialism).

A

Hyperinflation BEFORE the end of 2012 is a potential reality.

The Dollar (and probably some other fit currencies which are highly

interconnected with the Dollar) will NOT survive the coming

hyperinflation and in order to sell their new currency to the public

some kind of gold backing will be requested. I highly doubt however that

the solution will be a decent one. Your primary hedges are

Gold

and Silver,

but also the Australian Dollar, Swiss Franc and

Canadian Dollar.

Gold

companies from emerging to major producers have slowly begun the process

of issuing and

raising dividends.

For some reason the bulk of the investors tend

the ignore the impact of dividend on total return and let them scare off

by the ebb and tide of the stock market. 1930 Homestake mining had

a dividend of $8 and Earnings of $6. By 1935 the figures were $56 and

$32. The share price rose from $70 in 1930 to $500 in 1935 ! (+700% or

+175% y/y). Be aware of the fact

that as soon as investors start to smell the juicy dividends, they will

sell off the ETF's, and other Bank manufactured gold/silver investment

instruments and buy the REAL STUFF...more

Gold expressed in Euro

is about to break out of this Huge Accumulation. [see

PF chart] Once it leaves € 1080 behind our 1st

medium term technical objective is € 1280

Gold expressed in Sa-Rand

has broken out and is a CLEAR buy. The technical

pattern is very similar to what we may see for Gold expressed in Euro.

Gold expressed in Yen

shows a schoolbook PF example of a secular uptrend.

The Yen however remains a SHORT against the Euro. Japan holds too many

Dollars...and is about to pay for this mistake.

Gold expressed in Swiss

Franc is an extremely interesting and an extremely BULLISH

chart. If for one second you doubt about the future

relationship of the Euro/Dollar check the Swiss/Dollar chart. A steady

schoolbook stair case uptrend it is. The price evolution of the

Swiss against the Euro is EXTREMELY NEGATIVE for the Euro!

The

Australian Dollar

remains the strongest Fiat Paper currency and we have

a fresh BUY signal against the Dollar.

Gold expressed in Canadian

Dollar has also broken out of a bullish coil and is a clear

Buy.

Socialists loose elections

in Spain. More important however is the fact

that Spanish people openly state the Spanish problems originate beyond

left and/or right and beyond Spain. Spanish people stop believing that

Politicians can and will solve the pending economic problems and that

elections will bring any change. What "they" call Democracy ain't

democracy !

Greece not ready for a

debt moratorium (restructuring) and arrogant Italy like Portugal now

also attacks Standard and Poor's after its Credit

downgrade...more

Friday May 20, 2011

-

This is something your

banker will NEVER tell you and this is why Rising interest rates are so

dangerous. Rising interest rates will rip apart the

market for derivatives and bankrupt the financial system beyond your

imagination. Credit default swaps have been manufactured and sold during

the good days by only 7 banks....The next best solution (if you want to

survive, is to go for QE III, QE IV , etc...until we have Hyperinflation

and somebody else can be blamed for it.

-

Many of the silver bears

out there are non-specialist analysts who next week

may be commenting on markets in hogs, Soya beans or a murder case and do

not have the in-depth knowledge of those participating. There is a

disconnect between the paper Silver market and the Physical and for

example it took several months for the Sprott Physical Silver Trust to

be able to accumulate its silver. bullion suggesting a huge shortage of

actual physical metal available. Indeed paper silver trade clearly is a

Paper Joke. (don't expect JPMorgan to confirm this).

-

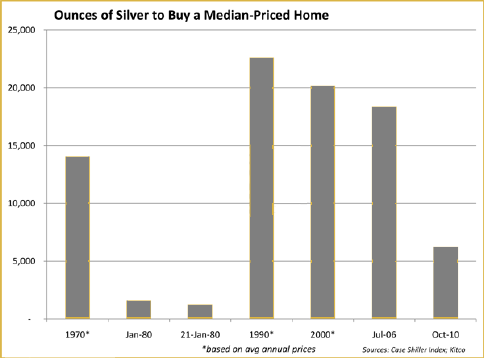

The price of real estate

is not only coming down in FIAT MONEY. It is also

coming down in REAL MONEY. Real Estate is a High Order Capital

Good and its price ALWAYS comes down during (hyper)inflationary

depressions.

Thursday May 19, 2011 - There must be something wrong

with us? or not...ever since 2004 we have been laughed at, over and over

again we have been ridiculized and a bubble and a top was called for

gold and silver....but Gold and Silver keep on rising...and

rising...ignoring the critics.

-

Will the

people arrest and put former Presidents and Federal Reserve Officers in

jail? The next big problem is the problem of the

Governments being confronted by the Debt they are responsible for. The

chickens are on their way home to roost. Will the culprits be punished

or will they succeed in fleeing away in the middle of the night like

John Law did?

-

Greece is

selling its silverware. Greece is bankrupt and will

NEVER honor its debt (Treasuries). This is only the beginning. Other

countries will follow in sequence and as the majority of the Sheeple is

invested in CASH (worthless fiat money) and Treasuries (an option to buy

worthless fiat money) the losses will be dramatic. Those amongst you who

think Real Estate will keep you safe, better be warned: Government

officials will act like Mob members and tax the hell out of everything

which they can lie their hands on. It is five to twelve to get out of

any investment instrument which carries some kind of official label.

-

This is

the dead of Socialism. Not the rich are to

blame (for they traditionally provide the capital which brings

employment) but the bureaucrats and politicians are. The cost of big

government is rising exponentially and needs to be funded. As they are

the law makers they will do whatever is requested to preserve their

position and income: legally take the money away where they can possibly

take it. It is not the rich (these don't have a police force, they have

no army) but the public employees which are the real thieves. In an

effort to survive they lowered artificially interest rates hereby

chasing away Capital (where ever Capital goes, employment follows), they

increased taxation to sickening levels, they increased the number of

Government officers to make up for the falling employment levels, they

increased regulation so they could appoint even more Government and para-government

officers so the employment rates looked even better. [one government job

takes away two jobs in the private sector]

-

Be advised

the coming financial crisis will signify the END of HEDGE funds, the END

of DERIVATIVES (credit default swaps, and other investment instruments

which have been manufactured by the Banksters). We

have better alternatives....please

use them.

Wednesday May 18, 2011 - What we live is the dead of Socialism -

-

We have added the

Road to Serfdom by Hayek to our

library. This masterpiece of Nobel Prize laureate

Friedrich Hayek

is an eye-opener, strongly advocating the free market principles. In

this all-time classic Hayek persuasively warns against the authoritarian

utopias of central planning and the welfare state. Fascism, communism

and socialism share these utopias. For the implementation of their plans

these authoritarian ideologies require government power over the

individual, inevitably leading to a totalitarian state. According

to Hayek there is no difference between Socialism and Fascism.

-

This is probably the ideal

point to buy (Junior) Gold and Silver shares and to invest in this

sector. Three taps and a breakout is what these

shares will dance very soon (see

Junior Index). The Silver ETF

SLV (chart to the right - do not buy - only buy physical Silver)

clearly shows a HUGE selling climax (very bullish) and is building a

bullish wedge with $ 40 as price objective, Last but not least

GLD (Gold ETF -

do not buy - only buy physical Gold) is accumulating Bullish signals.

[Be advised the

Bearish/Caution signals come BEFORE a top and the Bullish/Buy signals

come BEFORE a bottom. WEDGES are tricky formations because the price

reverses swiftly after a spike].

-

Check our charts of

Commodities, Silver,...expressed in Real Money or Gold...more

Tuesday May 17, 2011 - Gold, Silver, Oil, Commodities

continue to bottom out .

-

USA hits

debt ceiling. Today the American Problems

are in the spot light, tomorrow the European ones will be. Both

currencies are in fact a clear SELL.

Fiat currencies like the Aussie and the Swiss can

survive a bit longer...but nothing is sure. NOT one banker and one

politician who will tell you. In fact, they will do all within their

power to convince you of the opposite. Just like Madoff did. Only they

have more power than Madoff. Having said this, the USA will

increase the debt ceiling....more

-

What

happens in Hungry doesn't stay in Hungry. The USA

ain't better than the rest of the world.

It's so easy to tap the savings belonging to somebody else to cover your

own necessities if you're part of Government. My father used to call it

legal theft. Right he was...more

-

In some

parts of Europe The Tulip mania has

become a Real Estate mania. A real Estate cycle takes

76 year to complete. A boom of about 50 years and a bust of about 26

year. The vicious part is that just

because it takes so long, those who could testify of the previous cycle

are all dead and today nobody has in fact experienced a serious real

estate bust because they haven't lived long enough. The

Mississippi scheme was in

fact a huge Real Estate bubble. There are similarities between the

Mississippi scheme and today's crisis especially because the notes were

issued by the Banque de France and were so said Inflation proof.

To be honest, it is extremely difficult to UNDERSTAND why there are

so many investors out there which BLINDLY BELIEVE (!?) that Real Estate

will continue to prosper. I suggest these believers ALL book a holiday

to Florida or Spain and meet the non-believers of 2006. Having said this

how is it possible to deny the coming real estate crash in certain parts

of Europe after for obvious reasons it happened in the USA, Manhattan,

South-Africa, Spain, Greece, Ireland, the UK (City of London), etc...Real

Estate is a HIGH ORDER CAPITAL GOOD!

-

QE II

ending soon...expect QE III a day later.

Fractional reserve banking is like a shark, credit must continue

to expand (swim) or it faces death. Better not be around the day it

dies.

-

$-Silver can ease

another 10% to around $ 30 per oz. Once it has, we

shall be almost 100% sure the correction is also over for Gold, Oil and

Commodities. The average Silver correction (top to bottom) is 40%.

Remember we advised to hold Gold instead of Silver and one of the

reasons is that Gold is less volatile than Silver

During the next rally in

precious metals, silver will not be the leader. After all, the

recent plunge has devastated investor sentiment. The precious metals

sector will experience a rotation, whereby investors and speculators

will now turn to gold. Accordingly, we believe that during the next

big advance, the yellow metal will provide leadership and appreciate

more than silver.

-

I can't

believe my eyes when I see how well the ECB and the Fed manage to trick

the Financial markets. The USA hits its debt ceiling

and Chinese stop buying American paper but Bernanke (with the help of

derivatives) manages to push up the price of

Treasury Bonds. A magician he must

be. Even the American municipal Bonds made an unexpected recovery.

Is it not a wonderful world!?

-

Utilities are safer than Bonds but I expect some sort of Summer

correction.

Monday May 16, 2011

-

The worst

fear always comes from anticipation.

Today the anticipation is that QE II is coming to an end

in June. However better be aware that your biggest partners are

Bernanke and Trichet who by all means will try to avoid any

kind of stock market crash 2008 style. Expect the markets to resume the

bull run once they understand they are safe.

-

Crude Oil!? an

ongoing bull trend...expect higher gas prices to coke

the economy...but such makes only worse what it already is...

-

The

Commodity index

is giving a good idea of how long the actual correction

in the Gold and Silver sector (and Oil, Commodity sector in general) can

take and what the potential intensity could be. Just check for the

support levels.

-

Why is it

that each time Gold correct by less than 10% we always read these kind

of stupidities published by so said popular Media!?..more

Friday May 13, 2011 - Instead of Sell in May and stay away, we might see

exactly the opposite. At least for the sectors we advice to be invested

in -

-

Oil shares

have eased back in Oversold territory. The House of

Representatives voted to open more of the nation's oceans for oil and

gas exploration on Thursday by a vote of 243 to 179. High time

Politicians and movie stars living on the Californian coastline

understand all this Green propaganda doesn't make sense as long as we

have a shortage of energy...read

more. Individual shares will be updated this weekend.

-

Fat

bullish tails on our candle charts for

$-Gold and

$-Silver.

-

All shares

in our Gold and

Silver Majors section have fallen back to low risk buy

levels. Charts for individual shares have been

updated....here and there we happen to see sell climaxes (bullish).

Price tables and shares in

Junior Section were

also updated. At this point we prefer Gold shares to Silver shares.

Thursday May 12, 2011

-

Irish

government raids private

pension plans. This is a taste of what is to come

in 14 other European countries. There were similar raids in Argentina

and Hungry. Governments are crooks...those who don't believe it will

have the luck to experience it soon... [physical Gold/Silver can be

hidden out of sight and worst case scenario it is better to hold

Gold/silver at a loss than Private Pension plans which are stolen by the

Government]...more Irish

government raids private

pension plans. This is a taste of what is to come

in 14 other European countries. There were similar raids in Argentina

and Hungry. Governments are crooks...those who don't believe it will

have the luck to experience it soon... [physical Gold/Silver can be

hidden out of sight and worst case scenario it is better to hold

Gold/silver at a loss than Private Pension plans which are stolen by the

Government]...more

-

The

Silver section has

been updated. So far top to bottom $-Silver has

corrected by 30% (a figure of 40% was/is possible) Again I issue a

WARNING. There is important technical damage on the Silver charts and it

may take a lot longer than anticipated before the damage gets repaired.

At this time the Point and Figures chart for Silver expressed in

Swiss Franc is our canary in the Silver mine.

-

Bonds

are so overvalued that they will turn into the BIGGEST ever graveyard of

the people's wealth, overtaking the ongoing

real estate debacle. Prices are artificially high because

Central Banks have been buying them in their effort to keep long term

rates down in a misguided attempt to prop up property values as well as

the stock markets.

-

The section of

Gold and Silver juniors were updated.

This sector lives its final sell off spike and

offer tremendous buying opportunities,

Wednesday May 11, 2011 - History repeats because mankind is just too

stupid to learn from its past mistakes.

-

Portugal

taking Economists to court for bringing down their credit rating!?

. Those Politicians have no self respect

whatsoever by starting a court case against Standard & Poor's

economists. They are the origin of all the problems Portugal has right

now but they as usual point the finger to somebody else. Sickening it

is! What we live is the final showdown of Socialism and I expect

Governments will run off the cliff. As long as they are running a

deficit (10% for the UK and the US, 7% for France, 5% for Canada and

Australia the debt will escalate and the debt bubble getting bigger and

bigger. Balancing the budget becomes impossible as Tax income keeps

falling due to the depression and expenditures keep rising....

-

First

capital leaves, then the better managers follow.

Because of the improper actions of the Authorities capital keeps

concentrating elsewhere. Slowly but surely the public starts to find out

that Stocks are a far better alternative to worthless bonds/treasuries

(bonds are nothing more than an option to buy worthless fiat paper

money). Hard to understand for many investors because they have NO

EXPERIENCE and they feel safer to keep believing in the lies of the

Authorities and Banksters. Raising interest rates only makes sense if

Governments are NOT the largest borrowers and keeping the interest rates

artificially low only buys more time. In the end the natural forces of

the economy will push up interest rates and the devastation will only be

bigger than if they had allowed the market to auto-correct.

-

PF Charts in

the section of $-Gold and

€-Gold , PS-Gold have been updated...more

-

PF Charts in

the section of Silver have been updated. NOTE the ERRATUM

which was the consequence of an incorrect Silver price in Swiss Franc...more

-

It is five

to twelve for all Bond Holders...the time to sell

Bonds is NOW...not when it is too late!...more

-

Crude Oil is a

good indicator that the Correction for Gold is probably over

and that we have seen a short term bottom. Check the PF

chart and see how the price of Oil bounced off the bottom of its uptrend

channel.

Tuesday May 10, 2011 - There is a disconnect between the Physical and

paper (futures, ETF's, warrants, options, Turbo's,...) market for Gold

and Silver. If you have paper Gold/Silver you have NO Gold/Silver!

-

If

the correction for Gold and Silver has short legs, the legs of

Dollar

correction could be even shorter. Remember the

magical numbers: 1.44 € and $ 1444 for Gold. Only Silver has a problem.

Because the Silver price spiked it will need MORE

consolidation/digestion before it resumes its bull run. If

the correction for Gold and Silver has short legs, the legs of

Dollar

correction could be even shorter. Remember the

magical numbers: 1.44 € and $ 1444 for Gold. Only Silver has a problem.

Because the Silver price spiked it will need MORE

consolidation/digestion before it resumes its bull run.

-

What a

difference a day makes. The price of

Gold is bouncing off its 50 day moving

average (bullish) but we still have to clear the old

top of $ 1570 before we can confirm a new bull run is alive. Important

is that our technical indicators have moved into a BUY position. If the

bull run is confirmed over the next days (bottom fishing is difficult)

expect the next top for $-Gold to be higher than $ 1650.

-

What a

difference a day makes.

Silver has penetrated its 50 day MA but we have a bullish

long tail on the candle chart and our technical

indicators have also moved into a BUY position and the purple

acceleration uptrend is holding...Technically speaking Silver is as

cheap as last February. Extremely important is the chart of Silver

expressed in Swiss franc and the fact that the blue acceleration line is

holding. This will confirm the potential trend acceleration of the

Silver price. We may however need more consolidation/accumulation BEFORE

a new bull run for Silver will be initiated and I still think Gold will

over the next months perform better than Silver.

-

Elementary

Mister Holmes. If the paper price of Silver comes down

but you can't buy any physical Silver, it indicates the price of

physical Silver keeps raising...and the paper investor is holding thin

air.

-

Be aware

we CLEARLY advise you NOT to sell physical Silver.

As a matter of fact ANY drop in the paper

(COMEX) price of Silver and Gold MUST be used to add to your positions.

One must not be an Einstein to see that by manipulating down the price

of Gold and Silver 'they' actually INCREASE the DEMAND. The day the

physical market explodes in 'their face',

the Gold and Silver pool raiders (the FED, JPMorgan, GSachs, ECB...)

will look like idiots. And idiots they will be....By rigging the markets

(Bonds, Gold, Silver, Financials, Real Estate,...) Government and Too

big to fail are digging their own graves. This time won't be different

to the

Mississippi Scheme (John Law). Most people simple refuse to learn

from their mistakes and tend to forget that John Law had to flee Paris

in the middle of the night....

-

There is

something weird about people who blindly keep "believing" in Government

and Banksters while it has become visible and

evident that they are more dangerous than Madoff!?

Propaganda is being served on a daily basis and financial markets are

openly manipulated and rigged...and still, the Herd keeps believing in

the system and their leaders....The Herd simply refuses to accept the

fact that they are being knowingly misled and that it has become a

reality that they can loose all of their savings overnight. Whether this

happens because of (hyper)inflation or deflation doesn't matter as they

are convinced they will be able to escape the Apocalypse by acting the

day BEFORE the drama unfolds.

-

The

Central banks are playing God with the interest rates

and refuse to accept the poisonous potion they are brewing by doing so. After the Real Estate crash of 2007 came the

Stock market crash of 2008 and the

Bond market crash of 2011. As always the

Sheeple will try to get out of the Bond market at the same time....For

obvious reasons the credit rating of the USA has been kept a AAA and at

the same time the Municipal Bonds have, in only one month time,

recovered miraculously. Derivatives are a powerful and magic

weapon...uncontrolled and unregulated with off balance sheet items.

Using them one can rig the interest rates and financial only in the

short term. The Natural forces of the Financial markets ALWAYS

come back with a revenge....but like John Law and Le Roi Soleil,

Bernanke, Trichet, Paulson, JPMorgan & Co. are too stupid to admit this.

Interest rates remain at historic low levels but the Bank of America

has raised the interest rate for credit card debt to 30% !...more

are brewing by doing so. After the Real Estate crash of 2007 came the

Stock market crash of 2008 and the

Bond market crash of 2011. As always the

Sheeple will try to get out of the Bond market at the same time....For

obvious reasons the credit rating of the USA has been kept a AAA and at

the same time the Municipal Bonds have, in only one month time,

recovered miraculously. Derivatives are a powerful and magic

weapon...uncontrolled and unregulated with off balance sheet items.

Using them one can rig the interest rates and financial only in the

short term. The Natural forces of the Financial markets ALWAYS

come back with a revenge....but like John Law and Le Roi Soleil,

Bernanke, Trichet, Paulson, JPMorgan & Co. are too stupid to admit this.

Interest rates remain at historic low levels but the Bank of America

has raised the interest rate for credit card debt to 30% !...more

-

Real

Estate in the USA took another hit. It was the biggest drop since 2008.

Prices were down another 8% on a year to year basis and we may not see a

bottom before 2012..more.

Monday May 9, 2011 -

Short term

fluctuations are like a Roulette. What counts is to be correctly

invested and to ride the waves (up and down). If Gold expressed in Swiss

Franc sits in the bottom of its uptrend and is oversold, how much more

then can Dollar- Gold correct? DANGEROUS and SCARY is the market action

for Swiss Franc, Aussies and CanDollar against the US-Dollar and the

Euro this past Friday....(see the candle charts)

-

The

$CCI (commodity index)

provides a good indication as to how important the correction can be for

the commodity sector as a whole. This has

implications for stocks, Gold, Silver, Copper, Bonds, the Dollar, the

Euro,...Do check the candle charts and remember at all times that

NOTHING goes up or comes down in a straight line!

-

The

$-Gold correction

could have very short legs. Having said this, the

maximum correction from top to bottom of correction is about 10% (don't

let the big numbers scare you) and bottom fishing has always been a hard

discipline. Prices will go up when TIME has come! The

Silver PF chart

looks toppy after the $ 50 spike and here we may need more time

and Silver will as usual correct heftier...Don't forget our

Silver/Gold ratio has moved in FAVOR of Gold. Expressed in Swiss

franc we may have seen a Bull trap. If confirmed Silver will need a lot

more time than Gold to come out of the woods. Eventually it will resume

its bull run in the same way we saw it during the past weeks.

We have updated he major fiat currencies expressed in Real Money

and a walk through these sections will as usual give you

a CORRECT picture of the expectations for Gold over the next days and

weeks. Interesting is for example the

candle chart of Gold expressed in Euro.

The

$-Gold scenario

has been updated. The correction is early

but at the same time allows for a higher top of $ 1750. IMPORTANT

is to understand the PF charts are telling us that EITHER we shall see a

upward acceleration of the Gold price or Gold is to fall back to the

bottom of its secular bull trend (

Sterling,

Yen,

Swiss Franc, Dollar, Ruble,

Rupee) and

to the BOTTOM of the sideward accumulation (South-African

Rand, Euro, Can Dollar,

Aussie).

I increasingly get the feeling that the correction we have for Gold and

Silver is engineered by panicking central banks. Financial History shows

over and over again that this is the last available weapon (together

with misinformation - call it lies) . Gold is # 1 money, the

Aussie # 3 , the Swiss # 4 and the CanDollar # 5.

-

The

Dollar/Euro

correction also could have short legs. Having

said this, such is of minor importance for Goldonomic

as we advised months ago to move away form these currencies into the

Australian Dollar, Swiss Franc and Canadian Dollar. Gold off course,

remains our #1 currency.

The Point and Figures chart for the Dollar and Euro versus SWISS FRANC,

CANADIAN DOLLAR and AUSTRALIAN DOLLAR spells DANGER, DANGER.

-

The single

most important chart for the Dollar is the

Dollar/Swiss franc . It is the canary in the

Forex min for the Dollar. Remember that for the last weeks we told

you to buy SWISS FRANC!

-

The day is

coming where not only Greece but also Spain, Portugal, Ireland, Italy

and France will abandon the Euro and go back to their

good old currency which they could devaluate each time their economy

requested...more

. What Caesar, Napoleon and Hitler failed to unite won't be done by a

bunch of incapable professional narcissistic politicians.

Friday May 6, 2011

-

Our Canary

in the mine shaft for the Stock markets - The Footsie -

did once more not manage to break through the 6100 level...more

on the stock market indexes A random walk through the different

World Stock indexes still don't convince me that this year the "Sell

in May and stay away" expression will be honored. Markets may be

overbought but the intermediate bull trend is still intact for

particular markets.

-

The

Mexican Central Bank buys 100 Tonnes of Gold. Only

years ago, Mexico went through a financial meltdown....they know what

they are doing...more

If Central Banks (China) continue to buy Gold the correction we see

right now will have VERY SHORT LEGS!...more

-

Gold and Silver

continue to correct. How deep will the correction be

and why is Silver correcting so severely? Most investors forget or fail

to understand it is the paper market and NOT the physical market which

is coming down. In all cases, any dip must be used to ADD PHYSICAL GOLD

and SILVER to your positions. Important is to monitor how Gold is doing

when expressed in other currencies (Euro, Sterling,...) as this allows

to judge the severity of the correction.

-

Silver is

in backwardation...so what!? When we are

dealing with the Comex silver market we are dealing with a paper market.

Keep in mind that hedge funds that trade the paper markets do not care

about fundamentals. They are pure technicians who rely solely on their

computer trading algorithms to make trading decisions. These algorithms

are utterly indifferent to the realities in the physical market.

-

The

US dollar is

oversold and the Euro overbought....give it some time

to digest the move before the initial trend is resumed. But don't expect

anything spectacular.

Thursday May 5, 2011 - Gold and Silver shares will go A LOT HIGHER! (and

so will Gold & Silver)

I

would ask you to take some time and learn about following technical

formation so you can better understand the PF formations we see for the

Gold & Silver Index (HUI), Copper, e.o. I

would ask you to take some time and learn about following technical

formation so you can better understand the PF formations we see for the

Gold & Silver Index (HUI), Copper, e.o.

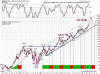

The HUI index has broken though a 27 year long resistance

line. After all these years Resistance is overwhelmed because of

external factors. In a rising market, a previous resistance level,

once penetrated becomes the initial support (500

on the HUI index) level. Most investors will at this time

re-establish their positions and as is often the case, only a modest

amount of buying is sufficient to launch a self-feeding upward trend.

Existing investors let their profits run (less selling) and new

investors become more aggressive (more demand).

We have a consolidation/accumulation formation right

on top of the Support line (500 on the

HUI index). Such is an additional confirmation of the Long Term

Trend Reversal. A similar pattern is developing for

Copper right on the Support line of 400

-

If Silver sticks

to its historic pattern, I expect a correction of around 40%

-

Gold and Silver

shares:

technical BUY signal

-

Oil shares are

overbought. Expect a correction (probably not for

drillers and oil services)

Wednesday May 4, 2011

-

We

had a spectacular technical breakout of Occidental Petroleum.

(one of our favorites) Short term the

petroleum sector

is overbought and running into the 2008 resistance. Buy the dips....The

shares in this shopping basket will go A LOT HIGHER...after a

correction... We

had a spectacular technical breakout of Occidental Petroleum.

(one of our favorites) Short term the

petroleum sector

is overbought and running into the 2008 resistance. Buy the dips....The

shares in this shopping basket will go A LOT HIGHER...after a

correction...

-

There is a

50% profit locked in our

Uranium mines.

-

Natural Gas

sits on the verge of a breakout and

COAL is heating up the boilers.

We don't like ETF's but we're sure they will start to

perform properly....

-

Copper and

the Agricultural index are consolidating right on top

of their breakout level and Platinum has

resumed its bull run...more If we get

another hot summer we may be on the road to create a 7 year weather

cycle that will burn up crops and keep food prices rising (notice the

increased volcanic activity)

-

The

Gold and Silver juniors have

corrected back either to the 50 day (strongest) or

the 200 day Moving Average, are oversold and a BUY. The 6 month long

consolidation/accumulation is coming to an end. Be aware that the sector

books exponential earnings and can suddenly reverse course. Gold and

Silver shares CAN move up by 30% and more in a day's time...All

those who have been patient for the last 6 months must not give up NOW.

Technically speaking we have an additional confirming consolidation

right on the 27 year support line. Once the Index brakes out of this

consolidation, prices will AT LEAST DOUBLE. Don't forget that at a

certain point the investor will shift from the dangerous Gold/Silver

derivatives into Gold and Silver shares which contrary to these

derivatives will pay nice dividends.

If you are really impatient, ADD to your positions NOW. It will

make you feel better!

-

We told

you to be cautious about

Silver. If $

42 does not hold, expect to see $ 39. The correction has started. The

increase in margin requirements by the CME (COMEX) did again have the

expected result. The change came into effect AFTER yesterday's

close. I expect in the near future to see the Silver margins to be

raised to cash. Expect the correction to be swift and violent!

-

Amazing is

that each time Gold

and Silver are initiating a correction as they bump

into the top limit of their PF trend channels or after reaching the

objectives (Silver)

Tuesday May 3, 2011

-

The Ghost

of Osama Bin Laden must be powerful:

according to the talking Heads it made the price of Gold

and Oil come down and pushed the value of Stocks upwards....these simple

minds should be banned all together for they do no more harm than good

and make the investor feel insecure. It is sickening to see the

proliferation of so much idiocy through the Media.

-

This is a

secular bull market for Gold. Make sure you have physical Gold, store it

safely and sit tight...and PLEASE don't start trading.

A top to bottom correction of 10% ain't worth the risk of

a mistake. If $-Gold rises from $1570 tot

$ 1650, makes a nice short term top at $1650 and corrects to $1480

before resuming its uptrend, it really isn't worth the hassle to try to nail the top, and suppose you do, make sure you nail the

subsequent short term bottom. [even if we adjust the objective and

correction, the correction margin remains 10%. [ Translated in

Euro's one may because of the exchange rate fluctuation between the

Dollar and the Euro even not see any correction at all.

to try to nail the top, and suppose you do, make sure you nail the

subsequent short term bottom. [even if we adjust the objective and

correction, the correction margin remains 10%. [ Translated in

Euro's one may because of the exchange rate fluctuation between the

Dollar and the Euro even not see any correction at all.

-

The fact

that the price of Gold mines still sit around a level of 2001 Gold, is

not the result of the potential nationalization risk of these mines.

The reason it that many investors have directed their

savings into DANGEROUS DERIVATIVES: ETF's, Warrants, Turbo's,

Options,...and other unregulated-uncontrolled bank manufactured

investment instruments. The day that the market starts to smell RAT

these funds (of the left overs) shall be redirected into the Gold and

Silver shares. Add to this that you must hold the share to receive a

dividend....and dividends of Gold and Silver co's will SOAR.

Better think twice before you decide for a bank manufactured product!

Also be aware that Bankers have been shorting extensively the shares of

Gold and Silver mines: they can short the stock and go long the

Derivative.... The argument that the price of Gold and Silver

shares lag because of a potential nationalization risk is not correct.

No African leader will take this risk. A perfect example is Randgold

(which has a gold mine in Ivory coast). Even during the worst of the

Civil War the mine was operating as nothing happened. Most African

countries are depending upon the export of commodities for their

survival and to risk a nationalization would be suicidal. Gold and

Silver miners are earning BIG

MONEY!

-

Many Gold

and Silver shares are (also) quoted in US-Dollars. But

the fact that a share is traded in Dollars on an US stock exchange

doesn't mean that by acquiring such a share, you also acquire a Dollar

risk. Harmony and Kinross

not only have mines over the whole world, but the shares are traded on

different stock markets. The financial institutions (trading

departments) ensure the price of a share is regulated all over the

world. Assume you buy Kinross on Wall Street in Dollars, the price of

the shares will go up when expressed in Dollars if and as the Dollar

weakens and vice versa.

-

$-Silver

has landed EXACTLY where we predicted it would: Objective #2 ...more

Monday May 2, 2011 - Today is a Bank Holiday in most of Europe.

-

Your

emotions are your #1 enemy when investing. You may be

a successful business man/woman but this does not make you a successful

investor. Bankers know this and operate out of impressive buildings and

wear Armani suits. Unfortunately many find out that their knowledge and

experience fails. Why do most people run to see a doctor as soon as they

don't feel well but fail to talk to a specialist if they see that

something is ashtray with the financial system and this will affect

their savings?

-

The more I

see the financial press forecast a correction of Gold and Silver, the

less probable it is to happen...see the section of

Gold objectives...and how small a potential correction

will be. A maximum correction of 10% from top to bottom is hardly

worth the risk!

-

Spanish

people love big figures. The

day the Euro was introduced in Spain retail prices were

often multiplied by 4. Spanish people were used to high nominal prices.

One hundred peseta was worth almost nothing and all Spanish were peseta

millionaires. Today their double stupidity (becoming part of the EU,

adopting the Euro and multiplying prices by 4) is the main reason why

the chickens are coming home to roost: official unemployment figures are

21% (reality is a lot worse). Real Estate prices suck (hard to call the

junk they built real estate) and Spanish people are back to square one:

olives and sheep. As long as Spain is part of the EU their economy

will DEFLATE up to the point where prices would have been after a

devaluation of the Peseta.

-

Today

professions which are of basic importance for society are rewarded LESS

than those which bring no real added value.

We live a reversal of fields where a football

and a tennis player make more money that anybody having an university

degree, than a medical doctor, an engineer,...Such not only adversely

affects society but also states a bad example for the youth.

-

The

Oil sector is

making big bucks and is rewarding its

share holders not

only by paying out a dividend but also by a capital gain (rising share

prices). We still advise to add to your positions: buy dips/corrections

and sit tight.

> back to the top of the page

> to all Archives

> back Home

© Copyright -

Florida, USA -

+1

(772)-905-2491

+1

(772)-905-2491 |