|

Posted Wednesday, 11 November 2009

In February 2009 Zimbabwe was the only country in the world without debt.

Nobody owed anyone anything. Following the abandonment of the Zimbabwe

Dollar as the local currency all local debt was wiped out and the country

started with a clean slate.

It is now a country without a functioning Central Bank and without a local

currency that can be produced at will at the behest of politicians. Since

February 2009 there has been no lender of last resort in Zimbabwe, causing

banks to be ultra cautious in their lending policies. The US Dollar is the

de facto currency in use although the Euro, GB Pound and South African

Rand are accepted in local transactions.

Price controls and foreign exchange regulations have been abandoned.

Zimbabwe literally joined the real world at the stroke of a pen. Money now

flows in and out of the country without restriction. Super market shelves,

bare in January, are now bursting with products.

I

recently visited Zimbabwe in the company of a leading Australian fund

manager. As a student of monetary history, I was interested to see what

had happened to a country that had suffered hyperinflation. How did the

people cope? How is the country progressing now? The current Zimbabwean

situation is complicated by the fact that President Robert Mugabe is

determined to stay in power whatever the cost.

The first part of this article deals with economics, the hyperinflation

and current situation, which is a picture of recovery and potential

vigorous growth. The second part deals with politics, both the historical

aspects as well as current developments, which are extremely fluid.

We were fortunate to have private interviews with the Prime Minister,

Morgan Tsvangirai, and a wide range of business leaders. This provided a

quick picture of Zimbabwe past and present.

There are common denominators in all hyperinflations. Generally

government finances reach a point where large budget deficits cannot be

financed by taxes or borrowings. The choices come down to austerity (with

the government cutting back its spending) or by funding the deficit by

creating local currency through the printing press, leading to the

inflation tax. This is always a political decision, but the line

of least resistance is the printing press. Cutting government

expenditures and laying off bureaucratic staff is anathema to most

politicians.

In Zimbabwe, Robert Mugabe has made it his mission to remain President for

life. This has caused him to infiltrate his supporters into the army and

police force. He also used Government finances as a way of funding

patronage. His use of the printing press was liberal and nobody was

prepared to stand up against him. This eventually led to inflation

gathering momentum to the point where the armed forces were getting

rebellious – they wanted more money. When Mugabe caved in to these

demands, the Zimbabwe Dollar plunged.

Shortly after Mugabe was elected President in 1980, the Zimbabwe

Dollar was worth more than the US Dollar. The ongoing abuse of the

financial system eventually produced a runaway inflation. The largest bank

note issued in Zimbabwe was for One Hundred Trillion Dollars and is

pictured below. These notes are now collector’s items and I had to part

with US$2 to a street vendor to acquire the note depicted below.

The worst trauma for ordinary people during the hyperinflation was lack of

food. This was due mainly to the imposition of price controls. If the cost

of production of an item was $10 and the price controllers instructed that

the item could only be sold for $5, the business would soon go bankrupt if

they sold at the controlled price. The result was that production and

imports just dried up, hence the empty shelves in the supermarkets.

People survived by shopping in neighboring countries and relied on

assistance from South Africa and the aid agencies. Companies

survived the hyperinflation with great difficulty and often by ignoring

laws. Although companies were left without debt post February 2009, they

were also left deficient in working capital and had dilapidated plant and

equipment. Regular repairs and maintenance could not be afforded.

Most companies now require urgent recapitalization.

There has been a major exodus of Zimbabweans over the years, estimated at

about 3 million prior to 2008. Many of these were qualified people who

were subjected to Mugabe’s campaign of terror. During the latter stages of

the hyperinflation there was a further exodus because people were

starving. Most of these people went south into South Africa. The current

population of Zimbabwe is estimated to be between 10 and 12 million

people, so the numbers that have fled the country are significant relative

to the total population.

Current economic activity is strongly supported by remittances from

Zimbabwean migrants to their families in Zimbabwe. Once the political

situation settles down, it is likely that many of these migrants will wish

to return to Zimbabwe. Some have already done so. Many activities

that perished in the hyperinflation, such as insurance, are now starting

to resuscitate.

Credit financing activities are starting to revive. Visa credit cards are

once again operating successfully in Zimbabwe, others will surely follow.

Banks have had both sides of their balance sheets devastated by

hyperinflation and now have no lender of last resort to call on.

They are understandably cautious in lending the deposits that are slowly

filtering back into the system. Banks also lost much of their equity

capital. Barclays Bank survived because it had 40 branches where the bank

owned the real estate and had a strong parent. These properties plus some

foreign currency holdings represent the equity capital on which the bank

currently operates.

In a country with no debt, only assets, people and companies are under

geared. With the ultra cautious lending policies of the banks, there is a

huge opportunity for foreign investors in the credit purveying industry.

There has been a sharp rise in economic activity since February. Real

wages have risen substantially compared to a year ago. Whatever workers

were paid in Zimbabwe Dollars during the hyperinflation bought virtually

nothing. Now even the minimum wage of around $100 per month allows for

basic purchases. A 10kg bag of maize meal, a staple in the local diet,

costs $3.50 and lasts for two weeks. Demand for products and services is

increasing rapidly. Corporate profits are rising, leading to greater tax

revenues for the Government, augmented by rising VAT taxes. Greater

Government revenue allows for greater Government spending.

This self-reinforcing loop will continue. The improvement in the

economy will become dramatic once Mugabe leaves the scene. At that

time aid agencies, NGO’s, Charities and foreign governments will start

injecting large volumes of funds and assistance into the country. They

refuse to commit any meaningful funds while Mugabe is still the President.

With Mugabe out of the way and the economy recovering strongly, one could

reasonably anticipate that a large proportion of the Zimbabweans living

overseas will return to the country bringing welcome skills and capital.

Indeed foreigners will also be attracted to investing in the country in

those circumstances.

It is fascinating to see how rapidly the economy is recovering. It is a

great testament to what can be achieved in a free enterprise environment

by the elimination of controls combined with the institution of new money

that people trust. It needs to be money that their Government cannot

create via the printing (or electronic) press.

The economic future of Zimbabwe is likely to be in mining,

agriculture, tourism and service industries, especially those providing

infrastructure and maintenance facilities. There remain many

problems, not the least being chronic unemployment, but the future looks

bright beyond the Mugabe horizon. The population is amongst the best

educated in Africa and most people can speak English. With the Zimbabwe’s

natural assets, there is scope for realistic optimism about the economic

future, especially once the current political difficulties are overcome.

The population has been brutally traumatized by the hyperinflation and the

political situation. They really deserve a decent change of fortune.

THE POLITICAL SITUATION.

To understand what has happened and is happening in Zimbabwe, it is

necessary to look at some history. Modern Zimbabwean history began in 1890

with the arrival of the Pioneer Column of white settlers under Leander

Starr Jameson at the behest of Cecil Rhodes. Initially they were searching

for gold but when nothing of importance was found, they turned to pegging

land for farms. The initial settlers were fortune hunters, grabbing land

at every opportunity.

Prior to the arrival of the white settlers, the Shona tribe occupied

the northern part of the country called Mashonaland, and the Ndebele tribe

were ensconced in the south, called Matabeleland. In 1896 these

tribes rebelled against white rule in one of the most violent episodes of

resistance in the colonial era. In Matabeleland a somewhat dubious

settlement was negotiated but in Mashonaland the Shona chiefs were hunted

down until all resistance ceased. No Peace Treaty was ever signed with the

Shona tribe.

The Shona, in particular, have never forgotten this. Mugabe, who is from

the Shona tribe, has made it his life’s work to recover for his people the

land that was “stolen” by the whites. He has repeated this statement on

many occasions.

A

book by Martin Meredith titled “MUGABE: Power, Plunder and the Struggle

for Zimbabwe” published by Jonathan Ball, gives a very readable account of

the recent history of Zimbabwe up to 2006, prior to the worst of the

hyperinflation. It is required reading for anyone wishing to gain a

balanced understanding of what has happened in that country with an

emphasis on the period since Independence was granted in 1980.

Returning to the white settlers, there was always an unfair division of

land between whites and blacks. This was accentuated after the Second

World War when Rhodesia benefited from an influx of white immigrants.

Farming boomed as a result of better equipment, better farming methods and

better seeds. The number of white farmers increased from 4,700 in 1945 to

8,600 in 1960, increasing the demand for white occupied land. The black

population was also expanding and African grievances over land eventually

swelled to voluble protest. This is the background to the land invasions

on white farms over the last decade. Mugabe was making good his promise to

return the land to his people.

In 1962 Ian Smith’s Rhodesian Front party swept to power on their policy

of maintaining the status quo for the white farmers. During the 1960’s

Britain was in the process of granting independence to its various

colonies. Smith attempted to negotiate independence for Rhodesia but

Britain would only accede to this if it was on the basis of democratic

(one person, one vote) elections. Smith was intent on entrenching white

minority rule “forever”, so Britain refused.

On 11 November 1965 the Smith government made a Unilateral Declaration of

Independence which they claimed had precedent in the USA Declaration of

Independence in 1776. This triggered a range of reactions. Sanctions were

imposed by Britain and the United Nations. The black population was

outraged, leading to the formation of black resistance movements aimed at

changing the government.

Smith introduced the Law and Order (Maintenance) Act which allowed

the government to literally do anything without recourse to the Courts or

rule of law. One of his first acts was to imprison four black

nationalist leaders without trial or publicity. Mugabe was one of these 4

and he spent the following 11 years in prison. He was released in 1974

during a brief cease fire between the Rhodesian forces and the liberation

movements. Mugabe took the opportunity to escape across the border into

Mozambique where he became leader of the resistance movement and was

instrumental in organizing many terrorist raids on farms in Rhodesia.

The terror war became increasingly vicious on both sides. Rhodesian forces

regularly crossed into neighboring territories, dealing brutally with the

local population suspected of harboring terrorists. The neighboring

countries eventually insisted that a peace deal be consummated. They would

no longer tolerate liberation movements on their soil. Mugabe reluctantly

agreed. The guerrilla war had spread to all corners of Rhodesia, forcing

Smith to also come to the negotiating table.

In early 1980 the country became independent and changed its name to

Zimbabwe. Mugabe stunned everyone by gaining 63% of the popular vote at

the first elections. Despite claims of vote rigging and intimidation of

voters, the numbers were so overwhelming that it was conceded that Mugabe

had won and he was elected President of Zimbabwe. People just wanted

peace.

Mugabe, despite initial claims of moderation, set about entrenching

himself as president, a position he wanted to claim for life.

Surprisingly Mugabe did not repeal the Law and Order (Maintenance) Act

that the white regime had used to cover its many evil acts. Mugabe relied

on its terms to justify the terrible things that he perpetrated over the

ensuing 3 decades.

These atrocities are recorded in Martin Meredith’s book “Mugabe” and there

is no point detailing them now. Suffice to say that he was bent on

eliminating his opponents and intent on punishing anyone who criticized

him. His Zanu-PF people infiltrated the army and the police force and were

at his beck and call to act as thugs when required. Faithful people were

rewarded with a range of patronage that he dispensed.

He found a compliant partner in the Governor of the Reserve bank, which

became Mugabe’s source of funds to pay his people and to dispense his

patrimony. Needless to say, much of the money came from printing new

Zimbabwean dollars, which caused inflation to gradually increase. Finally

the army and police forces to got cranky, publicly demanding much higher

pay.

The following is extracted from Wikipedia.org:

On 16 February 2006, the governor of the

Reserve Bank of Zimbabwe,

Gideon Gono, announced that the government had printed ZW$20.5 trillion in

order to buy foreign currency to pay off

IMF

arrears.[51]

In early May 2006, Zimbabwe's government announced that they would produce

another ZW$60 trillion.[52]

The additional currency was required to finance the recent 300% salary

increase for soldiers and policemen and 200% increase for other civil

servants. The money was not budgeted for the current fiscal year, and the

government did not say where it would come from. On 29 May, Reserve Bank

officials told IRIN that plans to print about ZW$60 trillion (about

US$592.9 million at official rates) were briefly delayed after the

government failed to secure foreign currency to buy ink and special paper

for printing money.

On 27 June 2007, it was announced that central bank governor

Gideon Gono

had been ordered by President

Robert Mugabe

to print an additional ZWD$1 trillion to cater for civil servants' and

soldiers' salaries that were hiked by 600% and 900% respectively.[53

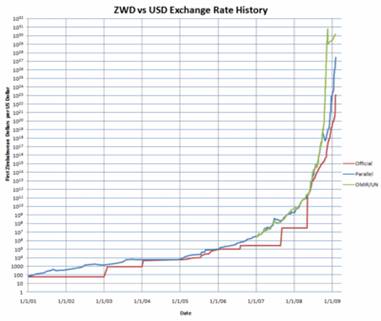

Official, black market, and OMIR

exchange rates Jan 1, 2001 to Feb 2, 2009. Note the

logarithmic scale

Clearly Mugabe was responsible for the hyperinflation. The causes were

those always present in these events. A weak economy, large government

budget deficits, inability to borrow funds combined with the political

decision not to cut Government spending. Governments are reluctant

to lay off government employees, especially those related to the armed

forces. The latter might invite a military coup. The only source of

funding left is the creation of new money.

A very important factor in assessing the current situation is that

Mugabe no longer has his own private source of funds to continue with his

system of patronage. The army, police force and civil servants are paid by

the Unity Government. Mugabe’s power base must be disintegrating rapidly.

He has also become very unpopular. It seems unlikely that he could

win an election again, even if he managed to get his thugs to resort to

intimidation. People identify Tsvangirai and the MDC with the new monetary

disposition and the improved economy, while Mugabe is correctly blamed for

the trauma of hyperinflation.

There is also the question of sanctions. In recent speeches Mugabe has

said that it was time for sanctions against Zimbabwe to be removed. This

is nonsense. It is Mugabe and 200 of his associates who are under sanction

by the US and other countries under the Zimbabwe Democracy and Economic

Recovery Act. This prevents them and their families from traveling

overseas and freezes their external bank accounts.

This combination of circumstances, combined with the fact that he is 86

years old, suggests that Mugabe must be under pressure to resign. It is a

logical deduction that behind the scenes Mugabe must be attempting to

negotiate a form of amnesty against prosecution. The next month is

important as the SADC, which guaranteed the terms of the recent Unity

Government, has given Mugabe until 6 December 2009 to comply with all

outstanding issues. Details of developments and current Zimbabwe news can

be found at

http://www.zimbabwesituation.com/

COMMENTS and CONCLUSIONS.

Having seen the impact of hyperinflation at close quarters, my view

is that this is the least desirable method for eliminating excessive debt.

The population has been traumatized physically (starvation), mentally and

financially. Most people did not have foreign assets or local tangible

assets, so lost virtually everything. The companies survived using unusual

skills, ignoring laws and protecting working capital by holding foreign

currency or purchasing equities.

The alternative option for eliminating excessive debt is to take the tough

political decision of allowing ‘too big to fail” companies to fail and

accept the unpleasant economic consequences. Excessive Government spending

should be curbed. A sound currency, elimination of all rules and controls

in a completely free market will produce a much better result in the long

term. If this option were adopted, the short term would likely be

extremely unpleasant, possibly including an economic depression. It is

doubtful whether any Government today has the courage to take this route.

Sadly this implies that the world is headed down the path of currency

destruction that will eventually result in a Zimbabwean situation for the

elimination of debt. Zimbabwe may yet prove to be a role model,

demonstrating how rapidly a country can recover from the devastation of

hyperinflation and the elimination of debt.

In Zimbabwe the serious problem of the land issue remains to be resolved.

Morgan Tsvangirai indicated that security of land tenure was vital. One

option is the Zambian model where all land was nationalized followed by

the issue of 99 year leases to property holders. The MDC will also look at

some form of compensation for farmers who have been dispossessed. They are

anxious to see a land audit set up, but Mugabe is stalling on this for

obvious reasons.

On mining, the MDC are examining a bill that will require concessions to

be developed in a shorter period, perhaps 2-3 years, compared to 100 years

currently. They will aim at a combination of royalties and taxes to

provide the State’s share of mining profits rather than insisting on a

percentage of local ownership.

PERSONAL

NOTE.

My family was concerned about me going to Zimbabwe. “Don’t you know that

it is a dangerous place?” I admit that I was nervous too. International

news on Zimbabwe seems to be preoccupied with violence, particularly the

brutal land invasions and physical intimidation in the political sphere.

The fact that foreign media have not been allowed into the country until

the past few months has resulted in a false image being projected.

Mugabe’s thugs have closed down newspapers that were critical of his

regime, so news has tended to be pro-Mugabe.

We arrived late on a Saturday evening and due to the massive time change,

I woke very early on Sunday morning. I decided to take a walk around

central Harare and found my way to the Harare Catholic Cathedral. There

were Masses in the local language at 7am, 8am, and 9am, followed by an

English Mass at 10.00am. All four Masses were standing room only, as can

be seen in the photograph below.

Standing room only at four consecutive Masses at the Harare Catholic

Cathedral.

The people were well dressed and looked well nourished. They were all

friendly and affable. My view that Zimbabwe was a dangerous place did a

dramatic about turn. These were peaceable people who wanted nothing but a

quiet life. Walking around the streets, I never felt harassed physically.

The curio sellers at Victoria Falls were a pain, but so are street vendors

everywhere. They were certainly all friendly and intelligent. They could

get involved in a serious conversation and all had strong views about

economics and politics. Obviously it is Mugabe’s thugs that people fear,

but that is becoming less of a problem.

All my preconceived ideas about Zimbabwe were smashed. I now believe it

has a bright future, especially once Mugabe leaves the scene. I was

sufficiently encouraged by the prospects for the economy and sufficiently

impressed by the high quality of the senior executives of major companies

to make some small initial personal investments on the Harare Stock

Exchange.

Anyone looking for a safe, interesting, place to visit should consider

Zimbabwe. I think that you will be pleasantly surprised and have an

enjoyable trip.

Alf Field

10 November 2009.

>back to Inflation

|