August 2020

Unthinking respect for authority is the greatest enemy of truth.

![[Most Recent Quotes from www.kitco.com]](https://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif) |

![[Most Recent Quotes from www.kitco.com]](https://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif) |

|

| physical: add up to $200 per oz. | for physical add up to $11 per oz. | Are you still Paper Gold? |

NOTE:

- The internet system makes it harder and harder for us to send out email messages and for you to receive these in your Inbox. If you wish to increase the odds, you have to create in your email system the following email addresses: This email address is being protected from spambots. You need JavaScript enabled to view it. and This email address is being protected from spambots. You need JavaScript enabled to view it. and check your spam box.

- Better, we advise you to consult the site on a daily base. Updates are made three times a week: on Monday, on Wednesday, and on Friday.

- If you don't have a subscription, better take one now and profit from our special BEFORE we link the price of the subscription to the price of Gold & Silver.

- Go back and read the older updates - there is A LOT of valuable information in these.

I believe in intuitions and inspirations. I sometimes feel that I am right. I do not know that I am.

Click here for our Privacy statement.

Monday, August 31, 2020 - Democrats are selling their own MOM to get into the White House!

Updated Sections: ,

'Trump voters' enthusiasm is 'OFF THE CHARTS!' Are you ready for a Trump victory? Are you ( and Democrats) mentally prepared to be outsmarted by Trump again?" Expect MORE Riots (Black lives Matter), Corona, and Anti-Corona protesters as the November Presidential Elections (November 3) come closer...Having said this, IF the Democrats (American Communists) do win the White House, we expect it to be the end of the Western World.

'Trump voters' enthusiasm is 'OFF THE CHARTS!' Are you ready for a Trump victory? Are you ( and Democrats) mentally prepared to be outsmarted by Trump again?" Expect MORE Riots (Black lives Matter), Corona, and Anti-Corona protesters as the November Presidential Elections (November 3) come closer...Having said this, IF the Democrats (American Communists) do win the White House, we expect it to be the end of the Western World.

The HERD is driven and blinded by FIAT MONEY (and by FEAR). They try to accumulate as much FOOLS GOLD as possible. However, once they hold it, they keep holding it until Taxation, Depression (bankruptcies), Hyperinflation, War,...takes it away. It seems to be impossible for the HERD to make a distinction between REAL MONEY (physical Gold & Silver) and FOOLS GOLD.

"The Herd cannot see the difference between Real Gold and Fools Gold."

It impresses me how people who were able to accumulate, save, and inherit important amounts of Fiat Money, don't have to brains to safeguard it. Propaganda certainly plays an important role. But WHY are those people unable to have a reasoning process and can they not distinguish fools gold and fiat money from REAL Money (Gold). Why do these people believe that real estate will safeguard their wealth and purchase power, while history and logic tell us it NEVER does. Why are so many blinded by these cryptocurrencies?

COVID-19. There is no and there will not be such a thing as a second wave. For any human creature who can SEE, LISTEN and REASON, there is NO DOUBT the COVID-19 is nothing but a hoax, a FLU used to scare and control the stupid Herd. Those crying a second wave have probably been bribed by Big Pharma who already see the $$$-vaccinations rolling in. Insiders know that bribes often are as high as $100 to $900 million. Everybody has a price. Especially politicians.

COVID-19. There is no and there will not be such a thing as a second wave. For any human creature who can SEE, LISTEN and REASON, there is NO DOUBT the COVID-19 is nothing but a hoax, a FLU used to scare and control the stupid Herd. Those crying a second wave have probably been bribed by Big Pharma who already see the $$$-vaccinations rolling in. Insiders know that bribes often are as high as $100 to $900 million. Everybody has a price. Especially politicians.

COVID-Tests are absolutely unreliable. One can be tested positive today and negative the next day (and vice versa). Statistics are unreliable. Hospitals are empty. It becomes clear that something much worse is happening. Those who in March of this year preached that we would have millions of deaths, never followed the rules themselves. And we did not see a million deaths. This clearly PROOFS that in March of this year they already KNEW that is was a HOAX. Also, today, in order to keep the FEAR alive, the focus is on the number of infections and not on the number of casualties.

"Soon they will tax you like there is no tomorrow!"

The conclusion?! Expect a catch, expect the scorpions to sting the coming weeks and months. They are coming after your money, after your savings. Expect Authorities to create even more fiat money, expect Authorities to tax you like there is no tomorrow. Countries without Capital Gain tax, without Wealth taxation, will soon get it. Taxation is all indebted countries will dramatically increase...to compensate those who suffered because of this political, artificially created COVID-IDIOCY.

French video with subtitles.

The end of summer means that the market is going to come back big. When everyone is back from vacations and schools get up and running, the market will see a swoon. Will that momentum and volume bring the market up to even higher highs? Or is this the tipping point? Our charts tell it all. More in the subscribers' sections.

Important Fundamentals:

- Stock Markets, Equity Markets, Bond Markets, Real Estate markets, Currencies, are all DRAMATICALLY OVERVALUED. One has to be nuts to keep his savings into these markets and/or into the Banking system. Banks are technically bankrupt and so are Central Banks. Whether or not this COVID is a hoax or not, the coming weeks and months we are going to see a shower of bankruptcies. Our previsions for 2021 are GRIM. Even if Donald Trump is re-elected. This Tsunami cannot be stopped.

- Oil majors can’t afford dividends. Click here for more

Important Technicals:

- Natural gas continues to rally and we have 2 breakouts of Solar Energy cos. (see sections).

- Charts tell more than 1001 words. Charts below CLEARLY show us what to expect in the coming weeks. Don't forget to pay special attention to AAPL for this stock is together with the other FAANG) an indicator for the US-Stock market indexes. A 50% correction will come with a lot of Media-coverage. What is coming, will even make a Trader (we call these Casino players) happy. As usual, we won't tell those who are too greedy to compensate us for our hard work...Click here for more

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic.

Friday, August 28, 2020 - No, your money is not safe with the bankers...

Updated Sections: ,

If you want to survive the Great Reset where EVERYTHING will go digital, you must get out of the financial system NOW. Real Estate is not an intelligent option. There is only one way to be safe: get into physical gold and silver, store it out of political reach, and re-enter the system later on in a thoughtful way as it pleases you. The price level where you get into Physical Gold and Silver is absolutely IRRELEVANT. Soon it will be the have and the have not.

The COVID-19 has become and is an inherent part of this Inflationary-Depression. Few understand that the COVID-19 is used all over the world by Politicians, Authorities, and Bankers as a tool to control the people and as a scapegoat for Fiat Money creation, Helicopter money, and other things which are to come.

"The fact that this COVID-thing is so politicized cries DANGER & CORRUPTION."

Video with Dutch subtitles. Note how the UN, the IMF, NGO's etc...are interacting and pulling the ropes.

This is a rather long video but you must watch it! It has been banned on YouTube. Bill Gates and his slimy hands have been around for years. I learned to know him years ago when he visited FLANDERS LANGUAGE VALLEY in Belgium. What happened after his visit tells it all about this guy. If I had to choose between Gates and an ordinary thief, I would trust neither but would go for the thief.

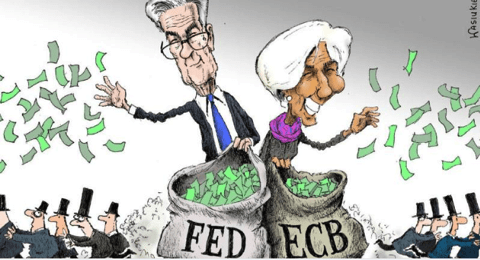

Forget the FDIC, the Central Banks,... your money is NOT safe in the Banks. You have to be crazy to maintain large deposits with banks. You have to be crazy to maintain large portfolios with banks and brokers. This is just a mere beginning of the BIG DEPRESSION of the 21st Century. With a bankrupt financial system, an extremely weak world economy, and a pandemic on top of that, the Fed and the ECB are totally lost. They are continuing to throw petrol on the fire as if that would solve the problem. But instead of extinguishing the inferno, they are just making it bigger and more dangerous by the day.

Real Estate a safe place to store your savings? Forget it...As a matter of fact, if you bought Real Estate with a mortgage, it all becomes even more hazardous. According to Zillow, during the first week of July, over 22.6% of U.S. rental households did not pay any rent, which is up from 19.2% in June and the highest since at least March.

One of the most significant factors in the increase of non-payments is that the government provided an additional $600 a week for unemployment since March, which ended on July 31. Without the subsidy, landlords may have to rely on cash reserves to manage any unforeseen events with a nonpaying tenant.

While some investors can offset the shortfall in rents, others may be facing financial hardship. Many rely on rental income to pay their mortgage, property taxes, maintenance, insurance, and other expenses. Non-paying tenants may induce landlords to default on their mortgages. If landlords fall too far behind, they could end up selling at a discount or default on their loans.

Important Fundamentals:

- As long as regular business travel does not go back to normal...the Click here for more

Important Technicals:

- More top building Click here for more

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic.

Wednesday/Thursday, August 26-27, 2020 - For the time being, the bandits (Deep State, Authorities) are delaying the catharsis...

Updated Sections: ,

WHAT IF!? What if they knew the world was in such bad shape that an accident and an uncontrolled economic and financial implosion could occur at any time? What if they decided to play the 'artificial coma card' and use this CORONA-SHIT and have the 'controlled implosion' we are living now? Don't you know, that THINKTANKS are paid fortunes to invent certain scenarios.

WHAT IF!? What if they knew the world was in such bad shape that an accident and an uncontrolled economic and financial implosion could occur at any time? What if they decided to play the 'artificial coma card' and use this CORONA-SHIT and have the 'controlled implosion' we are living now? Don't you know, that THINKTANKS are paid fortunes to invent certain scenarios.

"Unthinking respect for authority is the greatest enemy of truth."

Very well possible. This COVID-FEAR allows the authorities to create money like there is no tomorrow, to drop helicopter money, and to closely police control all sectors of the economy. It also allows to damper price inflation. This most of the time works in the short run. For the time being - the COVID-restrictions have lowered the general level of demand for goods and services (we have a lower velocity of money) and hence the upward pressure on the general level of the price of goods and services.

As Extreme risk and the advent of hyperinflation is most of the time signaled by social unrest, the COVID-measures, were able to (apart from Antifa and Black lives matter) minimize social unrest (Yellow Jackets).

"The Welfare economy crumbles and the Economic Activity plunges even with financial intervention."

It is bad enough that so many people believe things without any evidence. What is worse, is that some people have no conception of evidence and regard facts as just somebody else's opinion. Even more dangerous is that FEAR is blocking The Herd (+70% of the people) from having a reasoning process. It doesn't allow the Herd to think.

"You cannot multiply wealth by dividing it."

Socialism (today they call it Democracy) doesn't work. It never worked and never will. "You can't legislate the poor into freedom by legislating the wealthy out of freedom. What one person receives without working for, another person must work for without receiving. The government can't give to anybody anything that the government doesn't first take (STEAL) from somebody else. When half of the people get the idea that they don't have to work because the other half is going to take care of them, and when the other half gets the idea that it does no good to work because somebody else is going to get what they work for, that my dear friend, is about the end of any nation.

Socialism (today they call it Democracy) doesn't work. It never worked and never will. "You can't legislate the poor into freedom by legislating the wealthy out of freedom. What one person receives without working for, another person must work for without receiving. The government can't give to anybody anything that the government doesn't first take (STEAL) from somebody else. When half of the people get the idea that they don't have to work because the other half is going to take care of them, and when the other half gets the idea that it does no good to work because somebody else is going to get what they work for, that my dear friend, is about the end of any nation.

Global trade is beginning to implode. Like it or not, we truly live in a global economy. This is a global depression and it affects everybody. Official BNP figures are crashing by an average of 10%. This is a DEPRESSION level drop.

Most people don't understand what is happening today and don't even do the effort to understand. They are HERD and are following the Herd and live by fear, fiat Money, and Fools ' gold.

Even as only 0.5% of the world's assets are invested in Gold, some would-be-financial-analysts dare to pretend that gold sits in a bubble. Fundamentals and technicals CLEARLY proof this is NOT so. Gold & Silver are still severely undervalued.

There Is not a single journalist analyzing any situation today. Moreover, people do no longer take the time to read newspapers. Very dangerous at a time where all Mainstream media (controlled by an oligarchy) sell propaganda. The quality of articles published by most journalists in financial newspapers and magazines has become extremely poor and is often misleading.

Important Fundamentals:

- We have the largest central bank intervention, not just in the US but in many parts of the world, ever in history.

- Click here for more

- Are you still buying stocks?!? US Worker Must Work 128 Hours To Buy 1 Share Of S&P 500 IT Took Less Than 20 Hours In The 1980s!

Important Technicals:

- See the charts below. Maybe we should buy fishing lines and come back sometimes next month.

- Click here for more

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic.

Monday/Tuesday, August 24-25, 2020 - Do you really think (hope) these stock markets will continue to go up?!

Updated Sections: Silver,

Politics, Government is the MIRROR of the Dumb Herd. The Dumb Herd is responsible for the leaders it has elected over the past decennia. The Dumb Herd is responsible for the uncontrolled spending actions of governments over the past decennia. The Dumb Herd allowed Governments to put the world into this huge debt. The Dumb Herd doesn't understand that "The Government = themselves" and whatever the Government spends, soon or later they have to pay for. The dumb herd had no time for protest. They preferred to spend their time in the Arenas watching sports, the Olympic games, the Tour de France, and the Grand Prix.

Politics, Government is the MIRROR of the Dumb Herd. The Dumb Herd is responsible for the leaders it has elected over the past decennia. The Dumb Herd is responsible for the uncontrolled spending actions of governments over the past decennia. The Dumb Herd allowed Governments to put the world into this huge debt. The Dumb Herd doesn't understand that "The Government = themselves" and whatever the Government spends, soon or later they have to pay for. The dumb herd had no time for protest. They preferred to spend their time in the Arenas watching sports, the Olympic games, the Tour de France, and the Grand Prix.

"Whether we have inflation or deflation, ONLY Gold and Silver will protect you. Be advised the worst is yet to come."

Don't try to explain to the Dumb Herd (at least 75% of the people) what is going on. And 75% is a LOT of people. A complete waste of time and energy it is. Let them stay in their Fiat Bubbles. Let them keep their savings with some banks. They don't deserve any better.

Mind your own business and keep doing what you are doing: move your savings and purchasing power into Physical Gold and Silver and store these out of political reach. Let the Dumb Herd PAY for the debts. Let them bleed. They don't deserve any better.

Are Stock Markets about to implode as Gerald Celente forecasts? Check our charts to find out...our charts leave little doubt.

Whatever the PROPAGANDA is selling, we are moving very FAST towards a GLOBAL RESET. That is a BANK HOLIDAY where what you think you have as savings and purchasing power will be skimmed and pruned by the Authorities. Remember Governments don't take any prisoners.

Important Fundamentals:

- Delinquency rates are going up...and real estate prices going up? Something has to give in here and it will be the real estate prices. Sell your real estate NOW. This is what many alerted investors are doing now. And they are right. Once you did, DO NOT PUT your funds into Banks, Equities,...there is ONLY one way to go: physical Gold and Silver. Gold will preserve your purchasing power at all times and you will be able to use Silver as a BARTER for food, energy, and shelter.

- You should store your Gold & Silver in a politically safe country. In a country that has not those billions of debt. If there is no debt, there is less or no risk to see these confiscated. If on top you can ensure what you have against political theft make sure a loss is covered in Physical Gold & Silver. Not in fiat money.

- Gold & Silver also make it a lot easier to escape Government seizure and all kinds of taxation. Coaching relations already knot it.

- Whether we have inflation or deflation, ONLY Gold and Silver will protect you. Be advised the worst is yet to come.

- This is WHY Gold is real money - see the GIF-slide show.

Important Technicals:

- The backtest of the Gold and silver sector Click here for more

- Mind the bearish divergences on our charts for Click here for more

| Click here for more |  |

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic.

Friday, August 21, 2020 - The dollar sank to its lowest level since May 2018...exactly as we have been forecasting!

Updated Sections: Treasuries in Europe, Corporate Bonds, US Dollar, Long Term Indexes,

$-Gold, €-Gold,

Is COVID the most perfect distraction that could have hit the world? The timing couldn’t have been more perfect for the European and American economies. We knew that there were major problems in the financial system back in August-September 2019 when both the ECB and the Fed declared that they would do what it takes to save the system. And since then we have seen massive injections of liquidity in the form of QE and Repos.

Is COVID the most perfect distraction that could have hit the world? The timing couldn’t have been more perfect for the European and American economies. We knew that there were major problems in the financial system back in August-September 2019 when both the ECB and the Fed declared that they would do what it takes to save the system. And since then we have seen massive injections of liquidity in the form of QE and Repos.

This is how bad the situation is. After Q1, Q2, and Q3 they needed to inject trillions in the REPO market to keep Banks functioning. When they realized this REPO or Q4 didn't work, they had to recur to this COVID to allow Helicopter money to be dropped on the consumers. Money is not only given away to people in the USA (who actually receive more money from the government than they would earn by working), but also in Spain, and even in Germany.

What few analysts understand and even fewer investors do, is that we have reached the MARGINAL UTILITY level of each created entity of fiat money. In other words, the newly created fiat money works in a NEGATIVE WAY. The more they create, the worse the impact on the economy.

"In the near future, we expect to have a weakening economy together with a shower of bankruptcies, lower production levels, more poverty, higher inflation, more crime."

I would not be surprised to see gold move (up and down) by $100s and silver by $10s in a single day. Gold is up by $200 in the last two weeks and $500 or 33% in 2020. Silver is up 2,5 times and has become explosive The moves we have seen in the last few weeks in gold and silver are just the beginning. The long term bull market is well established and will go to heights that no one can imagine today. And we will see much bigger daily and weekly moves than we have just experienced once the market panics due to dire financial news combined with major shortages in physical gold and silver.

Once you have a fat profit on your Gold & Silver investments, what will be your next step? The Herd will sell its physical gold and silver positions for worthless fiat money while the few intelligent ones know better. We soon will be able to make the difference between douchebag investment advisors and their followers and the REAL Investment Analysts.

"Real Estate will NOT save you!"

Will Real Estate save you? Have a look at what happens in Manhattan, NewYork. Retail Chains Abandon Manhattan: Victoria’s Secret flagship store at Herald Square in Manhattan has been closed and stopped paying its $937,000 monthly rent. “The 5th avenue is no longer what it used to be,” In the prime real estate areas, all the stores rely on having half international tourists and half local tourists or those from the local neighborhoods,” said Thiago Hueb, a founder of a jewelry company who had decided to close his flagship store on Madison Avenue before the pandemic struck because of high rents. J.C. Penney and Neiman Marcus, the anchor tenants at two of the largest malls in Manhattan, recently filed for bankruptcy and announced that they would shutter those locations.

Will Real Estate save you? Have a look at what happens in Manhattan, NewYork. Retail Chains Abandon Manhattan: Victoria’s Secret flagship store at Herald Square in Manhattan has been closed and stopped paying its $937,000 monthly rent. “The 5th avenue is no longer what it used to be,” In the prime real estate areas, all the stores rely on having half international tourists and half local tourists or those from the local neighborhoods,” said Thiago Hueb, a founder of a jewelry company who had decided to close his flagship store on Madison Avenue before the pandemic struck because of high rents. J.C. Penney and Neiman Marcus, the anchor tenants at two of the largest malls in Manhattan, recently filed for bankruptcy and announced that they would shutter those locations.

Important Fundamentals:

- GLD Continues To Source...Click here for more

- Stocks and Bonds have NEVER been so EXPENSIVE. One really has to be suicidal to buy equities today (some exceptions exist). Especially when you were warned that someday, they will close these DIGITAL markets!

Important Technicals:

- US Dollar ....Click here for more

- We have BEARISH DIVERGENCIES on all charts for World Stock Market Indexes. Click here for more

- The Backtest for Gold Click here for more

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic.

Wednesday/Thursday, August 19-20, 2020 - Is a $600 per oz. Silver target realistic?

Updated Sections: Crude Oil, Coal-Solar & Rare Elements, Agriculturals, Copper-Platinum

& Non-Ferro's, LT-Commodity Charts, Commodities in Gold, Inflation Index, Treasuries-USA,

"Capitalism gets the blame for what Socialism has created."

In the 1980s a yearly income of $5,000 bought a house, 2 cars, raised 2 kids, paid for vacation, and allowed the wife to stay home to watch the kids...and it was possible to SAVE!

"Democrats dare to call this progress?!"

Today with a yearly income of $80,000 it is no longer possible to buy a house, to have 2 cars, to raise 2 kids, and to buy a vacation. And while your wife now also has to have a job, it has become impossible to save.

"If you know a train is gonna hit you, better get off the rails and prepare. Your time to prepare is limited."

The day will come where people will realize that in order to get their savings/money out of a failing system and out of their bank, they simply have to BUY Gold and Silver. Assume you bought Silver at $15 and you can sell it at $30. Assume you sell it. WHAT where will you put your money in? Transfer it into a failing Bank system (in Bank Deposits)? Buy overvalued Treasuries, Bonds? Buy shares that are in bubble territory? Buy Real Estate knowing that 50% of the renters can no longer pay their rent? The Shades of Gray are going away. We more and more have black and white. You will be forced to make your choice NOW.

Today, the Authorities don't have to physically take the money away from you through taxation. They just need to print more Fiat Money and hereby dilute your savings. Because of the price inflation, wages will rise, but not nearly as much as the cost of living. Because of inflation, your income will be taxed more, resulting in a lower REAL income. As soon as we have hyperinflation, many who don't have a job won't even benefit from higher wages.

"Silver is heavy at $30 per oz. but light at $600!"

Are you planning to sell your Gold and/or Silver coins once you have a profit? Or do you UNDERSTAND and know what is happening!?

Are you planning to sell your Gold and/or Silver coins once you have a profit? Or do you UNDERSTAND and know what is happening!?

Gold & silver are God's Money. In times of crisis where paper money rapidly loses its value, farmers and other merchants will want to be paid in Silver or in Gold coins. This was the case during the Great Wars (1st & 2nd World War). This was the case during the Napoleon-wars. Few know that Napoleon actually paid his privates with GOLD COINS (Napoleon).

Today these Napoleon coins sell for €320 - $380. They weigh 6.45 grams and have a purity of 900.0. Napoleons are very popular in Belgium and France but not in most other parts of the world. Internationally, AMERICAN EAGLES are the best know gold and silver coins. Margins are somewhat higher, but keep fluctuating with the value of Gold and/or Silver. Another big advantage is that you can buy NEW Eagles and that old Eagles often have a collector's value.

Important Fundamentals:

- As a real estate owner, you have fixed costs: mortgage, property tax, general maintenance, etc. When people stop paying rent, you are fucked. You can't sell (only at a 30%-50% discount and costs accumulate. That's why it is better to sell before a financial crisis occurs.

- GLD INVESTORS DON’T UNDERSTAND WHAT the investors of $82 billion in GLD what they are actually holding. For wealth preservation investors, GLD doesn’t satisfy any of the criteria of holding a reserve asset like gold totally risk-free.

- The main problems with buying gold through GLD, as outlined above, are the following:

- It is a paper security held within the financial system

- It has multiple counterparty risk

- The gold holdings are not segregated from custodians’ assets

- It owns no gold directly

- The gold is stored within the banking system

- The gold held is probably rehypothecated

- The gold is not fully insured

- Investors have no access to their gold

- Thus holding gold through GLD is no better than holding gold futures. For wealth preservation purposes, gold must be held outside the banking system in the safest private vaults in the world. The gold must be controlled directly by the investor with direct access to his gold in the vault. No other party must be allowed to touch his gold without his authorization.

- The inflation-adjusted price of Silver...Click here for more

Important Technicals:

- Manhattan, New York City is dead forever. The price of all these multi-million dwellings is crashing like a stone.

- Gold & Silver are bouncing up! Click here for more

|

|

| The beginning of High Inflation |

The beginning of High Unemployment |

| Result = the beginning of the hyperinflationary depression! | |

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic.

Monday/Tuesday, August 17-18, 2020 - “The greatest enemy of knowledge is not ignorance, it is the illusion of knowledge.”

Updated Sections: Recession Proof (Hold-Sell), Bio-Tech & Pharma, Oil shares,

Natural Gas Shares, Uranium Shares, Banks & Financials

Do you know the correct definition of inflation? If the answer is NO, there is NO WAY you will invest successfully ever. NEVER follow the advice of people who don't know the correct definition. NEVER follow university professors who teach economics but don't know the correct definition.

Do you know the correct definition of inflation? If the answer is NO, there is NO WAY you will invest successfully ever. NEVER follow the advice of people who don't know the correct definition. NEVER follow university professors who teach economics but don't know the correct definition.

"Inflation is an expansion of the money supply in an economy over a period of time."

"In economics, inflation is an expansion of the money supply in an economy over a period of time. One consequence of this expansion can be rising prices as each new unit of money devalues previously existing units." In the old dictionaries, the word PRICE is not even mentioned. Click here for more on inflation and deflation

This is a video published in 2019. Sarkozy already knew what was about to happen. (French spoken and no subtitles)

Friday, August 14, 2020 - Extraordinary Popular Delusions and the Madness of Crowds: South Sea Bubble, Mississippi, Tulips, Cryptos...

Updated Sections: US-Dollar, Silver, Short candles in most Gold sections.

The first tulip in Europe was seen in Augsburg, in Germany, in 1559, and was imported from Constantinople -Turkey, where it had long been a favorite. Ten or eleven years after this the plant was in great demand in Holland and Germany. Wealthy burghers of Amsterdam sent directly to Constantinople for their precious bulbs and paid extravagant prices for them.

The first roots planted in England were brought from Vienna in the year 1600 and were considered a great rarity. For thirty years tulips continued to grow in reputation. One would suppose there must have been some virtue in this flower that made it so valuable in the eyes of so prudent a people as the Dutch. Yet it has neither the beauty or the perfume of the violet nor the fragrance of the rose. It hardly possesses the beauty of the humble sweet-pea. Its only recommendation is its aristocratic stateliness, and this should hardly have commended it to the only democratic republic on the globe. But it is by no means the first time that fashion has turned ugliness into beauty and rarity in wealth.

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic.

Wednesday, August 12, 2020 - The Mississippi Company is a deja vu of what is happening today!

Updated Sections: World Stock Market Indexes, Indexes in Gold, Long Term Indexes,

Miners versus Gold and versus Stocks.

The Mississippi Company is a deja vu of what is happening today! Today's problem is not only PAPER MONEY, but also DIGITAL MONEY. Paper money (alias banknotes) has no intrinsic value. Bank Deposits (digital money) also has no intrinsic value. Even worse, all bank deposits are a LIABILITY. Cryptocurrencies are even worse. History rhymes....and this is also the case today. People are blinded by the Worthless IOS issued by the authorities...

The Mississippi Bubble is partly a story about inflation and subsequent deflation (i.e. misguided monetary policy)...and about a Real Estate bubble! At one time all France is carried away by the tremendous extravagance of the Mississippi scheme, which raised real estate to such a price that it was valued at one hundred years' purchase, that is, its rent only paid one percent on its cost. A little later and England burst out wither her South Sea Bubble, creating such a hunger for special corporations that one man who advertised an unknown scheme to be revealed at the end of the month, ten dollars to be paid down for each share subscribed for, took in $10,000 the first day...click here for more.

If you keep your Gold and silver within political reach, it WILL BE CONFISCATED! Those days they found a way to convince the MONEY, HUNGRY people, to turn in all their gold and silver against worthless paper...and yes, if they don't find a way to convince you to turn in your gold and silver, they will tax it like there is no tomorrow...to save the COVID victims.

COVID or follow the MONEY.

-

-

-

-

-

-

-

- Big Pharma profits

- The Central Banks (FED, ECB, BoE, BoJ,...) profit

- Government Agencies (petty government employees) benefit.

- Politicians benefit (kick-backs, buy votes,...)

- The Mainstream MEdia benefit.

- China benefits.

- NGO's benefit. Medecins sans Frontieres, e.o. can smuggle refugees without media attention.

- WHO (world health organization) officials profit.

-

-

-

-

-

-

"Once Gold goes off the charts, Silver will become the new Gold."

Once Gold goes off the charts, Silver will become the new Gold. Timing is very hard, but Q4-2021 (or earlier) is a good guess. Today (at $30 per oz.) Silver is heavy. Tomorrow at $1,000 Silver will be light. The day Bonds collapse, Silver will be even lighter.

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic.

Monday/Tuesday, August 10/11, 2020 - Is Agenda 21 the REAL plan behind the Green Planet and COVID-19!?

Updated Sections: Portfolio (all time high both when expressed in Dollars and Euro)

Royalties, Majors, Juniors,

Agenda 21 is REAL and the plan behind the Green Planet and COVID-19. Do Global Warming, Renewable Energy, Black lives matter, Immigration streams and COVID-19 have something in common? Why is the World on lockdown and the world economy destroyed for a virus which makes as many casualties as the yearly flu? Why does President Trump stop financing these International Institutions? Why are the American Democrats and Mainstream Media trying to get Biden into the White House this coming November? Maybe there is more Orwell 1987 around us than we are aware of? Is it not extremely weird that Authorities are keeping the world in lockdown and that in some countries we even have WAR MEASURES like CURFEW?

note:

- English spoken video with Dutch subtitles. Hopefully, YouTube has not deleted it by the time we publish it.

- They can at a certain time obviously also stop all electronic transfers (whether money or securities - stocks and bonds - ). The most important aspect of electronic money is that Big Brother is Watching ALL of us and can pull the plug (stop the computers) at any time. Nowadays the state has total electronic control of the citizens' money not just from a tax point of view but the state can decide to block individual accounts or to charge fines or taxes without the permission of the account holder…

While we forecasted that gold would rise above $2,000 (and higher). While we forecasted that Gold expressed in major currencies would break above their 2011/12 top, this is NOT a cause for celebration. As gold continues to set and to break new records, rewarding all with the foresight to own it (and those who followed our advice), remember that the move portends extreme economic hardship for most of the Western World.

"Gold AND Silver Are Just Getting Started."

Be advised that it is still not too late to buy and safely store physical gold and silver and that the longer you postpone it, the more FIAT MONEY it will cost you. Also, don't buy Gold & Silver to make some fast money. Rather buy it to keep your savings safe and alive.

With my 45 years of experience, I know for sure the following statement is 200% correct. No asset manager, no banker is interested in protecting their clients’ assets by investing in the ultimate form of wealth preservation which of course is physical gold.

The reason is very simple. Private wealth managers like all other asset managers are not interested in holding physical gold for their clients for the simple reason that they can’t earn sufficient revenue on just holding client gold. They prefer to put expensive financial products and their own managed funds into client portfolios and also buy and sell shares regularly to churn commissions.

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic.

Thursday/Friday, August 6/7, 2020 - “Gold’s Like A Freight Train And May Top $3,000 - Our pf-charts exactly show what the road looks like!

Updated Sections: Rupee-Gold & Rupee, Swiss-Gold & Swiss/$/€, €-Gold & €/$,

Can$-Gold & Can$/$/€, most PF-charts in the Gold sections,

In the USA the 1930 wealth destruction was lead by deflation: the dollar went up.

In the USA the 1930 wealth destruction was lead by deflation: the dollar went up.

Today's wealth destruction is lead by Weimar style inflation: the dollar (and other currencies) will come down! (There is a fundamental difference between the two cycles!)

The Weimar experience involved high unemployment and hyper-inflation simultaneously. With money supply growing at rates up to 35% per annum and central banks floating the markets with billions of fresh money to keep the system alive, we are heading full steam to Hyperinflation like Germany experienced during the Weimar revolution and Zimbabwe was living yesterday. (click here for the charts under CDO subprime)

In those days, printing money was somewhat limited as there was a shortage of paper and ink. Some countries like Poland were even forced to reduce the colors of the notes because ink got scarce and expensive. In Germany, it became cheaper to burn the money instead of buying wood or coal.

Today, Federal banks issue electronic money. The computer has become the limit. In other words, FIAT PAPER MONEY is about to become worthless, just as Treasury certificates, T-bills, Bonds, bank savings accounts and other similar deposits. Their face value will surely remain the same, as will the nominal interest. However, this won't suffice to cover the galloping Inflation rate.

Real Estate will unfortunately not be able to escape either. It is rather easy to imagine that Government will, (as happened during the Weimar Revolution) under the pressure of the voting public, block all rents. As a result, the landlords will get squeezed between the rising costs of maintaining the property and the low rental income(s).

Investing is about to become a totally different exercise. In an effort to safeguard income and savings, people will massively start to exchange paper fiat money for REAL MONEY and other tangible assets (LOCG). As a result, not only Gold and Silver will rise but I expect the same to happen for the stock markets and/or at least for certain parts of it. Pure logic as stocks are a participation in REAL ASSETS.

Investing is about to become a totally different exercise. In an effort to safeguard income and savings, people will massively start to exchange paper fiat money for REAL MONEY and other tangible assets (LOCG). As a result, not only Gold and Silver will rise but I expect the same to happen for the stock markets and/or at least for certain parts of it. Pure logic as stocks are a participation in REAL ASSETS.

It is not, however, the case that the economy within Germany continued to decline throughout the whole of the period 1919 – 1923. In 1920 the currency stabilized for a period of some 6 months. *The mark actually gained in value against foreign currencies, so that prices of imported goods (commodities) fell by some 50%. The price index remained almost constant and the value of the German mark improved to approximately 1US$ to 69 German marks. The Weimar Government, it has been argued, could have introduced a stable currency at this point. Instead, they continued to increase the amount of money in circulation – which is inflationary. The result was hyperinflation in 1923.

* This is EXACTLY the same we saw the past months with the Dollar and the falling commodities.

"By July 1922, the German Mark fell to 300 marks for $1; in November it was at 9,000 to $1; by January 1923 it was at 49,000 to $1; by July 1923, it was at 1,100,000 to $1. It reached 2! 5 trillion marks to $1 in mid-November 1923, varying from city to city.

So the printing presses ran, and once they began to run, they were hard to stop. The price increases began to be dizzying. Menus in cafes could not be revised quickly enough. A student at Freiburg University ordered a cup of coffee at a cafe. The price on the menu was 5,000 Marks. He had two cups. When the bill came, it was for 14,000 Marks. "If you want to save money," he was told, "and you want two cups of coffee, you should order them both at the same time.

"The presses of the Reichsbank could not keep up though they ran through the night. Individual cities and states began to issue their own money. Dr. Havenstein, the president of the Reichsbank, did not get his new suit.

Note for subscribers: the financial markets are doing exactly what we forecasted. At this point, there is not a lot we can add. Except that people who are naive, stubborn, and greedy will end up as bag holders. NOW is the time to act and use your brains.

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic.

Wednesday, August 5, 2020 - The government has NEVER created any Wealth, on the contrary, it ALWAYS destroys WEALTH.

Updated Sections: ,

Any attempt to redistribute any wealth results in recession, depression, and poverty. Wealth is produced by the people, never by the Government. It was President Nixon who demolished the current system. Once the gold standard was abolished in 1971, it has opened the door for all fiat money printing bonanza for 50 years.

Any attempt to redistribute any wealth results in recession, depression, and poverty. Wealth is produced by the people, never by the Government. It was President Nixon who demolished the current system. Once the gold standard was abolished in 1971, it has opened the door for all fiat money printing bonanza for 50 years.

Today, the chickens are coming home to roost. As the world is now in the very end game of the current currency system, there had to be a vicious catalyst to finish it off. Sadly that came in the shape of a pandemic which the world is coping extremely badly with.

World trade will contract substantially for a very long time. Whatever the course the pandemic takes in the next months, it has already had major effects on the world. We have permanent loss of jobs, businesses closed with major sectors like leisure and travel which will never get back to where they were. Same with retail, town centers, offices, etc.

Accelerated money printing is a desperate attempt by governments and central banks to save the world. But printing worthless money will, of course, have no positive impact. Instead, we will see the end of the currency system as all currencies fall to their intrinsic value of ZERO. Only REAL Money or Gold and Silver will survive.

The above speech was originally given on Feb. 11th, 1966 at the Utah Forum for the American Idea by Ezra Taft Benson, the 13th President of the Mormon Church, and the 15th Sec. of Agriculture under Pres. Eisenhower. It's a great speech and more people should listen and learn from it. His warnings were particularly prescient, and even more important now than they were over 50 years ago when the speech was given. It's too bad Benson's warnings were not headed sooner. Let's hope it's not too late to stop his worst fears from coming true.

Most people don’t want to hear the truth because it is uncomfortable. For some dark reason, most people invest in stocks, since they always go up. But no one ever tells stock investors that is has been a very poor investment. Virtually nobody knows that the Dow, for example, is down 80% against gold since 1999 (excluding dividends). No conventional banker, broker, journalist or analyst will ever mention this. They are just too lazy to check out the real facts.

We can be certain that gold will maintain its purchasing power as it has over 6,000 years. But due to the overvaluation of most assets and the undervaluation of gold, gold will perform much better than just keeping up with purchasing power. The shortage of physical gold and the failure of the LBMA system and gold futures markets will be major factors in this.

It is fascinating that only 0,5% of global financial assets are invested in the only asset that has held its purchasing power in history. In the next few years investors, from retail to institutional, will all want gold. Future gold supply will be extremely limited and demand massive. So the only way to get hold of gold will be at prices which will be multiples of the current price, even measured in today’s money. Remember to hold physical gold and silver and don’t store 1 oz. within the bankrupt financial system and within political reach.

more in the subscribers' section...click here to continue and see how Gold is breaking the $2,000 level.

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic

Monday/Tuesday, August 2-3, 2020 - Helicopter money is here: if you have no Gold, you're either RETARDED or an IDIOT.

Updated Sections: $-Gold, Silver, US-Dollar, Pharma-Bio (new share) ,

Helicopter money is here. Helicopter money is a proposed unconventional monetary policy, sometimes suggested as an alternative to quantitative easing (QE) when the economy is in a liquidity trap (when interest rates near zero and the economy remains in a recession). It never worked, doesn't work and will never work. If just creates more DEPRESSION and a HYPER-INFLATIONARY DEPRESSION...the big one of the 21st century.

"Helicopter Money is the direct road to HELL!"

consequences of Helicopter Currencies:

-

-

-

-

-

-

-

- hyperinflation

- higher nominal stock markets

- higher interest rates

- lower bond markets

- lower real estate markets

- exponentially higher gold and silver.

-

-

-

-

-

-

Today in Japan, Macao, Hong Kong, Singapore, the EU, the USA, Canada,...tomorrow in all Western countries. Economists like Milton Friedman have long seen helicopter money as the most radical tool that central bankers could deploy to fight a weak economy. The idea is usually credited to doyen of monetary economics * Unlike most monetary policy measures, people tend to get excited when it is mentioned — unsurprisingly given the image of loads hundred dollar bills being thrown out of helicopters and falling to the ground that it conjures up. It’s all very Hollywood in a way that, say, buying bonds on electronic screens is not.

However, in these latest instances, it’s the politicians leading the charge. Helicopter money now also has become reality in fiscally more conservative countries, such as Europe, and is also used to BUY VOTES. Helicopter money always ends with a Hyperinflationary Depression. A severe depression always ends in a WAR. The 1930 Great Depression resulted in a World War and it was only in 1945 that the World Economy was able to recover.

Helicopter Money is also DEBT...and debt is neither free nor irrelevant.

Helicopter Money is also DEBT...and debt is neither free nor irrelevant.

- Today in the USA one out of 5 corporations is a Zombie corp. This year the total amount of corporate debt is already up by more than 25%.

- The US Government is bankrupt. The situation in the US is worse than in the EU.

- Families are bankrupt. Credit Cards are maxed out, Student Loans and Automobile loans are delinquent.

- 50% of Renters in Florida can no longer pay the rent and risk eviction.

- The total debt of the USA is 400% of GDP.

- At 155% of GDP, stocks are the highest valued (the most expensive, the biggest bubble) in history.

- The government keeps buying high yielding, dangerous debt to keep corporations alive although there are bankruptcies laws.

- Interest rates are so low that a marginal interest rate hike to 3%-4% would make it impossible for Government to honor its' debt and crash both the DEBT, the Stock Market, and the financial system.

1930s = Depression. This decade was, for the most part, the opposite of the 1920s. It started with the bursting reactions to high levels of indebtedness and the markets discounting relatively high growth rates. This debt crisis and plunge in economic activity led to economic depression, which led to aggressive easing by the Fed that consisted of breaking the link to gold, interest rates hitting 0%, the printing of a lot of money, and the devaluing of the dollar, which was accompanied by rises in gold prices, stock prices, and commodity prices from 1932 to 1937.

Because the monetary policy caused asset prices to rise and because compensation didn’t keep up, the wealth gap widened, a conflict between socialists and capitalists emerged, and there was the rise of populism and nationalism globally. In 1937, the Fed and fiscal policies were tightened and the stock market and economy plunged. Simultaneously, the geopolitical conflicts between the emerging Axis countries of Germany, Italy, and Japan and the established Allied countries of the UK, France, and China intensified, which eventually led to an all-out war in Europe in 1939 and the US beginning a war in Asia in 1941. For the decade as a whole, stocks performed badly, and a debt crisis occurred early, which was largely handled via defaults, guarantees, and monetization of debts along with a lot of fiscal stimulation. Today is THE SAME but different.

Important Fundamentals:

- We have MOVING TARGETS for Gold and Silver. The more fiat money is created out of thin air, the higher targets. See the sections Gold and Silver Targets.

more in the subscribers' section...click here to continue

- Consumer confidence and spending crumble all over the world and COVID-19 is breaking the back of the WESTERN WORLD. Today there is not the slightest doubt that this will end VERY BAD!

more in the subscribers' section...click here to continue

- Don't dream, nor hope that soon all will be back to normal. It will not and we expect the crisis to last for at least the next 10 years. AND, what we have now, is only the Hors D'OEUVRES.

more in the subscribers' section...click here to continue

Important Technicals:

- Nobody seems to care about the xxxxx breakdown

- See the charts below.

- New share...xxxx has broken out and is a BUY.

more in the subscribers' section...click here to continue

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic