31

March

2023

Glass–Steagall Act

1933 Banking act

The Banking Act of 1933 was a law that established the Federal Deposit Insurance Corporation (FDIC) in the United States and introduced banking reforms, some of which were designed to control speculation.[1] It is most commonly known as the Glass–Steagall Act, after its legislative sponsors, Carter Glass and Henry B. Steagall.

The Banking Act of 1933 was a law that established the Federal Deposit Insurance Corporation (FDIC) in the United States and introduced banking reforms, some of which were designed to control speculation.[1] It is most commonly known as the Glass–Steagall Act, after its legislative sponsors, Carter Glass and Henry B. Steagall.

Some provisions of the Act, such as Regulation Q, which allowed the Federal Reserve to regulate interest rates in savings accounts, were repealed by the Depository Institutions Deregulation and Monetary Control Act of 1980. Provisions that prohibit a bank holding company from owning other financial companies were repealed on November 12, 1999, by the Gramm–Leach–Bliley Act. [2][3]

The Gramm-Leach-Bliley Act. was voted into place by President Clinton and actually broke the back of the financial system.

The repeal of the Glass–Steagall Act of 1933 effectively removed the separation that previously existed between Wall Street investment banks and depository banks and has been blamed by some for exacerbating the damage caused by the collapse of the subprime mortgage market that led to the Financial crisis of 2007–2010.[4]

In the past, we had deposit banks and loan banks. If you put your money in a deposit bank, the money was there to pay your rent and food expenses. It was safe. Loan banking was risky. You provided money to a loan bank, knowing funds would be tied up for a period of time and that you were taking a risk of never seeing this money again. For this, you received interest to compensate for the risk taken and the value of time preference. Back then, bankers who took a deposit and turned it into a loan took the risk of shortly hanging from the town’s large oak tree. During the early part of the nineteenth century, the deposit function and loan function was merged into a new entity called a commercial bank. Of course, very quickly, these new commercial banks realized they could dip into deposits, essentially committing fraud as a source of funding for loans. Governments soon realized that such fraudulent activity was a great way to finance government expenditures and passed laws making this fraud legal.

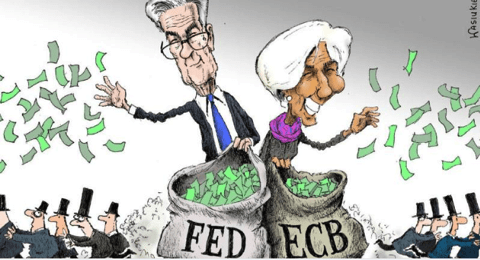

Similar regulations were voted into place in Europe during the 1980s and early 1990s. The result was that Banks became Hedge funds and could gamble with the funds of their depositors. Profits disappeared in the pockets of the Bankers, losses were paid by the taxpayer and/or by the large depositors.

Similar regulations were voted into place in Europe during the 1980s and early 1990s. The result was that Banks became Hedge funds and could gamble with the funds of their depositors. Profits disappeared in the pockets of the Bankers, losses were paid by the taxpayer and/or by the large depositors.

After the Hyperinflation, economic and financial crisis in Chili, a similar Banking Act of 1933 was put in place in order to protect the depositor. Such a law is A KEY LAW FOR ANY STABLE AND SANE FINANCIAL SYSTEM. Banks should not be allowed to speculate in any possible way with the deposits of their customers.

There are two kinds of contracts a depositor can have with his bank. Only one allows the Bank to use the deposit for other means. Today the line between these two contacts has been erased together, leaving an extremely dangerous situation.

The reality today is that as soon as somebody deposits funds into a bank account, he becomes a CREDITOR to the bank...not at all what most Savers have in mind!

© - All Rights Reserved - The report's contents may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic.

- Tags: banks deposit risks