20

April

2009

British Pound fundamentals

Gordon Brown's Gold bottom

The biggest mistake the Brits could make today, is to become part of this EU masquarade.

Updated April 20, 2009

This is the very end of the Empire and the Pound (Sterling - the sterling is lost - sold by Brown & Co). Thank you Politicians for a job well done!

This is the very end of the Empire and the Pound (Sterling - the sterling is lost - sold by Brown & Co). Thank you Politicians for a job well done!

During the early 1900,s the United Kingdom was ‘the Empire’ controlling most of the world and the Pound Sterling was ‘the reserve currency’. Less than 100 years later, England is the only remainder of the Empire. The Pound Sterling has not only lost its position as the World Reserve Currency, its paper value also kept sliding against the value of other Fiat Paper currencies as the manufacturing entity was outsourced and replaced by a service economy. A bicycle 'Made in Britain' still costs £ 500. A lot more than what the Chinese ask...British politicians have led this beautiful isle into the last act. How long will it now take before the citizens come up for their rights and clean the system? Iceland people do so!

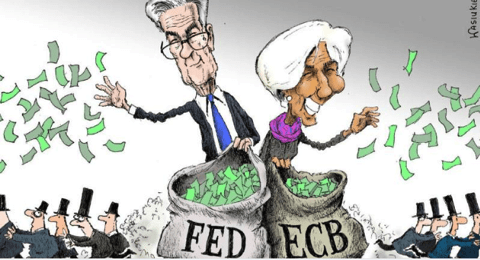

Old empires fall and new empires rise. What happened in the UK is about to happen to the USA. Printing money is not a solution, Gordon.

Historically, the UK has always been 'the canary' in a cage for the European continent and the Western world (USA)....The breakdown of the Sterling is the forerunner of a breakdown of the Dollar...!

The UK is run by a man who managed to sell England's Gold at the very bottom! The people who let such a man run the country, are now getting what they deserve...

managed to sell England's Gold at the very bottom! The people who let such a man run the country, are now getting what they deserve...

Conventional political analysis suffers from a profound failure of imagination. It imagines passing clouds to be permanent and is blind to powerful, long- term shifts taking place in full view of the world. Economic decisions made for political reasons, result in inefficiency and corruption

This hard-to-fault insight into the destructive nature of economic excess was given by Gordon Brown in his Budget speech of 1998. Later, as if to prove his point, the then-chancellor orchestrated a public and private spree of outrageous consumption that ruined the economy. Gordon Brows' fingerprints are all over the disaster 'Made in England" ! Click here for more...

On several occasions we explained the problems of the UK could be bigger than those of the USA. The Pound is a victim of the economic problems in the UK and its weakness is seen as at least part of the solution to those issues. However, the speed with which the currency has lost value has surprised most investors and it remains one of the world's weakest currencies. This probably happened after the interventions of the central bank became ineffective.

"It is going to be absolute murder in Britain if inflation turns negative," said Professor Peter Spencer from York University. "The big difference with past episodes is that we are now much more heavily indebted. Few people owned their own houses in 1930s. Debts were miniscule." But even is we have Hyperinflation (and we maintain that we shall first see Hyperinflation), the economy will fall into a depression. In both scenarios GOLD and SILVER are the best insurance one can have. In case of a deflation the Authorities will have no alternate than to issue a MORATORIUM on their debt and will so wipe out so said stable savings. This is done automatically in case of a hyperinflation.

Posted February 2, 2009

Revealed: Day the banks were just three hours from collapse

By Glen Owen

Last updated at 11:21 PM on 24th January 2009

Britain was just three hours away from going bust last year after a secret run on the banks, one of Gordon Brown's Ministers has revealed.

City Minister Paul Myners disclosed that on Friday, October 10, the country was 'very close' to a complete banking collapse after 'major depositors' attempted to withdraw their money en masse.

The Mail on Sunday has been told that the Treasury was preparing for the banks to shut their doors to all customers, terminate electronic transfers and even block hole-in-the-wall cash withdrawals.

Only frantic behind-the-scenes efforts averted financial meltdown.

If the moves had failed, Mr Brown would have been forced to announce that the Government was nationalizing the entire financial system and guaranteeing all deposits.

But 60-year-old Lord Myners was accused last night of being 'completely irresponsible' for admitting the scale of the crisis while the recession was still deepening and major institutions such as Barclays remain under intense pressure.

The build-up to 'Black Friday' started on Monday, October 6, when the FTSE 100 dropped by nearly eight per cent as bad news on the economy started to multiply.

The following day, Chancellor Alistair Darling began all-night talks ahead of an announcement on the Wednesday that billions of pounds of taxpayers' money would be used to pour liquidity into the system.

Chancellor Alistair Darling warns slump could be the worst for 60 years

Philip Webster, Political Editor

Britain could be heading for its worst economic downturn for 60 years and voters are fed up with Labour because ministers have failed to explain its central mission, Alistair Darling has said.

The normally cautious Chancellor has given by far his most explicit warning both of the problems lying ahead and of the reasons behind Labor's current plight. Mr. Darling’s Pre-Budget Report in the autumn is regarded as crucial to any hope of a Labour recovery, and he has been closely involved in a series of economic rescue packages that will be made public over the next three weeks.

He has been arguing for some time that a struggling economy is the true reason why Gordon Brown is finding it hard to lift Labour from its opinion poll lows, and has clearly decided that frankness with the electorate is the best way of explaining the current difficulties. There have been suggestions that Mr. Darling might be moved in an imminent reshuffle, but The Times understands that that is unlikely to happen. Click here for more...

Posted December 6, 2008

According to the International Monetary Fund, Britain's account gap has regularly hit record highs and will in relative terms exceed that of the US in 2008-09.

The fall in the pound is a boost to exporters, and is making up for Britain's lagging productivity performance and helping the economy shift away from its reliance on debt-fuelled consumer spending. This becomes more and more important as Britain is also living peak oil and income from crude oil exports start to dwindle. Additionally, a boost to manufacturing is needed to offset the weakness in services from the credit crunch.

A collapse of the pound is inevitable, irrespective of which way rates go, it will just alter the timing, but the end result will be the same. Like the USA the UK is bunged up with not repayable debt and falling asset values in EVERY sector - banks, businesses, households and government.

The pound might have to fall another 20% to bring UK manufacturing competitiveness in line with the EU and the Euro. Now that the USA is running into structural problems, I expect the UK to adjust its' policy in line with the EU. The British Real Estate bubble has also busted and the weaker Sterling has also cut the spendable income of those which emigrated to the continent (France, Spain and Portugal). Even the City is being hammered as many loose their jobs in the financial sector.

The Pond was a Roman invention. One could pay with it, and receive smaller coins as change…all by all one could use it all over Europe in an even better way then one can use the Euro today.

The reason why the Pond disappeared is that the Roman emperors debased it. In other words, they added more and more other metals to the Ponds that were made out of Gold and silver.