|

Friday December 31, 2010 - Expect much worse conditions in 2011 ! -

check the SA-Rand section

-

-

Believe

it or not, this ain't Ripley's and the price of your steak will double

in 2011. Cotton, wheat, corn, Soya,...all food

commodity prices geyser. Scary it is. This as a

result of rising energy and oil prices. Today many don't realize

fertilizers are a product of crude oil. [who remembers the green guys

which made the use of traditional fertilizer illegal?] Believe

it or not, this ain't Ripley's and the price of your steak will double

in 2011. Cotton, wheat, corn, Soya,...all food

commodity prices geyser. Scary it is. This as a

result of rising energy and oil prices. Today many don't realize

fertilizers are a product of crude oil. [who remembers the green guys

which made the use of traditional fertilizer illegal?]

-

We cannot believe our

eyes and ears when as we still see and hear some Analysts forecast $50

per barrel for crude oil.

Are those people living on another planet? Having said this, the bull

run of Crude oil is confirmed by a bull run for

Coal

and a plausible bullish breakout of

Natural Gas. What is happening

here matches exactly the rules for the coming hyperinflationary

depression.

-

France is building one

of the world first nuclear fusion plants.

The country has traditionally been a leader

for engineering and is the country with most nuclear fission plants on

planet earth.

-

To say business is

improving is one hell of a stretch. To say statistically business

conditions are MOPED is closer to the truth. This

coming year we're about to come out of the eye of the storm into the

next more painful part of the Hyperinflationary Depression.

-

Those pretending the

Recession is over and Recovery is around the corner should be arrested

and put in jail! ....The

Commodity index

has DOUBLED since the end of 2008/beginning of 2009!

Thursday December 30, 2010

-

The future will be nuclear

Fusion and/or Fission:

Uranium spot prices rose 40% this year and 34% since the end of

September to $62.50 a pound on Dec. 20,

according to Roswell, Georgia-based Ux

Consulting, which tracks the industry. Producers in Australia and Canada

forecast demand for the metal will increase as countries, including

India, expand their use of nuclear power to curb emissions from burning

coal. Solar, wind, etc...will - because their yield is way

too low and they cannot be used as a source of energy for most vehicles

(automobiles, airplanes, ships) only live during the transition

from Oil (liquid energy) to Nuclear energy. France

is building a fusion plant in ITER. The future will be nuclear

Fusion and/or Fission:

Uranium spot prices rose 40% this year and 34% since the end of

September to $62.50 a pound on Dec. 20,

according to Roswell, Georgia-based Ux

Consulting, which tracks the industry. Producers in Australia and Canada

forecast demand for the metal will increase as countries, including

India, expand their use of nuclear power to curb emissions from burning

coal. Solar, wind, etc...will - because their yield is way

too low and they cannot be used as a source of energy for most vehicles

(automobiles, airplanes, ships) only live during the transition

from Oil (liquid energy) to Nuclear energy. France

is building a fusion plant in ITER.

-

South Africa is, whether

it likes it or not, another [small] BRIC in the wall.

SA is a commodity country and even with

the problems it has to solve because of Apartheid, it does has some good

traditions and is probably in a better shape than many other

countries...more

Wednesday December 29, 2010 - A good pilot is an old pilot - A good

financial advisor is an old advisor - Financial analysis is a full

time job and requests a lot of experience...

-

Any investor which doesn't

understand that today it is NOT about making money but because we have a

paradigm shift, it's about PRESERVING buying power, will suffer a lot in

2011, 2012 and 2013.

-

It is understandable that

investors who believe in paper money and paper-denominated assets do not

understand gold. Gold, after all, is the natural

refuge of disbelievers in the current financial paradigm; and, as

today's credit and debt-based paper markets come under increasing

pressure and gold moves increasingly higher, most "paper bulls" remain

increasingly perplexed. [Darryl Schoon]

-

Over the past years

Prechter and most Elliott Wave theorists have (and still are) predicting

Gold (and also Oil and other commodities) will crash.

In October 2009, when gold had again breached the $1,000 level,

investment advisor Chad Brand warned investors not to jump onto "the

gold bandwagon". Unfortunately, for Mr. Brand's clients, it was the time

to jump-and still is today. Unfortunately for the Prechter fans, it's

all - for obvious reasons - going the other direction....

-

Many laughed each time we

published Gold would breach the 1000 level (whether

it was can$ 1000, us$ 1000, € 1000, CHF 1000, ....). We still have

to break the £ 1000 but are so close....

-

Many laughed each time we

published the price of Crude Oil would go up because of Peak Oil and

inflation. Many simply refuse to understand we will

probably pay over $ 4 for a gallon of Gas in the USA next year. Expect a

similar pattern in the EU with gas prices closing in to € 2 per liter

(about $ 8 per gallon).

Tuesday December 28, 2010

-

Greece

will be the 1st domino to fall. Is Greece Planning a Post-2013

Debt Restructuring? Greek newspaper Ta Nea has

reported that Greek authorities have settled on a plan to restructure

the debt after 2013 without a haircut by stretching maturities and

reducing interest rates. Expect other EU countries to follow...The

toll to pay for those who wait too long will be EXTREMELY HIGH Greece

will be the 1st domino to fall. Is Greece Planning a Post-2013

Debt Restructuring? Greek newspaper Ta Nea has

reported that Greek authorities have settled on a plan to restructure

the debt after 2013 without a haircut by stretching maturities and

reducing interest rates. Expect other EU countries to follow...The

toll to pay for those who wait too long will be EXTREMELY HIGH

-

China

hikes interest rates...so what!? The People's Bank of

China has raised interest rates for the second time in Q4 2010, in an

attempt to stem rising inflation in the face of excess liquidity and

strong capital inflows. We wrote in

2009 this would happen and we know how Gold and Silver and the Gold and

Silver shares and Juniors behave in such an environment. Certain

countries can survive higher interest rates, other countries will not.

Monday December 27, 2010 - Be aware that the more dangerous the

situation becomes the more the Authorities will claim ALL is Well Madame

la Marquise and that there is no reason at all to park your savings in a

particular way.

-

Relevant

is that People fail to understand we have a PARADIGM shift and that

today the problem is far bigger than invest in a way which offers some

return on your capital. As we move into the

Hyperinflationary depression your MAIN GOAL must be to PRESERVE your

CAPITAL. We don't think this will be an easy exercise but the best way

not to preserve it will be to stay with the Bankers which are part of

the problem we're having. If you keep investing like was fashion

in the 1980's and 1990's you take a BIG RISK. Relevant

is that People fail to understand we have a PARADIGM shift and that

today the problem is far bigger than invest in a way which offers some

return on your capital. As we move into the

Hyperinflationary depression your MAIN GOAL must be to PRESERVE your

CAPITAL. We don't think this will be an easy exercise but the best way

not to preserve it will be to stay with the Bankers which are part of

the problem we're having. If you keep investing like was fashion

in the 1980's and 1990's you take a BIG RISK.

-

What

many people don't know is that there is NO CAPITAL GAIN TAX in countries

like Belgium. so far...but when the King's treasury

chests are empty, this can change overnight. Only years ago the

government in Argentina confiscated all the Private Pension plans (401k)

and used the Forex (US Dollars mainly) deposits of Argentineans who

thought they had made a clever move to keep their savings in US Dollars

within the Argentinean Banking sector, to pay for the foreign debt.

-

What

many people fail to understand is that the digitalization of Securities

opens a HUGE door to Government confiscation. There

are plenty of examples from the USSR to Argentina...In the OLD days one

just had to cross to border and open a Bank account in the neighboring

country or buy a house to escape Big Brother. With the advent of the EU

all of this has slowly disappeared. With the Help of "Money Laundering

Legislation" all escape routes have slowly but surely be sealed.

Additional legislation even makes it illegal to provide any advice in

this matter.

-

In the

EU by 2012 ALL SECURITIES MUST be digitalized. In

other words, no more paper securities and bonds one can hide under his

mattress or in some safe. This comes after several EU countries allowed

for some fiscal leniency towards those who repatriated their savings to

their home country...something a lot of people did. As usual few could

even think that in 2011 any form of Bank secrecy would disappear

(also in countries like Belgium and we fear the same is to happen in

countries like Luxemburg). But we expect that in 2012 insult will come

to injury when Wealth Taxation will rule ALL OVER the EU.

-

Cities across the USA are raising property taxes, largely citing

rising pension and health-care costs for their employees and retirees.In

Pennsylvania, the township of Upper Moreland is bumping up property

taxes for residents by 13.6% in 2011. Next door the city of

Philadelphia this year increased the tax 9.9%. In New York, Saratoga

Springs will collect 4.4% more in property taxes in 2011; Troy will

increase taxes by 1.9%.In Illinois, towns have been raising property

taxes to keep up with pension and health-care costs for several years,

but the scale and scope of the increases this year are unprecedented,

said Joe McCoy, a lobbyist with the Illinois Municipal League.

Friday December 24, 2010 - We wish ALL our readers and supporters a

HAPPY HOLIDAYS -

Update will be minimum until the end of 2010.

Thursday December 23, 2010 - In the 13th century the

Church opposed to the translation of the bible out of fear people

(few people could read and those who could did could not

read Greek ad Latin) would question their

authority. Today the Authorities fear that people will read the

Wikileaks and so question their authority. Nothing has changed...except

for the wrapping.

-

What's

in your stocking? Did you buy some goodies out of the

Gold and Silver basket? What's

in your stocking? Did you buy some goodies out of the

Gold and Silver basket?

-

Within

4-5 months, the surge in costs at the wholesale level for food and for

metals is going to be reflected in the retail side.

When that occurs, consumers are going to learn how “tame” inflation is.

Keep in mind this will be against a backdrop where wages are flat and

the unemployment and underemployment remain high. Wonder how the

Authorities will explain this!?

-

Overdrawn American cities could face financial collapse in 2011,

defaulting on hundreds of billions of dollars of

borrowings and derailing the US economic recovery. Nor are European

cities safe – Florence, Barcelona, Madrid, Venice: all are in trouble.

the U.S. remains the proverbial elephant in the bathtub in terms of

pending effective sovereign bankruptcies.

The U.S. remains the proverbial elephant in the bathtub

in terms of pending effective sovereign bankruptcies and the

US-Dollar an

accident waiting to happen (as the £ was before its 30% crash in

2007-08) ...more

-

Turkish

Central Bank Cuts Policy Rate 50 bps to Curb Capital Flows.

The Turkish central bank lowered the policy rate by 50 basis

points to 6.5% at its December 16 monetary

policy committee meeting while widening the spread between overnight

borrowing and lending rates in response to strong capital inflows and

bank lending.

-

Debt-stricken

Greece

plans a garage sale as it has unveiled a privatization plan

to raise €7bn through the sale and exploitation of state companies and

other assets.

-

Why

are Japanese bonds moving up after 10 years? weird...

-

Silver glitters

and shines as we move through the year end...more

Wednesday December 22, 2010

-

We

are too busy to write a 2011 scenario and maybe we don't feel like

publishing one...out of fear to be

called doomsayers. The problem is that we hardly can publish something

we don't see and don't believe in. In other words

we cannot wish you a happy 2011

when we know

2011 is going to be A LOT WORSE than 2010 and 2008.

Better be prepared and don't take any chances...this

will be a terrible financial storm! What is published below is nothing

more than what we have been writing and publishing for months and

years....it's a never ending story....where The People are unfortunately

also playing a part and will have to take their responsibility because

they don't do anything to correct it. We

are too busy to write a 2011 scenario and maybe we don't feel like

publishing one...out of fear to be

called doomsayers. The problem is that we hardly can publish something

we don't see and don't believe in. In other words

we cannot wish you a happy 2011

when we know

2011 is going to be A LOT WORSE than 2010 and 2008.

Better be prepared and don't take any chances...this

will be a terrible financial storm! What is published below is nothing

more than what we have been writing and publishing for months and

years....it's a never ending story....where The People are unfortunately

also playing a part and will have to take their responsibility because

they don't do anything to correct it.

-

Banks are bankrupt and

they will rotten all the way to the core.

Still have Bank Bonds and/or shares? Be aware there is NO SOLUTION for

the problems the banks are in...more

-

UK borrowing hits new

record as government borrowing jumps.

Be aware it is IMPOSSIBLE to spent

yourself out of the problems as much as it is impossible to f..k

yourself out of virginity. Such actions only make it worse!...more

Tuesday December 21, 2010

-

Freedom

of Speech!? Is this what the Authorities want to take away by

controlling Internet? It is of course

a lot easier to control the printed media, radio and

television than internet. [Radio and Television stations are

traditionally the first to be taken over in case of a war or

revolution]...more

. Venezuelan President Hugo Chavez

also defended plans for a law that would impose broadcast-type

regulations on the Internet, saying Sunday that his government should

protect citizens against online crimes...more

and in Britain they still play it in the old fashioned way using

SEX and children as an argument...more Freedom

of Speech!? Is this what the Authorities want to take away by

controlling Internet? It is of course

a lot easier to control the printed media, radio and

television than internet. [Radio and Television stations are

traditionally the first to be taken over in case of a war or

revolution]...more

. Venezuelan President Hugo Chavez

also defended plans for a law that would impose broadcast-type

regulations on the Internet, saying Sunday that his government should

protect citizens against online crimes...more

and in Britain they still play it in the old fashioned way using

SEX and children as an argument...more

-

The

FDIC shut down another 6 banks last

week. 157 small banks have gone

under this year alone. Instead of sounding the alarm, this news is met

with a yawn by the mainstream media. What's wrong with the media?

-

Greece, Ireland, Belgium,

Spain, Portugal,...The various

European crises remain an intermittent foil for the

U.S. dollar, pulling market

attention away from the unfolding solvency crisis in the United States

and a likely move to massive selling against the U.S. currency.

-

The buy of a life time we

have. We've updated the sections of

Gold and

Silver shares and

Juniors and

you have to be blind not to see what we see. Some shares of these

sections will be the buy of a life time!

Monday December 20, 2010

-

The

HUI-index (Gold

index) is correcting like a school book example would do.

Don't miss what could be the

last opportunity of 2010. Buy your 2011 XMas present NOW. Today's Math's

will be tomorrows Magic. The

HUI-index (Gold

index) is correcting like a school book example would do.

Don't miss what could be the

last opportunity of 2010. Buy your 2011 XMas present NOW. Today's Math's

will be tomorrows Magic.

-

As I

sometimes write, one has to be blind not to see it.

The 2011 scenario is so

straight forward, is so clear that I start to have mercy of all those

who don't see it and/or don't believe it. It more and more seems

like the last days of 2010 could well be the last days of this huge

SALES period and that it is very plausible we shall NEVER see these

price levels again.

-

Better be very, very careful once politicians start to pretend the Euro

has been saved from a certain dead. Watch their

crappy faces when they lie about it. Once again it will cost a fortune

to the BELIEVERS.... I've seen this scenario happening so many times...At

some point, if a country does not get its fiscal deficit below nominal

GDP (and this is true for the US as well!) it will run into the wall.

Belgium's debt was also degraded by Standard and Poor's:

"Belgian's current caretaker government may be ill-equipped to respond

to shocks to public finances. The federal government's projected 2011

gross borrowing requirements of around 11 percent of GDP leaves it

exposed to rising real interest rates."

-

Greek five-year bonds

are now paying 12.8%. It is

hard to grow your way out of a problem when you are paying interest

rates higher than your growth rate and you keep adding debt and

increasing your debt burden. It becomes more and more apparent that the

very existence of the Euro will make any recovery of a member country

impossible.

In due time whichever Debt (Treasuries,

Bonds) cannot be inflated away will be rescheduled for at least 100

years by a debt moratorium. It happened in the past and it will happen

again. Only this time it could happen to you! [if you are stubborn and

keep your fixed interest investment instruments]

-

If

you think you're SAFE because you're holding Bonds, check this out....more

-

Belgian judges sent bailiffs to shops because they start the Sales

period before the law allows for!?

Non-European readers

will probably be stunned that such legislation even exists....such

practices are indeed sickening and we have no doubt the USSR would

have done it not better. We in fact doubt such legislation has ever

existed in the former USSR. In Europe the Authorities dictate

when Sales can be held. Any business which is not confining its sales

to what is legally allowed is heavily fined. What most

non-Europeans also don't know is that shop keepers ain't even allowed

to keep their shops open all week: they by law have to keep their shop

closed at least one day each week. Speaking of a recession and

depression and politicians who-so-said try to solve the problem...but

they don't allow shops to have sales and to keep their stores open when

ever they want to?. Looking at what is happening in Greece,

Ireland, Belgium and the EU it's not hard to see how poor business men

these elected idiots are. Allow a politician to run a

profitable business and within 3 years it will be bankrupt.

-

Europe is and keeps growing as a Seven Headed Political

Narcissist Monster fed by the an exponential amount of Fiat Paper

money. As usual Politicians are only thinking of

their own survival and are increasingly endangering the savings of the

European people to keep the monster alive. The untold problem is that

the European Banks have become an inherent part of the depression and

that a secession of the EU would also mean a de facto bankruptcy of

these banks....Deutsche bank is one of them.

Friday December 17, 2010

-

The steepening Yield curve (long term interest rates keep geysering up

from historic lows as we forecasted two years ago) is scaring off

investors. Short term this can result in a

correction for the World Stock

markets (a correction is plausible as markets are

overbought) and could even cool off more

Gold and

Silver. As long however as

our support levels (see individual currency sections of Gold and

Silver) are not broken, we remain positive. Gold and Silver sit in a

secular Bull trend and traditionally go up together with interest

rates.

-

Inflation

statistics are cooked. We all know this by now. In

India and Eastern countries where Governments haven't become so

sophisticated, the cooking is of a lesser quality and the Official

Inflation figures reflect more the truth. India's annual food

inflation rose for the second consecutive week, to 9.46 % for

the week ended Dec 4, as prices of food items like milk, poultry and

fruits continued to rule high, official data release Thursday showed.

Primary articles index rose to 13.25 percent, while that for fuels

increased to 10.67 percent...more

-

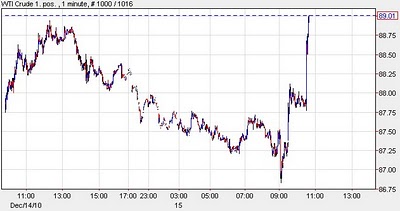

No relief

for Crude Oil users as its price steams to

almost $ 92 / € 70 per barrel. Remember our

Peak Oil

? It hasn't gone away! know what commodities do under

inflation pressure?

Hopefully you did not forget to shop in our

Oil

Share section as we advised you to some weeks

and days ago...more

-

Remember we

told you to buy BP

at $ 28 !?

Today (only months later)

the same share is sold for $ 44 (+57%)

-

World stock markets still sit in a

Nominal Bull trend. Markets are overbought and the

Footsie is running into resistance. But

so far the rising interest rates in no way indicate the end of the

nominal rise we are living.

-

The Total

Jobless rate = official unemployment + government employees + police

force + TSA + all non-productive Jobs + .....

ALL of these have to be kept alive by a Private Sector moving from a

Recession into a Depression. You don't have to be an Einstein to

understand that such is impossible.

Thursday December 16, 2010 - Expect Gold to

resume its bull run soon...now is the time to buy !

-

A foretaste of what is yet to come!? For now,

politicians and banks are the scapegoats.

Several politicians have been beaten up and abused

on the street.

[Following is 2002 news but it could happen again any day....]

By seizing its citizens' savings, the

government has broken a basic contract, and violated the rule of law.

Trust between government and citizens—the essential glue of a

prosperous democracy—has been destroyed. The past few weeks have seen

Argentina default on its $155 billion public debt (Treasuries, Bonds) ,

the largest such default by any country in history.

-

Since

December 1st, savings accounts have been frozen. People's Dollar

savings have been turned into devalued pesos. Depositors also face

restrictions on how much they can withdraw from current accounts. In

January, the banks were closed for all but half a dozen days...more

-

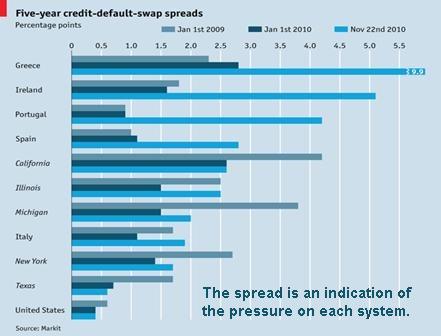

Check the ongoing Bond crash in the

Bonds section. Bonds

are as unsafe as dangerous and comparable with the Financials just as

they started to crash some years ago.

Note that the situation in

California, Illinois and Michigan is worse than the situation in Italy.

In

Portugal the chickens are coming

home to roost.

In

Europe it is now cheaper to hedge against corporate default than

sovereign default. That is not the way it is supposed to be.

Interest rates even go up in Japan!? Weird, weird,...

-

Hedge funds are also extremely dangerous...more

-

The charts in the Silver

and $-Gold section

have been updated. We do have a new objective for

Gold which is visible on the PF Chart.

-

We have school book examples on our PF charts for

€-Gold,

¥-Gold and

£-Gold. And

SA-Rand-Gold is also following a

precise line. The Euro has

successfully tested a very important level and the

Yen continues to perform better

than the Dollar and the Euro do. Checking on our charts of the Euro

against the Yen,

Swiss franc,

Canadian

and Australian

Dollar we get a confirmation that our

Investment roster is more than correct.

-

We have a similar formation on our PF chart of

Gold in British Pound.

-

Financials and Bank stocks have been

updated...pro forma....click

here

Wednesday December 15, 2010 - We're not going

to tell you another fairy tell each day as "all" what is unfolding has

already been published in Goldonomic.

-

The Dollar

and the Euro not only remain on the road to hyperinflation,

the rise in commodity prices and bond yields mean that

the dollar is picking up speed as it heads toward the fiat

currency graveyard. Our vision is that the Dollar will win the race

because there are a lot more dollars in circulation than Euro's...but

that the Euro, the Pound, the Yen,...will follow because the Central

Banks of those countries keep enormous amounts of Dollars. Our

Investment Roster clearly indicates which currencies we advice to keep

your Cash positions in. We're analyzing whether or not to add the

Chilean Peso.

-

This chart of the

commodity index gives an idea of what the inflation rate has

been since 1970. It

shows the temporary impact of the 2008 deleveraging, the 1981 top of the

Gold price and the present level (definitely too low...) . We're only

weeks ago of a new high of the Commodity index....and the day the Herd

realizes prices will go up and up....Hyperinflation is just like Santa

waiting to show up in the middle of the night. Once it does BONDS will

become worthless overnight, so will fiat paper money. Derivatives will

explode like a financial nuclear bomb and most bank manufactured

investment products will be worthless. And yes, it is possible that the

Stock markets crash....but given the choice between worthless fiat money

and a Bond (or the option to buy fiat worthless money) those having

Stocks will end up a lot better. Remember we have a paradigm shift and

it is high time to think out of the box...[note

the whipsaw we had in the late 1970's which looks exactly like the

whipsaw of the 2008 deleveraging. 1981 the USA and Volker cranked up

interest rates to double digit levels and managed to stop a pending

financial crisis. Ever since it has all become so bad that higher

interest rates will just make it all worse]

-

Our PF chart for

Copper is very worrying and is the canary in the mine shaft

of what we expect for other sectors....Take some time to

Google Double Top Breakouts....it could save your financial life.

-

Bonds continue and will

continue to crash...and it goes fast... The least you can do, is to SELL

ALL YOUR BOND HOLDINGS and keep the cash until you understand how to

allocate the funds.

This applies ALSO to most Bank Manufactured investment

vehicles. Please understand that any financial instrument with a so said

built in security system which will compensate for higher interest

rates, higher inflation rates, lower currency exchange rates, a lower

Dow Jones, etc...are ALL dependent upon the survival of DERIVATIVES (a

huge financial nuclear bomb). There is NO such thing as a free meal and

soon the chickens will come home to roost. The Central banks are

only able to keep the short term interest rates low...for so long.

Ultimately forces of Nature ALWAYS win.

- The Fed stuck to its policy of buying $600 billion in Treasury

bonds and keeping short-term interest rates near zero amid signs that

the recovery is gathering steam. JPMorgan, Credit

Suisse, UBS, ... and what they dare to say today will end up in the

History books as an idiocy as big as the idiocy sold by the Banks

before the Great Depression. What is wrong with these so said

specialists? I presume the kids are happy as long as they believe in

Santa...more

- What do you think will happen with the

Dollar once the USA looses its AAA

rating?

Hard to believe but It will crash in a worse way the Iceland Krona did...more

Tuesday December 14, 2010

-

This

is how fast it goes once the Apocalypse starts. See

how the Iceland Krona moved side ward for a long time before it all of a

sudden 'fell out of bed' ....and devaluates 60% against the Euro and the

US Dollar. The Icelanders who kept their savings in Barbaric Money or

Gold did not loose one cent of savings...on the contrary, they

increased! This

is how fast it goes once the Apocalypse starts. See

how the Iceland Krona moved side ward for a long time before it all of a

sudden 'fell out of bed' ....and devaluates 60% against the Euro and the

US Dollar. The Icelanders who kept their savings in Barbaric Money or

Gold did not loose one cent of savings...on the contrary, they

increased!

-

Not a lot to mention, except that JPMorgan is covering its Silver

shorts and the correction of the Gold and Silver sector is over again....sit

tight and surf the wave...there is a lot more to come!

Don't postpone you decision to buy the Gold and Silver

sector and PLEASE request Physical delivery of your Gold and Silver and

don't fall for ETF's and other bank manufactured products.

-

They even try to sell "Inflation free Bonds"!

DO NOT BUY THESE as they are directly linked to extremely dangerous

derivatives. This is the time to play it safe...during the last

depression "they" sold GOLD guaranteed Bonds...which, off course became

worthless!!

Monday December 13, 2010

-

Governments and politicians come and go...Bureaucrats and the

Administration however stay.

Governments succeed each other and each time

add their Bureaucrats to the system.

Give it some years and the Bureaucratic administration now is a Seven-Headed monster....and there is no way one can get rid of it without

risking a major revolution. Whoever the people will vote for, whatever change they

want...as long as this Monster hasn't been killed, nothing

can and will change. During the process leading to the climax of a

hyperinflationary depression the size of the Administration always

increases. These jobs are also very secure and relatively well paid as

they are the last line of protection for the leaders. Governments and politicians come and go...Bureaucrats and the

Administration however stay.

Governments succeed each other and each time

add their Bureaucrats to the system.

Give it some years and the Bureaucratic administration now is a Seven-Headed monster....and there is no way one can get rid of it without

risking a major revolution. Whoever the people will vote for, whatever change they

want...as long as this Monster hasn't been killed, nothing

can and will change. During the process leading to the climax of a

hyperinflationary depression the size of the Administration always

increases. These jobs are also very secure and relatively well paid as

they are the last line of protection for the leaders.

-

The day will come that even God won't be able to keep this Financial

Atomic bomb from exploding. A Secretive Banking Elite

Rules Trading in

Derivatives: the men share a common goal: to protect the

interests of big banks in the vast market for derivatives, one of the

most profitable — and controversial — fields in finance. They also share

a common secret: The details of their meetings, even their identities,

have been strictly confidential...more

-

We have updated our Investment Roster...click

here.

-

We have updated Wealth Preservation...click

here

-

What we don't understand is why so many investors invested in

dangerous Bonds (and some still are) when we have all

these super buys around in the stock markets (stocks = real

assets!)...see our Portfolio

-

Don't count on the Banksters to advice you to buy and hold Gold and

Silver...they'd rather tell you to sell your

holdings...so "they" can take advantage of it...more

Friday December 10, 2010 - Social unrest

and ultimately WAR...

-

A

situation becomes explosive from the moment those living in their

Ivory towers (Kings, Queens, Princes, Politicians and Officials) don't

understand what is really happening in the streets.

When the French people revolted because they had no bread

to feed their children Marie-Antoinette told them to eat cake.

When the Spanish people revolted because pork became too expensive

premier Zapatero told them to eat rabbit. The British students and not

the police are blamed for revolting because the tuition fees are

tripled... A

situation becomes explosive from the moment those living in their

Ivory towers (Kings, Queens, Princes, Politicians and Officials) don't

understand what is really happening in the streets.

When the French people revolted because they had no bread

to feed their children Marie-Antoinette told them to eat cake.

When the Spanish people revolted because pork became too expensive

premier Zapatero told them to eat rabbit. The British students and not

the police are blamed for revolting because the tuition fees are

tripled...

-

The Rolls-Royce carrying Prince

Charles and Camilla,

the Duchess of Cornwall, was attacked in central

London by revolting

students. Cameron defended the government's

contentious move to triple tuition at UK universities and said

protesters, not the police, should be blamed for last night's chaos on

Parliament street and nearby areas and for attacking a car transporting

Prince Charles and Camilla, the Duchess of Cornwall...more

-

We believe investors should continue to hold Low Order Capital

Good and food-related

shares such as grains, wheat, corn, soybeans, and

farm suppliers. John Deere is a good example.

-

Chile is one of the countries who has recently come into the news

because of a mine drama who came out of a crisis not

so long ago. The country has reshaped its banking system and exports

important commodities (Copper, Gold and Silver) and wines.

-

We are reluctant to invest in countries like Thailand, , Indonesia,

Colombia, and even China because we don't think their

system is not politically and financially stable.

-

Taxation or Inflation is Deal or no-Deal between Democrats and

Republicans. Whatever happens, the end result for the

citizen will be the same. The King's chest is empty and money has to be

found. Either by taxation or either by Inflation. Society can only be

taxed so much before Capital leaves it for better and once the limit has

been reached (it has in most western countries) the only mean tool which

is left is taxation through inflation. Bond

markets understand this!

-

Weak bonds mean the financing cost of the Authorities and its' debt

will increase dramatically forcing them to print even more money to

finance the debt.

Bond slide temporary halted by interventions of

JPMorgue. [J.P. Morgan Chase is an agency of the U.S.

government in manipulating the government bond market and discouraging

money from leaving that market for precious metals.]

Global bond rout deepens on US fiscal worries.

Agreement in Washington on a fresh fiscal package has set off dramatic

rise in yields of US Treasuries and bonds across the world, threatening

to short-circuit any benefits of stimulus. The bond rout raises concerns

that the US authorities may be losing control over events. The yield on

10-year Treasuries – the benchmark price of money worldwide and the key

driver of US mortgages rates – has rocketed to 3.3pc, up 35 basis points

since President Obama agreed on Monday to compromise with Senate

Republicans on tax cuts.

-

Bottom fishing in on...buy the dips!

Our technical signals

for the Gold and Silver sector which we published last Wednesday are

alive.

Thursday December 9, 2010 - Those Bankers are

so reliable and trustworthy Madame !?...and you can built on these

Treasuries...

-

Too early to tell when JP Morgan will become

JP Morgue but eventually they will.

We have still too many willing

sellers of Silver and maybe the Fed and ECB have found other ways of

shorting Silver. Remember that those who print the Fiat Paper money out

of thin air can - as long as we don't have a Hyperinflation print

exponential amounts of it. Having said this we keep listening to what

our charts tell us. Too early to tell when JP Morgan will become

JP Morgue but eventually they will.

We have still too many willing

sellers of Silver and maybe the Fed and ECB have found other ways of

shorting Silver. Remember that those who print the Fiat Paper money out

of thin air can - as long as we don't have a Hyperinflation print

exponential amounts of it. Having said this we keep listening to what

our charts tell us.

-

GoldMoney's James Turk knows of a silver

investor who for two months has been unable to induce a Swiss bank to

return 20,000 of silver for which the investor long

has been paying storage fees. (click

on the silver for the story)

-

US Treasuries hit by biggest sell-off in two

years.

US Treasuries suffered their biggest two-day sell-off since the

collapse of Lehman Brothers, following a torrid month that has seen

borrowing costs for western governments soar.

Germany,

Japan and the

US have all seen their benchmark market

interest rates rise by more than a quarter in the past month while

the

UK’s has risen by nearly a fifth.

The Bond crash we forecasted in 2009 is

alive and well. It's five to twelve to get rid of these extremely

dangerous investment instruments.

Having said this, remember that

CREDIT

DEFAULT SWAPS and other

DERIVATIVES are directly negatively

affected...more

If you think Stock markets are dangerous, better prepare for you haven't

seen what a crash of the Bond markets will mean for your Savings: Bonds,

Saving accounts, Bank deposits,...Greece

is insolvent, Portugal has a liquidity problem, Spain has

a liquidity problem, Belgium has been cooking the books for a

long time, Italy has been cooking the books for a long time and

the UK is totally insolvent! If you keep holding on to Bonds sold

by these and/or their Bankers you will also become insolvent!

the

collapse of Lehman Brothers, following a torrid month that has seen

borrowing costs for western governments soar.

Germany,

Japan and the

US have all seen their benchmark market

interest rates rise by more than a quarter in the past month while

the

UK’s has risen by nearly a fifth.

The Bond crash we forecasted in 2009 is

alive and well. It's five to twelve to get rid of these extremely

dangerous investment instruments.

Having said this, remember that

CREDIT

DEFAULT SWAPS and other

DERIVATIVES are directly negatively

affected...more

If you think Stock markets are dangerous, better prepare for you haven't

seen what a crash of the Bond markets will mean for your Savings: Bonds,

Saving accounts, Bank deposits,...Greece

is insolvent, Portugal has a liquidity problem, Spain has

a liquidity problem, Belgium has been cooking the books for a

long time, Italy has been cooking the books for a long time and

the UK is totally insolvent! If you keep holding on to Bonds sold

by these and/or their Bankers you will also become insolvent!

-

The HUI (Gold and Silver mines index) experienced a bearish engulfing

pattern on its daily chart yesterday

and that is leading to follow through selling today in

the mining shares. Watch the support levels closely and see how the

shares act as they move into this region especially if you are acquiring

for the long term. The HUI

has remained above the 40 and 50 day moving averages since August of

this year on an end of trading session basis. Should it move down into

this region again and refuse to breakdown, you will know what to

do...BUY!

Wednesday December 8, 2010

Interviewed

by King World News, market analyst and scholar Jim Rickards of Omnis

Inc. says he knows of a gold investor who recently had to struggle for a

month with a Swiss bank to arrange return of his gold -- not a

futures contract receipt but real gold that had been put on deposit at

the bank. Only the gold owner's threat to restore to legal action and

the news media pried the gold loose, Rickards says. He concludes that

the bank didn't have the gold it should have had and that this shorting

is endemic to the Western banking system. (click

on Santa for the Interview) Interviewed

by King World News, market analyst and scholar Jim Rickards of Omnis

Inc. says he knows of a gold investor who recently had to struggle for a

month with a Swiss bank to arrange return of his gold -- not a

futures contract receipt but real gold that had been put on deposit at

the bank. Only the gold owner's threat to restore to legal action and

the news media pried the gold loose, Rickards says. He concludes that

the bank didn't have the gold it should have had and that this shorting

is endemic to the Western banking system. (click

on Santa for the Interview)

-

Both US-Dollar and Euro holders should stop

playing the Dollar/Euro casino. All this time,

the Australian Dollar, Canadian Dollar, Swiss Franc, Japanese Yen and

even the South African Rand have been performing better. Gold and

Silver have done A LOT BETTER!

-

Selling all your gold is an act of madness

at any time, and during the greatest crisis in modern history, it is

“beyond madness”. Having no Gold is an act of stupidity...

-

Copper is "also" preparing for a major

breakout. Once it does, we have a calculated

objective of $ 5.25 and those using

Natural Gas or Coal

must also prepare for an expensive winter. [we mentioned the reversal

already last August and in October we gave a distinct Buy signal] Our

charts for Uranium, Agricultural

commodities, Platinum bring their own story about

the coming Hyperinflation.

-

Most

Commodity

markets have recovered all of their 2008 deleveraging loss.

The multi-billion dollar question is: "Will the

Authorities find another trick to delay the stampede of the coming

Hyperinflationary depression?"

-

The

Oil share index is about to make a

Double top breakout. Don't forget to shop before it

gets too expensive.

-

Key reversals

on our charts of the Gold and Silver mines (Seniors and

Juniors)

indicate we could have a small correction. Use the

correction to add to your positions. We'll keep our subscribers

informed. We urge

subscribers to study the key reversal chart for Yamana in the Gold and

Silver juniors section...and ALSO to check the scenario we show on the

HUI points and figure chart

inside the subscription section.

[A dip is something we'll probably see these

coming days....]

-

Bankers are Best case scenario, nothing more

than Car Salesmen. When talking heads of BNP

Paribas pretend cash and Gold will be the worst investments for

2011, I also have a problem. This problem gets even bigger if one looks

at the disastrous results their investment funds show over the past

years. Unbelievable investors still listen to those guys! Do

people NEVER learn? I started to advise to buy Gold in 2001 and you have

not to be an Einstein to figure out how well any investor did who

followed up my advises. And this includes Real Estate. For this

reason it should not be difficult to understand I get upset when people

ask for a TRIAL SUBSCRIPTION....knowing that 90% still hasn't got an

ounce of Gold and are keeping their Fools' gold or paper and digital

money with the banks and their fabricated dangerous investment articles.

Apparently 2008 hasn't teached them a thing!

-

Before I forget, American

Bonds were very

weak...hopefully ALL of our readers have SOLD

these dangerous investment instruments. After all we already advised to

get rid of these in 2009!

Tuesday December 7, 2010 -

-

It's all in the price...those amongst you who

subscribed years ago and started to buy

Gold

around $ 250 and

Silver around $ 4 are in a far more

comfortable position

than those who are only joining

us now. This are unfortunately the rules of the game. The less informed

you are, the more you listen to static (Banksters and Politicians) the

more you will pay for your Gold and Silver protection. But we may

have come to a point where one should focus more on Gold and let Silver

cool down for a while....remember too much, too fast and too high...

-

During the last weeks, we advised to buy the

dips and/or the breakouts. Yesterday we again advised

to buy the confirmed breakout of the Gold and Silver sector. A

correction has to be expected some time next year...but like things look

now, the longer you wait, the more you will have to pay. Try to study

our site and browse through the sections of Gold and Silver and Gold and

Silver Majors and Juniors...the charts will tell you what to buy and

when. Most important is to know that the coming weeks and months, we

expect the Gold and Silver sector to be strong.

Having said this, be aware we

don't advise to buy the Gold and Silver sector to make money but rather

to PRESERVE YOUR SAVINGS.

-

The

Dollar index and the

Euro have bounced off its 200 day Moving Average as expected..

-

It will tell you more than 1000 words.

As usual we refer to the charts of Gold expressed in

different Fiat currencies to judge about the short term trend. See Gold

expressed in Euro,

in South African Rand,

in Yen, in

Sterling,

Swiss Franc,

Aussie,

Canadian Dollar,

Rupee and Ruble

-

Those amongst you who need to keep some

cash/liquidities on hand don't forget the

Australian Dollars. Having said this, the Aussie

is a canary in the mine shaft for the US-Dollar.

-

And I almost forget, one barrel of Sweet

Crude Oil costs about $ 90...close to the $ 100 or

our 1st objective (deflation they said?). Don't forget to shop in our

department of Oil shares...

Monday December 6, 2010 - There is the

Invisible thief (Hyperinflation and Inflation), the Taxation thief but

also direct confiscation by the Authorities.

-

Philip

the Fair had all Templars arrested and confiscated all their

belongings. He also did this after arresting the

Jews so he could seize their assets to accommodate the inflated costs

of modern warfare. He debased the coinage. When he also

levied taxes on the French clergy of one half their annual income, he

caused an uproar within the Roman Catholic Church....[this shows you

how far these guys can be trusted].

His reign marks the French transition from a charismatic monarchy –

which could all but collapse in an incompetent reign – to a

bureaucratic kingdom.

Philip the Fair wasn't fair at all... Philip

the Fair had all Templars arrested and confiscated all their

belongings. He also did this after arresting the

Jews so he could seize their assets to accommodate the inflated costs

of modern warfare. He debased the coinage. When he also

levied taxes on the French clergy of one half their annual income, he

caused an uproar within the Roman Catholic Church....[this shows you

how far these guys can be trusted].

His reign marks the French transition from a charismatic monarchy –

which could all but collapse in an incompetent reign – to a

bureaucratic kingdom.

Philip the Fair wasn't fair at all...

-

Beating the Hyperinflationary depression is one

thing, keeping your savings out of reach of the Authorities will be

another. What sense

does it make to invest your savings properly if over the coming months

and/or years the Authorities take these away in a similar way they

took them away after the 2nd WW (Operation Gutt) or like happened in

Argentina some years ago and as is happening now in Hungary.

-

In Europe (EU) as of 2012 ALL SECURITIES must by law by DIGITALIZED

or they will become worthless. Physical Gold

and Silver can be stored away in an old tool box or paint

container in your garage. Real Estate cannot be deflated

and hidden in some stash [Napoleon taxed Homes on the number of

windows they had] Bank deposits and saving accounts are

digital and so are Securities (Bonds and Stocks). Or how

easy it will be for the Authorities to confiscate (with the help of

their best buddies The Banksters your savings.

Hence one must think twice

before deciding upon a bank and a location where to keep your bank

deposits and Gold and Silver shares.

-

JPMorgan cornering the Copper market in London is for us just

another indication we're heading for a Hyperinflation...and

probably also for a WAR (Copper is extremely important for Warfare)

...more

-

Gold and

Silver have

initiated another short term bull run and those who have none MUST buy

some as soon as possible. We have a paradigm shift and SECURITY comes

before price. Having said this, in many EU

countries Silver is taxed (21% VAT !) and Gold is not.

Either one must buy old silver or stay with Gold coins and Gold

bullion which are not taxed.

Friday December 3, 2010 -

-

Bond markets keep on sliding and the Bond crash we

forecasted in

2009 is gaining momentum...don't forget

to check the section of

Bond fundamentals. We've added a

scary chart. And STAY AWAY and SELL

CORPORATE BONDS. Bonds issued by

Banks in particular.

-

November 3 we indicated the reversal of Crude Oil and Oil stocks!

-

There is NO ECONOMIC RECOVERY on its way in Europe.

We shall have no until they have solved the basic

problems of taxation and regulation, the misallocated funds have been

washed out of the system and the problems of the Bond markets/debt

have been solved.

Thursday December 2, 2010 - The Herd makes the

market and it always looses: it doesn't get in when it's time and gets

in when it's too late !

-

In

the USA we have an ongoing battle between Democrats and Republicans

about the Bush Tax cuts. They pretend the future of

the USA is at stake. The

battle itself is pure propaganda: the authorities will take your money

either way - either by taxation or by Inflation. So simple it is. In

the USA we have an ongoing battle between Democrats and Republicans

about the Bush Tax cuts. They pretend the future of

the USA is at stake. The

battle itself is pure propaganda: the authorities will take your money

either way - either by taxation or by Inflation. So simple it is.

-

You were good enough to buy the crappy paper (Repacked Mortgage

contracts) from the bankers but now they refuse to buy it back from

Fanny and Freddy!? Still leaving your savings to

these Banksters? Still trusting them to manage your savings and keep

your deposits? Still

sitting with Bank-Bonds sold to you by these guys operating out of 30

stock marble buildings? Still trusting your well dressed banker around

the corner who's doing nothing more than following up instructions and

who doesn't understand what's really happening? ...more

-

Crude Oil has

broken out of a solid bottom and

Oil shares are

surfing out of the dips we were talking about only weeks ago.

See the updated sections and shopping baskets for

details. The Oil sector offers a GREAT DIVERSIFICATION for the Oil

sector! Don't forget to

shop in this section NOW...what is happening now is only

confirm what we wrote some weeks ago....Our charts in the section of

Oil shares tell a thousand words.

-

Our Commodity

section just confirms what we write in other sections...more

-

The coordinated efforts of the Gold Pool II (central banksters.,

etc...) are CLEARLY loosing their grip on the Gold and Silver sector.

Last intervention was nothing more than an ambush in mid session...and

it failed.

Expect Gold and Silver prices

to explode the day this happens...more

Wednesday December 1, 2010 - Fresh bull run of

the Gold and Silver sector - Capital rushes around fleeing political

changes and taxes just as it is attracted by prosperity!

-

The Financial Problems WON'T GO AWAY. They will get WORSE FIRST

!!!!

It is five to twelve for holders of

Government Bonds, Cash and Real Estate

(in Europe) to ACT NOW. Many have eyes but don't see, they have ears

but don't hear. They fail to understand the Paradigm shift we have and

their immobility will ruin them. American, Greeks, Irish,... know

better because they are actually have been living the Real Estate

crash in person. Government cannot save us, and will only assist the

very economic and financial disaster we face. Financial problems shift from the Private to

the Public sector but in the end the chickens come back to roost as it

is ALWAYS the private sector who end up paying for the bills.

As politicians explain, there are no problems as long as they can use

your savings to cover their deficits. (like they did in

Argentina, Hungary,...). Real

Estate cannot be hidden away in a safe out of reach of the

Authorities. Securities (Bonds, stocks) have been digitalized and in

13 months from now (2012) ALL will have to. What a luxury for the King

as one phone call with his buddy the Treasurer does to tax his people

in whichever way he needs to.... The Financial Problems WON'T GO AWAY. They will get WORSE FIRST

!!!!

It is five to twelve for holders of

Government Bonds, Cash and Real Estate

(in Europe) to ACT NOW. Many have eyes but don't see, they have ears

but don't hear. They fail to understand the Paradigm shift we have and

their immobility will ruin them. American, Greeks, Irish,... know

better because they are actually have been living the Real Estate

crash in person. Government cannot save us, and will only assist the

very economic and financial disaster we face. Financial problems shift from the Private to

the Public sector but in the end the chickens come back to roost as it

is ALWAYS the private sector who end up paying for the bills.

As politicians explain, there are no problems as long as they can use

your savings to cover their deficits. (like they did in

Argentina, Hungary,...). Real

Estate cannot be hidden away in a safe out of reach of the

Authorities. Securities (Bonds, stocks) have been digitalized and in

13 months from now (2012) ALL will have to. What a luxury for the King

as one phone call with his buddy the Treasurer does to tax his people

in whichever way he needs to....

-

"At the beginning of the 20th

century, Argentina was the seventh richest nation on earth. It's very name means

"silver." "As rich as an Argentine" was a byword. Even after falling from the

heights through a series of bad decisions, the country was still so wealthy

that, in 1946 when new president Juan Peron first visited the central bank, he

could remark that "There was so much gold you could barely walk through the

corridors."

-

Those who live in denial about

Real Estate in Europe (Spain,

the UK and

Ireland have/are actually experiencing it NOW) should do

themselves a favor and spent the year end in

Florida. Sometimes you have to see it with your

own eyes and have to touch the difference like I do by traveling from

continent to continent so they can clear their mind of the incorrect

propaganda. Only then you will be able to answer the question why €200,000 buys so little in Northern Europe and so much in the

USA and Florida. Having said this there

is something terribly wrong if you buy a € 1,000,000 flat on the

Belgian or Dutch coast and/or a vacation house in Southern France...

-

The Secular bull run of the Gold and Silver sector is actually

accelerating as expected. Check our charts in

the subscription section for the breakouts....We have a clear picture

in the Euro section.

and

£-section.

These sections

also bring a message for the Dollar/Euro/Pound Sterling exchange rate.

-

Take some time to check the

GLD EFT chart in our $-Gold section.

A school book example of break away gaps and what

happens afterwards...[Run away or break away gaps proof a market is very

bullish. Important is that most of the time these GAPS are closed before

the bull run is resumed]

-

It is extremely hard to understand why people don't understand and see

what is actually happening.

-

The inflation in India is 8.5% ....weird that it is a lot higher

than we the Authorities pretend we have in the West.

Or does somebody lie? Do you

still trust Louis XVI?...more

-

Gold and Silver

majors have been updated as well as

Gold and

Silver Juniors...interesting!

> back to the top of the page

> to all Archives

> back Home

© Copyright -

Florida, USA -

+1

(772)-905-2491

+1

(772)-905-2491 |